A freight train at sunset.

As an investor who seeks to build a portfolio of sustainable and growing dividend income, “sure things” constitute the majority of my portfolio. Mission-critical infrastructure like pipelines, utilities, and railroads are among my most consequential investment holdings.

That’s because, without the businesses behind this infrastructure, the modern economy couldn’t function. This is especially true in the case of railroads, which move nearly 30% of total U.S. freight by ton-miles.

As the largest railroad operator in the eastern United States, Norfolk Southern (NYSE:NSC) plays a pivotal role in the U.S. economy. Let’s take a look at why I am initiating a buy rating on the blue-chip railroad operator.

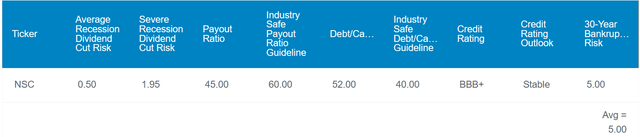

DK Zen Research Terminal

In terms of immediate income, Norfolk Southern’s 2.6% dividend yield is somewhat attractive versus the 1.5% dividend yield of the S&P 500 index (SP500). The company’s dividend is also rather safe. NSC’s EPS payout ratio of just 45% is well below the 60% that rating agencies consider to be safe per Dividend Kings. That leaves a nice buffer for the company to balance its dividend with share repurchases.

Relative to the 40% debt-to-capital ratio that rating agencies prefer from the industry, NSC’s debt-to-capital ratio is a bit elevated at 52%. But its status as an industry leader earns it a BBB+ credit rating from S&P on a stable outlook. That implies just a 5% risk of bankruptcy in the next 30 years for the company.

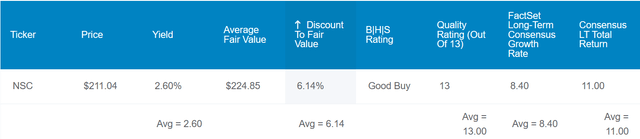

DK Zen Research Terminal

NSC is a classic example of a Buffett-like, wonderful company for a fair price. Based on historical fair values including dividend yield and P/E ratio, Dividend Kings estimates its fair value to be $225 a share. That suggests NSC is trading at a 6% discount to fair value versus its current $210 share price (as of November 20, 2023).

If the company grows as expected and its stock returns to fair value, here is what total returns could resemble for shareholders in the next 10 years:

- 2.6% yield + 8.4% FactSet Research annual earnings growth consensus + 0.7% annual valuation multiple expansion = 11.7% annual total return potential or a 202% cumulative total return versus the 9% annual total return potential of the S&P or a cumulative 137% total return

Norfolk Southern Can Get Back On Track

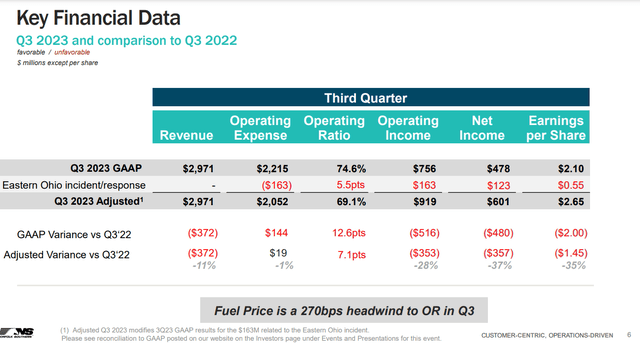

Norfolk Southern Q3 2023 Earnings Presentation

On paper, NSC’s third quarter wasn’t spectacular. The company’s operating revenue of $3 billion was down 11% over the year-ago period, although this was $40 million better than the analyst consensus.

The vast majority of NSC’s decline in operating revenue had to do with a $254 million drop in its fuel surcharge revenue. This was the result of a significant fall in fuel prices versus the prior year. The other major component of the company’s lower operating revenue base was a $74 million decline in revenue stemming from a 2% volume decline per CFO Mark George’s opening remarks during NSC’s Q3 2023 earnings call. This volume decline was the result of a return to normal levels in volume and what the company expects will be tough comparisons through the first quarter of 2024.

Moving down to the bottom line, NSC’s diluted EPS plunged 48.8% year-over-year to $2.10 during the third quarter. Adjusting for the $163 million charge that the company took from the East Palestine, Ohio derailment earlier this year, diluted EPS was $2.65. That was still down 35.4% over the year-ago period.

Aside from lower operating revenue, NSC also settled a historic wage increase and labor agreement with workers last year. Even adjusting for the East Palestine incident, this led the adjusted operating ratio 710 basis points lower to 69.1% for the quarter.

The good news is that NSC’s President and CEO Alan Shaw believes this impairment in the operating ratio is temporary due to low volumes and investments in its infrastructure that will pay off down the line. The company’s focus on steady improvement in productivity and an eventual recovery in its core business has FactSet Research expecting 8.4% annual earnings growth long term (details according to NSC Q3 2023 earnings press release).

NSC’s interest coverage ratio of 4.2 is somewhat low compared to what I would like to see. But considering the unfavorable industry environment and its East Palestine overhang right now, this should prove to be a trough interest coverage ratio for the company (page 3 of 41 of NSC 10-Q filing).

Dividend Growth Can Continue

NSC’s quarterly dividend per share has surged nearly 69% higher in the last five years. Though I wouldn’t expect growth near this level to persist, I believe the company’s dividend can continue to steadily rise.

Through the first nine months of 2023, NSC has generated slightly more than $1 billion in free cash flow. Compared to the $920 million in dividends paid during this time, that equates to a 91.1% free cash flow payout ratio (page 6 of 41 of NSC 10-Q filing). Until the business recovers and the payout ratio improves, dividend growth will probably be quite modest for the next couple of years. But for investors who are patient enough, NSC should be a decent pick for long-term dividend growth.

Risks To Consider

NSC is a solid business. However, it still has risks that investors must be able to tolerate if they want to own the stock.

The most obvious risk to NSC is the derailment of 38 railcars in East Palestine, Ohio back on February 3. Unfortunately, 11 non-company-owned railcars had hazardous materials, including vinyl chloride. To date, the company has incurred nearly $1 billion in expenses related to the incident (page 16 of 41 of NSC’s 10-Q filing). Total costs for this calamity could be well into the billions, which could certainly weigh on NSC’s cash flow and earnings for the foreseeable future.

Another risk to NSC is the potential for a cybersecurity breach. The company’s vast resources make it an attractive target for hackers. If NSC were to be meaningfully hacked, its operations could suffer. This could impact its reliability and hurt its operation among customers. That could be enough to harm the investment thesis.

Summary: A Great Dividend Compounder For A Reasonable Valuation

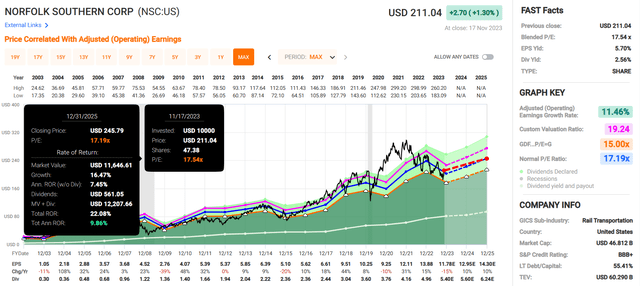

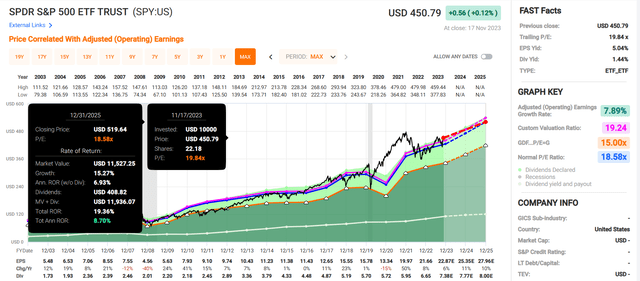

FAST Graphs, FactSet FAST Graphs, FactSet

According to FAST Graphs, NSC’s current P/E ratio of 17.5 is just above its historical average of 17.2. Assuming a slight downward reversion to the historical average, this would set up NSC shareholders for nearly 10% annual total returns for the next two years. The company’s 2.6% dividend yield should offset the compression in the valuation multiple while the 10% annual earnings growth expected in 2024 and 2025 should drive total returns.

That’s a bit better than the almost 9% annual total returns that are expected from the SPDR S&P 500 ETF Trust (SPY) over that time. This moderately better total return profile of NSC arguably compensates for the risks that are being assumed by buying the stock here. That’s why I rate it a buy right now around the $210 share price.

Read the full article here