In my previous analysis of Pacific Biosciences of California (NASDAQ:PACB), I focused on the potential impact of their upcoming Revio platform. Since then, the launch has taken place and we’ve seen the initial market response. With the release of their 3Q23 earnings, a reassessment of the company’s position and prospects is now timely.

Revenue Growth

In the third quarter of 2023, Pacific Biosciences disclosed a marked revenue surge of 72% year-over-year, hitting $55.7 million. This period marked the first instance of the company’s quarterly revenue crossing the $50 million threshold. A significant contributor to this growth was the shipment of 52 Revio instruments, setting a new company record and boosting the total installed base of Revio systems to 129 as of September 30th.

Revenue from consumables also saw an uptick, reaching $16.9 million. A key highlight was the accelerated sales pace of Revio consumables, surpassing that of Sequel II/IIe consumables more quickly than anticipated, signaling rapid market adoption. Additionally, the enhanced utilization of Revio was evident, with an increased number of cells being used per system, suggesting a ramp-up in production usage. The data output from the Revio fleet for the quarter outstripped the peak output of the entire Sequel II/IIe fleet, demonstrating the new platform’s potential.

A noteworthy metric was the annualized consumable pull-through rate for Revio, recorded at 483,000. This rate, a measure of consumable usage, stood at a promisingly high level. However, given the relatively early stage of the product’s lifecycle, it remains to be seen if this rate will be sustained in the long term.

PacBio’s third-quarter earnings call highlighted another key metric: the adoption of their Revio system, particularly among new customers. Over 40% of Revio system orders were from new PacBio customers, underscoring the platform’s competitive edge and appeal in the genomic sequencing market. This uptake by new users indicates Revio’s potential to draw users from other sequencing technologies.

Moreover, there exists a considerable opportunity for PacBio to convert existing customers using Sequel II/IIe systems to the newer Revio platform. Currently, less than 30% of the roughly 300 Sequel II/IIe customers have transitioned to Revio, suggesting a significant untapped market within their existing customer base.

To provide some color, one notable new customer, Helix, has incorporated the Revio system to bolster its population genomics business. Helix’s goal is to integrate long-read sequencing capabilities into its existing platform, which is already engaged in large-scale programs throughout the United States.

Another interesting case is the Children’s Mercy Hospital in Kansas City. The hospital reported that Revio has enabled them to streamline tests, enhance efficiency, improve solve rates, and notably reduce turnaround times. A striking achievement with Revio is the ability to deliver results in just two weeks using five-based HiFi sequencing, a significant advancement from the extended periods required by multiple legacy tests.

Upcoming Enhancements to Revio Platform

As the addressable market for PacBio expands, the company is intensifying efforts to enhance the usability of its Revio platform. Several key enhancements have been introduced or are in the pipeline, aimed at improving overall performance and user experience.

Preload Feature: A simple yet pivotal enhancement is the preload feature. This allows users to prepare for their next sequencing run while the current one is underway, significantly boosting the instrument’s throughput and efficiency. Originating from the Sequel IIe platform, the adapted DNA preloading feature is tailored to the customer’s sample, preventing SMRT cell overload and facilitating more confident and increased DNA loading, thereby yielding better and more consistent results.

Support for Shorter Libraries: The forthcoming update will extend Revio’s compatibility to libraries shorter than 3 kilobases. This broadens its application scope, making it suitable for use in areas like AAV, Iso-Seq, and 16S microbial sequencing.

Flexible Run Times: Another enhancement includes the introduction of flexible run times. Users will have options for 12-hour and 30-hour run times, accommodating various lengths of DNA inserts. This flexibility allows for more tailored and efficient sequencing operations.

Run Preview Feature: A future update is set to introduce a run preview feature. This will enable users to view the statistics of their sequencing run after the initial four hours, aiding in better planning and optimization for subsequent runs.

In the coming year, PacBio is set to introduce significant enhancements in the sample preparation process, leveraging technology acquired from Circulomics. This initiative is aimed at improving size selection on the SMRT cell, which is a crucial aspect of their sequencing methodology. These advancements are anticipated to enable users to achieve higher sequencing output per SMRT cell and consistently produce longer read lengths.

To support these developments, PacBio has entered into collaborations with leading automation providers, including Hamilton, Integra, Revvity, and Tecan. These partnerships are focused on fully automating sample preparation protocols for both the Revio and Sequel II/IIe systems, streamlining the process and potentially increasing efficiency.

Additionally, earlier in the month, PacBio launched the PacBio Whole Genome Sequencing Variant Pipeline (WGS Variant Pipeline). This pipeline represents a standardized computational approach that amalgamates over ten distinct secondary and tertiary analysis tools into a singular, easy-to-use workflow. Designed to be user-friendly, the WGS Variant Pipeline caters to individuals with varied levels of bioinformatics expertise, thereby simplifying access to HiFi whole genome sequencing. This development marks a significant step in making advanced genomic sequencing more accessible and user-friendly.

From Genomics to Multiomics

PacBio has been aiming to transform itself into a more multiomic company. A multiomic approach integrates data from various biological layers like the genome, epigenome, transcriptome, and proteome, providing a more comprehensive understanding of biology and disease. With the flexibility and increased throughput of the Revio system, combined with HiFi single-molecule detection capabilities, PacBio is beginning to realize this goal. The Revio is envisioned as a versatile tool – a “multi-omic Swiss Army Knife” – for diverse applications in genomics and beyond.

A recent preprint by researchers from the University of Washington and other institutions showcased how the Revio system could produce data on four high-quality ‘omes’ (genome, methylome, chromatin epigenome, and transcriptome) using just one Revio SMRT cell.

In a study involving a participant from the Undiagnosed Disease Network, data from each of these ‘omes’ helped explain one or more of the participant’s phenotypes. This illustrates the effectiveness of using a synchronized, single long-read multi-omic test to uncover unexplained rare conditions, as opposed to conducting multiple separate tests.

Valuation & Risks

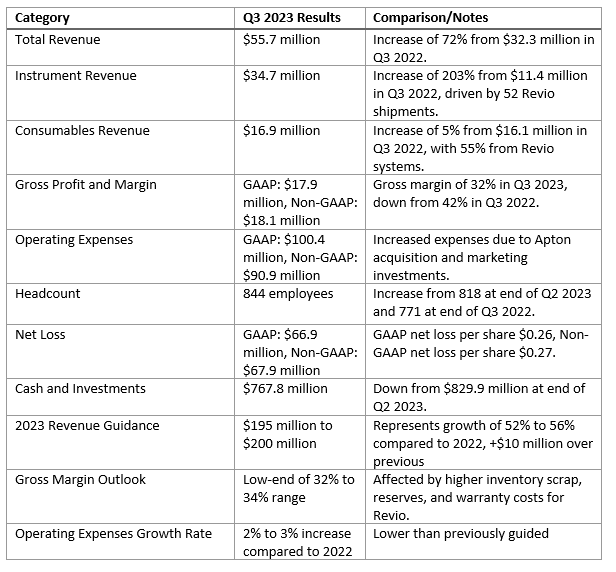

In its latest earnings call, PacBio revised its 2023 revenue forecast upward, now estimating between $195 million and $200 million. This marks a 52% to 56% increase from 2022, surpassing previous long-term projections. A summary of key variable trends is provided below.

Author compilation based on PACB financials

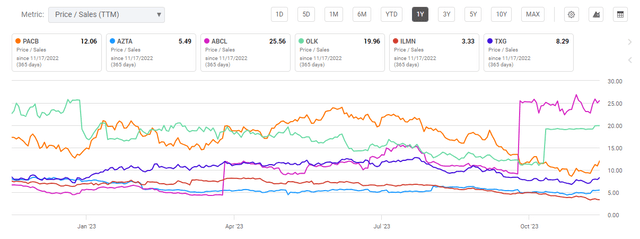

Current Revio sales figures are notable, aligning with the earlier positive analysis. Ongoing enhancements to the Revio platform suggest the potential for further sales growth. The company’s trajectory indicates possible earlier-than-anticipated achievement of the $500 billion revenue goal by 2026. Such an outcome could potentially influence a reevaluation of PacBio’s sales multiple in the wider market. The following chart illustrates how investor perceptions can shift significantly over a 12-month period in this industry.

Seeking Alpha

However, PacBio faces clear challenges. The current trajectory of sales growth, while promising, is not a certainty. Rapid growth in early-stage companies often encounters unexpected hurdles. The effectiveness of planned improvements to their offerings remains to be proven, and there’s a risk that these enhancements might not drive sales growth as anticipated, potentially leading to financial and resource inefficiencies.

Moreover, the company’s operational expenses (OpEx) are still high. With an estimated cash burn of around $200 million per year and current assets near $880 million, product launch periods typically exert significant pressure on a company’s cash reserves and can lead to spikes in OpEx. While PacBio’s current cash position appears solid, a reduction in cash burn would be a positive indicator, particularly if the company can increase revenue from high-margin consumables and services.

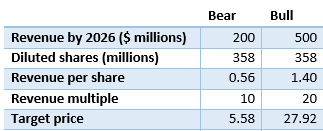

Overall, the scenarios previously outlined for PacBio seem to be unfolding. The likelihood of the company achieving 20 times multiple on a projected $500 million revenue is growing.

Author computations

I believe that the market may eventually adjust its valuation of PacBio, potentially leading to a stock price around a projected median scenario of $16. The future remains uncertain, but current trends suggest that the company’s strategy and market position may be aligning more closely with these expectations.

Read the full article here