Upstart (NASDAQ:UPST) delivered a very interesting quarter in Q1. The numbers were above Wall Street expectations, although fundamentals are still depressed.

Importantly, Upstart is starting to secure long-term funding commitments, which could be a game-changer for the company. There are incipient signs indicating that the business could be turning the corner.

If this happens, which is obviously a big “if”, then the stock has massive upside potential from current prices.

In the short term, the biggest risk is that the economic environment could continue to deteriorate and this could postpone, not necessarily derail, the recovery in fundamental performance.

Please note that the headline of this article “Upstart: The Inflection Point?” includes a question mark.

Leaving aside the aspect of timing, the economy is going to recover sooner or later, and Upstart management is making the right moves to position the company for a strong acceleration in earnings when the time comes.

An investment in Upstart is extremely risky, and it has a real possibility of permanent loss of capital. That being acknowledged, the upside potential can widely compensate for the risk in a moderately sized position for investors with a long-term horizon and a high tolerance to uncertainty.

The Context

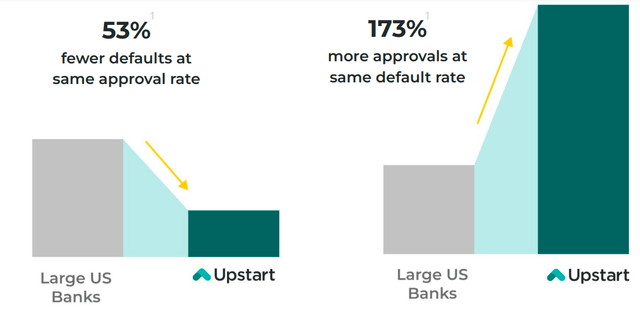

Upstart is a fairly unique and complicated story, so it is important to understand the broader context when analyzing the stock. Going back to the basics, Upstart is a tech platform that seeks to disrupt the FICO score by providing superior credit ratings via Artificial Intelligence.

Upstart

The company can keep some loans on its balance sheet, but most of the revenue comes from fees charged on the loans that go through the Upstart platform. These loans are either held by banks and credit unions or sold to hedge funds and other capital market participants.

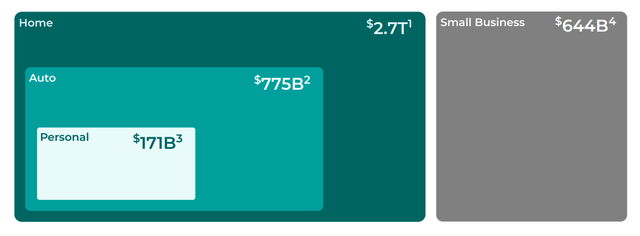

Most of the loans are to underserved populations with relatively low credit qualifications. The company operates mostly in personal loans, but Upstart is also expanding into vehicles and it has plans to expand into home loans later this year.

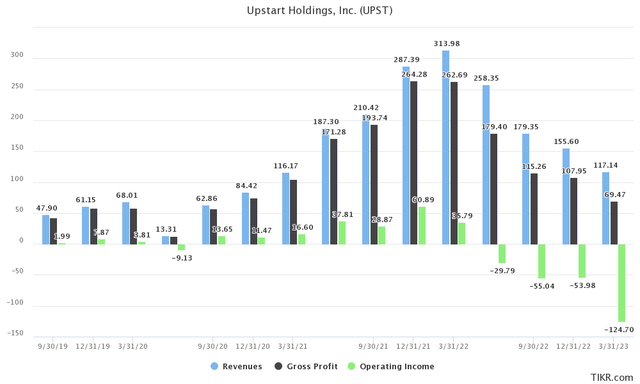

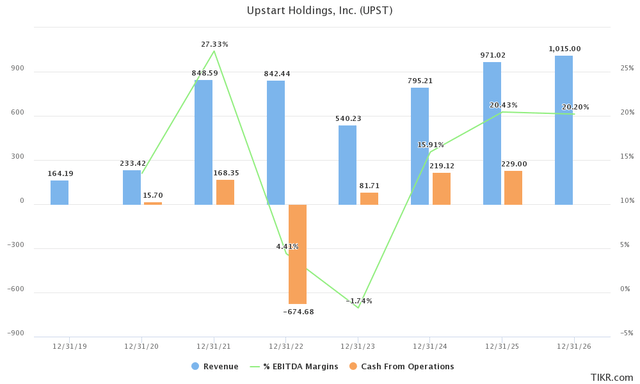

Financial performance until the first quarter of 2021 was downright spectacular, with the company growing revenue exponentially and making huge profit margins. Upstart was doubling or tripling revenue year over year, and the net income margin on those sales was above 25% of revenue.

TIKR

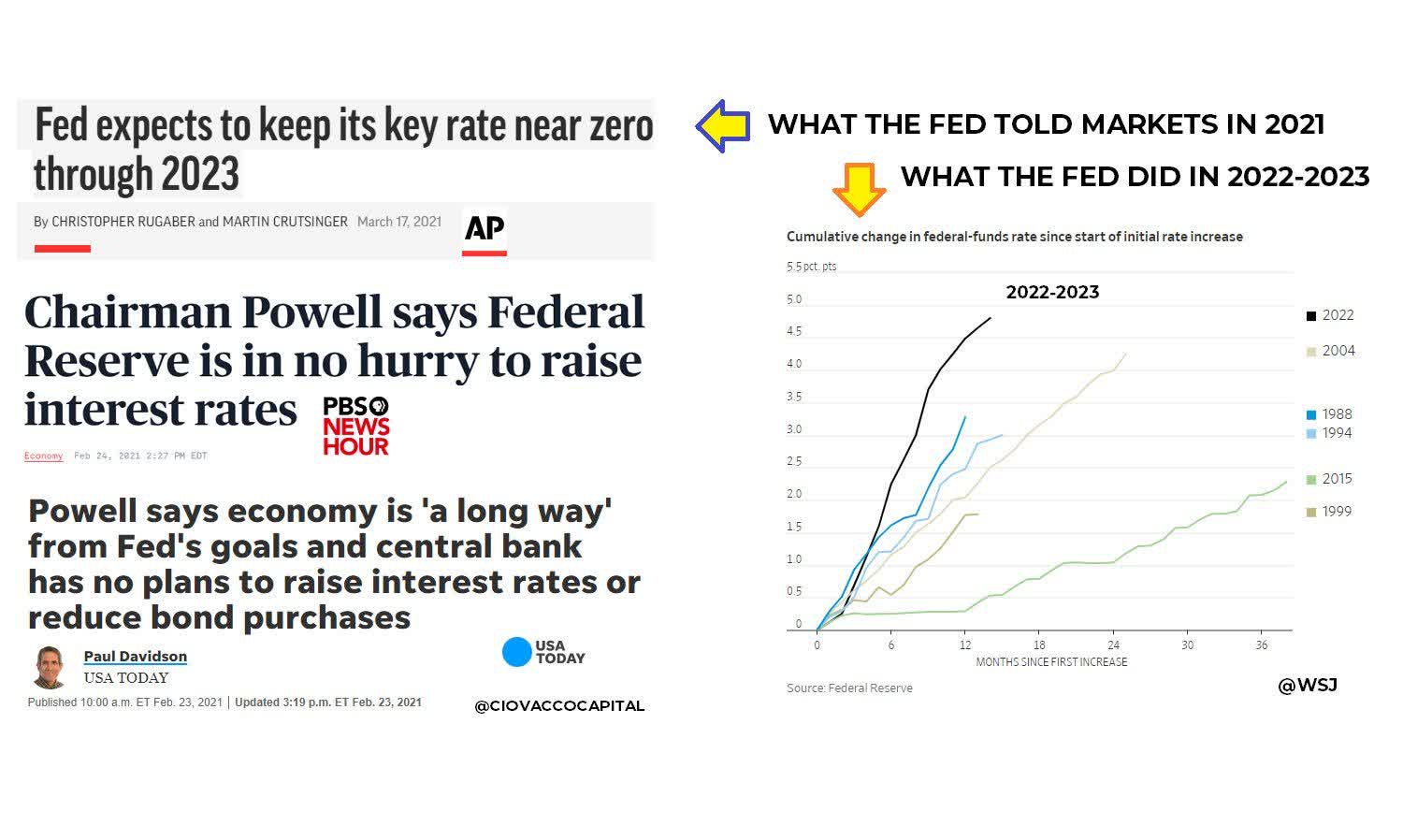

But financial conditions changed radically in 2021. At that time, the Fed was guiding to historically low rates through 2023, and then they implemented the most aggressive tightening campaign in 4 decades. The image from Ciovacco shows what the Fed said it would do versus what the Fed actually did.

Ciovacco Capital

This is a massive problem for banks. You don’t want to make loans today when you can make those loans at a higher rate tomorrow. If you are dealing with subprime borrowers, then the situation is even more critical because you are probably expecting higher default rates as financial conditions tighten.

More recently, the financial sector has been dealing with the bank runs at regional banks plus the uncertainty produced by the debt ceiling negotiations and the unlikely but never impossible risk of a US debt default.

Credit supply for subprime sectors declined abruptly in the past several quarters, and higher interest rates are also an issue for borrowers who are no longer eligible for loans under current conditions.

Upstart loan originations were $997 million last quarter, down 78% year over year, and total fee revenue was $117 million, a decrease of 63% year-over-year. The company has transitioned from being massively profitable to losing money due to declining revenue.

What Really Matters In The Long Term

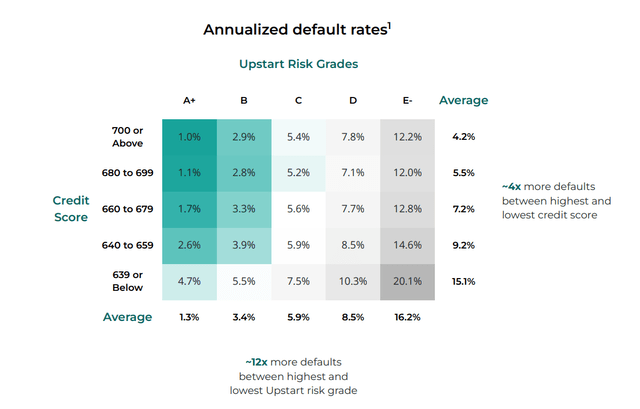

From a long-term perspective, the big question for investors is whether Upstart continues to perform well in terms of credit ratings or not.

If the technology provides superior credit qualifications versus FICO, then revenue and earnings are going to recover when credit supply returns to the market. Even more, if Upstart proves that it can perform well in a bad economy, that would be enormously beneficial in terms of generating long-term confidence from lending partners.

In that regard, the company provides this table showing how Upstart credit ratings perform much better than the FICO credit score in terms of predicting defaults.

Upstart

It is of utmost importance to monitor loan performance versus expectations, and this is closely related to the macro environment. When the economy is getting worse, the loans are going to perform worse than anticipated, and vice-versa.

This dynamic makes Upstart a particularly complex investment to analyze because we never know for sure if defaults are rising due to external and temporary factors such as macro conditions or if the company’s AI models are not delivering as expected.

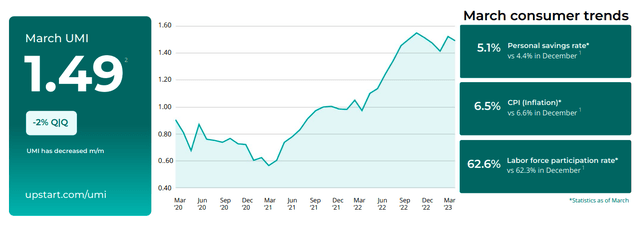

Upstart publishes its Upstart Macro Index, an indicator that shows how the main economic variables are trending and how this may impact loan performance in such periods. When UMI is rising, this means that the variables are getting worse and loans are underperforming.

Upstart

Management said in the most recent conference call that the UMI is stabilizing and even improving. It is not so much that the economy is doing well but savings rates have increased, perhaps because consumers are more cautious and concerned, and saving rates are a big factor for UMI.

Our own analysis, which we launched publicly in March in the form of the Upstart Macro Index, or UMI, suggests that the financial health of the mainstream American consumer deteriorated rapidly through the first 9-or-so months of 2022, but has since stabilized, if not improved for the last several months.

The personal savings rate, which may be the most relevant predictor of UMI, bottomed out mid last year at 2.7%, and has increased to 5.1% since then.

Since late 2022, loans on our platform have been priced conservatively relative to UMI. So our bank and credit union partners can feel confident that recent vintages are today performing at or above expectations.

To the extent that recent vintages are in fact outperforming expectations, that could be enormously helpful in terms of proving that the models work well through the ups and downs in the economic cycle and generating confidence among lending partners.

Perhaps the biggest positive in the report is that Upstart announced multiple long-term funding agreements. These commitments are expected to deliver more than $2 billion to the Upstart platform over the next 12 months.

Management was asked in the conference call if this $2 billion is securing minimums from existing partners or incremental funding. The company indicated that it is mostly incremental money.

A lot of it is coming from partners that are new to the platform that we’ve never worked with before. Some of it is coming from existing partners who would either sort of stepped away from funding during the turbulence of the past few quarters and are coming back to the platform or they’re re-upping in significant size and committing forward in exchange for the longer-term agreement.

So I think in almost every case, you can view it as sort of being additive to what we’ve been doing recently, and sort of underpins the — both the improving guide that we have in our Q2 numbers as well as the sort of more general optimism we’re signaling qualitatively.

The number is not particularly large, but it is a clear step in the right direction. The biggest problem for Upstart is that lending partners have no appetite for risk when financial conditions deteriorate, so securing these kinds of agreements can be enormously valuable in terms of providing more stability.

Risk And Upside Potential

Upstart is a high-risk investment, as the business is deeply exposed to economic conditions. We are talking about a company involved in disruptive AI-driven credit ratings at a time when the Fed has embarked on the most aggressive tightening campaign in 40 years, regional banks are falling, the economy could be entering a recession, and financial markets are agitated due to the debt ceiling negotiations.

In the short term, the biggest risk could be that perhaps we have not yet seen the worst for the economy. Even if we assume that the Fed has stopped hiking already, the banking crisis could get worse, and so could economic activity. In such a scenario, the inflection point in Upstart will be postponed.

There are other longer-term risks, such as the chance that the company’s models could fail or another AI company could provide superior solutions. This is not something that concerns me right now, but it is a risk that has to be acknowledged when investing in a disruptive growth stock at an early stage.

Risk and potential reward should always be considered together, and Upstart has truly massive potential from current prices in a bullish scenario.

The company had 10 lending partners at the time of the IPO, 50 lending partners one year ago, and almost 100 lending partners today. Partners are being restrictive in their lending right now, but they are clearly finding value in Upstart’s tech platform from a long-term point of view.

Upstart is also making material progress in terms of boosting efficiencies and cost-cutting. Nearly 84% of Upstart-powered loans are fully automated as of Q1, this means that those loans are approved and verified instantly with no human intervention whatsoever.

The company also reduced operating expenses by 15% year over year, driven mostly by a 76% decline in marketing expenses.

Management is expected to be breakeven at the adjusted EBITDA level in Q2. Stock-based compensation will still be an issue, but adjusted EBITDA is a broad approximation for cash flow, so this basically means that financial risk would be quite low if the company delivers on this guidance.

Upstart used to have huge profit margins in 2020-2021 with a much larger fixed cost structure. If the company can start growing again in a more favorable economic environment, then profitability could accelerate substantially. Rapid revenue growth and expanding margins could provide a double boost to earnings growth.

The company now has more than doubled or tripled its lending partners in the past several quarters, and it is expanding into huge markets.

Upstart

It is interesting to keep in mind that Upstart stock reached $400 per share in October of 2021. That was in a very different market environment, but it is not crazy to say that Upstart could deliver a similar level of earnings in 2024, 2025, or even 2026 to those of 2021. If we cut the valuation in half, we still get a target of $200 per share for a stock trading at $16.4.

The chart below shows reported and projected numbers for revenue, EBITDA margin, and operating cash flow. The average estimate is that Upstart will in fact recover those levels of revenue and earnings in the next few years.

TIKR

Wall Street estimates always carry a large margin of error, but it is not crazy to believe that financial conditions will eventually normalize, and Upstart could not only meet but even exceed the numbers it produced in a stronger economy a couple of years ago.

Assuming that the Fed has stopped rising rates, or at least that we have already seen most of the monetary tightening, some stability and predictability in that regard could be an important tailwind for Upstart and its partners.

Valuation And Timing

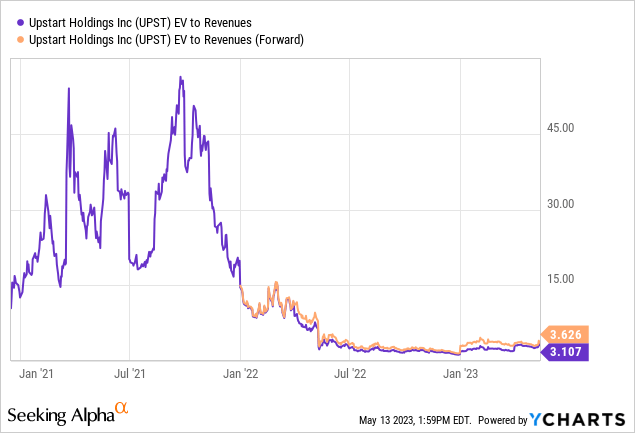

Upstart stock is currently trading at around 3.6 times trailing revenue and 3.1 times forward revenue estimates. This valuation is quite low from a historical point of view, especially because we are looking at cyclically depressed revenue levels in a bad economy.

YCharts

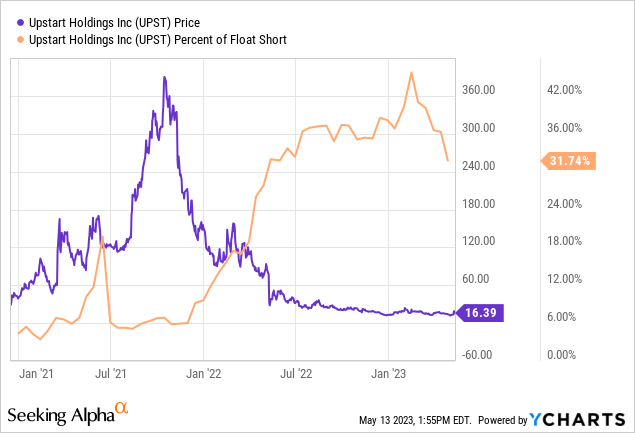

Short interest levels are very high, at over 30% of the float. Elevated short interest can make the stock particularly volatile in the short term, but it can also create the potential for a short squeeze if the stock starts moving higher and the shorts are forced to cover their positions.

YCharts

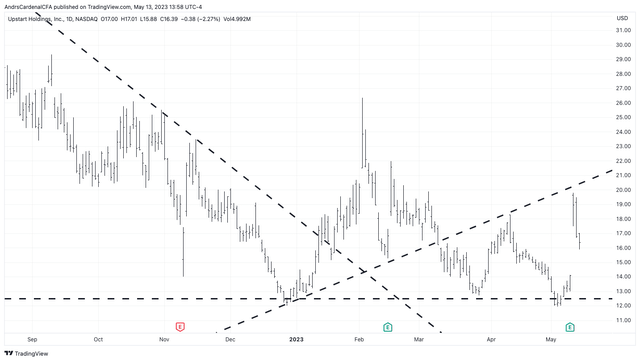

Upstart stock surged more than 30% after earnings, but then it pulled back over the following days. The stock price seems to have strong support at around $12.5 per share.

TradingView

The Bottom Line

Upstart is the quintessential moonshot investment. There is a high risk that things could not work out and investors in Upstart would lose capital. But the upside potential is also huge, and it is not much of a stretch to say that Upstart could deliver 5X or 10X the current price in 3 to 5 years.

Higher price targets are not out of the question if the company goes back to its growth trajectory over the long term. Leaving aside the valuation ratios, the business itself could be exponentially larger than it is now if Upstart succeeds.

There is a lot of appetite for AI investments right, and Upstart is a pure play on AI technology for credit ratings. It is not hard to imagine that the narrative around Upstart could change dramatically if economic conditions improve.

A lot of things could go wrong, but management is making progress on the fundamental side, and it is reasonable to expect financial conditions to eventually normalize in the not-so-distant future.

All this being said, Upstart is not the right kind of investment for everyone. Investors who like to focus on companies with consistent earnings generation and with a low risk of losing money over the long term should look for other opportunities. There are plenty of high-quality growth stocks offering flawless execution and attractive valuations these days.

For investors willing to assume the risk of losing money in exchange for massive upside potential, Upstart is an investment worth considering as long as the size of the position is in accordance with the investor’s risk tolerance.

Read the full article here