Shares of Keysight Technologies (NYSE:KEYS) have been a poor performer over the past year, losing of 20% of their value. Last October, I recommended investors buy shares, which has proven to be a bad recommendation, even as the company actually achieved my EPS estimate as the company’s earnings multiple has contracted meaningfully on future growth concerns. Its fiscal Q4 report has provided a bit of a respite for investors with shares rising about 2.5% after-hours on Monday. Given this, the question is whether now could be the start of a comeback, or if investors should cut losses. I would sell shares here.

Seeking Alpha

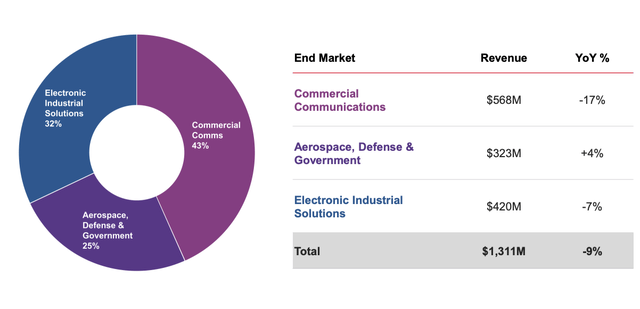

In its fiscal fourth quarter, Keysight earned $1.99 in non-GAAP EPS, beating estimates by $0.12, though revenue declined by 9% to $1.31 billion. This result was above the high-end of guidance. For the full year, KEYS earned $8.33, in the mid-point of my $8.20-$8.40 expectation. These results have been buoyed by margin expansion, and its backlog of orders. Last year with a 19x PE, there was a hope this double-digit earnings growth could persist, but with revenue lower than a year outlook, that near-term outlook is far murkier.

In the quarter, orders were $1.33 billion, slightly better than revenue, but still down 16% from last year. Still, it was encouraging to see a book-to-bill ratio above 1.0x, which may be a sign the business has begun to trough near current levels. For the full year, revenue rose from $5.4 to $5.5 billion, meanwhile orders fell from $6 billion to $5.2 billion, for a full year book to bill of just 0.94x. These orders helped to cushion H1 revenue, but now that backlog cushion is diminishing. This level of orders is consistent with the company being able to maintain near-term revenue, but they do not provide a clear growth trajectory.

Keysight’s geographic mix has been a leading problem this year. The Americas represent 44%, Asia 39%, and Europe 17% of KEYS’s revenue. As you can see below, Keysight does not see any region growing (there is no green), and Asia is the leading problem area.

Keysight

The Americas revenue was down 4% due to declines in commercial communications, offset by strength in aerospace, government, and defense (ADG). Europe was down 2% but saw the opposite trend, interestingly. These declines are manageable. Unfortunately, Asia was down 17% with weakness across all categories as China’s economy continues to struggle, creating problems across the region. There is also an industry mix issue at play here, as semiconductor activity is concentrated in Asia and has been soft.

In addition to regional disparities, KEYS is seeing very different trends by product, as you can see below. Its communication solutions group (CSG) accounts for about 2/3 of revenue and is comprised of commercial communications and ADG. It was down a blended 10% from last year while Electronic Industrial Solutions Group (EISG) was down 7%.

Keysight

Within CSG, the strength in ADG is one bright spot. The unit is actually seeing record revenue as countries continue to invest in radar and satellite solutions. With Boeing (BA) gradually recovering from the 737 MAX and COVID production issues, growth on the commercial side should continue. Given the ongoing focus of upgrading defense systems’ technology, this unit should see ongoing growth. Conversely, while 5G and AI-data spending are strong, investment in commercial communications is cautious. Companies like AT&T (T) and Verizon (VZ) have seen constrained cash flows and have large dividend payments. The telecommunications industry as a whole carries significant debt within its capital structure, which has become more burdensome as rates rise. This serves to constrain the appetite for capital spending, increasing the hurdle rate for new projects. Additionally, Chinese operators may be attempting to shift towards domestic companies to limit their exposure to further US sanctions as tensions remain high. Over the medium term, wireless network usage continues to rise, which should support demand for Keysight’s network monitoring products and service. This long-term potential has been overwhelmed by these cyclical headwinds. The Chinese headwind may persist, even as it accounts for less than half of Asian revenue.

Within EISG, consumer electronics were weak. KEYS’s offers a mix of products here. Some go into finished products, like sensors for electrical vehicles, which has been a bright spot. However, others are used to monitor factory production and model product performance. Here, KEYS is seeing weakness in auto and semiconductors as firms pull back on capital spending, given economic uncertainty. With the CHIPS Act increasing semiconductor factory spending in the US, this unit should see some growth as these factories move closer to completion in a couple of years. KEYS is also in the process of completing its 913 million euro acquisition of ESI Group (OTCPK:ESIGF), having assumed majority control. This will provide additional software capabilities to digitally simulate products’ behaviors.

While revenue was soft for the year, Keysight’s 2023 operating margin was 30.2%, up from 29.3% last year. However, it lost some momentum as the year progressed and revenue shrank with a Q4 operating margin of just 29.3%. Keysight’s net income was also buoyed by the fact interest income has risen six-fold from $16 to $102 million this year. That is now more than its $78 million in interest expense as it is carrying $2.5 billion in cash against $1.7 billion in debt. KEYS does have a pristine balance sheet, and its business generated a solid $1.2 billion in free cash flow this year, allowing it to reduce the share count by 2% via $700 million in repurchases.

Alongside results, it guided that in Q1, the company expects $1.53-$1.59 in non-GAAP EPS on ~$1.245 billion of revenue. This would represent a 10% drop in revenue from last year and a 23% drop in EPS. One challenge is that R&D spending has increased to 17% of revenue from 15% two years ago. Essentially, as revenue has fallen, KEYS is keeping up with past year R&D spending plans. On the negative side, this reduces margins in the near-term, but by continuing to invest, KEYS ensure it maintains cutting edge products and software, defending the franchise. Given its stellar balance sheet, I believe this to be the wise long-term decision.

Shares now have a trailing multiple of 16.5x, and the company has a net cash position. With orders now above revenue, we should see the business stabilize around current levels, barring a further economic downturn, and the sequential stabilization in communications is encouraging, albeit at a depressed level. However stabilizing near the Q4 exit-rate likely means 2024 results will come in below 2023 levels. Particularly with elevated R&D spending, and the potential for interest income to fall as it completes its purchase of ESI, spending down cash, I expect earnings to fall 0-5% for the year. This is primarily due to tough fiscal H1 comps. With about $7.90 in earnings power, shares have a 17.5x forward multiple.

This is not expensive, but unless one expects to see a strong recovery in Asia, KEYS business is set to shrink in 2024, and the recovery may take some time, despite favorable long-term dynamics. With shares up 12% from their lows and up further after-hours, I would now sell out of this broken-growth story. There may not be much downside, but 17.5x forward earnings for a business with declining earnings suggest the market is already pricing in a turn of the business. I struggle to see material upside, unless one expects a significant acceleration in Asia, which I do not view as particularly likely. My buy recommendation has not panned out, and I would not compound the error by staying long shares.

Read the full article here