Introduction

I’m a very picky investor. I currently own just 20 individual dividend (growth) stocks in my portfolio, which holds almost my entire net worth.

Essentially, there are two reasons why I hold just a few stocks:

- I try to avoid holding many correlated plays. Although I own four defense contractors, three railroads, and two self-storage REITs, I view these investments as single themes. Adding too many companies would make it harder to maintain my strategy.

- I want to have meaningful exposure. Of course, I could easily buy every company I’m bullish on. However, that would make many investments insignificant, which is more or less the same as not owning them.

In other words, although I cover way more stocks than I actually own, it is by no means a vote of no confidence in my own work.

Having said all of this, one stock I desperately want to own is Moody’s Corporation (NYSE:MCO), a financial powerhouse with a $65 billion market cap.

When it comes to financial stocks, I want to own companies that bring something to the table besides traditional lending and asset manager capabilities, which is the biggest chunk of the multi-trillion dollar financial sector.

For example, I own CME Group (CME), the owner of stock exchanges like COMEX, NYMEX, and CBOT, which allows me to make money from people trading futures and options and using related services.

Moody’s is similar. It doesn’t own stock exchanges, but it makes money on ratings, financial research, and a wide range of next-gen services that make the lives of so many financial professionals easier.

In this article, I’ll walk you through my thoughts.

So, let’s get to it!

A Financial Powerhouse

When you think of Moody’s, you’re probably thinking of headlines like the ones below, as the company has just adjusted the credit outlook of a number of nations, including the United States of America.

Wall Street Journal

Together with S&P Global (SPGI) and Fitch, which is owned by the Hearst Corporation, the company dominates global credit rating services.

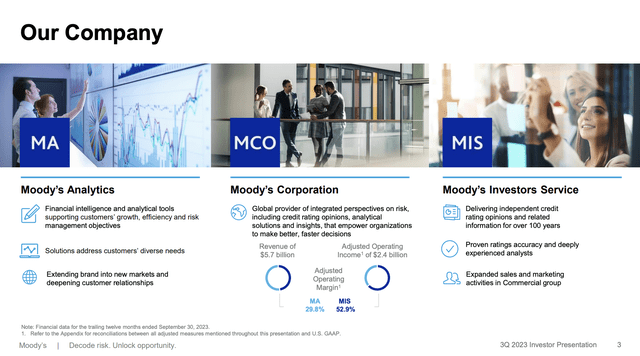

The company operates two major business segments, each accounting for roughly half of total revenues, with analytics accounting for the majority of operating income.

Moody’s Corporation

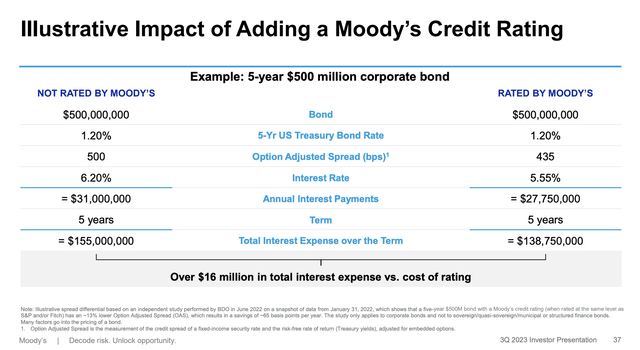

- Moody’s Investors Service (“MIS”): This well-known segment provides credit ratings, research, and analysis for various types of debt securities and entities, including government and corporate bonds, structured finance products, and municipal securities. As the overview below shows, a rating from Moody’s has significant benefits, often leading to significant cost savings.

Moody’s Corporation

- Moody’s Analytics (“MA”): This segment offers financial risk management software and services, economic research, data services, and analytical tools to help corporations make informed financial decisions.

Moody’s Corporation

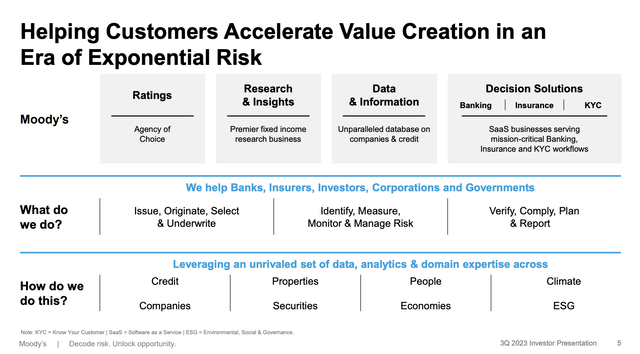

The beauty of providing services that companies rely on is that it covers so many different assets.

Moody’s estimates that its TAM (total addressable market) is currently north of $40 billion, including commercial lending, insurance analysis, fixed-income investing, supply chain management, real estate, and so much more.

But wait, it gets even better.

What makes companies great is recurring revenue. Once companies achieve to build a large recurring revenue base, they benefit from less volatile cash flows and often strong foundations for long-term growth.

- 70% of Moody’s revenue is recurring!

This has meaningfully contributed to rapid growth in its key financials. Over the past ten years:

- The company has grown its revenue by 6.9% per year.

- Higher margins and buybacks have allowed earnings per share to be compounded by 9.3% per year.

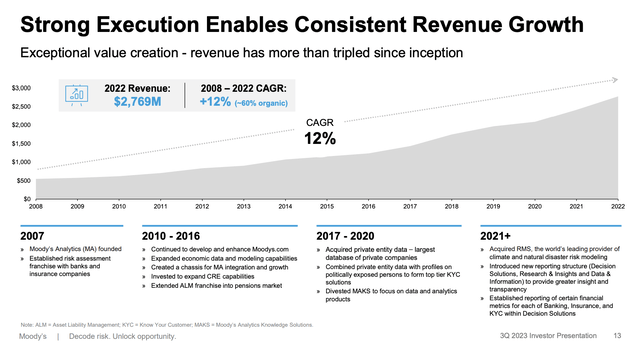

Since 2008, revenue has grown by 12% per year.

Moody’s Corporation

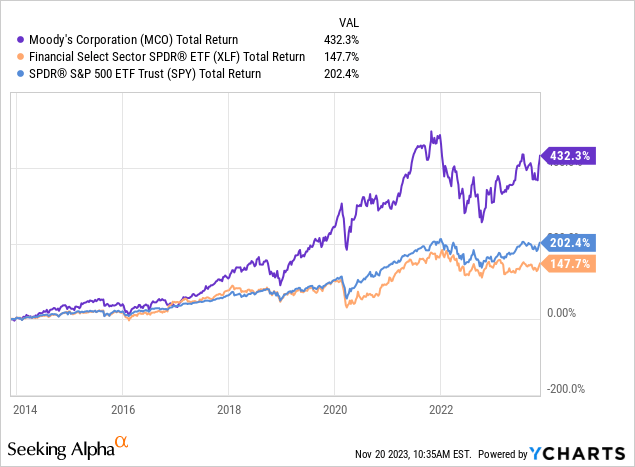

Going back to 4Q13, MCO shares have returned more than 430%, beating the S&P 500 by roughly 130 points. It has beaten the financial sector by an even bigger margin.

It also has a top-tier dividend scorecard.

The company scores high on safety, growth, and consistency, with a poor score for its yield.

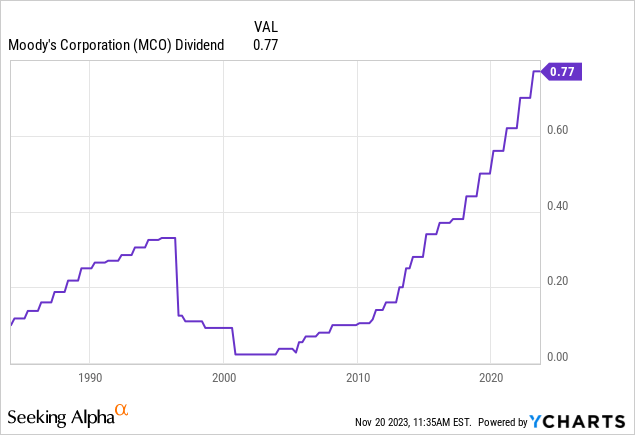

Although its yield is just 0.9%, it comes with a low 30% payout ratio, a five-year CAGR of 12.1%, and 13 consecutive years of dividend growth.

During the Great Financial Crisis, the company kept its dividend unchanged, which is good news, as many financial companies were forced to cut.

Furthermore, the good news is that the company continues to do well, especially in light of macroeconomic challenges and new technological developments.

Moody’s Is Prepared For What’s Next

In its most recent quarter, Moody’s showed strong growth.

The company reported robust financial results in the third quarter, showing a 15% overall revenue growth.

This growth was accompanied by improved adjusted operating margins across all businesses, contributing to an impressive 31% increase in adjusted diluted EPS.

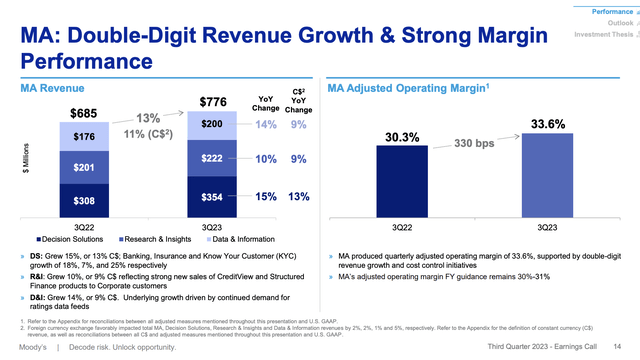

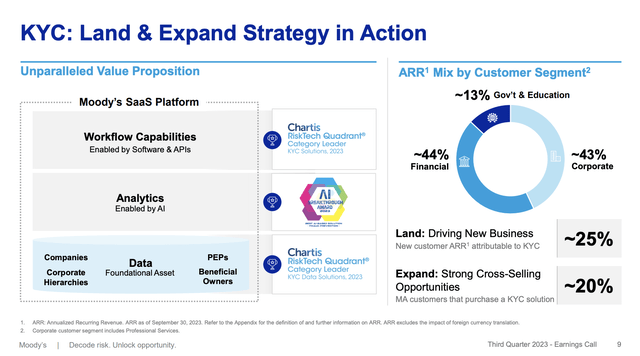

- Within MA, revenue grew by 13%, with the KYC business leading the way. According to the company, the KYC business, focused on Know Your Customer, demonstrated exceptional performance, reaching over $300 million in annualized recurring revenue (“ARR”) and sustaining an 18% growth rate. As we can see below, MA’s adjusted operating margin reached an impressive 33.6%.

Moody’s Corporation

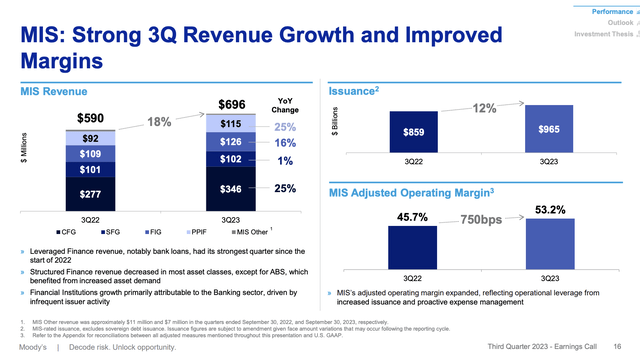

- The MIS segment experienced a notable 18% growth in the quarter, driven by improvements in the leveraged finance issuance markets. Despite uncertainties in the capital markets, MIS expects its revenue to grow in the mid-to-high single-digit percentage range for the full year.

Moody’s Corporation

Furthermore, while elevated rates are bad for new debt demand, the company sees a strong bull case.

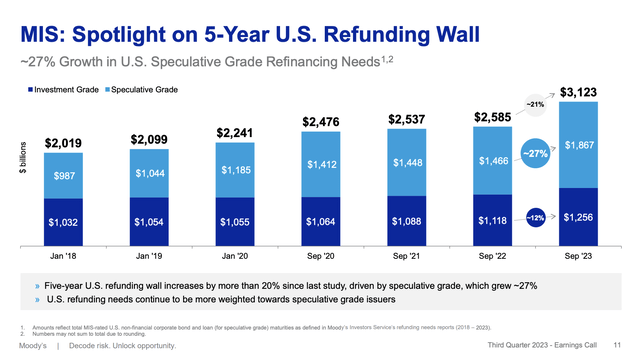

During its earnings call, the company highlighted its annual refinancing wall study, revealing a substantial 21% increase in total U.S. nonfinancial corporate debt coming due over the next five years.

This data underlines the importance of these refinancing walls in Moody’s long-term growth algorithm.

Also, most of it is non-investment grade debt, which will be a challenge, as I am fairly sure that most of it will be refinanced against much higher rates.

Moody’s Corporation

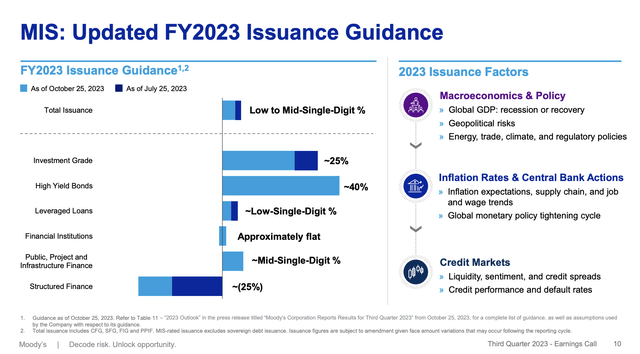

Unfortunately, due to a challenging macro environment, the company adjusted issuance guidance, which I believe was already expected, as it didn’t have a major impact on its stock price.

Moody’s Corporation

What matters more than this guidance adjustment is the company’s investments in its capabilities.

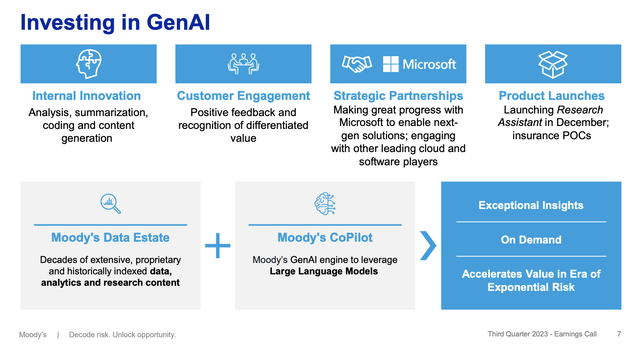

Moody’s is actively prioritizing innovation and embracing new technologies as part of its GenAI strategy.

For example, the adoption of GenAI is geared towards developing cutting-edge solutions that empower both customers and employees. The pace of innovation within the company is accelerating across all business segments.

Moody’s Corporation

Moody’s is rapidly developing tools and using customers to get feedback to get them to market quickly.

Moody’s Analytics, for example, introduced its first GenAI-enabled product, Research Assistant, which has been previewed with over 150 customers.

This product, set to be commercialized during the year-end renewal cycle, leverages the power of GenAI to enhance credit insights.

Moody’s is also leveraging GenAI in its Decision Solutions, particularly in banking, while the launch of a new module in CreditLens integrates a bank’s loan-level data with Moody’s content, providing a dynamic view of a bank’s loan portfolio.

Additionally, Moody’s is integrating RMS’s physical and transition risk models with proprietary ESG and climate data, empowering customers to make informed decisions around lending, portfolio management, stress testing, and regulatory reporting.

Moreover, Moody’s extended its domestic ratings business to Latin America and launched VIS Rating in Vietnam, tapping into exciting opportunities in these regions.

Moody’s Corporation

On top of that, Moody’s is not only investing in new technologies but is also focused on integrating data and enhancing content across its platforms.

In the case of CreditView, the coverage was expanded to include 12,000 new unrated names, catering to the private credit market.

This move exemplifies content integration to serve new customers and address emerging use cases.

The company is constantly investing in its data estate, integrating cyber data and scores from BitSight into Orbis, enabling customers to gain a deeper understanding of cyber risk, which is a rapidly evolving market as well.

Valuation

This is the tricky part, as good things often don’t come cheap.

After rallying 14.5% over the past four weeks, MCO shares are now up 28% year-to-date, making it one of the best years since the Great Financial Crisis.

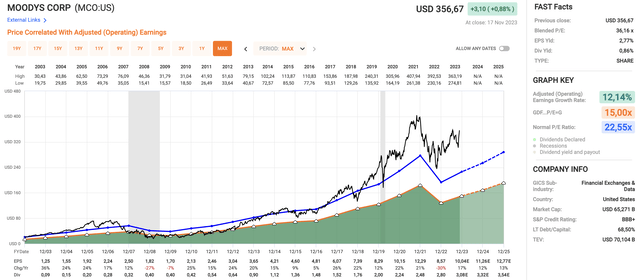

Using the data in the chart below:

- MCO is trading at a blended P/E ratio of 36.2x.

- Going back two decades, its normalized valuation multiple is 22.6x earnings.

- After seeing a 30% decline in EPS in 2022, 2023 is expected to see 17% EPS growth, followed by 12% and 13% growth in 2024 and 2025, respectively.

- Given the company’s strong business, I wouldn’t bet against prolonged annual double-digit EPS growth. This would warrant a 22-25x earnings multiple.

FAST Graphs

On a side note, it has a BBB+ credit rating from S&P. This is one step below the A range.

Based on a 22.6x multiple, traders have priced in at least two more years of strong growth.

It currently trades at $359 per share. The consensus price target is $356, which makes sense.

Hence, I put MCO on my watchlist, not in my portfolio.

I’m hunting for an entry close to $280. It’s a bit of a long shot, but I prefer to buy the stocks on my watchlist at a discount. I rarely chase rallies.

If we were in a very strong economic environment, I may be tempted to buy MCO at its current price.

However:

- As MCO points out, we’re about to hit a wall of maturities.

- If inflation remains sticky (I expect that to be the case unless we get a major recession, which also isn’t bullish), we could see elevated rates on a prolonged basis.

- Given economic risks and elevated default probabilities, I believe we could get a buying opportunity in MCO shares next year.

Again, feel free to ignore my macro view. The main message is that MCO is a great company and a fantastic fit for my portfolio.

I hope to get a buying opportunity, as it would go very well with my strategy to buy top-tier dividend growth stocks with wide moats and secular growth opportunities.

Also, I stick to my Buy rating, which is a long-term rating.

Read the full article here