Burning bridges behind you is understandable. It’s the bridges before us that we burn, not realizing we may need to cross, that brings regret.”― Anthony Liccione.

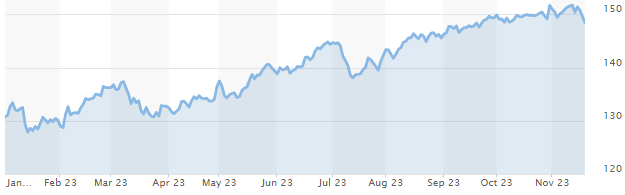

We are quickly approaching Thanksgiving Day and the commencement of the holiday season as 2023 fast approaches its close. After a dismal August, September and most of October for investors, the market has put together an impressive three-week winning streak. Last week, the S&P 500 (SP500) added 2.2%, while the Nasdaq (COMP.IND) rose 2.4%. The Dow (DJI) closed the week with a 1.9% gain. So far in November, the S&P 500 is up 7.6%, while the Dow has posted a 5.7% rise, and the NASDAQ has rallied nearly 10%.

So, what is ahead for 2024? We highlight the knowns, the unknowns and two key watch items as we approach the New Year below.

Two Things We Know

Find a job you enjoy doing, and you will never have to work a day in your life.”― Mark Twain.

Economic Growth Is Slowing:

There is nowhere to go but down from the 4.9% GDP growth experienced in the third quarter. The quarter should be viewed as a one-off that was bolstered by a tremendous amount of taxpayer largesse via new “infrastructure” legislation, commonly referred to as the ill-named Inflation Reduction Act.

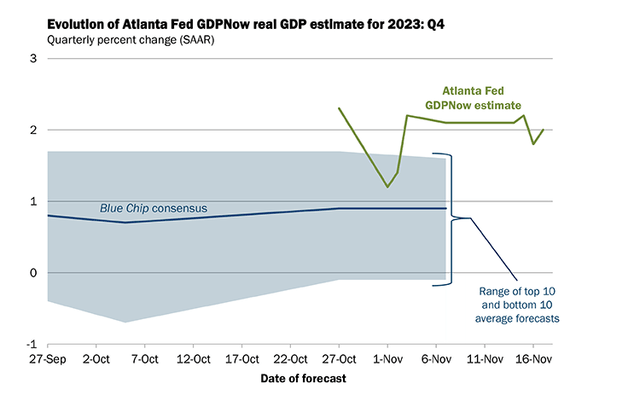

Atlanta Fed’s GDP Now

Currently, the Atlanta Fed’s GDPNow is predicting only 2.1% GDP growth in the fourth quarter of this year. And this projection is far above most estimates, it should be noted. Canada, the largest trading partner of the United States, has seen flat or slightly negative growth over the past two quarters and Europe is on the cusp of recession.

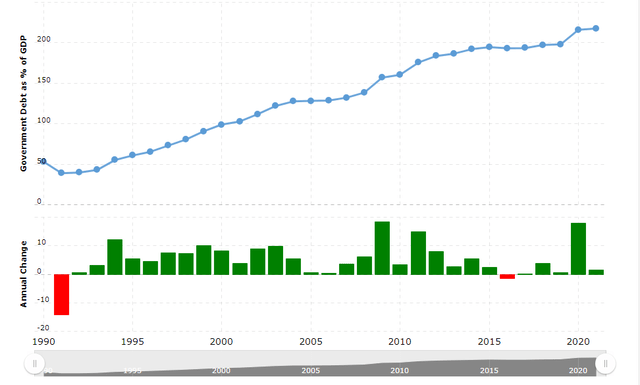

Japan’s Debt To GDP Level (Macro Trends)

China and Japan both have a litany of problems to deal with as well. For Japan, the largest debt to GDP ratio in the developed economies is providing a huge headwind to its economy in the environment of rising rates. One reason the yen has seen such a drop this year, which is not helpful on the inflation front for the Land of the Rising Sun. China is increasingly dealing with a massive property bubble.

Yen to USD (MarketWatch)

The Consumer Is Faltering:

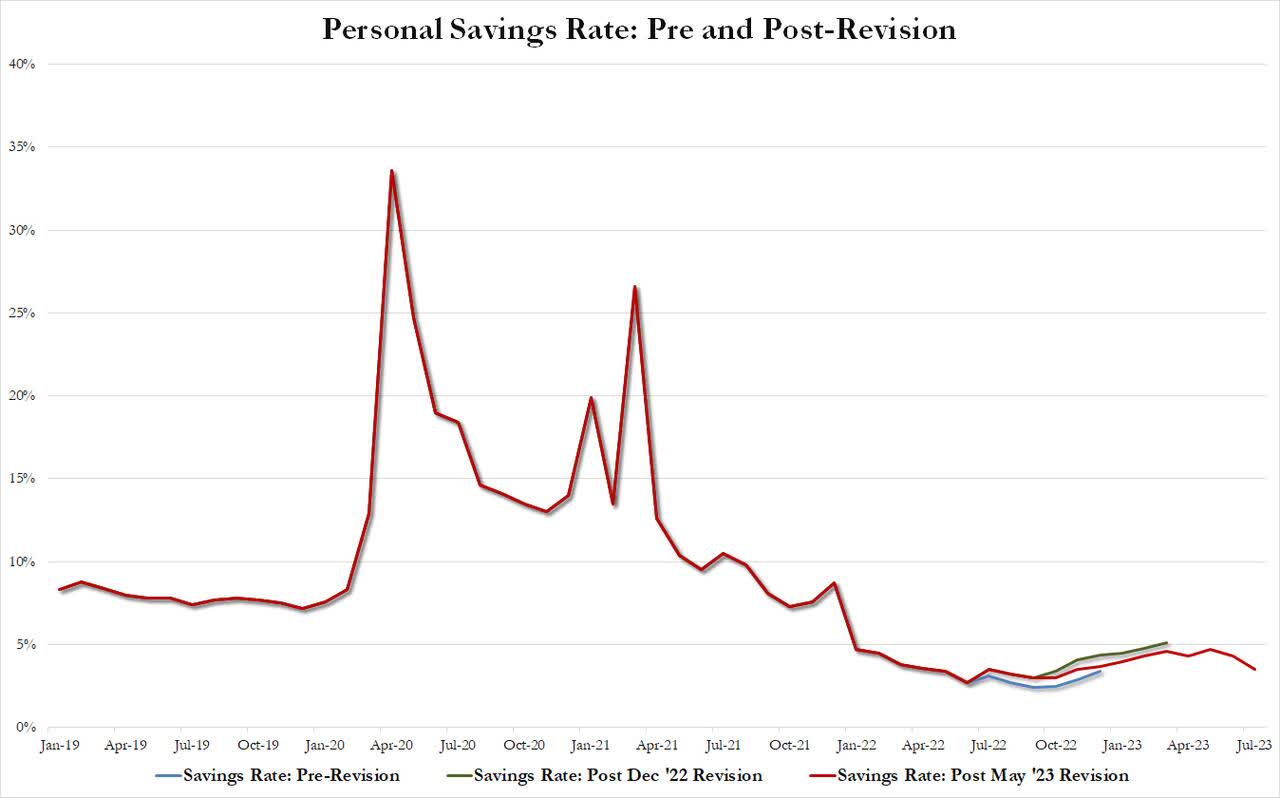

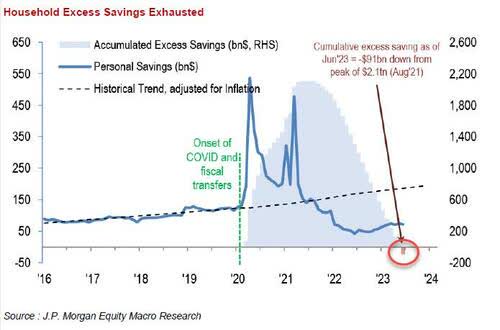

The consumer has been sustained by two key things over the past two years as the country has experienced the highest bout of inflation since the late 70s/early 80s. The first was the massive amount of excess savings built up during the pandemic and its aftermath.

Seeking Alpha

Those funds have now been largely burnt through, and the personal savings rate is at its lowest level since the Great Financial Crisis of some 15 year ago.

JP Morgan Equity Macro Research

Job growth also has been strong consistently since the Covid lock downs started to be lifted. The jobs picture is starting to deteriorate in recent months, however. Full time positions have declined over the past three months and the only reason headline monthly BLS jobs numbers are still positive is due to the surge in part time jobs as a record number of Americans are working two or three jobs to make ends meet.

Tens of millions of Americans are also now facing the resumption of student loan repayments after a three plus year, taxpayer funded hiatus. This is probably one reason retail sales only rose .1% in October. Retail sales in October of 2022 were up 1.3% on a month-over-month basis it should be noted. The consumer, who makes up nearly 70% of economic activity in the United States, is likely to remain under duress throughout 2024.

Two Things We Don’t:

It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”― Harry S. Truman.

Will The U.S. Skirt A Recession?

This is the $64,000 question for investors as we head into a new year. Economic pundits have increasingly embraced the view that the Federal Reserve will achieve a “soft landing” in recent months, and that scenario has now become the consensus.

However, I am more in the hard landing camp still, which I articulated most recently in this article. I am aligned with former Treasury Secretary Larry Summers, who correctly predicted a huge uptick in inflation in 2021 when the Fed was saying surging prices would be “transitionary” and “temporary,” views that the chance of a soft landing is approximately one in three.

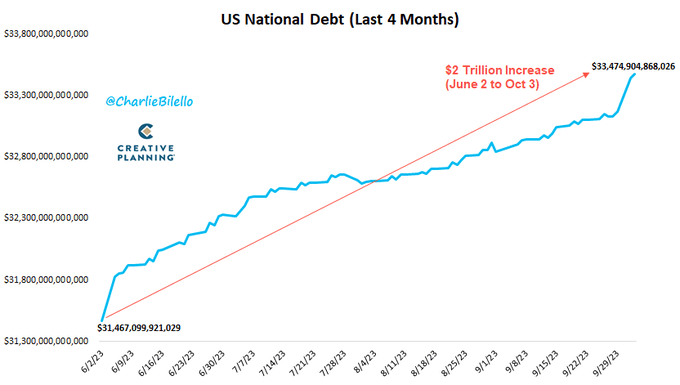

Charlie Biello – Chartered Market Technician

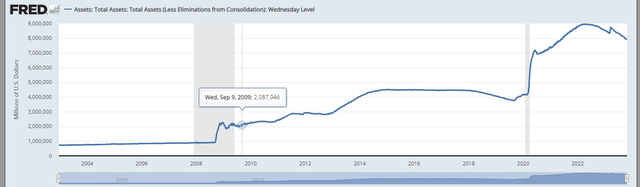

I continue to believe that the most aggressive monetary policy since the days of Paul Volcker can only result in the central bank ‘breaking something’ significant at some point in 2024. This is especially true given the national debt is roughly four times as large as it was heading into the economic crisis of 2008 and the Fed’s balance sheet is ten times larger.

Federal Reserve Balance Sheet (St. Louis Fed Economic Data)

Will Interest Rates Continue To Fall?

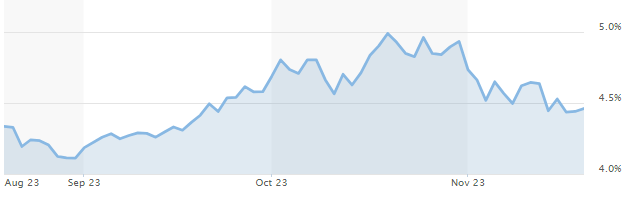

The rebound in equities over the past three weeks has directly coincided and tracked the fall in interest rates. After broaching the five percent briefly in late October for the first time since July of 2007, the yield of the 10-Year Treasury (US10Y) has fallen back to 4.44% as of the market close on Friday.

10-Year Treasury Yield (MarketWatch)

If yields continue to slowly decline, equities probably will continue to rally into year end. Where interest rates head in 2024 which be a primary driver of capital appreciation and will be closely watched by investors and the financial media. The one caveat being that if they fall sharply in the coming year, it most likely means the economy is in a significant recession. Obviously, this would not be good for equity performance.

Two Things To Watch

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” Ronald Reagan.

The “Last Mile” On The Inflation Front:

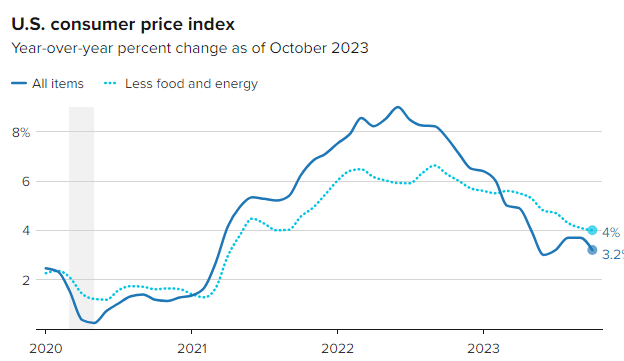

After peaking at just north of nine percent in June of 2022, the CPI fell consistently all the way down to the three percent level in June of this year. However, the CPI backed up notably in the July through September period (which corresponded to the fall in equities). In October, the CPI came in at 3.2%, just under expectations. The Core CPI, excluding food and energy, rose four percent. This is the lowest rise in year-over-year CPI in two years.

CNBC

There are some caveats to this report, it should be noted. Overall CPI benefited from large decline in energy prices, particularly gasoline, which is unlikely to repeated in the months ahead. In addition, core CPI is still twice that of the Fed’s official target of two percent.

The so-called “last mile” on the inflation fight is likely to take longer to accomplish than most investors currently expect thanks to “sticky inflation.” How fast or slow prices come down from here is an unknown that will provide significant uncertainty until resolved.

Commercial Real Estate Delinquencies And Defaults:

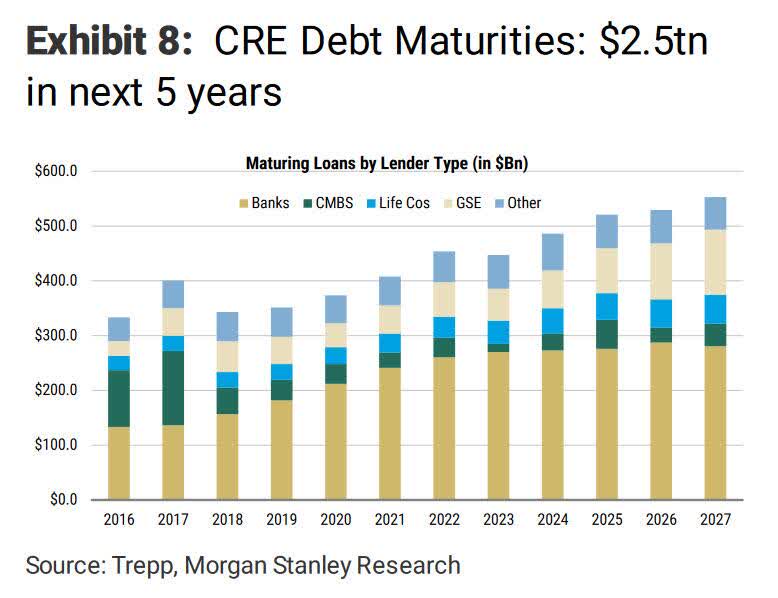

If it isn’t the flagging health of the consumer or a major geopolitical event that triggers a recession in the year ahead, it most like is the commercial real estate sector. Asset values are falling fast across many parts of the CRE complex that has $540 billion worth of debt that needs to be refinanced at much higher rates in 2024.

Trepp, Morgan Stanley Research

As but one of many examples of falling asset values, the loans of now defunct Signature Bank reflect the fall in asset values as loans on NYC apartment complexes (a relatively healthy part of the CRE space compared to office and retail) are being auctioned off for a bit under 70 cents on the dollar to face value.

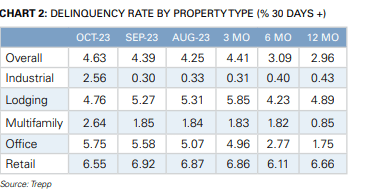

October Delinquency Rate By Property Type (Trepp)

This is not good news for the regional banking system which endured the second, third and fourth largest bank failures in U.S. history in the first half of this year. Regional banks provide approximately 70% of CRE loan originations and hold 30% of all CRE debt. Therefore, where CRE delinquency and default rates head from here should be a key determinant of potential economic disruption in 2024 and should be monitored closely.

Verdict:

And that is how the market stands as we head into the last few weeks of 2023. My base scenario in 2024 is that the United States will enter a shallow recession at some point in the New Year, most likely in the first half of next year. Stocks should decline in this scenario and probably touch on official “bear market” territory. This would put us roughly at the 3,700 level on the S&P 500 given the index’s recent high in late July. Given that view, my portfolio is positioned very conservatively with an approximate allocation of 50% to short term treasuries yielding just under 5.5% currently.

MarketWatch

Note: Please feel free to post your view on the where the economy and markets are heading in 2024 in the comments section below.

The past does not dictate the future…but it can draw a very detailed sketch.”― Aegelis.

Read the full article here