Booz Allen Hamilton (NYSE:BAH) is a consulting service provider for the U.S. government, including Defense, Intelligence, and Civil sectors. They generate almost 98% of their group revenue from the government and also have a small operation servicing commercial customers. Booz Allen Hamilton is a stable business with some structural growth tailwinds from AI and Cybersecurity. I am initiating a ‘Buy’ rating with a $150 fair value per share.

Grow With the Government IT Spending

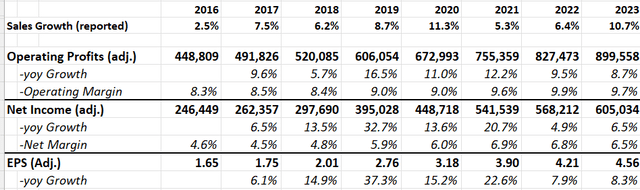

Booz Allen has experienced notable revenue growth over the past few years, attributed to increased U.S. government IT spending. In the last 7 years, they have achieved an average revenue growth of 8% and operating profit growth of 10.5%.

BAH 10Ks

Booz Allen is strategically positioned in high-growth areas, particularly AI and cybersecurity. According to the White House, cybersecurity is a top priority for the current administration, with plans to allocate $10.9 billion for cybersecurity-related activities-a notable 11% increase from the 2022 level.

The government’s investment in AI is in its early stages, having spent only $1 billion in 2020. Anticipating accelerated federal AI spending in the coming years, there is a heightened sense of urgency across the White House and major agencies to implement AI and machine learning capabilities. This urgency has been further intensified amid recent geopolitical events and conflicts, where big data and AI machine learning are seen as crucial for effective intelligence collection and decision-making.

During the Q2 FY24 earnings call, Booz Allen’s management revealed that their AI business currently generates around $500 to $700 million in revenue. They anticipate substantial growth in this sector over the coming years, with expansion spanning Defense, Intelligence, and Civil markets.

Financial Analysis

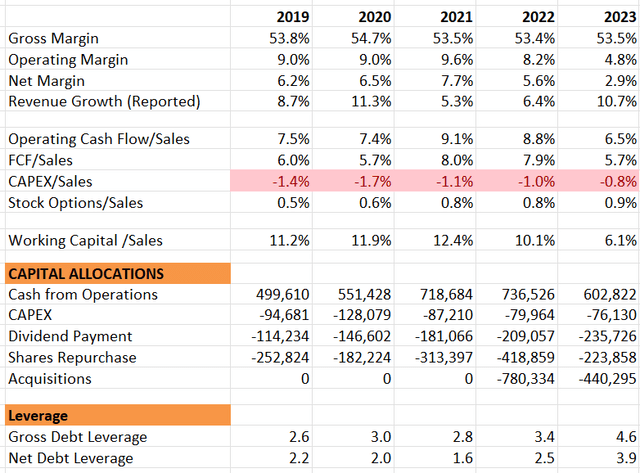

Booz Allen has experienced robust growth in recent years, achieving a 9% organic revenue increase in FY23. Operating on an asset-light business model, their capital expenditure represents less than 1% of group sales. Cash from operations has been allocated towards dividends, share buybacks, and strategic tuck-in acquisitions.

On the balance sheet, their net debt leverage stood at 3.9x at the end of FY23. While this debt leverage may seem high compared to other consulting companies, it is important to note that Booz Allen primarily serves the U.S. government. Given their focus on government services, relatively higher leverage is considered acceptable and manageable.

BAH 10Ks

Recent Business Updates and Outlook

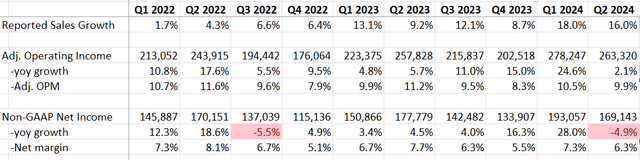

In Q2 FY24 reported on October 27th, Booz Allen delivered impressive results with a 16% growth in revenue and a 2.1% increase in adjusted operating income. Of the reported revenue growth, 14.8% was organic. During the earnings call, it was revealed that the total backlog as of September 30 reached a record $35 billion, marking a significant 10.1% year-over-year increase. This robust backlog, coupled with a strong project pipeline, lays a solid foundation for their future growth.

As of the quarter’s end, the net debt leverage ratio was 2.7x adjusted EBITDA, falling below their target range of 3-3.5x set during their 2021 Capital Market Day. This indicates a financially prudent position, further contributing to Booz Allen’s positive outlook.

BAH Quarterly Results

During their 2021 Capital Market Day, Booz Allen outlined mid-term growth targets, aiming for 5-8% organic revenue growth and a substantial increase in adjusted EBITDA from $840 million in FY21 to $1.2-$1.3 billion by FY25. This implies a compound annual growth rate of 10.4%. The organic revenue growth rate appears both achievable and realistic, aligning with their historical growth rates. Furthermore, the potential acceleration in government IT spending on AI and cybersecurity positions Booz Allen favorably, potentially exceeding their historical growth trajectory.

BAH 2021 Capital Market Day

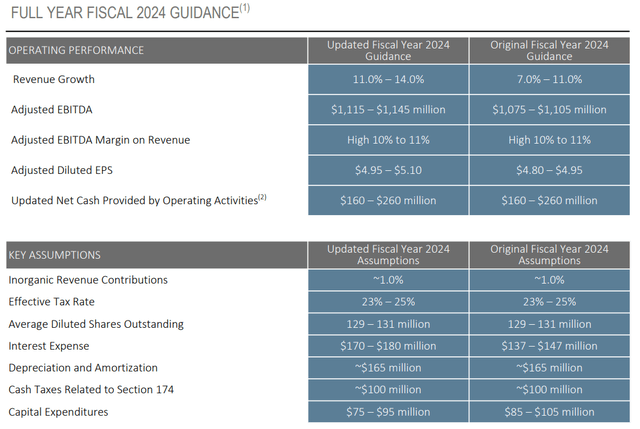

In Q2 FY24, they revised their full-year guidance, anticipating robust performance in both top-line and bottom-line growth. The updated projections for FY24 now stand at 11-14% revenue growth and a 9.6% increase in adjusted diluted EPS. It’s noteworthy that the FY24 revenue growth guidance is being compared to the already substantial base of a 9% organic revenue growth rate achieved in FY23. This makes the projected growth rate particularly impressive.

BAH Q2 FY24 Presentation

Key Risks

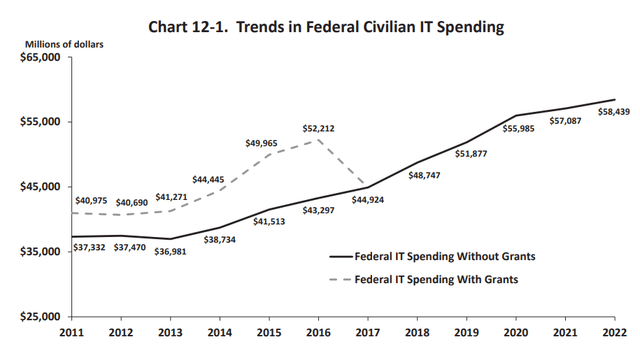

Government Spending Cycles: As Booz Allen derives the majority of its revenue from the U.S. government, fluctuations in federal IT spending cycles can significantly influence the company’s growth rate. The chart below illustrates historical trends in federal civilian IT spending, revealing an accelerated pattern since 2013. Looking ahead, there is a possibility of a slowdown in government IT spending, particularly in the event of budget tightening measures.

White House

Settlement with the Department of Justice: In July 2023, Booz Allen reached an agreement to pay $377.45 million to settle allegations under the False Claims Act. The accusations involved improperly billing commercial and international costs to government contracts. The settlement addresses claims spanning from approximately 2011 to 2021. While the financial impact of the settlement may not be significant for the company, the allegations have raised concerns regarding internal control policies and corporate governance practices.

Government Shutdown: In the event of a government shutdown, Booz Allen’s projects could face disruptions and delays. Notably, Booz Allen has factored the possibility of a U.S. government shutdown into their guidance. As of November 14th, 2023, the U.S. House has passed a temporary spending bill to prevent a government shutdown. However, this extension is only in effect until mid-January and still requires approval from the Senate. In summary, the situation remains uncertain for now.

Valuations

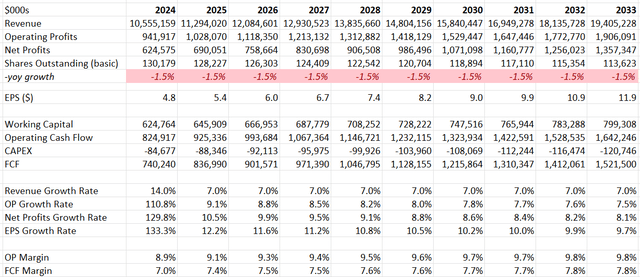

Regarding the normalized growth rate, several factors merit consideration. Firstly, Booz Allen aims for 3-5% client staff headcount growth year over year, potentially contributing 2-3% to revenue growth when accounting for the gradual onboarding of new consultants. Secondly, only 22% of their revenue is derived from fixed-price contracts, with the majority being cost-reimbursable or time and materials-based pricing. Even in a normal inflationary economy, a 2% pricing growth is feasible.

Thirdly, according to the White House, federal IT spending has demonstrated a compound annual growth rate of 5.4%, increasing from $45 billion in 2017 to $58 billion in 2022. Given Booz Allen’s strategic positioning in higher growth areas such as 5G, AI, quantum, and cybersecurity, an assumption of growth surpassing the market average is reasonable. Taking all these factors into account, I am confident that Booz Allen can achieve a 7% revenue growth, representing the higher end of their 5-8% mid-term growth rate projection.

Margin expansion is anticipated from operating leverage, with the model incorporating a conservative 10 basis points annual margin expansion rate in my view.

BAH DCF-Author’s Calculation

The model utilizes a 10% discount rate, 4% terminal growth rate, and assumes a 24% tax rate. Based on these parameters, the estimated fair value in the DCF model is $150 per share.

Verdict

In summary, Booz Allen Hamilton stands as a high-quality business, primarily reliant on revenue from the U.S. government. Its growth prospects are closely aligned with the overall expansion of the federal IT spending budget, along with strategic a focus on high-growth areas like AI and cybersecurity. Consequently, I am initiating a ‘Buy’ rating with a fair value estimate of $150 per share.

Read the full article here