We previously covered Alibaba Group Holding Limited (NYSE:BABA) in August 2023, discussing its battleground stock status as it continued to trade at impacted prices, despite the previously outstanding FQ1’24 results.

While geopolitical issues might remain a headwind, we had rated the stock as a Buy for long-term investors then, thanks to the potential contribution by Generative AI to its cloud performance and the potential rerating in its valuations nearer to its peers.

This article will be focusing on BABA’s recent performance in the Cloud and e-commerce segments since we believe these two segments are the company’s long-term growth drivers.

We will also discuss why we are finally adding here, with the recent summit between Biden and Xi likely to thaw market sentiments surrounding Chinese ADRs, especially with the stock already nearing its lowest-ever recorded P/E valuation of 8.30x.

BABA’s Valuations Indicate That It Is Extremely Cheap Here

For now, BABA has delivered a surprising update in its internal break-up plan, with the spin-off for the cloud segment scrapped as the US government widened the trade restrictions for Nvidia’s (NVDA) AI chips.

While this segment may not be its top and bottom line driver, the company’s Cloud Intelligence Group remains China’s largest cloud provider, with 34% of the market share in Q1’23.

In addition, we have observed a notable improvement on a QoQ basis in BABA’s cloud revenues of 27.64B Yuan (+10% QoQ/ +2.2% YoY) and EBITA of 1.4B Yuan (+264% QoQ/ +43.6% YoY) in the latest quarter.

This is likely attributed to the robust consumer demand for its cloud computing services and in-house generative AI capabilities, with the management preferring to temporarily shelve plans until the IPO market conditions are more favorable.

This was also why Mr. Market had cheered the break-up then, with a fellow analyst on Seeking Alpha awarding BABA’s Cloud segment with an estimated Enterprise Value of $603B in April 2023, well exceeding the company’s current Enterprise Value of $164.34B.

Interested investors may want to note that a similar observation has been noted for Amazon (AMZN), which as the leading global cloud market share of 32% as of Q2’23. A Redburn analyst has previously estimated the AWS to be worth approximately $3T as a standalone business in the long term, well exceeding the overall company’s Enterprise Value of $1.6T at the time of writing.

For now, BABA’s prospects have also been temporarily destabilized by the miss on the FQ2’24 top-line, with overall revenues of 224.79B Yuan (-3.9% QoQ/ +8.5% YoY), or the equivalent of $30.81B missing the consensus estimates of $31B.

In this case, the untimely combination of these two poorly received news items has already triggered a -10.8% plunge in its stock prices over the past week, despite the announced cash dividends of $1 per ADR, implying a forward dividend yield of 1.2%.

However, we believe that Mr. Market has over-reacted, due to the robust expansion in BABA’s overall adj EBITA to 42.84B Yuan (-5.5% QoQ/ +18.4% YoY) and adj EBITA margins to 19% (-0.3 points QoQ/ +1.6 YoY). This naturally contributes to the expanded adj EPS of 15.63 Yuan (-10% QoQ/ +20.9% YoY) in the latest quarter.

These numbers imply that the management’s drastic cost optimizations have worked as intended, attributed to the moderation in its global headcounts to 224.95K employees (-3.72K QoQ/ -18.95K YoY).

Most importantly, investors must not ignore the potential boost BABA may enjoy from the biggest shopping event of the year, namely the 11.11 Singles’ Day in November 2023.

With Taobao and Tmall Group (domestic e-commerce) comprising the majority of the company’s top and bottom lines at 97.65B Yuan (-15% QoQ/ +4.1% YoY) and 47.07B Yuan (-4.5% QoQ/ +3.1% YoY) in the latest quarter, or the equivalent of 43.4% of its top-line, we may see FQ3’24 bring forth excellent results indeed.

This should also build upon the robust top-line growth reported in Alibaba International Digital Commerce (international e-commerce segment) at 24.51B Yuan (+10.8% QoQ/ +52.8% YoY) and narrowing losses at -384M Yuan (+8.5% QoQ/ +48.6% YoY), respectively.

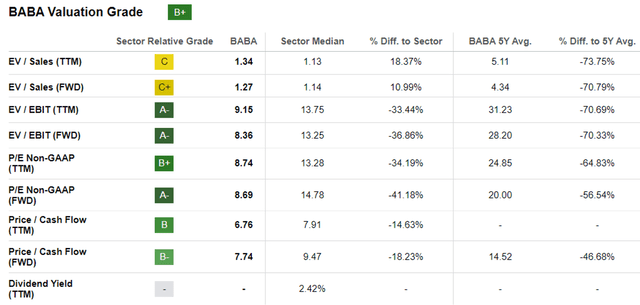

BABA Valuations

Seeking Alpha

As a result of the factors discussed above, BABA’s valuations appear to be extremely cheap across most metrics, especially in its FWD P/E of 8.69x and FWD Price/ Cash Flow of 7.74x, compared to its 3Y pre-pandemic mean of 28.43x/ 25.61x and sector median of 14.78x/ 9.47x, respectively.

The depression in its valuations is even more stark when compared to similar e-commerce/ fintech/ cloud giants, such as AMZN at 54.40x/ 16.47x and MercadoLibre (MELI) at 66.17x/ 50.26x, respectively.

For now, the BABA stock’s depressed valuations are understandably attributed to Mr. Market’s wary sentiments surrounding Chinese ADRs, on top of the previous regulatory crackdown across multiple sectors, slowing Chinese economy, and the trade war between China and the US.

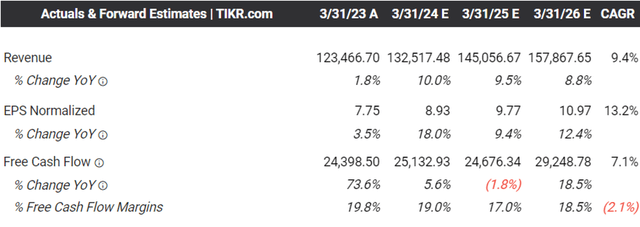

The Consensus Forward Estimates

Tikr Terminal

However, we believe that the discount observed in BABA’s stock is unwarranted since the company is expected to generate robust top and bottom line growth at a CAGR of +9.4% and +13.2% through FY2026.

Most importantly, the company continues to grow its net cash position to $56.95B (+6.7% QoQ/ +20.1% YoY) by the latest quarter, thanks to its robust annualized Free Cash Flow generation of $24.12B (+14.2% QoQ/ +22.8% YoY).

The healthy balance sheet and growing profitability have allowed the BABA management to execute excellent shareholder returns, with 103M of shares retired since FY2019, naturally leading to its expanding book value per share of $55.87 (+1.9% QoQ/ +10% YoY).

Even if the stock’s FWD P/E stays stagnant here, there is still an excellent upside potential of +22.8% to our base-case long-term price target of $95.32 as well, based on the consensus FY2026 adj EPS estimates of $10.97.

So, Is BABA Stock A Buy, Sell, or Hold?

BABA 2Y Stock Price

Trading View

For now, the uncertainty surrounding Chinese ADRs has previously led to a massive sell-off between late 2020 and early 2022, with the BABA stock drastically losing -74.3% of its value since the November 2020 peak and currently retesting its critical support level in the $75s.

Assuming that bullish support fails to materialize, we may see the correction continue, with the stock likely to return to its October 2022 bottom range in the $65s.

However, we believe herein lies the opportunity to dollar cost average, since the BABA stock is extremely undervalued here, compared to its peers based in the US and Argentina.

Thanks to the show of cooperation between Biden and Xi in the recent summit, we believe that there is hope for a slow but steady thawing in market sentiments, especially since the stock is already near its lowest-ever recorded P/E valuation of 8.30x.

With the floor to its decline almost here, we believe that these levels already offer growth-oriented investors the chance of great upside potential to the bull-case long-term price target of $162.13, assuming a future rerating in its FWD P/E valuations nearer to the sector median of 14.78x.

As a result of the attractive risk-reward ratio, we maintain our Buy rating for BABA here, with us also finally initiating a small position at these levels.

It goes without saying that the stock is not for the faint-hearted, attributed to the headwinds discussed above.

Therefore, BABA is only suitable for investors with higher risk tolerance and long-term investing trajectory. Even then, they must also size their portfolios accordingly, since bullish support has yet to materialize, with it remaining to be seen when or if a reversal may occur.

Read the full article here