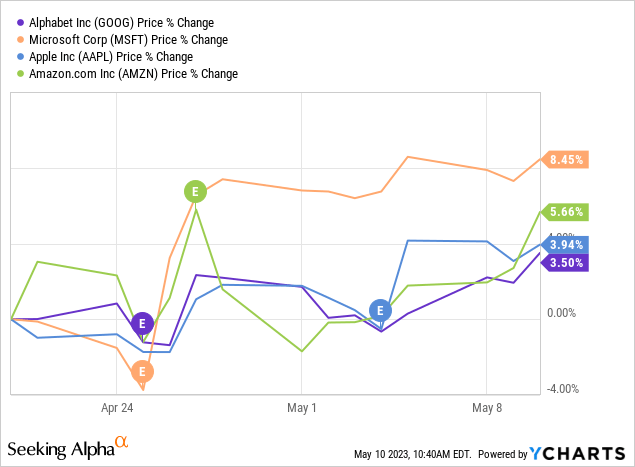

The markets breathed a sigh of relief recently as Big Tech earnings came in better than feared.

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL), Microsoft (MSFT), Apple (AAPL), and even Amazon (AMZN) avoided major selloffs, as shown below.

The talk of the town since the debut of OpenAI’s generative chatbot ChatGPT is Artificial Intelligence (AI) and Machine Learning (ML).

In fact, AI was mentioned 49 times (really!) on Alphabet’s earnings call and was the subject of the first two analyst questions.

So, why now? After all, these companies have been integrating, using, and spending billions developing AI and ML tools for years. ChatGPT’s debut thrust the tech into the spotlight, and Microsoft’s billion-dollar investment was an opening salvo in the fight to make Bing a legitimate competitor to Google Search.

Many believe AI will be as transformative to society as the internet. No tech company can afford to appear unprepared or left behind. Alphabet quickly introduced its own generative chatbot, Bard, detailed its other efforts and combined its existing AI research teams to form DeepMind.

This technology race will be critical to Alphabet’s future, but the immediate hype will inevitably fizzle as the mainstream media moves on. Transformative changes take time.

Meanwhile, there was big news from Google’s Q1 that is vital to investors right now.

Let’s take a look at two items that seem to be flying under the radar.

#1: Focus on efficiency

Alphabet CEO Sundar Pichai pledged to make the company 20% more efficient when he spoke in 2022.

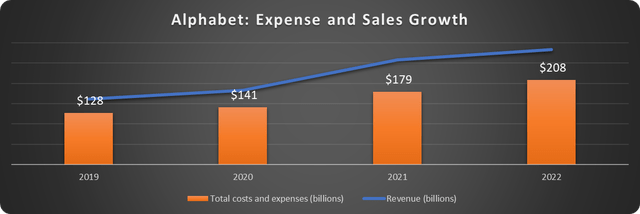

Revenue skyrocketed with economic stimulus flowing during the pandemic, and Alphabet ramped up spending. As shown below, total operating costs and expenses rose 63% between 2019 and 2022.

Data source: Alphabet. Chart by author.

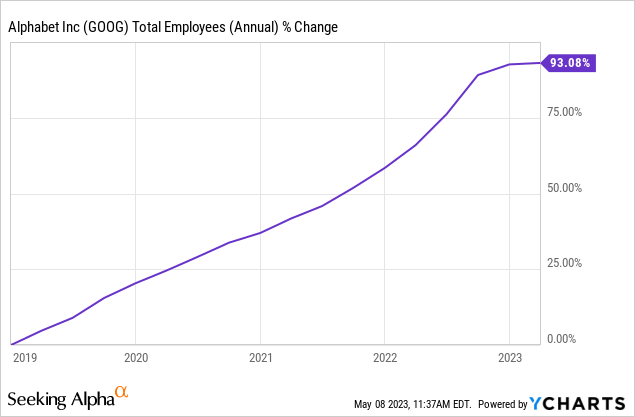

The headcount nearly doubled to over 190,000 employees as of the end of 2022, graphed below.

Headcount isn’t the only contributor to increased costs, but it is a big one. The growth seen immediately after the pandemic isn’t sustainable, nor is the audacious spending.

Management must address efficiency for two reasons:

- Financial performance

- Organizational agility.

Financial efficiency

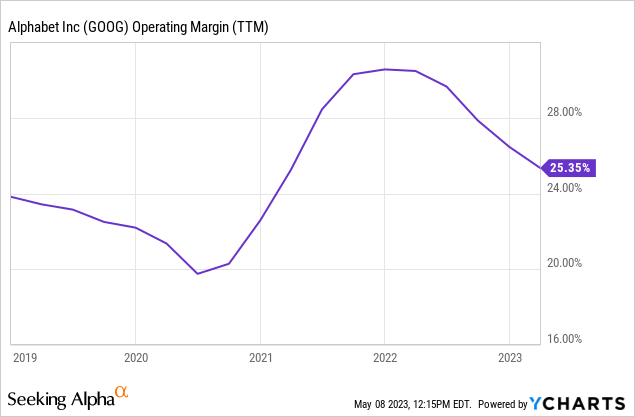

Alphabet’s operating margin rose to over 30% in 2021 as sales skyrocketed 41%. However, growth has returned to Earth, the economy is challenging, and the operating margin is declining, as shown below.

Google reported $2.6 billion in charges related to cost-cutting initiatives in Q1, with $2 billion in severance costs and $560 million in office space reductions.

Removing these one-time charges raises the operating margin back above 28%. This is a small sign that the streamlining plan can be successful.

Organizational agility

Google seemed caught flatfooted when ChatGPT took the country by storm. They quickly highlighted their initiatives, but the perception is that it is behind.

More is not always better for corporations. Too many cooks in the kitchen slows decision-making and creates poorer overall execution.

Airbnb (ABNB) is a terrific example of how successful a company can be by focusing on core results and efficiency.

The pandemic decimated Airbnb’s top line and forced the company to streamline. Airbnb’s revenue is now up 75% since 2019, yet the headcount is still 5% lower as of Q4 2022. As a result, Airbnb had its first GAAP profitable year in 2022 with an impressive operating margin and terrific free cash flow. This is extremely impressive for a young growth company.

Airbnb CEO Brian Chesky had this to say on the Q4 earnings call:

…on headcount, something that’s really interesting happened. So obviously, in 2020, we had to make some really difficult decisions, and we became a much smaller and more focused company. And the obvious result is that we got more efficient and profitable. But there was a less obvious result. What ended up happening is we had fewer people in meetings, and people can move a lot faster. And we concentrate all of our very best people and put them on only a few problems.

Google can’t afford to be caught flatfooted again as it competes with Microsoft on Search and AI; being agile and responsive is critical.

#2: Is Google Cloud profitable?

Well, it’s complicated. But let’s not miss the forest arguing about the trees.

Investors and commentators have followed Google Cloud’s path to operating profits closely. For some history, please take a glance at this article I published recently.

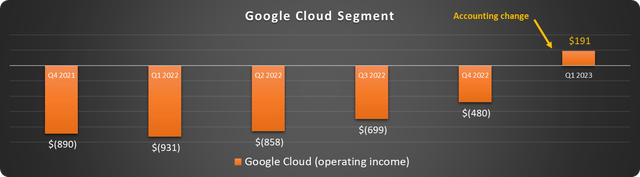

Great news! The Google Cloud segment reported an operating profit for the first time in Q1, as shown below.

Data source: Alphabet. Chart by author.

But it isn’t that simple (is it ever?).

Alphabet changed accounting estimates for servers and network equipment depreciation, extending useful life from four to six years. This lowered operating expenses by $988 million in the quarter. A large chunk likely hit the Google Cloud segment and propelled it to operating profitability.

Many have argued over whether this is progress or just a gimmick to make results appear better. But this isn’t important.

What is important is that depreciation is a non-cash expense, and the change created positive operating income. This clarifies that the Google Cloud segment is significantly accretive to EBITDA and operating cash flow. That’s the critical positive news.

Is Google Stock A Buy?

Alphabet reported solid results in Q1, with 3% revenue growth led by 28% growth in Google Cloud. Operating income and earnings per share dipped, but this was expected, given inflation and the one-time charges discussed above.

The company is a cash flow machine with $23.5 billion in operating cash flow for the quarter. Stock buybacks increased to $14.6 billion in Q1, and another $70 billion (~5% of the market cap) was recently authorized.

Despite the handwringing over Microsoft and ChatGPT, Google Search isn’t likely to be dethroned anytime soon. Alphabet has its own AI initiatives and an impressive research team at DeepMind. A long runway remains for the cloud, and YouTube is getting a much-needed push with new leadership.

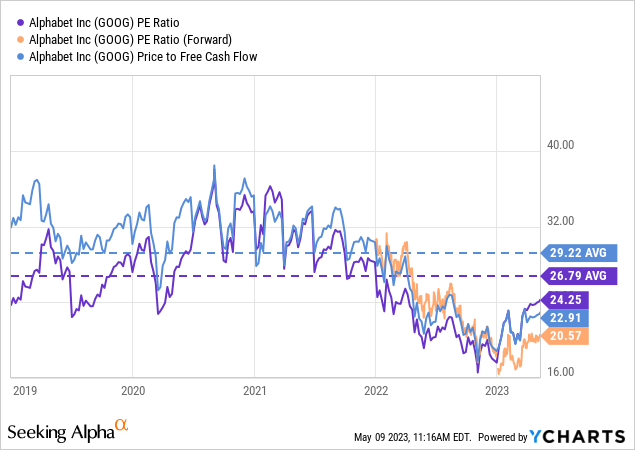

The valuation is still below historical averages, as shown below.

Alphabets’ focus on efficiency, terrific cash generation, and a renewed urgency to innovate make it a solid long-term investment.

Read the full article here