I last updated my coverage on wide-moat cybersecurity Fortinet, Inc. (NASDAQ:FTNT) in early September, expecting FTNT to consolidate after the battering that saw it falling toward its March 2023 lows. However, that thesis was proved wrong, as Fortinet disappointed again in its recent third-quarter or FQ3 earnings release, suggesting significant execution challenges lie ahead.

As a result, FTNT was battered again as investors rushed out of the stock and experienced substantial downside volatility in early November. Accordingly, FTNT plunged and revisited lows last seen in late 2022, falling to a one-year low. The good news is there’s a distinct possibility that FTNT could have bottomed out, even though more conservative investors could consider assessing the consolidation for the next four to six weeks before deciding whether to add more shares.

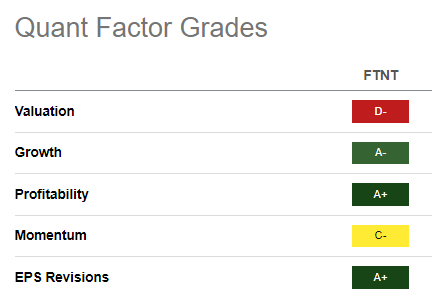

Observant investors should know by now what led to such a massive loss of confidence in investors as they rotated out in FTNT, leading to a collapse. The first critical metric investors should consider is that FTNT still isn’t priced at a discount, notwithstanding its battering. Seeking Alpha Quant rated FTNT with a “D-” valuation grade, suggesting it’s still priced at a discernible premium against its sector peers.

As a result, the market shouldn’t be expected to show patience for Fortinet’s poor execution and outlook, as its billings performance and forward guidance suggest growth is expected to slow further.

Fortinet reported Q3 billings of $1.49B, up 6% YoY. While that was a relatively weak performance, it’s arguable that the market had already priced it in before its earnings release. However, Fortinet’s Q4 billings guidance suggests its growth is expected to turn negative, with a midpoint outlook of $1.63B, down 5% YoY. As a result, if it wasn’t clear previously, it seems increasingly clear now that Fortinet’s growth normalization headwinds are expected to persist at least until 2024.

Due to more cautious and extended sales cycles, management stressed that its most critical secure networking segment is facing significant challenges. Compounded by tougher comps, given its previous impressive growth rates, the segment is undergoing a much-needed normalization phase that seems worse than expected. As a result, the company is expected to intensify resources for its sales team and efforts to invest in the faster growth Secure Operations and Universal SASE segments. However, these two segments (about 30% of Fortinet’s business) are highly competitive as Fortinet competes against the best-of-breed pure-play cybersecurity companies.

Despite that, management is confident about its well-integrated approach across the cloud and on-prem opportunities. Bolstered by its hardware segment, Fortinet expects to ride out the near-term headwinds and emerge stronger in the second half of 2024. Management stressed that the company expects robust adjusted operating margins of at least 25% despite the near-term growth challenges. Also, Fortinet anticipates that billings growth is expected to bottom out and inflect into “double-digit” growth by the second half of FY24, driven by the efforts in Universal SASE and Secure Ops.

FTNT Quant Grades (Seeking Alpha)

FTNT’s “C-” momentum grade should have provided clear clues to investors that the selling intensity took out quite a bit of buying fervor in the leading cybersecurity company.

Despite that, FTNT still boasts an “A” range Quant grades in Growth, Profitability, and Earnings Revision. In other words, FTNT bulls could view the hammering as “unwarranted,” offering even better opportunities to buy more shares.

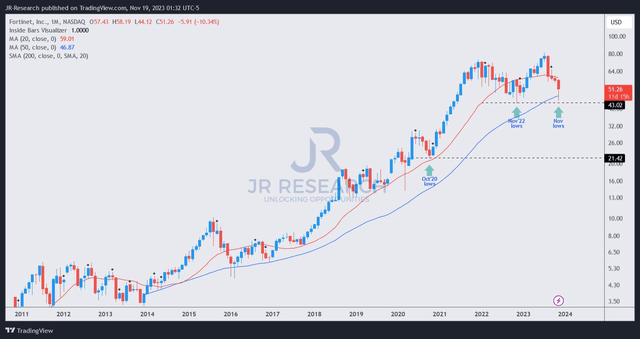

FTNT price chart (monthly) (TradingView)

FTNT’s long-term price action (monthly chart) suggests it re-tested the low $40s this month with constructive buying sentiments. Although I’ve not gleaned a decisive bullish reversal, buyers seem to be willing to defend the current zone.

The level also aligns with FTNT’s 50-month moving average or MA (blue line), underpinning its long-term uptrend over the past ten years. As a result, I don’t expect buyers to give up the $40 zone so easily, as the next critical support zone at the low $20s zone is a distance away. In other words, unless the market expects Fortinet’s profitability to sink as it focuses its efforts on SASE and Security Ops, I don’t expect us to revisit the low $20s again.

Therefore, I see the current levels as attractive, suggesting investors should consider capitalizing on the steep selloff, compelling FTNT to revisit its one-year low recently.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here