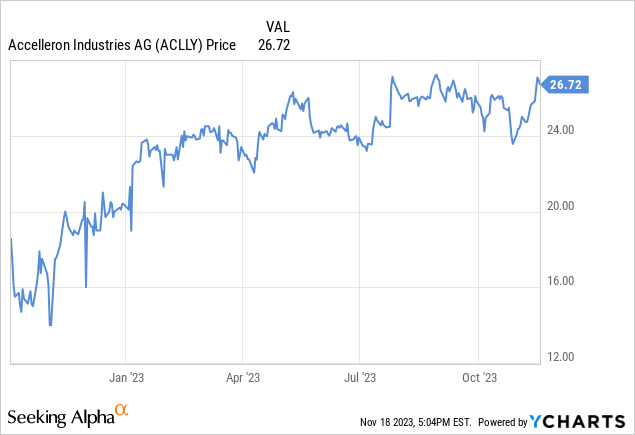

Accelleron Industries (OTCPK:ACLLY)(OTCPK:ACLIF) has exhibited exactly the type of price action spin-offs are known for, with an initial drop after shareholders receive the new shares and many of them sell for various reasons, and then strong performance as the company finds a new shareholder base.

We wrote about Accelleron even before its spin-off from ABB (OTCPK:ABBNY), and noted that there could be heavy selling initially, but that it was an interesting company worth learning more about. We are taking another look at the company now that it has published results for the first half of 2023, and with shares trading at a much higher level.

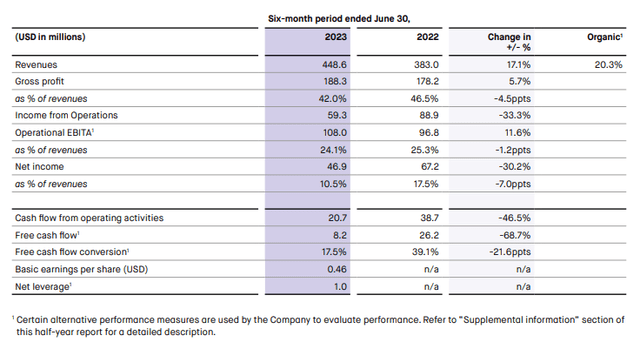

Accelleron delivered decent financial performance in the first half of the year, with revenues increasing 20.3% y/y, or 17.1% in constant currency. For the full year the company believes organic revenue growth will be around 13%, and 15% when including a recent acquisition. The company purchased OMT (Officine Meccaniche Torino), which is a market leader in fuel injection for two-stroke engines. Accelleron believes this acquisition will help it better position itself in the large marine engines using alternative fuels such as hydrogen, methanol, and ammonia.

We did not find anything particularly remarkable in the half year report, other than commentary on the supply chain. The company noted reliability has improved, but issues remain with some suppliers. This resulted in some orders that could not be delivered due to missing components.

Financials H1 2023

There was a sharp drop in net income, which decreased by $20.3 million from the previous year. This was mostly due to a $48.8 million one-time costs related to the separation from ABB. Another area of weakness was free cash flow conversion, which dropped significantly in part due to higher net working capital needs.

Accelleron Industries Investor Presentation

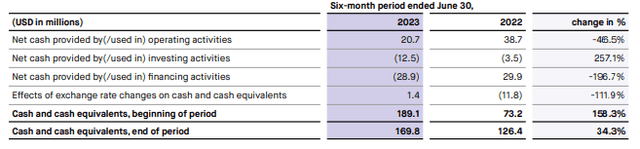

Net cash provided by operating activities also decreased very significantly, primarily as a result of separation expenses. Volume growth and supply chain issues led to an increase in net working capital use as well.

Accelleron Industries Investor Presentation

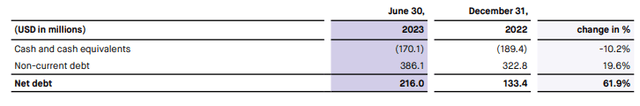

Balance Sheet

Net debt increased by $82.6 million, or 61.9%, to $216.0 million in the first half of 2023. The higher net debt level is mainly the result of the dividend payment to Accelleron shareholders in the amount of $76.3 million, and weak free cash flow generation.

Accelleron Industries Investor Presentation

Future Outlook

Management sounds relatively optimistic about future market demand, noting strength in the marine market, where they see positive long-term trends and an order book that remains at a high level. It is also encouraging that the IMO (International Maritime Organization) adopted new emission targets, aiming for zero carbon to be achieved as early as 2050. This is a tailwind for Accelleron, as its turbo-chargers help improve efficiency and reduce emissions. Other applications experiencing growth include turbo-chargers used in back-up power for data centers. One market where the company did admit weakness is that of large-power plants, where demand is below previous levels.

Valuation

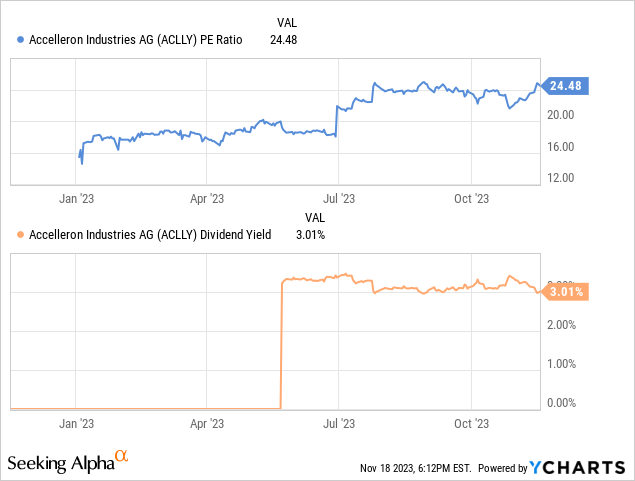

At current prices it is difficult to get too excited about the shares, especially considering the general increase in interest rates around the world. At current prices the dividend yield is ~3%, which is lower than what investors can get from short term government securities in the US and European Union. Although it could be argued that it is still higher than the Swiss National Bank current policy rate of 1.75%, and Accelleron is based in Switzerland and declares dividends in Swiss Francs.

In any case, we believe the company does not have enough growth potential to justify a P/E ratio of ~24x. Using analysts’ earnings estimates for the next fiscal year, the valuation looks somewhat more reasonable, with a forward P/E of ~15x. Still, we view Accelleron’s growth long-term growth potential as relatively limited, and we would demand a good margin of safety relative to fair value given the high risk that electrification poses to its business in the long-term.

Risks

As we have previously mentioned, the biggest threat we see to an investment in Accelleron in the long-term is the eventual electrification of its end markets. For example, while marine transportation has seen relatively little progress in moving towards electrification, we believe there will be a tipping point where it will make sense for ships to become electric.

Batteries have seen a continuous reduction in costs, driven by innovations coming from the EV sector. At some point we believe batteries will be cheap enough to compete with traditional marine propulsion systems, making turbo-chargers obsolete. Cheaper batteries also pose a threat to the use of turbo-chargers in diesel energy back-up generators, and other similar applications. The full transition to electric alternatives will probably take decades, but we believe it will eventually happen, and it is one of the reasons we are not comfortable paying a high valuation multiple for the shares.

Conclusion

The financial results for Accelleron for the first half of 2023 were very decent, despite some one time expenses related to the separation from ABB. There were some minor developments such as the OMT acquisition, and the company sharing that a few orders could not be delivered due to some remaining supply chain issues. More importantly, shares have increased in value despite a general rise in interest rates, making them now less attractive. At current prices we believe shares to be slightly overvalued, and are therefore adjusting our rating to ‘Sell’ from ‘Hold’ previously.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here