As DEX traded tokens continue to mount sensational rally moves, the AVAX-native Wonderland’s global unit-of-account, TIME token, has began to mount a come back, but – could this unlikely emerging crypto be next?

Recent months have seen a huge trend in explosive DEX-traded token moves, with countless moon-shots garnering significant attention, including the ever-popular APX, SAMBO Bot, Baby Meme, MILK, XDOGE and IO.

Red coin bros…please don’t let a Lambo slider fool you this $time pic.twitter.com/wI2R7dt07t

— Cheds🐐 (@CryptoGemCheds) November 20, 2023

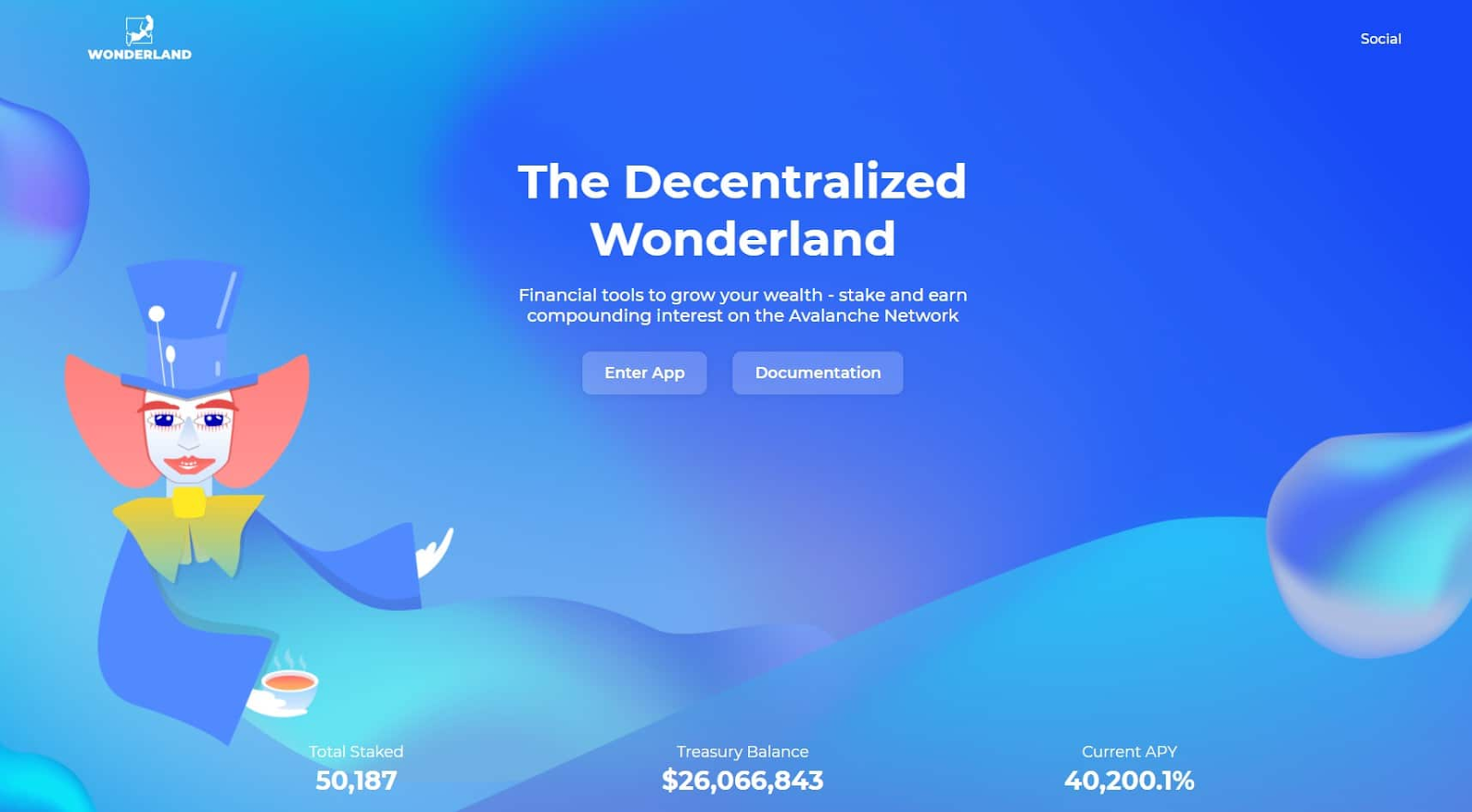

The latest mover – The Wonderland project, is a decentralized reserve currency protocol built-on the Avalanche Network, backed by assets in the treasury with the central goal of creating a policy-controlled currency for the AVAX ecosystem.

However, since launching in 2021, $TIME token has undertaken a horrific bleed-out in price, falling -99.72% in an almost capitulative move from an all-time high at $9,908.

TIME Price Analysis: Is The Wonderlands Making a Come Back as TIME Token Pumps +1,298% Overnight

As the Wonderland recovery rally begins, TIME token is currently trading at a market price of $6.48 (representing a 24-hour change of +1,298%).

Blasting out of rock-bottom floor pricing at $0.70 on November 19, the Wonderland’s native TIME token hammered up +1,763% in a skyrocket move yesterday.

This comes after price lost key support above $7 on November 8, following rejection from an attempted recovery at $9.90 – creating two areas of upper resistance ahead.

TIME price action has built strong bullish posture in the recent break-out move, with a localized consolidation move establishing support at $6.50 – setting the stage for the emerging re-test of upside resistance.

Structure on the chart has consequently been left in an alluring bullish pendant pattern, suggesting price will push up on the short-time frame – however, capstone resistance at $7 marks the key level to watch.

Rejection here would spell disaster, but flipping $7 to support could see $TIME push up further towards a retest at $10.

The move appears to have been triggered by a substantial influx of more than $272k in 24-hour trading volume, which has fuelled substantial growth due to TIME token’s lowly $5.9m market cap.

TIME token therefore has an upside target at $10 (a potential +55.24%).

While downside risk could see TIME token fall down to $5.40 (a possible -16.17%).

Overall then, TIME token has a risk: reward ratio of 3.42 – a strong entry with a great deal of upside potential on the cards, however, on the tail-end of a -99.7% move this is also a play at risk due to 33,500 underwater holders – that will be keen for exit liquidity.

This is why smart capital are seeking out the best presale opportunities to supersize their opportunities due to the early bird advantage, and one of the fastest growing presales making it big on the back of hype around the anticipated Bitcoin spot ETFs is Bitcoin ETF token.

This Bitcoin Alternative Token Could Skyrocket Amid Bitcoin ETF Bullrun – Don’t Miss Out

A new Bitcoin alternative presale launched this week, offering eagle-eyed traders the opportunity to make it big on unfolding Bitcoin ETF rumors, without having to eat the $36,000 cost of becoming a wholecoiner.

Bitcoin ETF Token ($BTCETF) is currently trading at a market price of $0.0056 in funding round stage 1 with an alluring $1,195,768 raised in the opening weekend of presale.

Designed and built with skyrocket potential in mind, this promising token aims to bank big on market excitement surrounding the ongoing applications for Bitcoin spot ETFs.

Aiming for a hard-cap of $5m in presale funding, the early-stage of this emerging project’s presale offers investors a unique opportunity to get in during this early entry point, which could set the stage for life-changing gains.

Ride the ETF Rally with Ease: Bitcoin ETF Token is a Critical Component in Every BTC Trader’s Toolbox

Indeed, Bitcoin ETF isn’t simply a useless meme coin, beyond taking aim at the biggest narrative in crypto – BTCETF has a major utility: Bitcoin ETF news alerts.

The token’s dApp offers traders a live-feed of the latest Bitcoin spot ETF information and news, with sophisticated technology tracking applications real-time at the SEC, and high-speed bots monitoring social media for the latest breaking ETF news.

But a simple feed of Bitcoin spot ETF news only highlights a fraction of Bitcoin ETF token’s potential, with easy-access to real-time update alerts offering sharp traders the opportunity to make market-beating returns stress-free; being amongst the first to hear about privileged Bitcoin Spot ETF news.

This could enable traders to position themselves appropriately in seismic Bitcoin market movements, making Bitcoin ETF token a critical component in every BTC trader’s tool-box this Winter.

Surging Interest in Bitcoin Alternatives Leaves $BTCETF Poised to Outperform TIME Token

Project tokenomics are bolstered by ambitious plans for the incorporation of staking rewards that incentivise long-term holding, alongside a burn mechanism, which will enhance $BTCETF as a ‘digital gold’ alternative, by creating a deflationary mechanism in price.

Set for stage 3 of the Bitcoin ETF project roadmap, an initial burn mechanism will be introduced amid a well-marketed DEX launch, imposing an initial 5% burn tax on transactions – this will be reduced by -1% each time a Bitcoin ETF news milestone is reached.

However, plans are afoot for a larger burn mechanism in stage 4, in a move that will see 25% of token supply burned overtime, this will be conducted in 5% burn intervals – with each supply-side reduction taking place as a Bitcoin ETF news milestone is met.

The milestones for the burn mechanism are as follows:

- Milestone 1 – $BTCETF Trading Volume hits $100m – burn tax on transactions reduced from 5% to 4%, and 5% of total supply is burned.

- Milestone 2 – First Bitcoin ETF is approved by SEC – burn tax on transactions is reduced from 4% to 3%, and a further 5% of total supply is burned.

- Milestone 3- First Bitcoin ETF launch date – burn tax on transactions is reduced from 3% to 2%, and a further 5% of total supply is burned.

- Milestone 4 – Bitcoin ETF assets under management (AUM) hits $1bn – burn tax on transactions is reduced from 2% to 1%, and a further 5% of total supply is burned.

- Milestone 5 – Bitcoin price hits $100k – burn tax on transactions is reduced from 1% to 0%, and a further 5% of total supply is burned.

This will create a gradual decrease in total supply, eventually leaving around 70% of BTCETF in circulation, with the supply side reduction inducing upside price growth.

And that is without considering the potential for token value accrual driven by demand from traders for access to the ETF news dApp and the ever-present demand for Bitcoin alternatives.

Indeed, 2023 has seen explosive growth in Bitcoin related tokens – with markets showing a real appetite for BRC-20 ordinal tokens, Bitcoin Cloud Mining, and Bitcoin derivatives.

So don’t miss your chance to get in early ahead of the next major Bitcoin rally leg.

Buy Bitcoin ETF Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Read the full article here