Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the second week of November. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

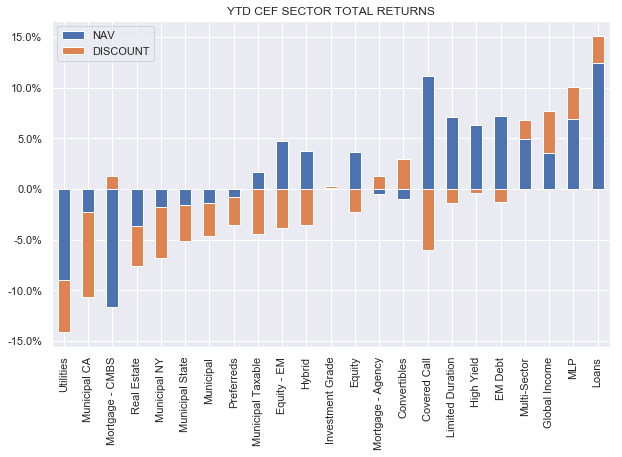

Most CEF sectors struggled during the week with only Muni sectors finishing decisively in the green, as a result of a reversal in the recent rise in Treasury yields.

Year-to-date, the CEF space is about evenly split in terms of performance with higher-beta / longer-duration sectors like REITs and Munis towards the lower end and floating-rate / energy funds towards the top end.

Systematic Income

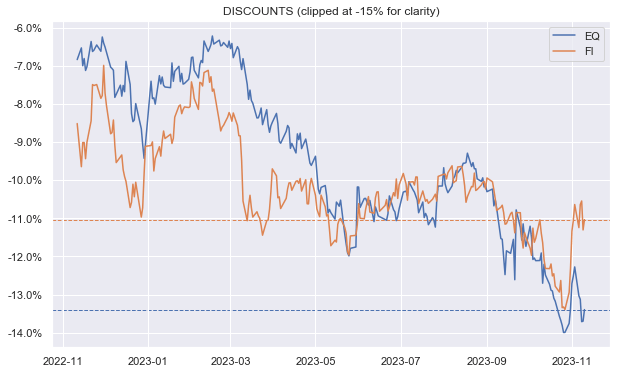

In discounts we saw an interesting divergence between fixed-income and equity funds with the equity space remaining depressed in discount terms – a reversal of the previous discount picture.

Systematic Income

Market Themes

There are lots of erroneous beliefs across the CEF space and the income space more broadly. Certainly one of the strangest ones we have come across is that the launch date of the fund matters as far as income or yield is concerned.

The idea seems to be that a fund that got started when yields were high somehow locks in those high yields at inception and can carry those high yields over its life, making it relatively attractive. Alternatively, a fund that got going in a low yield period is stuck with those low yields and, hence, is very unattractive.

In short, there is absolutely no basis for this view and it does not stand up to a minute of reflection. Consider two funds, one launched at the end of 2021 (when yields were low) and another launched now (when yields are high).

To keep it simple, let’s imagine they hold one security – the same bond. What do you own in one fund and in the other fund? Well, you own the same bond. Does it matter that in the first case the bond was bought in 2021 and another in 2023? Of course not. That bond trades at the same yield and the same price today. The bond doesn’t know which fund it’s in. It puts out the same level of income and yield for both funds.

In short, the starting date of the fund matters a whole lot for its future price performance. However, as far as the underlying level of income or yield is concerned, it doesn’t make any difference.

Market Commentary

BlackRock is withdrawing its plan to merge four of its Muni CEFs. The reason is the pushback by Saba which creates additional proxy solicitation costs for the funds. In its submission, Saba simply says that rather than merging the funds BlackRock should be focused on tightening the wide discounts.

This is a nonsensical and an obviously self-serving comment. Muni CEFs trade at wide discounts primarily as a result of the rise in long-end rates (and price falls) as well as high leverage costs. There is nothing unique about the wide discounts of BlackRock Muni CEFs.

The handful of other Muni CEFs that trade at tight discounts are the low-beta/unleveraged ones like NXP or those that massively overdistribute like NDMO. By killing the merger Saba is preventing shareholders from gaining an improvement, if marginal, in the cost structure and in liquidity. Saba typically achieves positive outcomes for CEF shareholders however this case is not one of them.

Stance And Takeaways

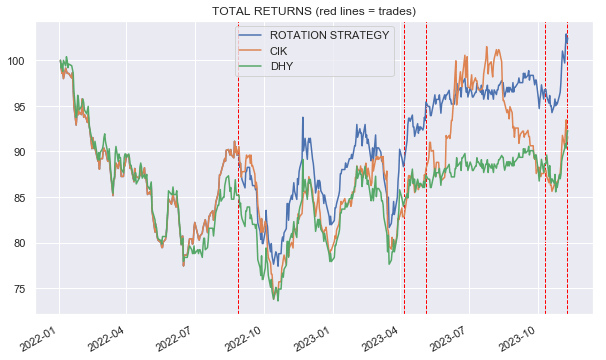

We made several CEF rotations across our Portfolios this week. One of these was moving back to bond CEF (DHY) from sister fund (CIK). CIK has traded up nicely and at the time of the rotation traded at a 7% tighter discount than DHY. This strategy has generated a total return 10% higher than either fund since the start of 2022.

Systematic Income

We also switched to the PIMCO CEF (NRGX) which is due to switch to a credit fund (PDX) at which point its discount will likely tighten over time to be more in line with other PIMCO CEFs.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here