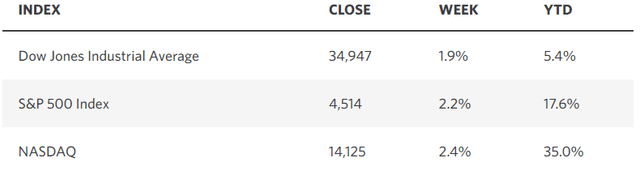

In just three weeks, the consensus has gone from questioning the validity of the bull market to putting its first correction behind us to seeing the S&P 500 climb within 6% of reaching a new all-time high. As the major market averages pushed higher last week, the most encouraging development was the improvement in breadth. Every sector of the S&P 500 finished green with leadership coming from more cyclical and economically sensitive industries, such as real estate, materials, utilities, and financials. That is a positive sign for the ongoing expansion and vitality of the bull market, which up to this point has been fueled by no more than the Magnificent 7 technology stocks.

Edward Jones

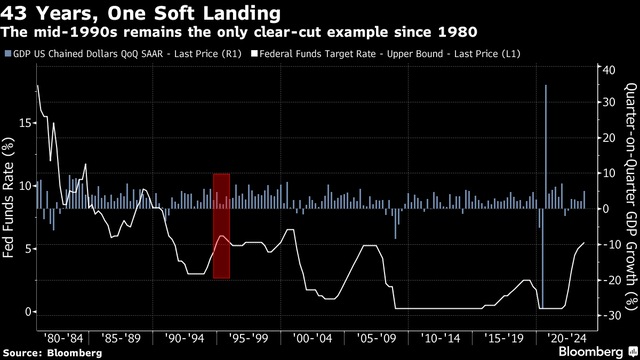

On November 17 of last year, I outlined the soft landing scenario in what was an extremely unpopular view. My outlook was grounded in the belief that wage growth and excess savings would help mitigate the financial stress caused by higher prices, and that the price increases would abate over the coming year as the one-time factors helping to fuel them faded. That would result in a return to real wage growth, as the rate of inflation fell below the rate of nominal wage growth, helping sustain consumer spending, which is the engine of economic growth. The reason that outlook was so unpopular is that we have only realized one soft landing over the past 43 years, but I cautioned that economists and investors would need to look at the new expansion in a different way than prior ones.

Bloomberg

The reason is that the post-pandemic period was littered with anomalies, which I expected to undermine traditional methods of measuring economic activity. As a result, we should question historically reliable indicators when triggered to signal that a recession is imminent. So far, that looks like it was a prescient warning.

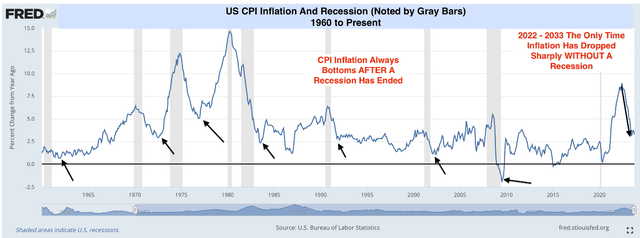

The most important development so far in 2023 is that inflation, as measured by the Consumer Price Index, has realized its largest decline on record without causing a recession. It has already dropped from 9% to 3%, supporting my assertion a year ago that it would fall as quickly as it rose. The final grind to 2%, while only one more percentage point, will undoubtedly be the most difficult, but I still think the odds favor getting there without forcing an economic contraction. Monetary policy, as well as market rates, will be critical.

DataTrek

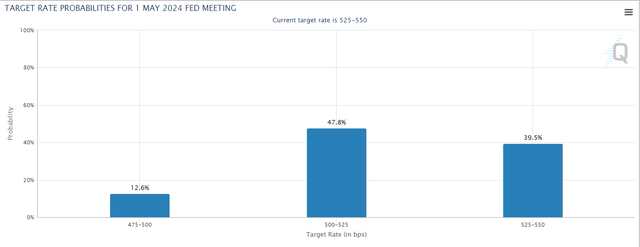

The market is no longer listening to Fed rhetoric. Instead, the consensus of investors (the market) is telling the Fed when it will start to cut rates to normalize policy and by how much. I have a lot more faith in the market, especially when it is coming around to my long-held view. Currently, the consensus sees the first reduction in rates of 25 basis points coming at the May meeting with three additional quarter-point rate cuts by the end of the year, bringing the Fed funds rate down to a range of 4.25-4.50%. That’s moving in the right direction, but I think we will be closer to 3.75-4%, which is approaching a neutral rate where policy is no longer restrictive or stimulative. That rate is a moving target and is continually up for debate. The point is that it is a positive rate of change in which both stocks and bonds can produce results for investors.

CME

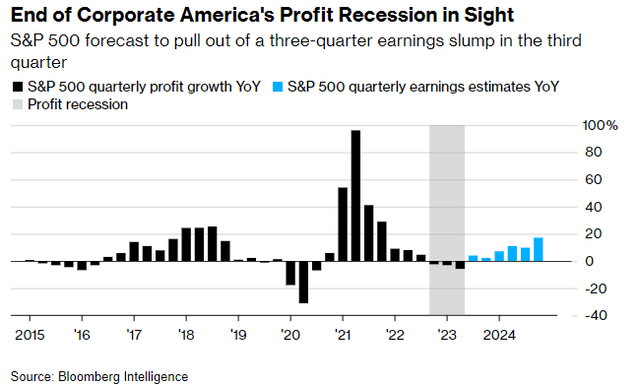

Another positive development I see extending this bull market, other than a soft landing in 2024, is a return to year-over-year earnings growth for the S&P 500. According to FactSet, with 94% of companies reporting for the third quarter, profits rose 4.3%. This is not entirely tech-driven, as eight of the eleven sectors are reporting growth, and the growth rate should improve as we move into the first quarter of next year.

Bloomberg

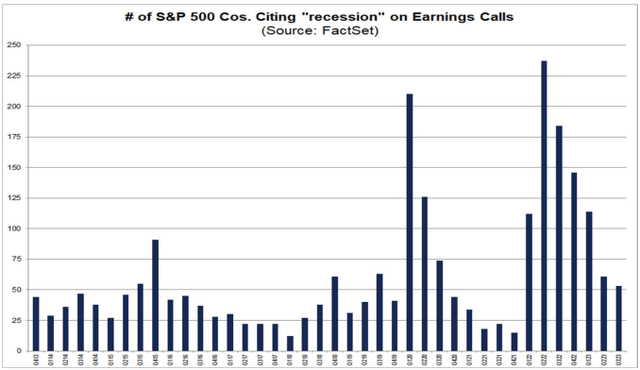

It is also encouraging to hear fewer and fewer companies raise concerns about recession on their earnings calls, as management teams are on the front lines of economic activity.

FactSet

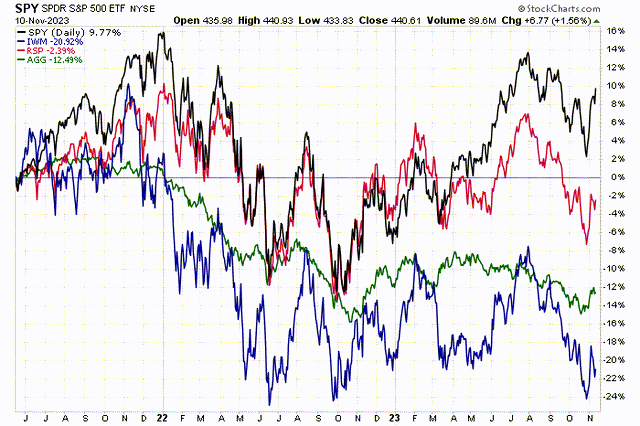

During the earnings recession over the past year, we saw investors flock to the seemingly recession-proof Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla). These names are responsible for the market-cap weighted gain in the S&P 500 over the past two-and-a-half years, leaving the rest of the stock market and bond market behind, as seen in the chart below that I shared last week.

Stockcharts

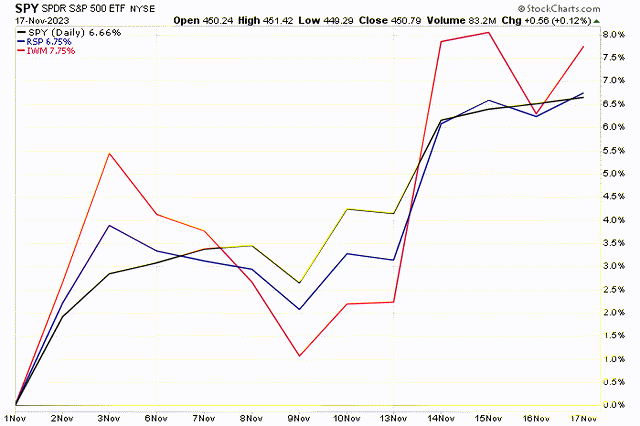

This needs to change as we start 2024, and we may be seeing an early indication of that last, as breadth has started to improve during November. The market-cap weighted S&P 500 is trailing its equal-weighted version, as well as the Russell 2000 index. I am looking for this to continue.

Stockcharts

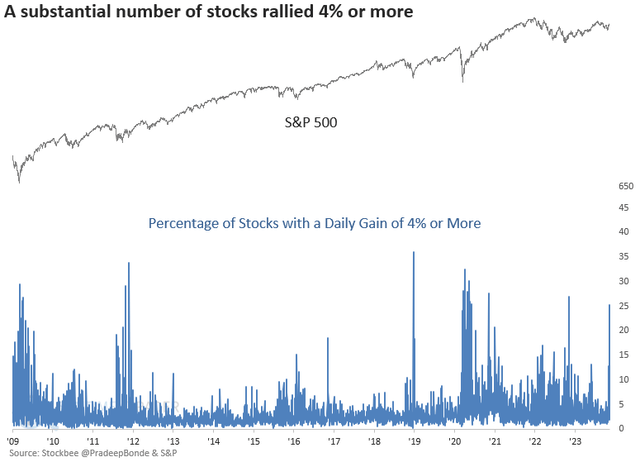

November’s performance so far triggered a very rare and powerful breadth buy signal, known as the Zweig Breadth Thrust, which I reviewed last week in this report. Prior buy signals produced higher S&P 500 levels in the 6- and 12-month periods that followed 100% of the time in data going back to World War II. Building on that bullish development, last week we saw another indication of positive breadth. On Tuesday, following the better-than-expected inflation report, the percentage of stocks rallying 4% or more on that day surged to 25%. According to SentimenTrader, prior occurrences were associated with positive rates of return for the S&P 500 in the three, six, and twelve months that followed 100% of the time.

SentimenTrader

My bullish outlook for the economy and markets in the year ahead is based solely on fundamental analysis, but it sure does build my conviction when I see technical data like this suggesting that I am heading in the right direction.

It has been as frustrating a year for the average investor as it has been for the average stock because both have likely underperformed the market-cap weighted indexes. Outside of the Magnificent 7, it has been a frustrating two-and-half years. The knee-jerk reaction is to make an emotionally driven change to one’s allocation or holdings, chasing performance, but I think the more prudent move is to sit tight and let this market come to us. Interest rates seem to have peaked, inflation continues to recede, earnings are starting to grow again, and valuations are reasonable from which we should see attractive returns for the average stock in the year ahead as breadth improves.

Read the full article here