Shares of NiSource (NYSE:NI) have been a mixed performer over the past year, essentially treading water, though this has outperformed some other utilities that have been more negatively impacted by higher interest rates. This is partly because the company maintains a relatively strong balance sheet and it not relying on excessive debt financing. NiSource looks positioned to deliver mid-to-upper single-digit dividend growth, which makes it an attractive option for dividend growth investors.

Seeking Alpha

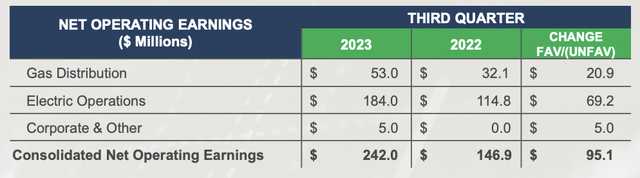

In the company’s third quarter, NiSource had $0.19 in adjusted earnings even as revenue declined $62 million from last year. This was because the company’s cost of energy was down by $149 million. As you may remember, natural gas prices were extremely elevated last summer as Europe was scrambling to replace lost Russian gas. That has since normalized. While there can be a brief timing mismatch, as a regulated utility, NiSource is not taking on material commodity risk, instead passing that through to customers’ bills, which makes the revenue decline a bit misleading.

For NiSource, what matters much more is how much energy its customers use and regulatory-approved rate increases it can pass on. Excluding weather (when the weather is hotter or cooler than normal that obviously can temporarily impact utility demand), gas volume rose by 4.8% as customers grew by 0.9%. Electric volumes rose by 1% excluding weather as customers grew by 0.8%. This was modest growth, in keeping with the fact NiSource operates in relatively slow growth states, namely: Indiana, Ohio, Virginia, Kentucky, Maryland and Pennsylvania.

NiSource also continues to control what it can quite well as operation and maintenance spending was down almost 2% from last year. Moreover, in August, the company won a rate case, dating back to its 2018 resource plan in Indiana. Maryland recently passed a rate case, and it has filed a new case in Indiana for $1.1 billion of cap-ex through 2024. Regulated utilities earn a guaranteed return on investment on their approved capital projects, and so by growing the capital base, they grow revenue over time. With these rates boosting revenue alongside modest usage growth, NiSource reported solid earnings growth relative to last year.

NiSource

As a consequence, management now expects to come in at the upper half of its non-GAAP EPS range of $1.54-$1.60. Alongside this, the company has provided 2024 guidance of $1.68-$1.72. This implies 6.6% earnings growth at their respective midpoints. This is broadly in keeping with the company’s aim to grow its earnings power, and accordingly its dividend, by 6-8% from 2023-2028. Underpinning this plan are several things.

First, it aims to hold operating expenses flat—given the 2% decline this year, NiSource is well on the way to achieving this. Because of this spending discipline, NI will not need to raise customer bills by more than 4% to achieve these returns for shareholders This is important to emphasize as the relatively small impact on customer bills makes it more likely that regulators will approve the cap-ex plan and the associated rate increases.

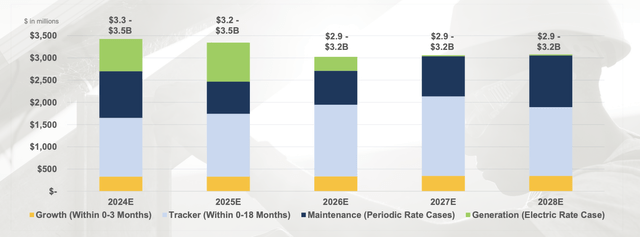

The primary driver though is that the company plans to invest $15 billion in cap-ex from 2024-208 for 8-10% annual rate base growth. Spending will be a bit higher in 2024-2025 as it invests in improved generation capacity and then slow to about $3 billion from 2026-2028 as it completes those projects, in part taking advantage of incentivizes in the Inflation Reduction Act.

NiSource

About 75% of these projects deliver returns by regulators within 18 months. This is one drawback I see for NiSource. For comparison, Atmos (ATO) begins earning on 90% of its investments within six months, as its program is more tilted towards maintenance. Its shares have a slightly lower starting yield, but an easier regulatory environment, which provides more certain growth.

NI has to wait a bit longer for its cap-ex to begin boosting earnings, during which time it is carrying debt to help finance these programs but not seeing the offsetting cash flow. When I combine this fact with the fact that Atmos operates in a higher growth region of the country (Texas primarily), I do think it is appropriate for NiSource to trade at a discount and have a higher dividend yield, as it does, currently at 3.9% yield. Ultimately, NiSource has proven it can recoup its investment, but the process just takes a bit longer.

NiSource manages this risk by maintaining a somewhat more conservative balance sheet. It carries $2.3 billion of short-term debt and $11 billion of long-term debt with a 12-year average maturity. That long-dated debt load does help to mitigate somewhat the headwinds posed by higher rates but they still exist via its short-term debt and new issuance. During the last quarter, interest expense rose by $37 million or 40% to $102 million. The company maintains just a 48% debt to capitalization, and it is screening new cap-ex against a continuation of this high rate environment.

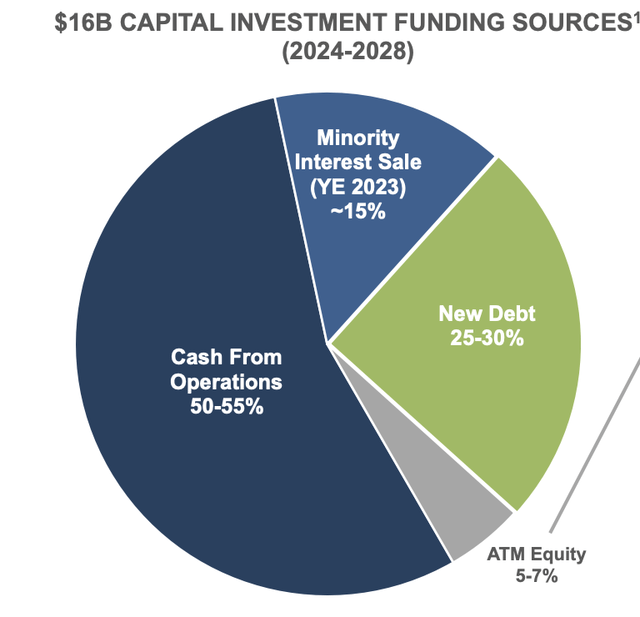

For its new cap-ex program of $15 billion, incremental debt will be less than 1/3 of its financing mix. The majority of its cap-ex funding comes from operating cash flow. Excluding working capital, NiSource has generated $1.31 billion of operating cash flow in 2023 up from $1.151 billion last year. That strong uplift is validation of its rate actions.

NiSource

Now, NI plans to issue no equity in 2024, but it will target $200-$300 million of equity issuance per year starting in 2025, which will increase the share count about 2% per year. This is the primary reason EPS growth will be 6-8% even as the rate base grows 200bp faster at 8-10%. The other large source of funding is that Blackstone (BX) is paying $2.15 billion for 19.9% of NIPSCO (its Indiana utility), for a $14.3 billion enterprise value including debt.

Thanks to these proceeds, NI will not issue equity next year, and its debt funding needs are greatly reduced. This deal is on track to closer before year end. I also would emphasize that NiSource is getting a full valuation. Blackstone, which does not have a reputation of overpaying for assets, is valuing NIPSCO at 1.85x its rate base. At this valuation, all of NiSource is worth $30.7 billion. However, with where NI shares are trading today, the company has just a $24 billion EV. A $30.7 billion enterprise value would represent a 62% premium to where shares trade, or over $40/share. Now, NiSource does carry $3.6 billion of tax and regulatory liabilities, though as it long as it keeps investing in cap-ex more quickly than it depreciates its assets, these liabilities get pushed out. Even if we count them as debt, NI’s enterprise value is $27.6 billion. That still provides $3 billion of equity upside from here, or over 25%.

Now, NiSource’s Indiana operations are more scaled and in a favorable regulatory environment, so if it were to sell pieces of the company, other utilities like Kentucky may not receive such robust offers. Still, selling this piece of the business at that valuation is accretive given where the stock market is valuing all of NiSource. I do not expect shares to fully converge to Blackstone’s implied price, but this transaction does point to further upside. I also view NI’s relative small debt financing needs for growth programs as a positive, given how high rates have derailed growth plans at NextEra (NEE) and NextEra Energy Partners (NEP).

With 2024’s guidance, NI is well poised to begin another period of solid dividend growth as this year’s rate hikes take hold and incremental cap-ex enables further rate increase. Moreover, a solid valuation on its stake sale should make this program fairly accretive to equity holders. With a starting yield of 4% and at least 6% dividend growth, investors in NI are likely to enjoy a roughly 10% medium-term return, with potential upside if private equity seeks to buy more of the company at a similar valuation, though I would not view this as the base case, just a potential upside risk. With a 10% medium term return potential, I view shares as attractive for dividend growth investors.

Read the full article here