ESAB Corporation (NYSE:ESAB) has seen excellent growth in the last year due to solid earnings amid macro headwinds. I believe that the company is currently a hold because even though ESAB has a solid balance sheet and outlook, the company is currently overvalued assuming my DCF figures.

Business Overview

ESAB Corporation is engaged in the design, development, manufacture, and sale of control equipment as well as consumable goods and equipment designed for automated welding, joining, and cutting. Its wide selection of welding supplies includes fluxes made of different specialist and non-specialty materials, electrodes, and cored and solid wires. Its cutting accessories also include electrodes, nozzles, shields, and tips. Portable welding machines and huge, specially designed automated cutting and welding systems are among the equipment owned by ESAB. Additionally, the business offers a range of software and digital solutions that are intended to boost output, allow for remote welding operation monitoring, and make it easier for clients to digitize their documents. ESAB serves a wide range of end markets, including general industry, infrastructure, renewable energy, medical and life sciences, transportation, construction, and energy. It sells its products under the ESAB brand. Its products are distributed via direct sales channels and independent distributors. To better service its customers, ESAB Corporation operates in North America, South America, Europe, the Middle East, India, Africa, and the Asia Pacific region.

ESAB

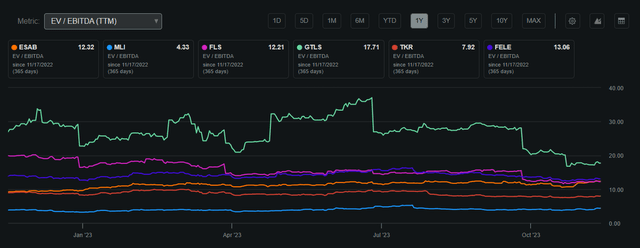

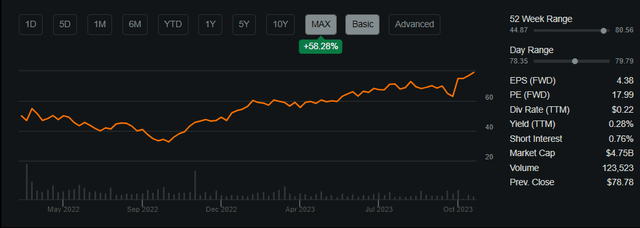

ESAB holds a market capitalization of $4.75 billion and has achieved a 9% Return on Invested Capital. Over the past 52 weeks, its stock has ranged from a high of $80.56 to a low of $44.87. Currently priced at $79.14 with an EV/EBITDA ratio of 12.32, ESAB’s stock is presently positioned near its peak. Additionally, when compared to its industry peers, the company’s EV/EBITDA ratio falls within the range, indicating a potential overvaluation due to the elevated EV/EBITDA ratio.

ESAB EV/EBITDA Compared to Peers (Seeking Alpha)

The firm also pays a dividend of 0.28%, representing a payout ratio of 6.17%. I believe that this is currently beneficial for the firm because although the income for investors is small, ESAB can open multiple avenues for growth while also effectively using its ROIC of 9% to capitalize on growth.

Share Performance (Seeking Alpha)

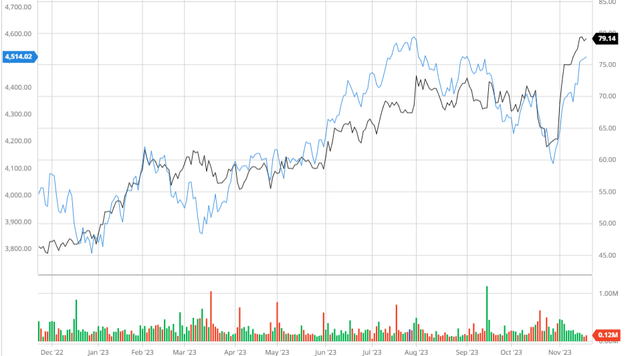

Performance Compared to the Broader Market

ESAB has outperformed the S&P 500 when adjusting for dividends in the last year. This demonstrates ESAB’s effective use of cash flows to outperform during macro headwinds. In the long-term, I believe that ESAB will continue to utilize cash flows but may be too expensive thus hindering the firm from outperforming the market.

ESAB Compared to the Broader Market (Created by author using Bar Charts)

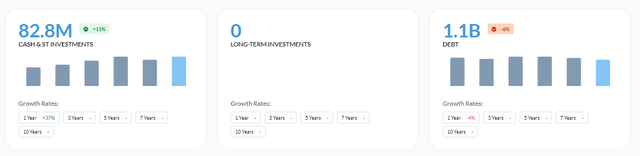

Balance Sheet

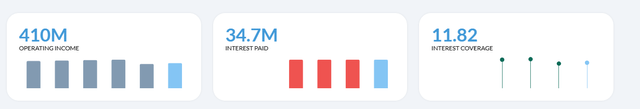

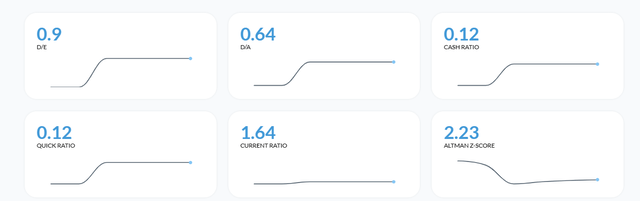

ESAB also holds a fairly solid balance sheet moving into current macro headwinds. With an interest coverage of 11.82, ESAB’s cost of debt to raise capital, coupled with its soaring share price will allow the firm to remain solvent and hedge against macro headwinds with ease. ESAB’s Current Ratio is also at 1.64 and has an Altman-Z-Score of 2.23 ensuring the firm will be solvent in the short term.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Earnings

In Q3 2023, ESAB reported a mixed financial performance, with earnings per share falling slightly short by $0.01 at $0.94. However, revenues exceeded estimates by an impressive $52.75 million, reaching $680.99 million and reflecting a noteworthy 9.8% year-over-year growth. This highlights ESAB’s ability to sustain profitability while expanding its business in the face of macroeconomic challenges. Monitoring interest rates and inflation will be crucial to assess the resilience of ESAB’s core operations. Looking ahead, positive earnings are anticipated in the coming years, with both EPS and revenues showing steady growth into 2024 and 2025. The reliability ESAB has exhibited thus far suggests that these projections are credible, making sustained and continuous growth appear quite achievable for the company.

Earnings Estimates (Seeking Alpha)

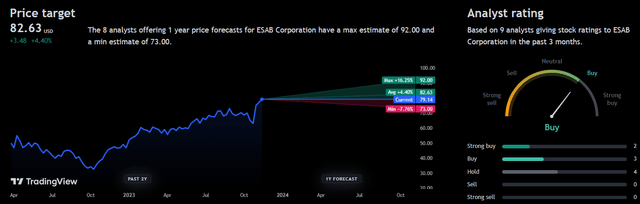

Analyst Consensus

Analysts currently rate ESAB as a “buy” with a 1-year price target of $82.63 demonstrating a potential 4.4% upside. I believe that analysts are recognizing that although ESAB has had excellent growth, valuation may be slightly too high making returns seem more difficult to achieve at this rate.

Analyst Consensus (Trading View)

Valuation

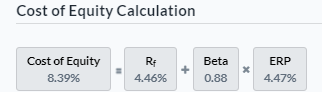

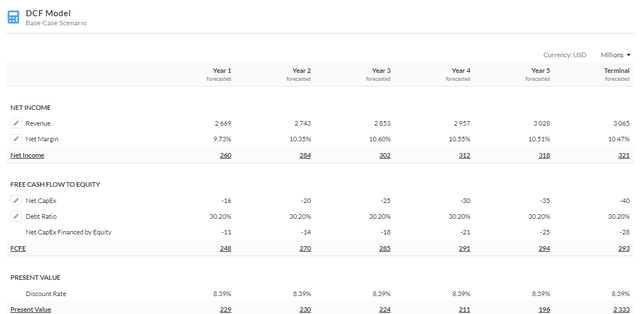

Before finding a fair value for ESAB, I must calculate its Cost of Equity using the Capital Asset Pricing Model. Using a risk-free rate of 4.46% based on the 10-year treasury yield, I found a cost of equity of 8.39%.

Cost of Equity (Created by author using Alpha Spread)

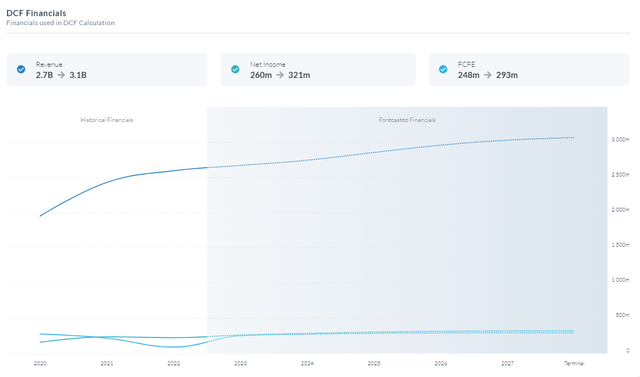

Using a 5-year Equity Model DCF based on FCFE, ESAB is currently overvalued by 30% at a fair value of ~$55.78. I utilized the firm’s Cost of Equity of 8.39% as the discount rate for my DCF due to a stable balance sheet and resilience in macro headwinds. I also estimated revenues and margins to grow in line with estimates. I also began to decrease revenue growth rates in the later years of my DCF because although I believe that the company will grow, as the company becomes larger, I believe ESAB will focus more on creating share value rather than using its FCF in its core business by increasing the dividend and repurchasing shares.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Constant Innovation Resulting in Resilient Operations

ESAB Corporation has continuously followed an innovative approach to be at the forefront of the industry. A key component of this approach is a dedication to creating innovative goods and technology that cater to changing consumer demands and business obstacles. The adoption of modern welding technologies with automation and artificial intelligence by ESAB is a prime illustration of its inventiveness. These systems use artificial intelligence algorithms to optimize welding settings in real time, improving weld quality, efficiency, and precision. By adopting smart welding technologies, ESAB advances the industry’s drive for more technologically advanced and efficient manufacturing processes while also improving the performance of its products. By providing solutions that not only meet but also beyond the expectations of a varied client base, this innovation is in line with ESAB’s customer-centric strategy. It also establishes ESAB as a technological leader in the welding and cutting business, highlighting the company’s dedication to providing cutting-edge solutions that upend industry norms and directly benefit its customers throughout the globe. This will allow ESAB to outperform its competitors in the long term resulting in greater cash flows to improve its core business and scale further. This would result in compounding growth and greater pricing power for the firm leading to shareholder value improving.

Risks

Raw Material Costs: ESAB uses a variety of raw materials in its production operations. Price fluctuations for metals and other necessary inputs can have an influence on profit margins and manufacturing costs.

Foreign Exchange Exposure: Because of its global operations, ESAB is subject to changes in exchange rates. The company’s revenues and costs may be affected by currency devaluations or appreciations when converted into its reporting currency.

Conclusion

To summarize, I believe that ESAB is currently a hold because even though the firm has seen excellent growth amid macro headwinds and has a safe balance sheet, the company is overvalued given its current growth trajectory. I believe revisiting ESAB once its valuation becomes more attractive would be the best course of action.

Read the full article here