Thesis

Because of my background in energy production, I regularly check in on several utilities. When I last wrote an article about Dominion Energy, Inc. (NYSE:D), I came to the conclusion that this company had placed itself into an extremely unattractive debt situation.

However, the actions taken by the company during this most recent quarter represent a significant course correction. They still have quite a ways to go, but now appear to be headed toward a financial situation where I would consider buying. After reviewing their current financials and valuation, I presently rate Dominion as a Hold.

Company Background

Dominion Energy, Inc. is a utility provider headquartered in Richmond, Virginia. They provide natural gas and electricity for roughly 7 million customers. Like many utility providers in the United States, they have set a goal of reaching net-zero emissions by 2050.

States Served (Dominionenergy.com)

Long-Term Trends

The United States natural gas market is expected to experience a CAGR of 5% until 2028. The United States power market is expected to experience a CAGR of over 5.6% through 2027. The Inflation Reduction Act is currently providing strong tailwinds for utility providers across the country.

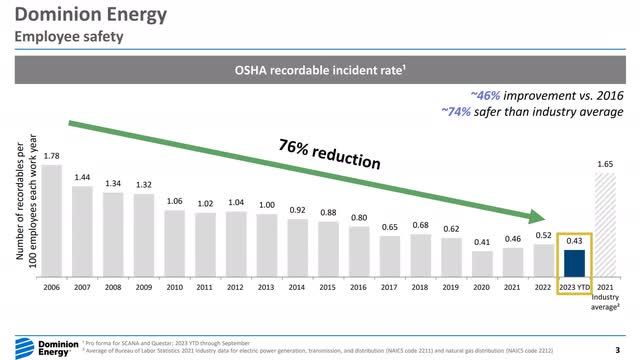

Dominion has been actively working to improve its safety record over the years. These efforts have had a positive impact.

Safety Record (Q3 2023 Investor Presentation Page 3)

Guidance

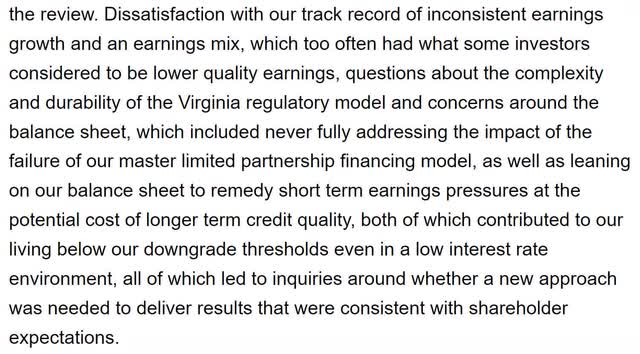

Their most recent earnings call transcript revealed many details I am not covering here. I am only highlighting what I consider to be the most important points. They are in the process of a review to determine the best course of action to perform some sort of operational pivot to improve investor returns.

Guidance 1 (Q3 Earnings Call Transcript)

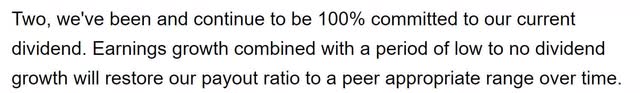

They have stated that they remain committed to maintaining their current dividend.

Guidance 2 (Q3 2023 Earnings Call Transcript)

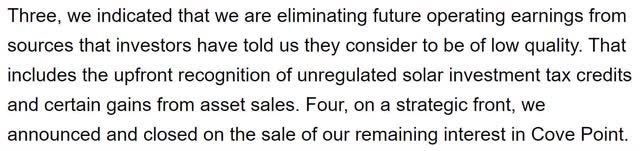

They have shifted their stance on acquiring and maintaining low-quality revenue sources.

Guidance 3 (Q3 2023 Earnings Call Transcript)

Most importantly, they paid off $3.3B in debt and have declared their intent to spend all available after-tax earnings to pay it down further.

Guidance 4 (Q3 2023 Earnings Call Transcript)

The board has stepped in and tied a significant portion of the CEO’s compensation to investor returns.

Guidance 5 (Q3 2023 Earnings Call Transcript)

Their offshore wind project is still on track to meet their previously established goals.

Guidance 6 (Q3 2023 Earnings Call Transcript)

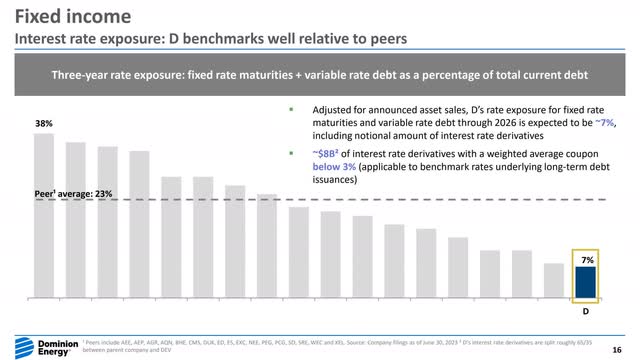

Although their debt load is quite large, the quality of that debt is better than many of their peers.

Guidance 7 (Q3 2023 Investor Presentation)

This can be seen visually on page 16 of their Q3 2023 investor presentation, which can be found here.

Debt Quality (Q3 2023 Investor Presentation)

Annual Financials

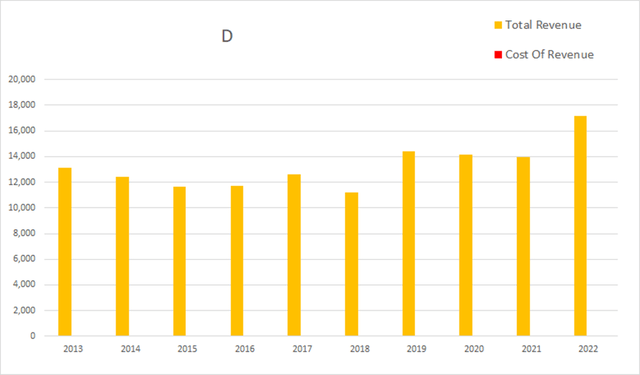

The company has been increasing its revenue at a rather slow rate over the last decade. In 2013 they had an annual revenue of $13,120M. By 2022 that had grown to $17,174M. This represents a total increase of 30.9% at an average annual rate of 3.43%.

D Annual Revenue (By Author)

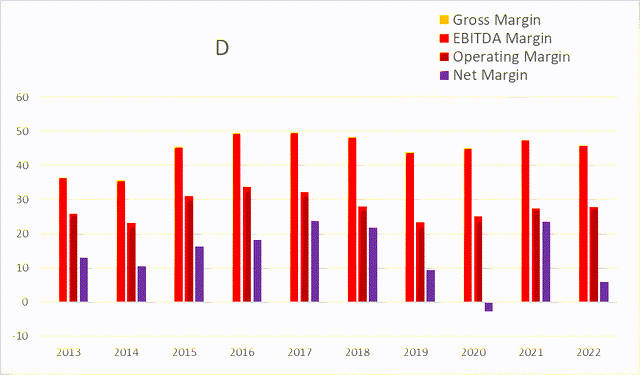

Because they are in the middle of a multi-decade portfolio shuffle, I expect their margins to continue fluctuating as time goes on. As of the most recent annual report, EBITDA margins were 45.92%, operating margins were 27.79%, and net margins were 5.79%.

D Annual Margins (By Author)

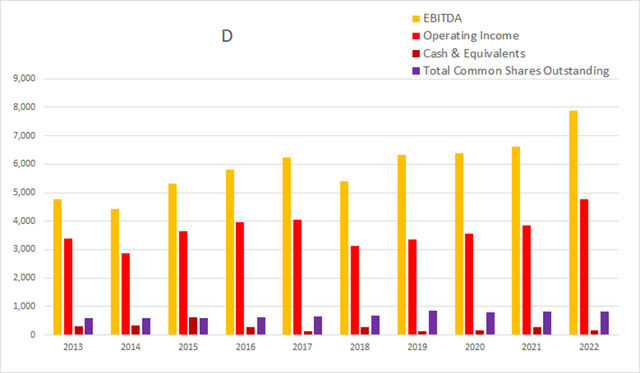

Total common shares outstanding was at 581M in 2013; by the end of 2022 that had risen to 835M. This represents a 43.72% rise in share count, which comes out to an average annual rate of 4.86%. Over that same time period operating income rose from $3,387M to $4,773M, a 40.92% total increase, at an average rate of 4.55%. The last decade of dilution has been barely accretive.

D Annual Share Count vs. Cash vs. Income (By Author)

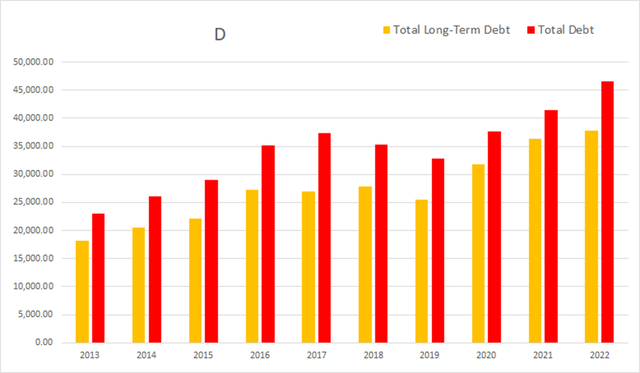

Their debt has risen significantly over the last decade. As of the 2022 annual report, they had -$1,001M in net interest expense, total debt was $46,608M, and long-term debt was $37,730M.

D Annual Debt (By Author)

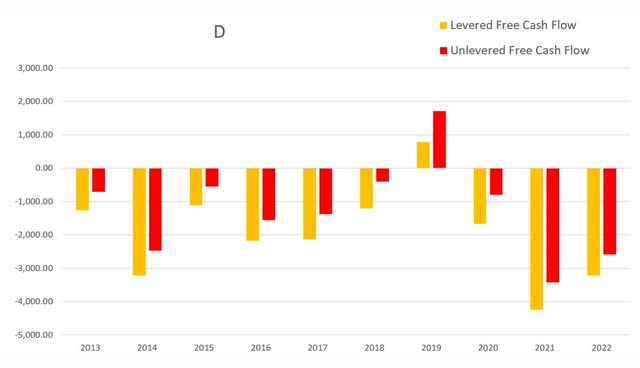

Annual cash flows have been negative for most of the last decade. As of this most recent annual report, cash and equivalents were $153M, operating income was $4,773M, EBITDA was $7,886M, net income was $994M, unlevered free cash flow was -$2,591.9M, and levered free cash flow was -$3,217.50M.

D Annual Cash Flow (By Author)

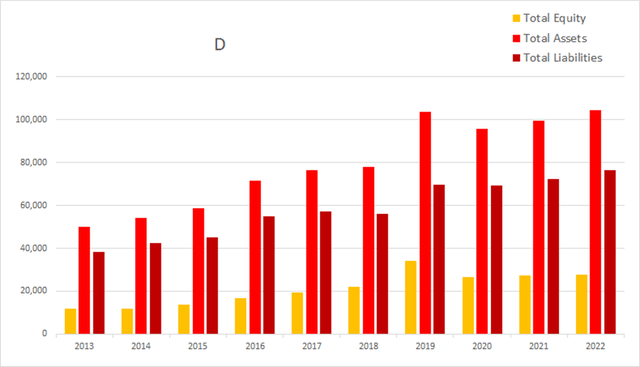

Their total equity was rising until it reached a peak in 2019. It has been relatively flat since then.

D Annual Equity (By Author)

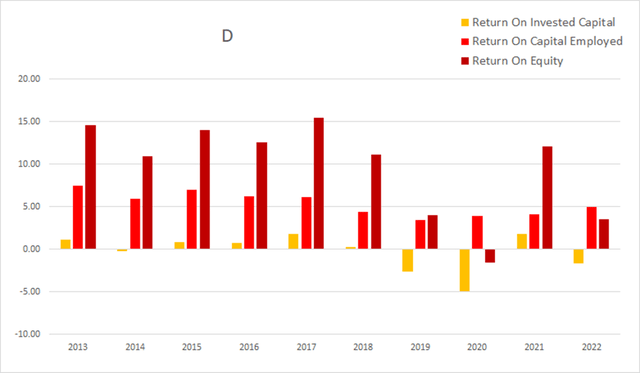

Their returns became unattractive in 2019 and have yet to recover to their previous range. As of the most recent annual report, ROIC was -1.66%, ROCE was 5.00%, and ROE was at 3.57%.

D Annual Returns (By Author)

Quarterly Financials

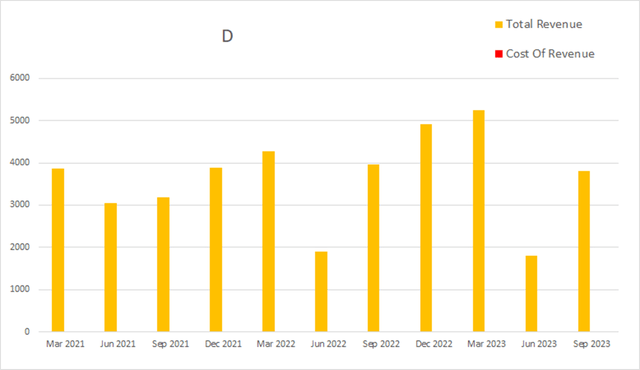

Their quarterly financials show clear seasonality. They experience lower-than-average revenue during warmer months, and higher-than-average revenue during colder months. Eight quarters ago Dominion had a quarterly revenue of $3,176M. Four quarters ago it reached $3,963M. By this most recent quarter that had dropped to $3,810M. This represents a total two-year rise of 19.96% at an average quarterly rate of 2.50%.

D Quarterly Revenue (By Author)

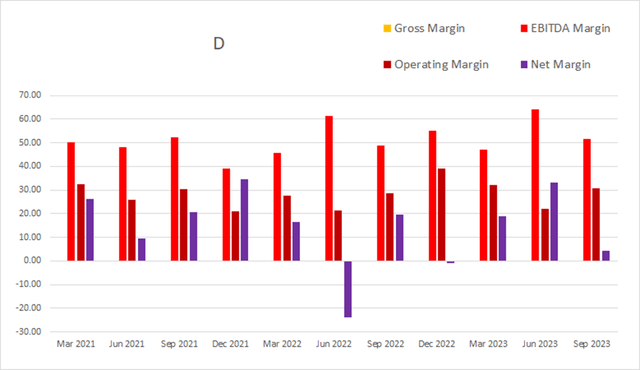

Their quarterly margins do not appear to be significantly affected by the seasonal changes in revenue. As of the most recent quarter EBITDA margins were 51.76%, operating margins were 30.63%, and net margins were at 4.28%.

D Quarterly Margins (By Author)

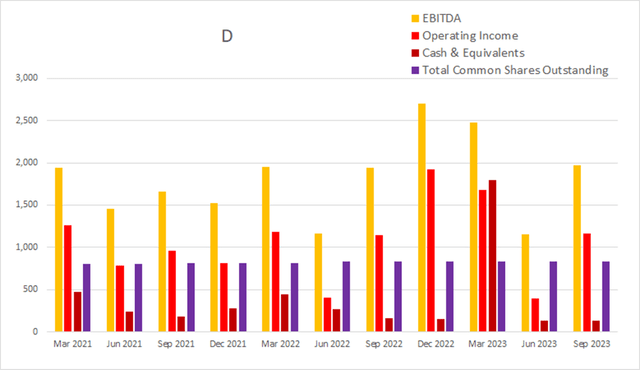

Their dilution rate appears to have been lower over the last couple of years than the average they have been experiencing over the last decade. The sum of their last eight quarters of dilution comes to 3.31%; over the last four quarters, this has dropped to 0.48%.

D Quarterly Share Count vs. Cash vs. Income (By Author)

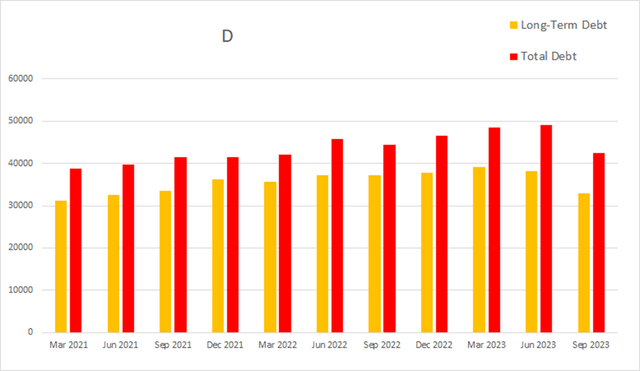

In this most recent quarter, Dominion had -$500M in net interest expense, total debt was at $42,435M, and long-term debt was at $32,915M.

D Quarterly Debt (By Author)

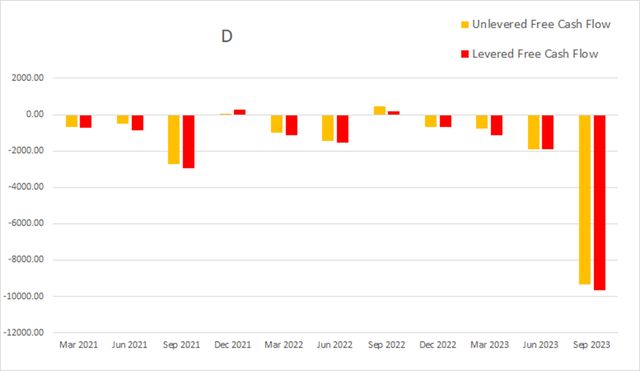

As of the most recent earnings report, cash and equivalents were $137M, quarterly operating income was $1,167M, EBITDA was $1,972M, net income was $163M, unlevered free cash flow was -$9,344.6M and levered free cash flow was -$9,657.1M.

D Quarterly Cash Flow (By Author)

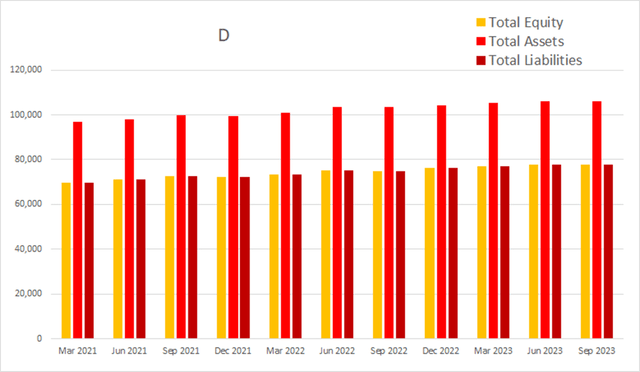

When viewing their quarterly financials, their total equity has been steadily rising.

D Quarterly Total Equity (By Author)

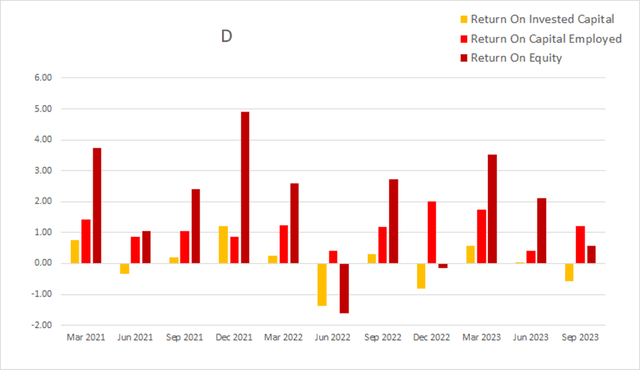

Their quarterly margins are showing significant variation. As of the most recent earnings report ROIC was -0.56%, ROCE was 1.21%, and ROE was 0.58%.

D Quarterly Returns (By Author)

Valuation

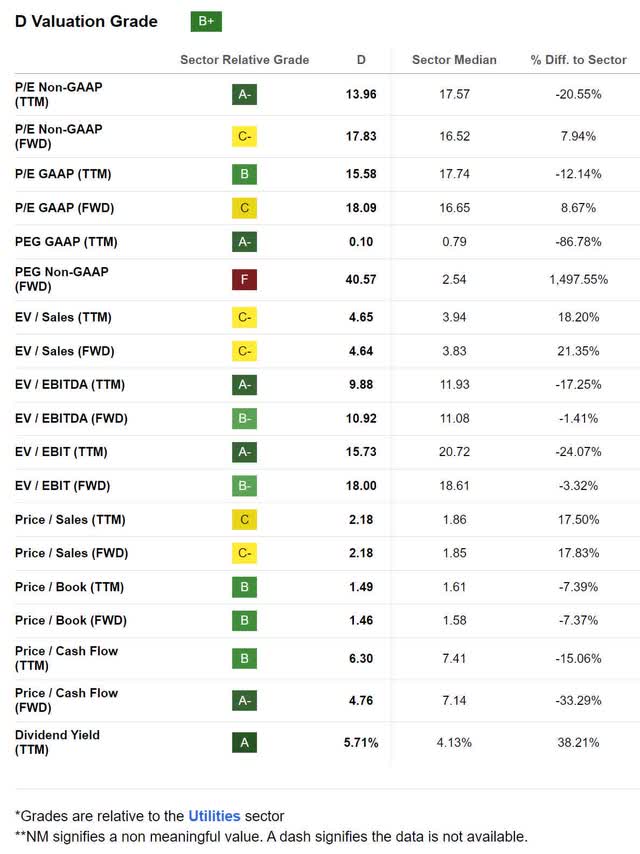

As of November 18th, 2023, Dominion had a market capitalization of $39.22B and traded for $46.74 per share. Using their forward P/E of 18.09x, their EPS Long-Term CAGR of 0.44%, and their forward Yield of 5.71%, I calculated a PEGY of 2.941x and an Inverted PEGY of 0.340x. This PEGY estimate implies the intrinsic value of the company is presently around $15.89 per share from a growth perspective.

D Valuation (Seeking Alpha)

If I instead choose to use a Dividend Discount Model, I get a significantly different result. The company stated in their earnings call that they were committed to maintaining the present dividend while they pay down debt. Seeking Alpha lists a projected dividend CAGR of 1.89%. Using the current annual dividend of $2.67 per share, a dividend growth rate of 1.89%, a discount rate of 9%, and assuming they can maintain this dividend growth for 20 years, a discounted cash flow calculator produces a fair value estimate of $36.03 per share.

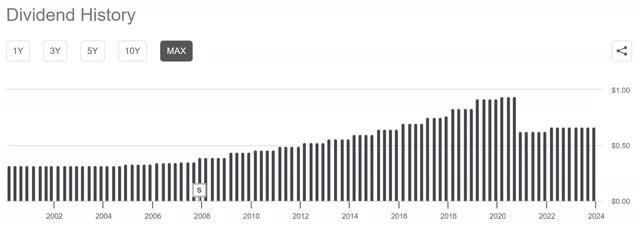

D Dividend History (Seeking Alpha)

Risks

Along with most of the other utilities in the United States, Dominion is in the middle of a multidecade portfolio adjustment. Not only are they likely to face temporary periods of diminished profits during the change, but the final portfolio of energy sources they end up with may not be as profitable as present-day projections.

Catalysts

As they continue paying down their long-term debt, the burden it places on their returns will diminish. If they pay it down far enough, the company may find itself in a situation where they are not only able to begin raising the dividend, they may be able to begin buying back shares. While most utilities do not view buybacks as a priority, being able to use buybacks to outpace any and all stock-based compensation would be a significant step toward making Dominion a more attractive investment.

Conclusions

This may sound like heresy to current shareholders, but I believe companies should always prioritize their long-term health over paying a dividend. In my last article, I stated that I believed they should cut the dividend even further and try to pay down their debt as fast as possible. Maintaining their dividend while they dedicate all available funds to paying it down is a less dramatic position for them to adopt; one that is also less likely to leave present shareholders upset.

Overall, they have put themselves on a much better path. Because of their shift in attitude, I no longer believe the company is in any danger of slipping into a debt spiral. However, the road out of the hole they have found themselves on is not a short one. They stated they were planning on spending about $9B per year paying down debt. With their present long-term debt at $32.925B, it should take them about 3.65 years to pay it down to zero. Utilities are used to operating with significant debt, so I believe it is likely they will merely pay it down to levels they consider healthy. I don’t expect them to attempt to pay it all the way off.

At some point over the next 3.65 years, I expect management to feel they have improved their situation enough that they begin raising the dividend. While this is likely to cause a valuation improvement, I will view it as an indicator that I should seriously consider opening a position in Dominion.

Read the full article here