Prologis, Inc. (NYSE:PLD), my personal favorite REIT, stands as the largest publicly traded REIT in the US, with a market cap close to $104 billion and the largest 7.07% holding in the Vanguard Real Estate ETF (VNQ). To put this into perspective, its market cap is three times larger than that of the widely popular Realty Income (O), a company known for its monthly dividends – a topic I recently covered in an article recommending a “Strong Buy,” which you can find here.

What makes Prologis particularly attractive to me, as an investor with another 20-30 years of investment horizon before depending on passive income from my portfolio, is its consistent growth. The company has achieved an 11.57% CAGR in AFFO over the past 5 years, significantly outpacing the sector’s meager 1.91% average.

Prologis pays a healthy 3.16% dividend that has grown at a remarkable 12.58% CAGR over the same 5-year period. Admittedly, during the Great Financial Crisis in 2008, Prologis cut its dividend in half – a move typically associated with underperformance in the future, similar to what I expect from W. P. Carrey (WPC) after the dividend reduction. However, since the dividend cut, Prologis has proven the naysayers wrong by not only thriving but also becoming a financially and strategically stronger company.

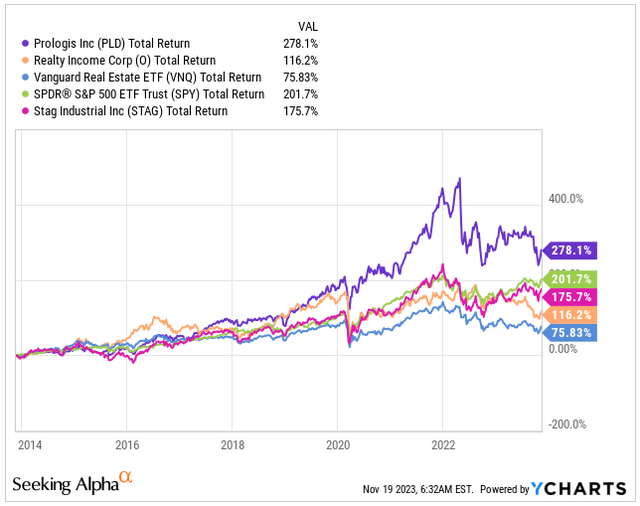

Being an industrial REIT with logistics centers in its heart and e-commerce explosive growth serving as its tailwinds, Prologis has not only outperformed the market (SPY) but also surpassed its peers such as STAG Industrial (STAG). In an industry where size matters and the financing landscape favors the strongest players, I anticipate a continuation of this outperformance in the future.

Total Return (Seeking Alpha)

Let me show you why I like Prologis today, at what I consider to be a very favorable valuation despite the elevated interest rates.

Well-Diversified & Defensive Portfolio

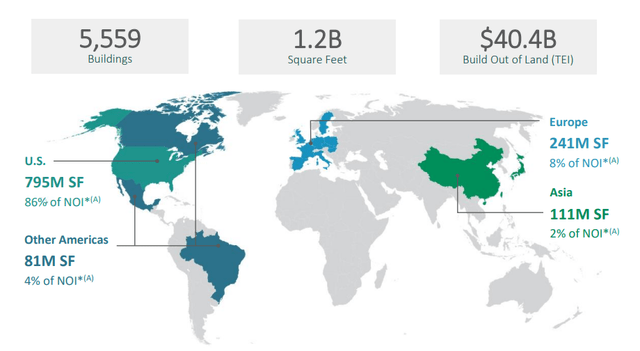

Prologis operates as a global logistics REIT. Near major cities around the world, you’ll often spot expansive warehouses with numerous truck bays – typically managed by logistics REITs like Prologis. With a colossal 1.2 billion square feet of owned and managed facilities, Prologis estimates that approximately 2.8% of the world’s $95 trillion GDP in 2022 courses through its distribution centers.

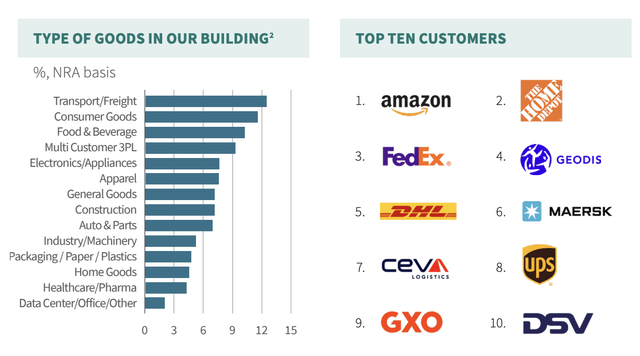

Their focus lies in securing facilities in high-demand, limited-access markets, often situated in proximity to major urban areas where real estate is scarce. The surge in e-commerce has significantly benefited logistics companies such as Prologis, given that these businesses require three times the logistics space compared to traditional brick-and-mortar retailers. This heightened demand comes from the necessity to stock higher inventory levels to accommodate items not found in physical stores, as well as to manage returns and fulfill consumer shipping demands, for companies such as Amazon (AMZN) and Home Depot (HD) to name a few.

Type of Goods & Customer Breakdown (PLD IR)

The COVID-19 pandemic highlighted a crucial point for Prologis: businesses learned that having ultra-lean supply chains with minimal inventory, a trend since the 1980s to boost efficiency, posed significant risks. Companies aimed to cut costs by reducing inventory, but the pandemic revealed that having too little inventory was just as risky as having too much. Finding the right balance became more critical as supply chain disruptions underscored the importance of having a buffer to navigate unforeseen challenges, a trend that Prologis significantly benefits from.

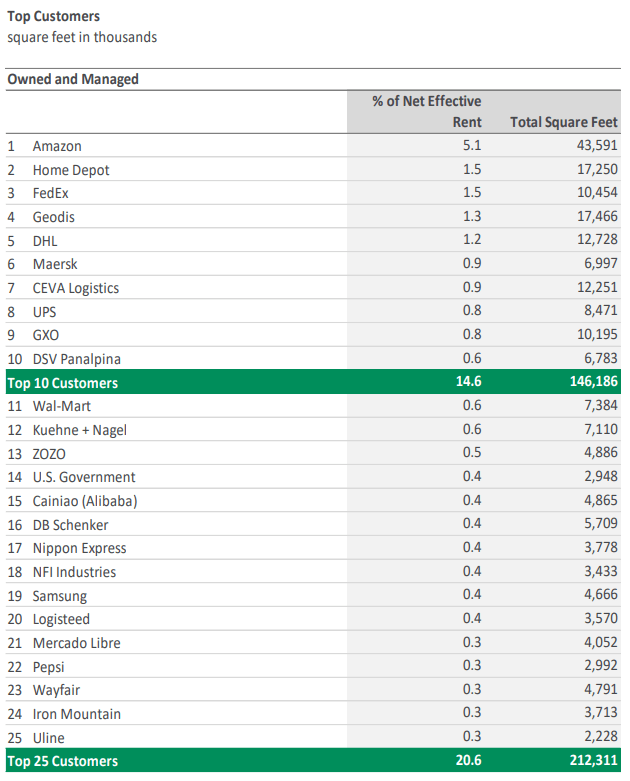

One key reason why Prologis tops my list of preferred REITs is its customer composition. While Amazon represents the largest customer, contributing 5.1% of the net effective rent, a closer look reveals that the top 10 customers collectively contribute only 14.6% to the overall rent. This suggests a highly defensive portfolio. In contrast, Realty Income, although operating in a different REIT segment, has its top 10 customers, prior to acquiring Spirit Realty Capital (SRC), accounting for 27.1% of the rent.

Top Customers with Weight (PLD IR)

However, there’s more to it. Prologis has highly diversified customer portfolio, catering to 6,700 customers globally. The largest among them predominantly hold investment-grade ratings, and 38% of total customers are focused on daily essential needs. This significantly mitigates economic risks for PLD.

Moreover, Prologis enjoys international diversification to some degree.

As of Q3 2023, Prologis has established its presence across four continents. However, a substantial 86% of the net operating income or “NOI” originates from the US, with Europe contributing 8% of the NOI. Its primary markets are California, the US Midwest, and the United Kingdom.

Despite recent political challenges directed at California, the state remains a crucial trading hub within the US, with some of North America’s largest ports. This necessitates storage facilities for transporting goods to various destinations.

Geographical Diversification (PLD IR)

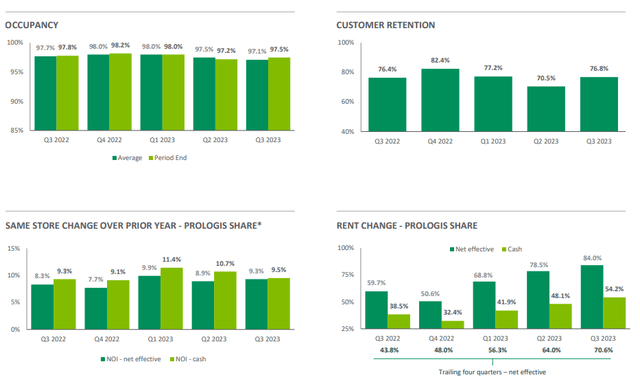

You might be concerned about the current state of affairs, especially with interest rates hitting multi-decade highs and potential economic slowdowns. But, I’ve got some good news to share about Prologis’ Q3 performance. They’ve excelled, with FFO reaching $1.30-$0.05 higher than analysts’ estimates. Plus, their revenue hit $1.92 billion, marking a 9.7% YoY increase and surpassing expectations by $180 million.

Moreover, Prologis revised its FY23 Guidance, raising the Core FFO outlook from $5.56-$5.60 to $5.58-$5.60. They’ve also narrowed the average occupancy forecast from 97.00-97.50% to 97.25%-97.50%. This uptick signals a positive recovery from the Q2 2023 dip, suggesting a potential stabilization in the logistics real estate market – a promising sign amidst uncertainties.

Q3 Operating Highlights (PLD IR)

In November, Prologis provided insights into the current market scenario in the US logistics sector, where data shows a mix of signals. Specific industry segments react to short-term uncertainties while maintaining a focus on optimizing supply chains for the long haul. Here are three key trends shaping logistics real estate:

-

Activity levels align with the surge in demand for logistics real estate. The Industrial Business Indicator or “IBI” remained steady at 57.3 in October, mirroring the Q3 average. This stability reflects sustained robustness in consumer spending and the continuous flow of goods.

-

The dynamics within logistics real estate continue to tighten across most markets. Despite a faster influx of new facilities, the national vacancy rate remains remarkably low at 4.8% compared to the historical expansionary average of 6.1%. This tightening persists despite a 70 basis point increase in market vacancies.

-

Expect significant rental rate hikes upon lease expiration, even as the market rent growth normalizes from the rapid pace observed in 2021/2022. The US witnessed an 85% rent growth from 2019 to Q3 2023, indicating ongoing steep rental rate escalations for customers at lease renewal.

Although the immediate future appears uncertain, Prologis with its substantial size, stands well-prepared to navigate the current market fluctuations. In my opinion, it will emerge stronger, leveraging significant rent increases upon lease renewals and the introduction of new properties into its portfolio.

Dividends & Growth

Now, onto the aspect that piques everyone’s interest in REIT investments: the dividend and its growth.

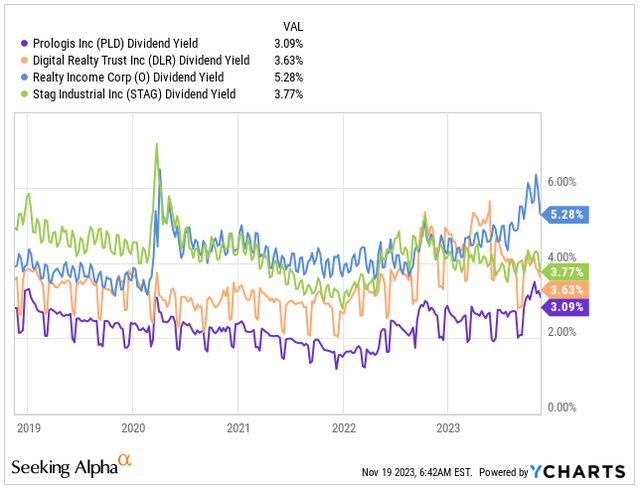

Though Prologis doesn’t boast the highest dividend in the industry, its yield is still what I’d consider satisfactory, standing at trailing-twelve-months or “TTM” of 3.09% or $0.87 per share.

While this figure might seem modest to some, it’s essential to note that this dividend comes with less than a 65% expected 2023 core FFO payout ratio, a robust balance sheet, and a business model capable of significant growth.

For comparison, Realty Income offers a TTM of 5.28%, Digital Realty Trust (DLR) stands at 3.63%, and STAG Industrial at 3.77%.

Dividend Yield (Seeking Alpha)

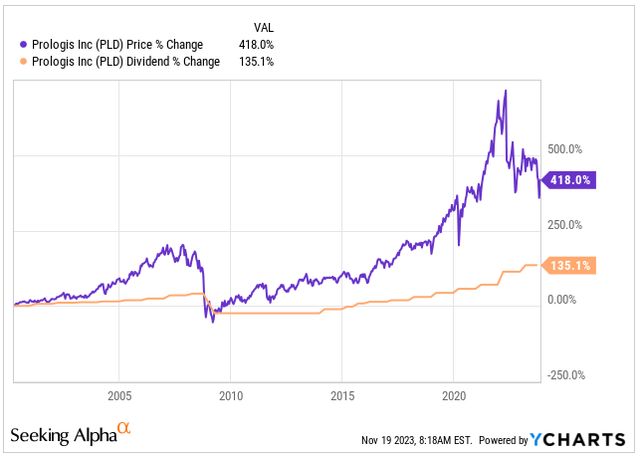

Despite the evident dividend cut visible in the 2008 graph below, Prologis has succeeded in increasing its dividend by 135% over the span of 23 years.

What’s particularly noteworthy is the company’s accomplishment of a 418% capital appreciation during this period, surpassing the overall stock market by over 110%. Additionally, Prologis still has potential for further dividend growth, as demonstrated by the recent 10% increase in February 2023.

Price Appreciation & Dividend Growth (Seeking Alpha)

Favorable Valuation

We’ve all seen how the H2 2022 and 2023 posed challenges for REITs, especially with the Fed’s fund rates most likely peaking at 5.25% to 5.50%. These 11 consecutive hikes sent ripples through the real estate market, raising concerns about higher refinancing rates for heavily indebted companies and the possibility of slower economic growth.

The negative macroeconomic developments have impacted Prologis as well, despite its robust business fundamentals. The stock has shown nearly flat total returns year-to-date, with a stock price performance of -2.32%.

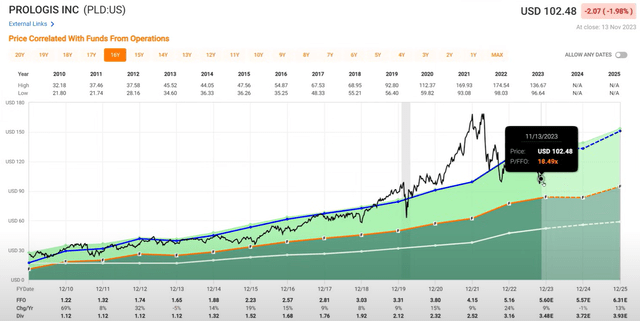

As of today, Prologis is trading at a P/FFO of 18.49x, notably below the 15-year average of 23.94x.

Prologis Valuation (Fast Graphs)

It seems reasonable to anticipate that we might not swiftly return to the 15-year average, particularly given the historically low interest rates over the past 15 years. I’m rather optimistic that the Fed won’t take the risk of cutting rates too far and experiencing another round of heightened inflation period.

My outlook leans towards interest rates stabilizing at approximately 3.0% to 3.5% in the medium term, with initial rate cuts potentially arriving in Q2 or Q3 of 2024. This shift could have a positive impact on REITs, including Prologis, aligning them more closely with their historical valuations.

Considering this, I foresee an FFO growth of around 8.9% CAGR over the next 4 years, reaching $7.84 by the end of 2027. Simultaneously, I believe Prologis could reasonably trade at 23x its P/FFO by then, indicating a stock price of $180 – representing an approximate 64% increase from today’s $110.

This projection suggests an annual capital appreciation of 13.1%. Coupled with the average dividend yield of 3.2%, it’s reasonable to expect an annualized rate of return of around 15% over the next 4 years.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 |

| FFO $ | 5.60 | 5.57 | 6.31 | 7.00 | 7.84 |

| FFO Growth | 2.0% | -0.5% | 13.3% | 12.0% | 12.0% |

| P/FFO | 18.5 | 19.5 | 21.5 | 22.5 | 23.0 |

| Stock Price $ | 104 | 109 | 136 | 158 | 180 |

Conclusion

Prologis holds a special place among my favorite REITs due to its robust and well-diversified business model boasting over 6,700 customers. What’s striking is that the top 10 customers collectively represent less than 15% of its portfolio, and a significant portion operates in what I consider defensive industries, mitigating cyclicality risks.

It’s a rarity to encounter quality REITs like Prologis trading at a reasonable valuation, especially considering its 15-year average P/FFO hovering around 24x. Presently, amid economic uncertainty and the Fed’s fund rate in restrictive territory, the market offers a compelling total return opportunity, potentially yielding a 15% annualized total return over the next 4 years.

During the recent dip on October 27th, Prologis dipped below the magic threshold of $100. This prompted me to reinforce my position by doubling down, as I anticipate industry-leading FFO growth from this heavyweight REIT at approximately 8.9% CAGR over the next 4 years.

As it stands, the stock remains an attractive prospect for many dividend growth investors. Personally, I see value in purchasing the stock all the way up to $120.

Read the full article here