It’s been almost six months since I last wrote here about Trulieve Cannabis (OTCQX:TCNNF), calling out its excellent entry point then at $3.87. Indeed, it was, but is it a buy at the higher price now of $5.61? In this piece, I discuss why it has rallied, review the two quarterly reports since my last article, assess the updated outlook, look at the chart and dig into the valuation of Trulieve relative to its peers as well as outright.

Why Trulieve Rallied

Trulieve is not at the highest point since my article in early June, but has appreciated by 45%. The move is fully explained by the late-August move of the Department of Health & Human Services to get cannabis moved from Schedule 1 to Schedule 3 by the DEA. The reason that this could be so good is that if the DEA does that, then the onerous 280E taxation would go away, providing a big boost to the cash flow due to lower tax payments.

Investors should not assume that this will happen soon or even at all. If the DEA were to go to Schedule 2, then 280E would remain. Even with Schedule 3 and 280E gone, the government could move to impose another tax, though this could take some time to do.

Schedule 3 would eliminate 280E taxation, which would be great, but cannabis would still be illegal federally. The NASDAQ and New York Stock Exchange aren’t prohibited by law from including cannabis companies, and the rescheduling wouldn’t necessarily provoke them to reconsider their policies. A bigger reason to change would be the passage of the SAFER Act, but this probably won’t happen ahead of the 2024 elections and would not require them to begin to list American cannabis companies.

A Look at Q2 and Q3

TCNNF reported its Q3 on November 9th and provided a new 10-Q. It had reported Q2 in early August. Analysts, according to Sentieo, had expected the company to report revenue in Q2 of $281 million with adjusted EBITDA of $73 million. Revenue fell 10% to $281.8 million with adjusted EBITDA of $78.7 million. In Q3, they projected revenue would decline 10% to $269 million with adjusted EBITDA of $73 million. Revenue was a touch better at $275 million, and adjusted EBITDA was also ahead of expectations at $75 million.

Year-to-date revenue of $842.2 million has declined 8%. The gross margin has declined from 57.9% to 51.6%. Weighed down by the lower gross profits and a $307.6 million impairment of goodwill, which doesn’t mean much to me, the operating profits have declined from $45 million to -$250.8 million. Excluding the impairment charge, operating profits have expanded despite a sharp decline in revenue.

Looking beyond the income statement, cash flow from operations has swung big-time, as the company used $31.9 million to fund its first three quarters in 2022. It generated $70.4 million in the first three quarters of 2023. A big part of this has been the swing in inventory, which consumed over $87 million during the first three quarters of 2022 and generated more than $65 million this year so far. An expanding income tax payable has helped too. Positively, capital spending has declined significantly. The balance sheet shows net debt at $399 million, which is substantially lower than at year-end or a quarter ago. This excludes income tax payable, which is $205 million.

The Updated Outlook

The analysts projected ahead of the report that revenue in 2023 will decline 10% to $1.116 billion with adjusted EBITDA margin falling 24% to $305 million (27.3% margin). Now they expect revenue will fall 10% still, but to a slightly lower $1.114 billion. Adjusted EBITDA in 2023 is projected to drop 23% to $307 million.

For 2024 the forecast has gone from revenue of $1.195 billion to $1.114 billion, unchanged from 2023. Adjusted EBITDA is expected to increase 2% to $313 million, down from the prior prediction of $327 million.

Ahead of the Q3 report, 4 analysts were projecting 2025 revenue would grow 3% to $1.18 billion with adjusted EBITDA expanding slightly to $328 million. Now 5 analysts project that revenue will 4% to $1.157 billion with adjusted EBITDA up 2% to $320 million.

So, the numbers for the quarter were stronger than expected, but the analysts chopped their outlooks.

The Chart

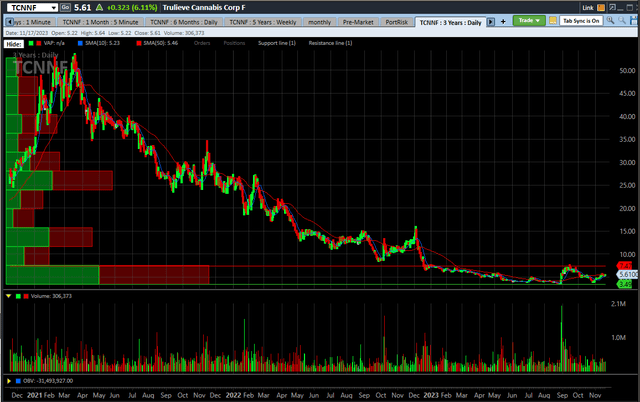

Trulieve is trading at a tiny fraction of where it peaked in 2021:

Charles Schwab

The largest bolus of volume over the past three years has been between $3.50, near the all-time low, and $7.50, which first broke in late 2022’s disastrous December. Taking a look at the last year, that December to remember is quite evident:

Charles Schwab

I first recommended Trulieve as a relative buy here in February, and the stock is still lower today, though it finally exceeded the price in early September. It’s currently up a lot from the price I reiterated my interest in early June. I see support at $4.50 and resistance at $6.25.

Trulieve Is Cheap and Cheap to Peers

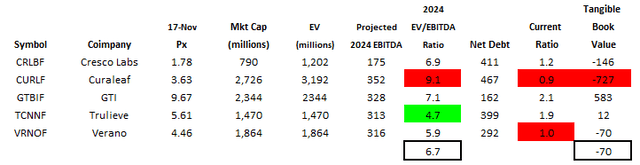

I think that Trulieve is the cheapest of the largest 5 MSOs by far based upon where it is trading on an enterprise value to projected adjusted EBITDA for 2024:

Alan Brochstein using Sentieo

At 4.7X, Trulieve is much cheaper than its peers. The most expensive, Curaleaf (OTCPK:CURLF), stands out, and I continue to be concerned that it has more risk than its peers.

I think that Verano (OTCQX:VRNOF) is a good comparison given its similar large exposures to Florida, Arizona and Pennsylvania, and the stock trades below average too but at a significant premium to Trulieve. Its balance sheet is more strained, with a current ratio of just 1.0X and negative tangible book value. I think that the projected adjusted EBITDA margins at VRNOF are too high.

One of the things that concerns me about the MSOs and even Trulieve is the lack of tangible book value. In the case of Trulieve, tangible book value is only $12 million. There are much worse levels for peers, and the high debt levels gives me concern. Of course, if 280E goes away, so does this issue.

I introduced recently a range of targets for year-end 2024 based on the enterprise value to adjusted EBITDA projected for 2025. It’s an either-or situation, as far as I can tell. If 280E goes away, the valuation could soar to 8X, which would be $11.31, 102% higher. I think that this target could be too low. If it does not go away, then I think the multiple would fall to just 3X, which would be $2.93, 48% lower.

Conclusion

I still like Trulieve despite the higher price. I boosted it this past week in my model portfolio that aims to beat the American Cannabis Operator Index to 25%. I like the stock a lot compared to other MSOs, and, as I discussed above, it looks cheaper than its peers. In my view, MSOs can do better if 280E does go away, but they will decline if it doesn’t.

I don’t own any currently in the Beat the Global Cannabis Stock Index model portfolio, where I own only two other American cannabis companies for now. I have a lot of exposure to three Canadian LPs and to several ancillary companies. Each of the Canadian LPs that I own in the model portfolio trades below tangible book value. They won’t be impacted by the elimination of 280E. While the ancillary companies won’t be directly helped by an end of that tax, their clients will, and I expect over time that their revenues and earnings will be boosted if it happens.

It’s still not clear if Florida will move to legalize cannabis for adult-use, but this would be a positive for Trulieve. The company is heavily dependent upon its home state’s medical cannabis market, and that market is seeing growth slow substantially. Each of its large peers operate in the state as well, so this would hurt them too if the medical cannabis market slows further.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here