We previously covered Petrobras (NYSE:PBR) in August 2023, discussing the changes in its dividend policy after the new CEO took over, marking the end of its hyper-pandemic payouts and yields, worsened by the intensified low carbon investments over the next few years.

However, we maintained our Buy rating then, since the company remained a low-cost oil/ gas producer, with the elevated Brent spot prices likely to sustain its rich variable dividend payouts.

In this article, we will be discussing PBR’s mixed prospects, as the volatile spot prices and elevated expenses trigger its impacted profitability and dividend payouts.

While we reiterate our Buy rating, thanks to the intact dividend investment thesis, we also recommend investors to wait for a moderate pullback, due to the stock’s tremendous rally by +74% YTD.

The PBR Dividend Investment Thesis Remains Robust

For now, PBR has delivered a mixed FQ3’23 earnings call, with revenues of $25.55B (+11.2% QoQ/ -21.1% YoY) and EPS of 2.04 reais (-7.6% QoQ/ -42.2% YoY).

Its top and bottom lines appear to underwhelm on a QoQ basis indeed, despite the notable expansion in the Brent crude oil spot prices to $86.76 (+10.6% QoQ/ -13.9% YoY).

Its profitability headwinds is mostly attributed to the drastic increase in PBR’s operating expenses to $3.59B (+13.9% QoQ/ +52.1% YoY) in the latest quarter.

This naturally translates to its impacted adj Free Cash Flow generation of $8.36B (inline QoQ after accounting for divestiture/ -17.3% YoY), further contributed by the intensified FQ3’23 capital expenditures of $3.18B (+9.2% QoQ/ +63.9% YoY).

Then again, these are mostly old news, since the intensified investments have been well communicated in PBR’s previous earnings calls, attributed to the Strategic Plan 2024-2028, which underlines the management’s focus to be a well-diversified energy company with multiple low carbon businesses.

If any, investors may be encouraged by the notable moderation in the FY2023 capex from the original guidance of $16B (+70.3% YoY) to $13B (+38.4% YoY), implying that the FQ4’23 dividends may be improved than that announced for FQ3’23, assuming that nothing changes.

In addition, PBR’s net debt position of $43.72B (+3.6% QoQ/ -7.9% YoY) remains somewhat stable, with a weighted average maturity term of 11.5 years, implying that the oil/ gas producer remains well positioned for its aggressive growth plans ahead.

Investors may want to note that its expansion efforts are already paying off extremely well, with the management achieving an impressive production of 3.98M boed in FQ3’23 (+7.8% QoQ/ +9.1% YoY).

FQ4’23 is likely to bring forth additional output of up to 4.18 M boed (+5% QoQ/ +12.9% YoY) as well, with the newly commissioned wells contributing to the PBR management’s raised guidance for FY2023.

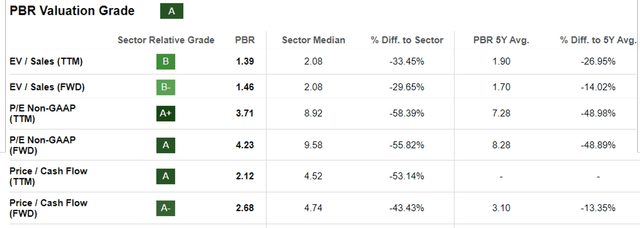

PBR Valuations

Seeking Alpha

On the one hand, the PBR stock’s FWD valuations remain impacted at FWD P/E of 4.23x and FWD Price/ Cash Flow of 2.68x, compared to its 3Y pre-pandemic mean of 10.44x/ 5.93x and the sector median of 9.58x/ 4.74x, respectively.

On the other hand, there is already great improvements from its 1Y mean of 3.71x/ 2.12x, likely attributed to the improved market sentiments surrounding Brazil’s geopolitical stability, as the new CEO continues to deliver excellent growth as discussed above.

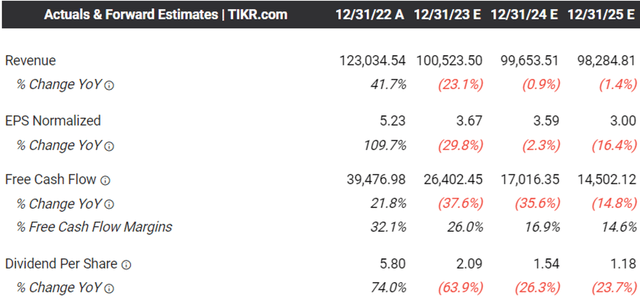

The Consensus Forward Estimates [USD]

Tikr Terminal

For now, we believe that the discounts observed in PBR’s stock valuations are still unwarranted, since the oil/ gas producer is expected to generate robust FCF through FY2025, sustaining its variable dividend pay outs.

Despite the revised shareholder return policy to only 45% of FCF, compared to the previous 60%, it appears that the stock’s dividend investment thesis remains excellent, with the consensus still estimating an FY2024 dividend payout per share of $1.54, implying an excellent forward dividend yield of 9.6% based on the current share prices.

While the number may seem to be underwhelming compared to PBR’s 4Y average of 20.85%, this FWD yield already exceeds the sector median of 3.70% and the US Treasury Yields of between 4.44% and 5.40%.

Most importantly, its dividends remain more than safe, based on the TTM Interest Coverage ratio of 15.75x and TTM Free Cash Flow Yield to Dividend Yield Ratio of 16.64%, compared to the sector median of 7.89x and 3.08%, respectively.

So, Is PBR Stock A Buy, Sell, Or Hold?

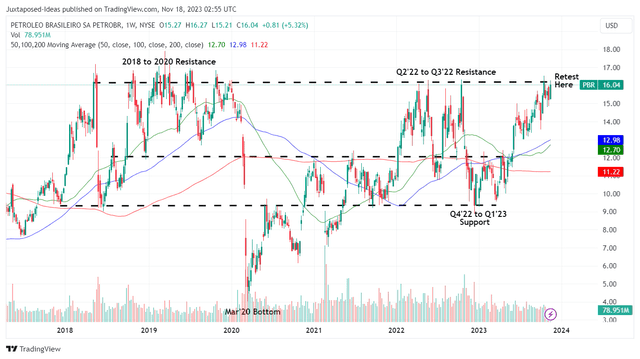

PBR 5Y Stock Price

Trading View

For now, PBR has already rallied tremendously to retest its critical 2018 to 2023 resistance level of $16s, with it remaining to be seen if the stock is able to break out.

At best, we believe that the stock may trade sideways at current levels, if not retrace to its support levels of $14s in the near term. This is because the Brent crude oil has already moderated to $80.62 at the time of writing (-11.8% MoM/ -7.8% YoY), down drastically by -16.4% from the YTD peak of $96.55 in September 2023.

Depending on how things develop over the next one and a half months, PBR’s FQ4’23 results may potentially underwhelm on a QoQ and YoY basis, with the expanded FCF from reduced capex and raised output guidance negated by the lower spot prices and forex headwinds, as similarly observed in FQ3’23.

Therefore, any investors looking for special dividends in the upcoming quarter may want to temper their near-term expectations.

Brent Crude Oil Spot Prices

Market Insider

However, with the Brent crude oil still up by +34.3% from the 2019 averages of $60, we believe that PBR may still have a few more quarters of expanded FCF generation, with the EIA still forecasting elevated spot prices of $93 through 2024.

For now, while we may continue rating the PBR stock as a Buy, there is no specific recommended entry point since it depends on individual investor’s risk appetite and dollar cost averages.

Generally, we recommend waiting for a moderate pullback for an improved margin of safety and expanded forward yields. Patience may be prudent here.

Read the full article here