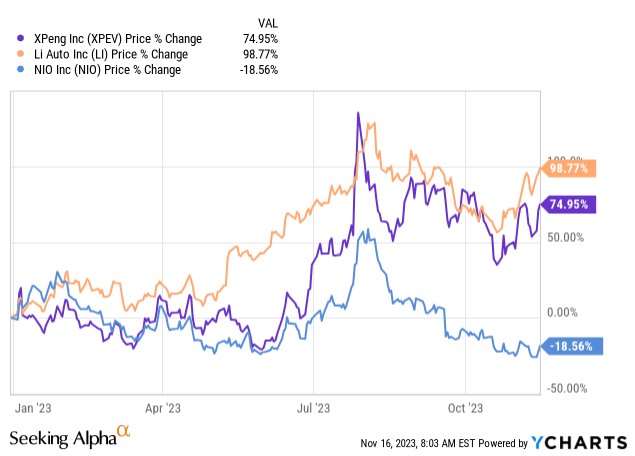

XPeng (NYSE:XPEV) submitted a mixed earnings sheet for its third-quarter on November 15, 2023, but guided for significant delivery and top line growth in the final quarter of the year. While XPeng saw a substantial increase in third-quarter deliveries due to a return of consumer demand, the Chinese electric vehicle was not able to translate growing sales into stronger earnings. With competition in the electric vehicle market ramping up, XPeng’s margins remained under pressure as well. Since Li Auto (LI) is widely outperforming XPeng in terms of delivery growth and vehicle margins, I believe XPeng is not the most attractive, nor cheapest, Chinese electric vehicle start-up that investors should buy right now!

Previous rating

In August, I rated XPeng a hold after the EV company acquired DiDi Global (OTCPK:DIDIY)’s smart vehicle unit and said that it would use its acquired tech to start a new electric vehicle brand next year. I believe the margin trend, although it slightly improved in the third-quarter, is still not attractive… especially in light of much better options in the Chinese electric vehicle start-up market.

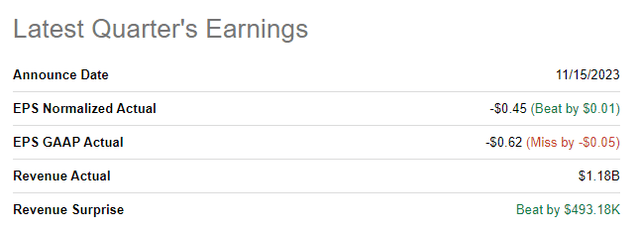

XPeng’s third-quarter earnings beat expectations

XPeng beat earnings and revenue expectations for the third-quarter: adjusted EPS came in at $(0.45) which was $0.01 per-share better than the average prediction. The top line beat was marginal with XPeng out-performing the consensus estimate by $0.5M.

Source: Seeking Alpha

Strong delivery growth fails to translate into earnings growth

XPeng delivered 40,008 electric vehicle in the third-quarter, showing 35% year over year growth. In October, XPeng delivered 20,002 electric vehicles which was a new monthly delivery record for the EV maker. However, EV rival Li Auto is crushing XPeng in terms of delivery growth: it delivered more than twice as many vehicles, 40,422, in October and Li Auto’s third-quarter delivery volume totaled 105,108 EVs, representing 296% year over year growth.

Li Auto, due to its stronger delivery growth, higher monthly output volume and much better margin picture remains my top bet on the Chinese EV market. Another company that is crushing it right now in terms of deliveries and which is set to overtake Tesla (TSLA) in global delivery volume, is BYD Company (OTCPK:BYDDF).

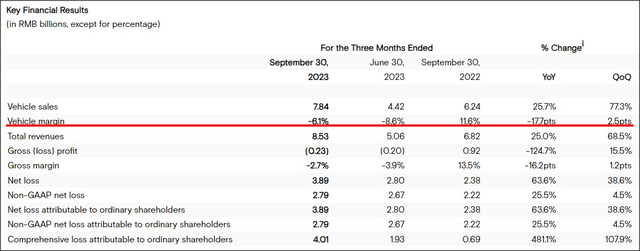

XPeng generated total revenues of 8.53B Chinese Yuan ($1.17B) in Q3’23, showing 25% year over year growth. Despite higher revenues, XPeng’s losses expanded to 3.89B Chinese Yuan ($0.53B) compared to 2.38B Chinese Yuan ($0.33B) in the year-earlier period. Although XPeng generated higher deliveries and revenues compared to last year, the EV pricing environment remained weak… and it has been reflected in XPeng’s margins.

XPeng’s vehicle margins for Q3’23 improved quarter over quarter from (8.6)% to (6.1)%, but margins remained deeply negative which stands in stark contrast to Li Auto which reported a third-quarter vehicle margin of 21.2%. Li Auto grew its margins 0.2 PP quarter over quarter while XPeng improved its vehicle margins 2.5 PP Q/Q, but the fact that margins remained negative is why I can’t see a realistic case for a rating upgrade for shares of XPeng at the moment.

Source: XPeng

Outlook for Q4’23

XPeng submitted a strong forecast for Q4’23 which was possibly the best take-away from the third-quarter earnings release. The EV maker expects to deliver between 59,500 and 63,500 electric vehicles in Q4’23 which in the high-case would imply a year over year growth rate of 186% (and 168% in the low-case). In terms of revenues, XPeng guided for B12.7-13.6B Chinese Yuan, implying year over year top line growth of 147.1-164.6%.

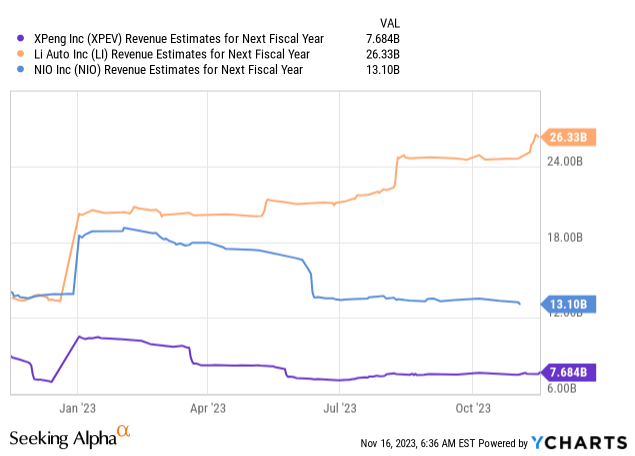

XPeng’s valuation, falling and concerning estimate trend

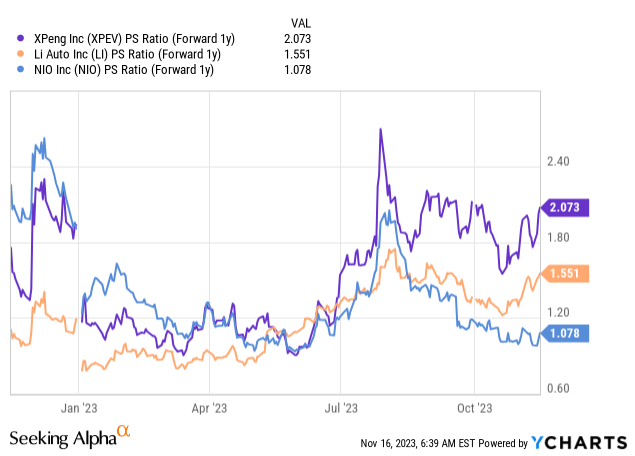

XPeng remains the highest-valued Chinese EV start-up in the industry group, despite an unfavorable margin picture. Li Auto, NIO and XPeng are expected to grow their top lines 57%, 55% and 75% next year, but as I have indicated in my work on Li Auto, XPeng’s estimates have consistently fallen (as did NIO’s)… while estimates for Li Auto have increased steadily in the last year.

Based off of revenue expectations, XPeng is currently the EV maker in the industry group with the highest revenue multiplier factor of 2.1X. Considering that Li Auto is growing deliveries much faster, I believe Li Auto should also be the highest-valued EV company… however, Li Auto is selling at just 1.6X and is therefore the much better EV deal for investors, in my opinion.

NIO is seeing a rebound in delivery growth as well and the company launched new EV products in 2023 which is why I see an improving setup for NIO at the moment. NIO also currently offers the lowest price-to-revenue ratio of 1.1X which translates into an attractive risk profile. I have currently strong buy ratings on Li Auto and NIO, and a hold rating on XPeng.

Risks with XPeng

XPeng is seeing strong delivery growth, but Li Auto is still way ahead of its EV rival in terms of total delivery volume. Li Auto’s margin picture also looks much better than XPeng’s. With negative vehicle margins still prevailing in the third-quarter I believe XPeng faces a potentially long road towards profitability while Li Auto is already expected to turn its first full-year profit this year. XPeng is expected to generate its first full-year profit in FY 2027… and this is if the margin situation won’t get worse. A delayed profit timeline and persistently negative vehicle margins could threaten my hold rating going forward.

Final thoughts

XPeng grew its revenues 25% year over year in the third-quarter, which was a solid accomplishment, but the EV company continued to report negative vehicle margins and expanding losses relative to the third-quarter of last year. While vehicle margins improved 2.5 PP Q/Q, the EV pricing environment is still challenging and the margin situation is unlikely to get materially better in the near term. Considering that shares of XPeng are expensive relative to Li Auto and NIO, I believe the risk profile is not skewed to the upside for the EV maker right now. If I had to choose between either Li Auto or XPeng, I would go for Li Auto due to its stronger delivery growth, a fast-track to profitability this year and positive vehicle margins!

Read the full article here