Main Thesis/Background

The purpose of this article is to evaluate the PIMCO High Income Fund (NYSE:PHK) as an investment option at its current market price. This is a CEF that is designed to seek “high current income, with capital appreciation as a secondary objective”.

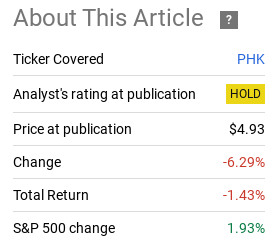

I have covered PHK for many years, mostly recently back in June. At the time I suggested readers approach it selectively as I saw limited value. In hindsight, I was pretty spot-on with that assessment based on its return since that article was published:

Fund Performance (Seeking Alpha)

it less frequently than other CEFs that I actually own (or recommend) since the value proposition rarely changes. Still, it has been over a year and a half since I last covered PHK specifically – so I thought it was time to take another look at this high yielder. In retrospect, my passiveness towards this fund has been vindicated so far:

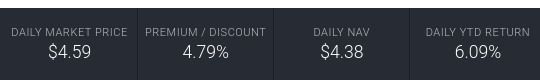

Valuation: Same Old Song & Dance

I always touch on valuation when it comes to PIMCO CEFs because their securities often trade at substantial premiums to NAV. PHK is an example of one that used to, but then had a remarkable fall from grace in that regard. Still, even though PHK doesn’t have the 30%+ premiums it used to in the past, the fund is rarely “cheap”. That is true even today as it sits with a premium in excess of 4% to its underlying value (at time of writing):at time of writing

PHK’s Stats (PIMCO)

I will keep the analysis brief here because this is a subjective argument that doesn’t need constant rehashing. The simple fact is that some investors (like myself) put an emphasis on avoiding overpaying for funds based on this metrics. Others do not, and that is their prerogative. The bottom-line is a 5% premium is nothing to be overly alarmed about, but it certainly doesn’t represent a bargain either.

Back in June the fund’s premium was richer by about 3% (it was 7.71% when I wrote that article). So the fund’s negative return since then has had the benefit of narrowing the premium. This makes for a better argument for entry points here, rather than in June. Fair enough, but a premium near 5% still suggests investors are overpaying for this fund. On this metric alone it would be hard for me to justify a “buy” rating, but the premium is narrow enough that I wouldn’t be overly bearish either. This is central to why “hold” is the right call in my view.

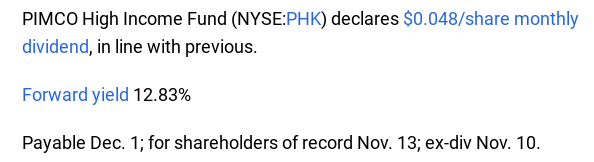

Some Positives? Income Is One

A second important attribute for any PIMCO fund is income – both the current yield and investment income metrics. This is fundamental to evaluating any high yield vehicle, PHK included. A high yield on the surface can often be a big red flag that the market is not convinced management is capable of maintaining an income stream or, with the case of equities, that the long-term health of the company may be in jeopardy. PHK, with a current distribution yield near 13%, is certain to draw plenty of attention from income-oriented buyers:

Current Yield (Seeking Alpha)

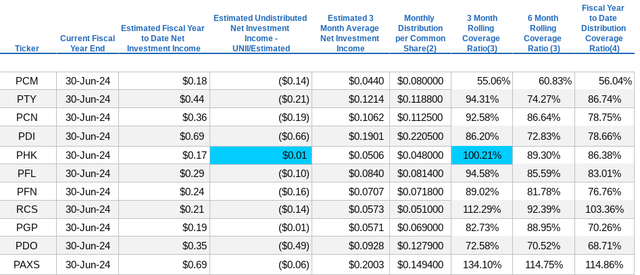

On the surface this does strike me as a “too good to be true” type of metric. Approaching 13% could mean a fund is very under-valued or that it is paying out too much. Through most of 2023 I would have said definitively that PHK was over-paying and that the distribution was going to be cut. After all, the fund trades at a premium to NAV, so a high yield because the fund is under-valued is not really the case here. However, PIMCO’s latest UNII report paints a bit of a different story now. The coverage ratios have improved markedly and the fund has a positive UNII balance at present (albeit a small one):

UNII Report (PIMCO)

This is a pretty favorable report for PHK. It shows the distribution is not in any immediate danger. That is of paramount importance for the fund. Secondly, it illustrates that PHK is actually performing quite a bit better than other PIMCO CEFs in terms of income production. The chart shows quite clearly that many alternative funds have large negative UNII balances as well as coverage ratios that are much weaker. This could actually work to PHK’s favor if it solicits a rotation by some investors into it.

Equity Investors Flashing Contrarian Sign?

The next point to touch on is more of a macro-view. But it is important because it considers why someone would want bonds or other debt securities at this moment. This is an analysis one should perform before buying PHK – or any debt product for that matter. Is the market favorable for bonds or leveraged loans currently and – if not – then would buying PHK even make sense from that fundamental perspective?

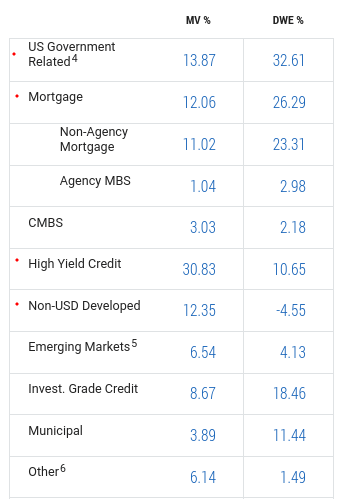

To understand why, consider PHK’s holdings. The fund is heavily involved in the high yield credit market – so that is a critical area to evaluate. But it also holds substantial amounts of debt from the US government, non-US developed economies, and mortgage backed securities:

PHK’s Sector Breakdown (PIMCO)

It is fair to say that someone should be pretty bullish on credit as a whole if they want to buy and hold this CEF!

This begs the question – why would someone be a bond or credit bull right now? There are actually a number of reasons. One, inflation has begun to cool, both in the US and globally. Readers are probably aware of the weaker-than-expected inflation report we got domestically last week, but the story goes beyond that. Euro-zone inflation has also come down sharply. This improves the outlook for fixed-income debt overseas as well:

Euro-Zone Inflation and GDP (Bloomberg)

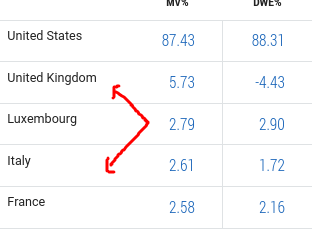

The point here begin that inflation has become a tailwind for both US-backed debt and also Euro-zone debt – which is part of the “non-US developed” debt that PHK holds:

PHK’s Exposure (PIMCO)

Another reason to consider bonds right now goes beyond the inflation and interest rate outlook. Bonds often move inversely with equities (although that direction has been challenged over the past two years). This means, on average, if one expects weakness in the equity markets then going over-weight fixed-income is a smart move – whether through PHK or another vehicle.

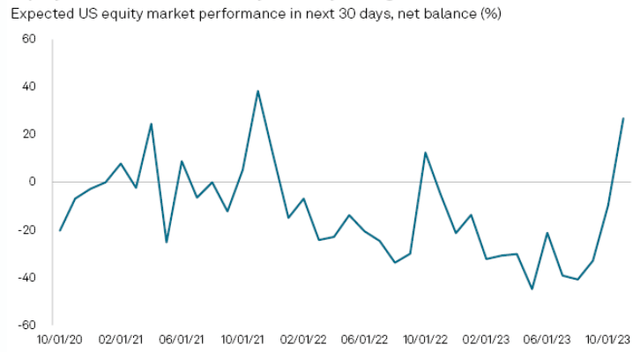

This brings me to the contrarian point. As equity markets have rebounded sharply over the last month, why would one want to be bearish on equities and bullish on bonds? Perhaps it is precisely that reality – that equities have risen so much – that the time to shift allocations makes sense. I see some logic to this because as equities have risen, so too has investor confidence. In fact, investor optimism for forward equity returns has hit a two year high recently:

Investor Sentiment (Equity Market) (S&P Global)

The conclusion I draw here is that there could be some merit to locking in equity profits and shifting to bonds. The recent rally has offered strong short-term returns and investor euphoria is often a signal we are nearing a top. While PHK would not be my personal way to play this, it does give the fund more merit than it might have had just a couple of months back.

Leverage Still A Potential Thorn

Through this article I have touched on a couple concerns I have with PHK, but I have also highlighted a few positives. This is indeed a balancing act – PHK is not a clear buy or sell to me because of this push-pull dynamic. I am going to wait and see what the next big move is (if there is one) and reassess from there.

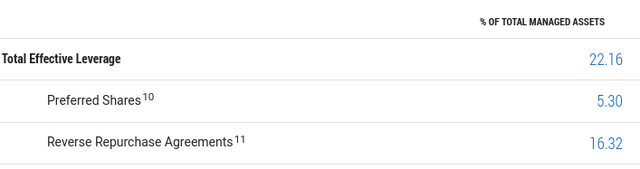

Beyond what I have already talked about, another attribute that makes me cautious is the fund’s use of leverage. At 22%, PHK is actually less leveraged than many of the PIMCO sister CEFs. This makes this particular fund a bit safer (or at least less volatile) by comparison, all other things being equal:

PHK’s Use of Leverage (PIMCO)

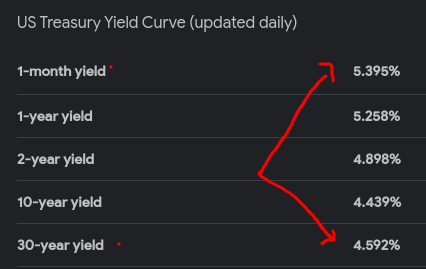

This is a topic that I have talked about repeatedly for a year and a half. Leverage, useful in boon times, has been a big thorn in the side of many CEFs because borrowing costs (for the leverage) have shot up while opportunities at the longer end of the yield curve have been limited. This is due to the yield curve inversion – pressuring the net interest income dynamic for many funds – PHK included.

The good news is that with inflation cooling and the outlook for a more dovish Fed in 2024, this major headwind has diminished going forward. The bad news is, in the short-term, not much has changed. Yes, investors are forward looking, but short-term pressure on the income producing of funds like PHK is still impacted negative for the time being. This is because, despite recent CPI reports, the yield curve remains inverted:

Yield Curve Inversion (Google Finance)

The net result of this is that even though the outlook going forward is much more favorable for leverage than it has been in the prior 18 months, the short-term challenge remains. For this reason I would still caution against getting too aggressive on leveraged CEFs. Pick your spots carefully and don’t get over-extended because the pain might not be over yet.

Bottom-Line

PHK continues to disappoint by offering negative returns over time. At this juncture, I find it difficult to upgrade it. While the premium is smaller than it was in June, it is still a lofty price when alternative funds trade at discounts. Further, its past history and leverage headwind tell me to continue to be patient. While I see an argument for buying bonds here – both in absolution and in relation to equities – I believe better options than PHK are out there. Therefore, I will keep this fund on my radar but reaffirm “hold” at this time.

Read the full article here