Fisker (NYSE:FSR) reported weaker than expected financial results for the third quarter yesterday and the EV company has delayed filing its 10Q report after the company’s Chief Accounting Officer left the firm. According total Fisker’s preliminary earnings for Q3’23, the company reported a jump in revenues and a widening of losses related to its electric vehicle operations.

The electric vehicle company also revised its production outlook and expects to produce between 13,000 and 17,000 electric vehicles this year. Previously, Fisker submitted a guidance range of 20,000-23,000 EVs, meaning its guidance has been lowered by 30% at the mid-point. Despite the down-graded guidance for FY 2023, I believe that Fisker represents a long term investment opportunity for investors and with shares still trading near their 1-year low, the risk profile remains favorable!

Previous rating

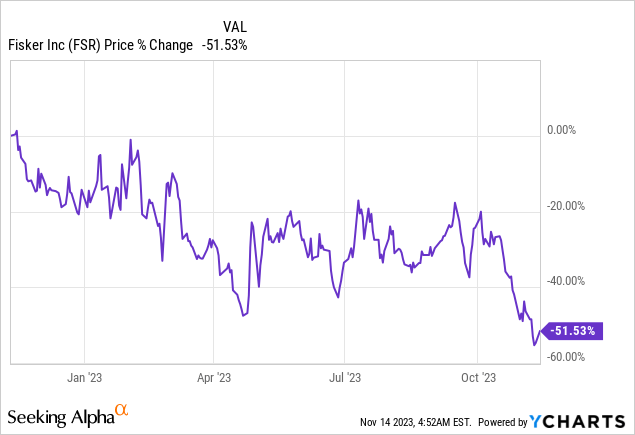

I upgraded Fisker to buy in September — Finally Going On The Offensive — largely because of the company’s push into a number of European countries where it was ramping up deliveries. While Fisker down-graded its production outlook again, the company is seeing a massive increase in revenues due to deliveries just beginning to ramp up and it recently successfully raised capital through the offering of convertible senior notes. I believe investors are overreacting to the earnings release — which caused shares to slump 14% — and I am up-grading FSR to strong buy.

Fisker misses estimates, delayed quarterly report, Q3’23 accomplishments

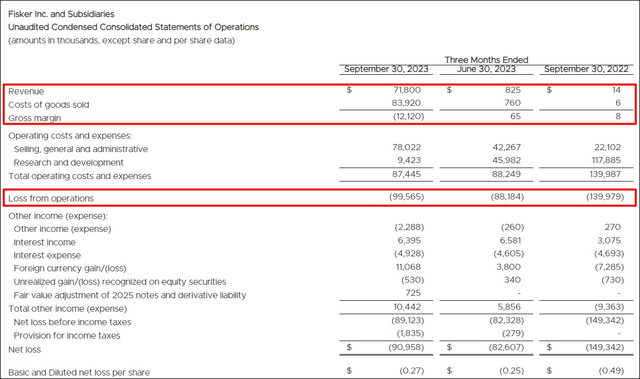

Fisker reported mixed results for its third-quarter. The electric vehicle startup reported adjusted earnings per share of $(0.27) per-share which missed the average prediction by $0.06 per-share. The top line came in at $71.8M, $63.9M below the consensus expectation.

Unfortunately, we don’t have the 10Q filing just yet (at the time writing) as the company’s Chief Accounting Officer departed the firm recently, causing a delay. However, the company’s preliminary results showed that the company is growing fast now that large-scale deliveries have begun: Fisker disclosed Q3’23 revenues of $71.8M compared to just $825k in the previous quarter. Due to the ramp in production, deliveries, and revenues, Fisker also saw a massive increase in its cost of goods sold, resulting in a negative gross margin of $12.1M. Fisker’s operating loss also widened, as expected, from $88.2M in Q2’23 to $99.6M in Q3’23. Going forward, investors should expect continual losses as the firm will remain unprofitable for at least a couple of more years.

Source: Fisker

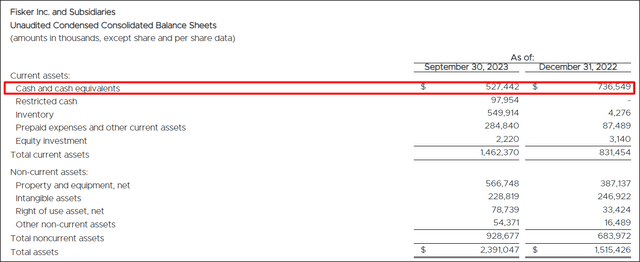

Negative operating cash flow, convertible notes offerings

Fisker managed to cover its liquidity needs chiefly through offerings of convertible notes in FY 2023. In October, Fisker raised another $170M in additional convertible notes by selling them to an investor at a discount of 12% and the EV company had $1.1M in convertible notes outstanding at the end of Q3’23.

In total, Fisker raised $450M in gross proceeds in the third-quarter to finance its cash burn that comes with the ramping up of production and deliveries. In the first nine months of the year, Fisker had negative operating cash flow of $520M, including $308M from the third-quarter, based off of preliminary disclosures. In other words, Fisker burned through more cash in the third-quarter than in the first six months of the year. The monthly average operating cash flow, January through September, was $(58)M and I believe, based off of Fisker’s available cash, the company should have enough resources to ensure a liquidity run-way until the end of next year. Fisker also had another $550M available through additional convertible notes sales. With production and deliveries just ramping up, investors should be prepared to see high negative operating cash flow at least for the next two to three years.

Given the demands for production growth and scale, I estimate that the electric vehicle company will consider issuing new senior convertible notes in FY 2024.

Source: Fisker

Guidance for FY 2023 production

Fisker is going to produce less Fisker Oceans this year than expected. The EV company lowered its FY 2023 production outlook from 20,000-23,000 to a new range of 13,000-17,000, implying a 30% guidance revision at the mid-point. It was not the first cut for Fisker this year as the company previously lowered its production target from 32,000-36,000 electric vehicles.

However, the guidance reduction should not cloud the company’s delivery achievements, especially most recently. According to Fisker’s disclosures for Q3’23, the electric vehicle start-up delivered 1,097 electric vehicles in the third-quarter to customers. In the second-quarter, Fisker just began making deliveries and delivered 11 EVs to customers. Since the end of the quarter, however, the EV company delivered 1,200 Fisker Oceans to customers which is 3X the delivery volume of Q3’23.

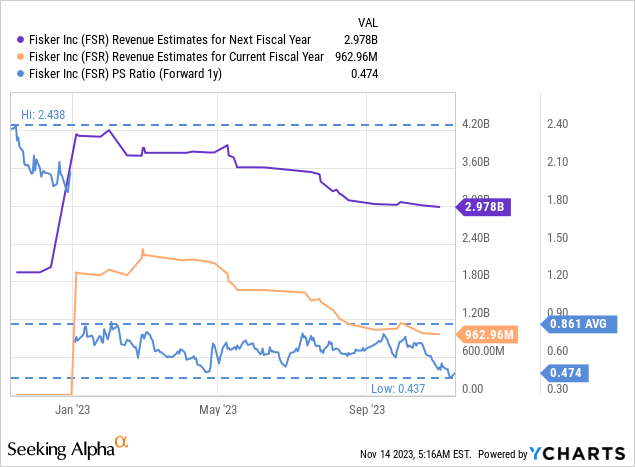

Fisker’s valuation

Fisker is a high-risk, high-reward play in the EV industry, largely because the company is relatively small and doesn’t have as much cash available as some of its EV rivals like Rivian Automotive (RIVN).

Nonetheless, Fisker is projected to grow its top line by 209% next year and generate revenues of around $3.0B. At the same time, the revenue potential has a low multiplier factor of 0.5X… which reflects Fisker’s higher than average risks and shorter liquidity runway. Most EV companies are valued based off of their expected future revenues and large EV firms like Tesla, Lucid Group (LCID) or Rivian are trading at much higher P/S ratios of 3-5X. The low revenue multiplier for Fisker is due to the company not having as strong a balance as its larger EV cousins, but also because the company reduced its production guidance for the third-time.

Given that shares of Fisker are trading about 45% below their 1-year average P/S ratio and that shares recently slumped to a new 1-year low, I believe investor sentiment has become too bearish. With a tripling of Fisker’s revenues expected for next year, Fisker has strong revaluation potential, in my opinion. Even if Fisker’s revenue multiplier only returned to its 1-year average P/S ratio, shares of the EV company would have considerable (82%) upside potential.

One of the best values for investors in the large-cap category of the EV market is represented by Rivian Automotive, in my opinion. I initiated a position in Rivian recently and covered Q3 earnings as well: Best Value In The Large-Cap EV Market.

Risks with Fisker

Fisker is a smaller EV start-up and can’t be compared to cashed up EV firms like Rivian, which I am aware of. Fisker has a much weaker balance sheet than either Rivian or Lucid Group which means that Fisker has less financial stability and greater production and timeline risks than its larger EV rivals. However, given the ability to raise additional cash and still impressive revenue outlook, I believe the risk profile, despite the short term headwinds, is favorable.

Final thoughts

Fisker’s delayed 10Qa and the departure of the Chief Accounting Officer was not good news, obviously. The electric vehicle company also didn’t perform as well as expected by analysts in Q3’23, as shown by the company missing earnings and top line expectations. Additionally, Fisker lowered its production target for FY 2023 (again) by 30%, at the mid-point.

Despite the lowered production target, however, I believe the October Fisker Ocean ramp is very promising and Fisker is still expected to ramp up revenues nicely in the near future. Shares of the EV start-up are currently widely out-of-favor, but the company’s demonstrated ability to raise cash and an attractive valuation based off of P/S, make Fisker a high-risk, but also a high-potential bet on the EV market!

Read the full article here