With inflation easing and cracks emerging in the US labor markets, the days of Fed-driven rate hike pressures are likely at an end. The key risk, though, is that the US yield curve remains inverted, and until term premia normalizes, emerging market central banks may be kept on the defensive. Note the surprise rate hike by Indonesia’s central bank to defend its currency – despite a well-controlled domestic inflation backdrop. The rest of emerging Asia is also experiencing similar currency pressures, and in the event they do implement defensive tightening measures (e.g., rate hikes or liquidity withdrawal) to stabilize their currencies, bonds could still underperform.

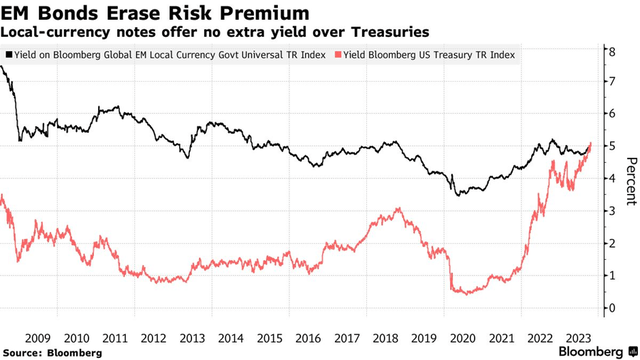

Also concerning is the surprisingly narrow emerging market (‘EM’) to US yield differentials, particularly at the long end. While there’s merit to a tighter spread, writing off US Treasuries as the ‘risk-free’ assets seems premature. EM investors could, thus, be vulnerable as a growing wave of new issues come onto the market and when the term premia returns to the Treasury yield curve, pushing EM yields higher in tandem.

Bloomberg

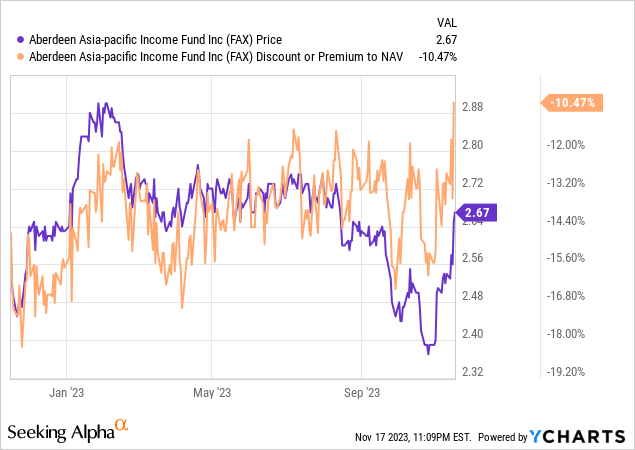

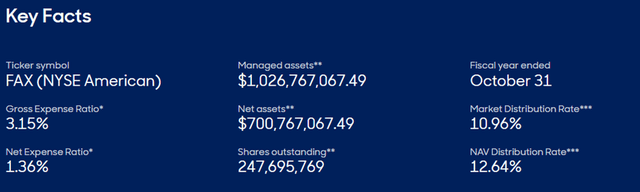

Still, the income benefits on offer in the high-yield emerging market/Asian bond universe are attractive, as evidenced by the emerging Asia-focused abrdn Asia-Pacific Income Fund’s (NYSE:FAX) sustained >10% distribution yield. The catch, however, is that FAX achieves this yield through a generous amount of leverage, which feeds through to not only higher volatility and downside risks but also in its expenses (2.6% net expense ratio, including debt costs). The current >10% NAV discount (in line with historical levels) seems fair for a pricey high-risk fund with a lackluster total return track record over the last decade.

Fund Overview – A Highly Levered, (Mostly) Emerging Asia Debt Fund

The abrdn Asia-Pacific Income Fund is an income-oriented closed-end fund primarily focused on the emerging Asia fixed income universe, though the manager has also ventured into developed Asia and, to a lesser extent, non-Asia emerging market bonds. The fund aims to outperform a blended benchmark comprising the following indices – J.P. Morgan Asia Credit Diversified Index (40%), Bloomberg Ausbond Composite Index (35%), iBoxx Asia Government USD Unhedged Index (15%), iBoxx Asia India Index (5%), and iBoxx Asia Indonesia Index (5%).

abrdn

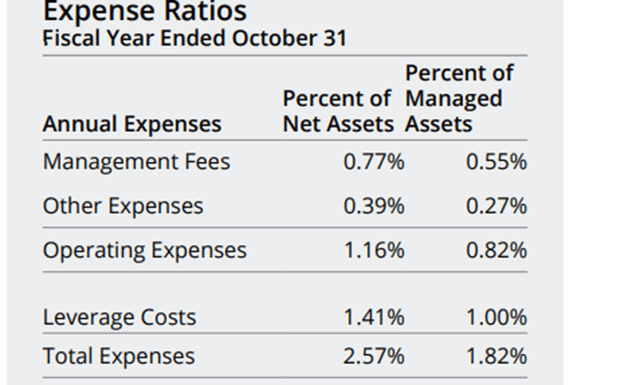

The key differentiator lies in FAX’s levered capital structure – the fund typically runs leverage levels below 33% of its total asset base, though it is permitted to run leverage even higher depending on circumstance. As of Q3, the fund managed $726m of net assets ($1.1bn gross assets, including borrowings) and charged a pricey 2.6% expense ratio on top.

Most of the expense is down to leverage costs (1.4%), though, as FAX has been able to issue debt at lower than market rates – specifically, the debt comes from $250m of A-rated senior secured notes at low fixed rates between 3.7% and 3.9%, a higher 5.7% on a ~$65m revolving credit line, as well as 4.1% on $50m of preferred shares. Depending on the terms FAX obtains when it returns to market or refinances (note ~$115m matures this year), expect some volatility around the leverage part of the expense ratio. The 77bps management fee portion, on the other hand, is competitive (by active manager standards), with the remaining 39bps going to other operating costs.

abrdn

There aren’t many comparable US-listed active funds to FAX, though comparable emerging market bond ETFs typically come with far lower expense ratios. For instance, the ~0.4% for unlevered dollar-denominated EM bond funds like the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) and the JPMorgan USD Emerging Markets Sovereign Bond ETF (JPMB)), with Vanguard’s Emerging Markets Government Bond ETF (VWOB) charging an industry low ~0.2%. These ETFs also deliver lower income and upside potential because they are unleveraged, so investors should carefully evaluate the kind of risk/reward they are comfortable with.

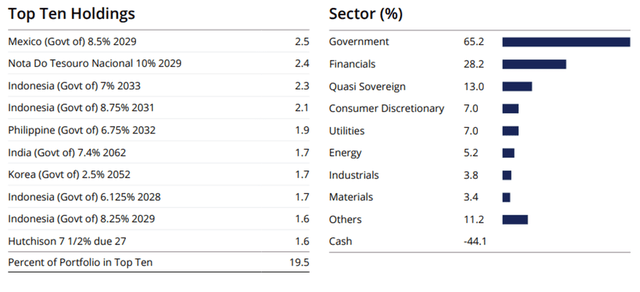

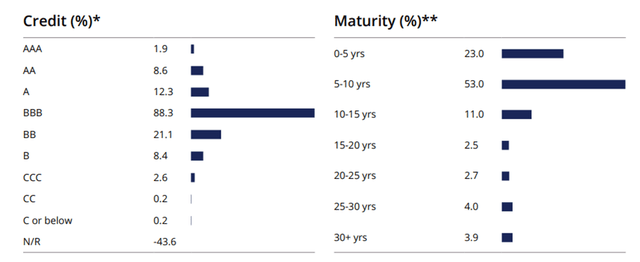

From a single-issue perspective, FAX maintains a fairly diversified emerging Asia-focused bond portfolio, with no single holding crossing the 3% threshold. The two largest holdings are notably non-Asian (Mexican and Brazilian government bonds yielding 8.5% and 10%, respectively), though the rest of the top-ten list is heavy on high-single-digit % yield emerging Asia debt. As the modified duration stands at 6.9 years (excluding interest rate swaps), the portfolio is skewed toward the longer end of the curve. More specifically, the five-to-ten-year segment is the focus at 53.0%, followed by <5-year (23.0%) and ten-to-fifteen-year maturities (11.0%).

abrdn

By virtue of its underlying leverage, the fund isn’t as well-diversified in other key metrics. For instance, the two biggest geographic exposures, India and Indonesia, contribute 51.1% of the portfolio. Including the rest of the top five geographies (China, Australia, and South Korea), this rises to 86.1%, so FAX’s performance is very closely tied to their fortunes. The credit quality breakdown is also extremely skewed toward BBB (i.e., borderline investment grade) at 88.3%, with BB (i.e., one notch below investment grade) contributing 21.1%.

abrdn

Fund Performance – Attractive >10% Yield but Mind the Risks

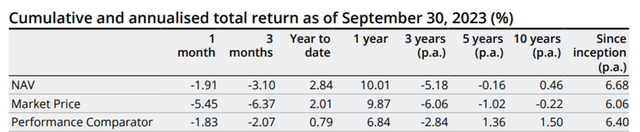

Against a rising rate backdrop, FAX has done well over the last year, posting a +2.8% YTD return and a +10.0% one-year return in NAV terms. This doesn’t change the fact, however, that the fund has not returned enough over the last decade to justify its high fees or its higher-risk, leveraged portfolio. Annualized total NAV returns over the last five and ten years stand at -0.2% and 0.5%, respectively, though the widening NAV discount means market price returns were consistently negative at -1.0% and -0.2%, respectively.

abrdn

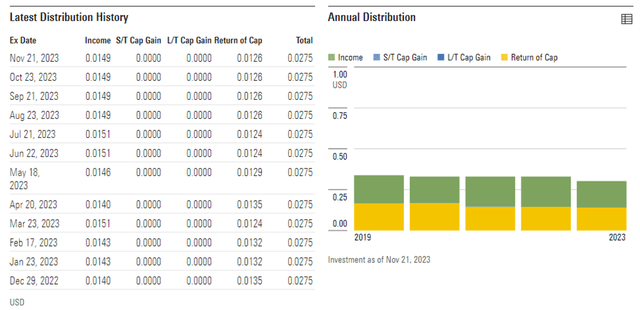

Where the fund shines is in its well-covered distribution (paid monthly), currently at 12.6% NAV (11.0% market) – well above the high-single-digit % yields of comparable emerging market ETFs. It’s worth noting, however, that the fund takes on a lot of leverage to achieve this yield and passes through its debt costs via a higher expense ratio. Additionally, there is a fairly significant return of capital component in the yield; the income portion of the yield is closer to the high-single-digits %, in line with lower-cost, unlevered EM ETFs. Given the risks associated with FAX’s levered portfolio, as well as the high expense ratio, the current >10% NAV discount is probably justified.

Morningstar

A Risky Play on Emerging Asian Bonds

Emerging market bonds have been surprisingly resilient this year relative to US Treasuries, driving a historically tight yield spread between both regions. To some extent, lower emerging market yields are warranted, given the comparative lack of inflation pressures and their stronger fiscal positions. That said, keeping rates low in the face of a strong US dollar remains a challenge, with recent defensive rate hikes (Indonesia) and tightening (India) being cases in point. And as longer duration US Treasuries regain their term premia, emerging market/Asian bond yields could still come under pressure, particularly at the long end.

In any case, there are probably better ways to gain exposure to emerging Asia bonds than the highly geared abrdn Asia-Pacific Income Fund’s (FAX) portfolio. Yes, the fund’s >10% headline distribution yield is attractive, but it comes with a lofty price tag (2.6% net expense ratio) that has also eaten into overall returns over the last decade. Also concerning is the leverage FAX uses to deliver its returns, leaving little downside protection should key components of its concentrated bond portfolio underperform. The >10% NAV discount helps but isn’t enough to skew the risk/reward favorably, in my view.

Read the full article here