Back in April, I placed a “Buy” rating on Philip Morris International (NYSE:PM), saying it had huge opportunity in front of it as it started to derive more and more revenue from higher margin smoke-free products. I followed that up in July saying the growth story was just beginning. However, the stock has underperformed since then. Let’s take a close look at the name.

Company Profile

As a quick reminder, PM is an international tobacco company that sells cigarettes in approximately 175 markets outside the U.S. It owns a variety of brands, but Marlboro is its largest, representing nearly 40% of its cigarette volumes last year.

The company is allowed to sell some of its smoke-free brands in the U.S. and will be allowed to sell its IQOS heat-not-burn products in the U.S. starting in April. Its other big smoke-free brand is ZYN, which is a nicotine pouch.

Q3 Results

Looking a PM’s Q3 results, the company saw revenue rise 13.8% to $9.14 billion. That just missed the consensus by $80 million. Organic growth rose 9.3%. Excluding just currency, revenue rose 16.4%.

Combustible tobacco revenue grew 4.3%, or 6.2% on an organic basis. A 9% increase in pricing drove the results. Smoke-free product revenue soared 35.6%, and was up 16.5% on an organic basis.

Total cigarette and HTU shipment volumes rose 2.2% to 193.6 billion units. HTU shipment volumes climbed 18% to 32.5 billion units, while cigarette volumes declined -0.5%. Marlboro volumes declined -1.6% to 63.0 billion units, due mostly to declines in the Philippines.

The company saw its international – excluding the U.S. and China – market share rise for cigarettes and HTUs by 90 basis points to 28.9%. Cigarette market share climbed 60 basis points.

In Europe, the company saw cigarette volumes decline by -4.3% to 43.4 billion units, while HTU volumes climbed 12.6% to nearly 13.2 billion. Revenue rose 12.2%, or 6.1% excluding FX and acquisitions, to $3.7 billion, while adjusted operating income rose 17.5% to $1.8 billion.

Its SSEA, CIS & MEA region saw cigarette volumes rise by 3.4% to 89.4 billion units, while HTU volumes increased 4.4% to nearly 6.1 billion. Revenue fell -1.6%, or was up 12.6% excluding FX and acquisitions, to $2.8 billion, while adjusted operating income fell -26.3% to $850 million.

Its EA, AU AND PMI DF region saw cigarette volumes fall by -4.1% to 12.9 billion units, while HTU volumes increased 32.7% to 13.1 billion. Revenue jumped 11.7%, or 15.3% excluding FX and acquisitions, to $1.6 billion, while adjusted operating income climbed 34.9% to $781 million.

In the Americas, the company saw cigarette volumes decline by -7.3% to 15.4 billion units, while HTU volumes rose 3.2% to nearly 129 million. Revenue edged up 0.9%, or was down -7.2% excluding FX and acquisitions, to $478 million, while adjusted operating income plunged -85.7% to $14 million.

Discussing the HTU market on its Q3 earnings call, CFO Emmanuel Babeau said:

“In the EU, the majority of member states have transposed a delegated directive withdrawing the heated tobacco product exemption from the characterizing flavor ban international law. The ban in those markets will be effective as of October 23 and the remaining markets are expected to adopt in 2024. As previously mentioned, we are adjusting our HTU portfolio as required in line with this transposition and while short-term volatility is possible, including in year-end trend inventories, we do not expect significant change in the structural growth of the category. In Japan, IQOS ILUMA celebrated its second anniversary of the national launch in September and continues to exhibit strong growth due to excellent conversion, consumer satisfaction and retention rates. Adjusted total tobacco share for our HTU brands increased by plus 3 points in Q3 year-over-year to 26.6%. Importantly, adjusted in-market sales volume again grew sequentially on a 4-quarter moving average, reaching over 10 billion units for the first time in Q3 ’23 as IQOS outgrew the heat-not-burn category. In addition to this excellent consumer trend, our Q3 shipment to Japan also benefited from further switching back to sea freight during the quarter. This shift is now substantially progressed, and we expect a more normalized rate of HTU shipments in Q4.”

Oral product shipment volumes doubled to 209 million cans, and were up 19.4% when including Swedish Match in both periods. Swedish Match’s total oral product shipment volume jumped by 20.5%. ZYN nicotine pouch volumes in the U.S. soared 65.7% to 105.4 million cans, up from 63.6 million cans a year ago.

Gross margins increased by about 200 basis points to 65.4%.

Adjusted EPS rose 20.3% to $1.67, topping analyst estimates by 5 cents.

Looking ahead, PM forecast full-year organic revenue to grow by about 8%, compared to prior guidance of 7.5-8.5%. It is projecting adjusted EPS of $6.58-6.61, representing 10.0-10.5% growth. That’s up from the guidance it provided in July, which called for adjusted EPS of between, $6.46-6.55, representing 8.0-9.5% growth

It’s expecting cigarette and HTU shipment growth of 1.0-1.5% versus up to 1% previously. It is looking for cigarette volumes to decline by -1.0% to -2.0% compared to a prior outlook of -1.5% to -2.5%. It is expecting HTU volumes at the low end of its previous 125-to-130-billion-unit range due to a delayed launch in Taiwan, the Russia-Ukraine war, and a flavor ban in the EU. It forecast nicotine pouch shipment volume of 390-410 million cans, up from 370-400 million cans previously.

Discussing future growth on its call, Babeau said:

“The U.S. represents the most significant opportunity to drive accelerated smoke-free growth at both the top and bottom line. We are continuing to invest behind ZYN and readying our organizational and commercial capabilities for the launch of IQOS in Q2 2024 and a scaled up rollout with ILUMA once authorized. We remain on track to file for IQOS ILUMA’s PMTA and MRTPA this month. The international expansion of nicotine pouches remain a key mid- to long-term focus notably for ZYN as the world’s leading brand. During the third quarter, we relaunched ZYN in Switzerland and following positive regulatory developments, rolled out ZYN in Finland.”

In my original article, I said that PM’s biggest opportunity was its continued move into smoke-free products, as they have higher prices per unit and more robust margins. That showed up nicely in Q3, as volume increases with ZYN and HTUs helped power results, despite a slight decline in cigarette volumes. The company also showed off its pricing power in the quarter, with a 9% price increase having a pretty minimal impact on overall cigarette volumes. The company is also trying to transition smokers to IQOS, which impacts cigarette volumes, but which helps revenue and margins. The margin improvement in the quarter showed some of the progress the company is making on this front as well.

Moving forward, the continued expansion of ZYN in the U.S. and international markets remains one of PM’s biggest opportunities. The launch of IQOS in the U.S. is another big potential driver, and since it does not sell cigarettes in the U.S., any new U.S. users would be all gains. However, breaking into a market where vaping has become popular could be difficult as well. The flavor ban in Europe, meanwhile, could have some initial adverse effect on its HTU momentum there are well. That said, I think the opportunity with IQOS outweighs the potential risks.

Valuation

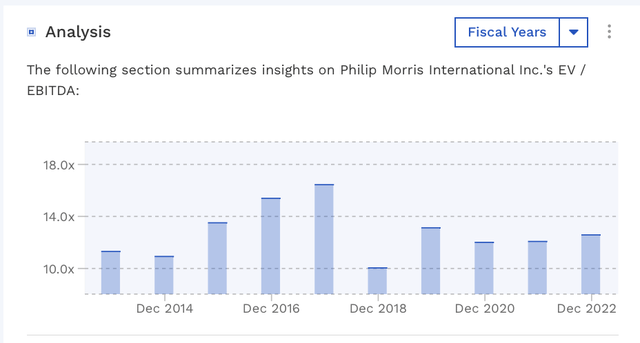

PM’s stock currently trades around 13.1x the 2023 consensus adjusted EBITDA of $14.0 billion and 11.6x the 2024 consensus of $15.8 billion.

It trades at a forward PE of 15x the 2023 consensus of $6.11 and 14.1x the 2024 consensus of $6.50.

It’s projected to grow revenue by 10.5% this year, helped by the Swedish Match acquisition, and 4.6% in 2024.

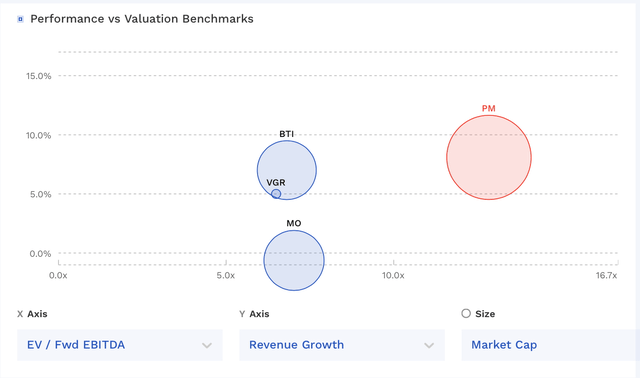

The stock trades at a premium to its tobacco peers, although it is expected to grow a bit faster than most of them. The company also isn’t exposed to the more difficult regulatory and less growth market of the U.S. for cigarettes, which is a positive.

PM Valuation Vs Peers (FinBox)

Historically, the company has largely traded between 12-16x EBITDA the past several years. I think a 13.5x multiple is appropriate given its growth opportunities, which would be a $110 price target. The company also pays a dividend of $5.20, good for a yield of about 5.7%.

PM Historical Valuation (FInBox)

Conclusion

PM offers the unique combination of defense, expanding margins, and growth from a large cap consumer staples stock. With its cigarette sales all outside the U.S., it also doesn’t have to deal with the tougher U.S. market, both from a declining consumer and regulatory standpoint. Now it will enter the U.S. market with its heat to burn product IQOS next year. That adds some risk, but any smokers or vape users it converts, will all be new users to the company. Meanwhile, ZYN has been a strong growth driver, and it should have plenty of expansion opportunities moving forward.

All in all, I continue to find PM attractively valued given its growth and defensive characteristics, and rate the stock a “Buy.”

Read the full article here