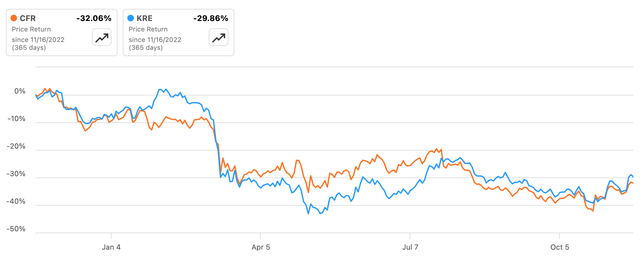

It has been a tough year so far for Cullen/Frost (CFR), the holding company of Texas-based Frost Bank. Shares of the firm have fallen around 30% with dividends year-to-date, roughly matching the struggles of the broader regional bank industry.

Source: Seeking Alpha

Putting recent industry turbulence to one side for a moment, there is a lot to like about this bank. For one, it operates a very strong core deposit franchise, and with its focus on higher yielding commercial lending comes healthy net interest margins. Non-interest-bearing (“NIB”) demand balances funded around 30% of its asset base as of Q3, with the bank paying just 38bps on a further $10 billion or so in interest-bearing demand and savings accounts. Cumulative deposit beta was still sub-40% in Q3, which is solid notwithstanding the bank having to pass on much more of the Fed’s rate hikes in recent quarters.

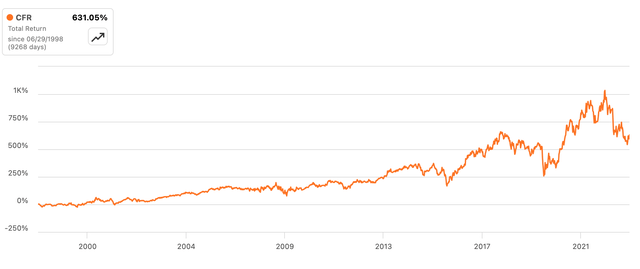

Of course, what really matters in banking are risk-adjusted margins rather than just headline NIM, but Cullen/Frost’s history suggests that its underwriting standards are comfortably above average too. As an exclusively Texas-based bank, it has no doubt seen its fair share of economic volatility, yet the stock has always come through to hit fresh highs.

Source: Seeking Alpha

This year has been tough for the industry. Higher funding costs have hit margins and have led to significantly lower than expected earnings. Cullen/Frost is no exception, but the situation is now showing signs of stabilizing. Non-interest-bearing deposit balances fell less than 2% sequentially in Q3, a large improvement on the 7% and 9% sequential declines registered in Q2 and Q1 respectively. Total deposit balances also returned to growth, advancing around 0.7% on an end-of-period basis. While that was led by interest-bearing balances, alongside mix-shift to more expensive Time accounts, the 22bps sequential rise in its annualized cost of interest-bearing funds was again lower than Q2 (32bps) and Q1 (42bps). With NIB balances also stabilizing, overall funding cost pressure should ease, especially now that the Fed appears to be done hiking.

Cullen/Frost has a large slug of floating rate loans and cash, so it has also seen upward repricing on the asset side of the equation too. Furthermore, I would note that the bank is still laying on meaningful loan growth at this point. Period-end total loans clocked in at $18.4 billion, up around $650 million, or circa 3.7%, sequentially. Those loans are obviously being added at nice yields right now given the effective Fed funds rate is over 5.3%, and this is helping in terms of net interest margin (“NIM”) and net interest income (“NII”). NIM was only down 1bps sequentially in Q3, while NII was virtually flat at $407 million on a fully taxable-equivalent basis. With NIB balances stabilizing and upward cost pressure easing, I think there’s a good chance that we have seen the bottom in NII.

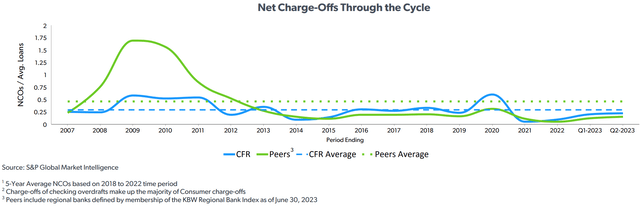

Asset quality remains excellent. Non-accrual loans dipped 1bps sequentially to 37bps, with total past due loans also falling on a sequential basis. Net charge-offs landed at just 11bps. In terms of key areas of market concern, roughly 20% of the loan book (~1.7x tangible common equity) is in non-owner occupied commercial real estate, with a further 8% of the book (~0.65x TCE) in construction loans. Pleasingly, non-accrual CRE and construction loans actually fell sequentially in Q3 to circa 26bps of those total loans.

Investor office was about 5% of the book (~0.40x TCE) as of Q3. Now, investor office is probably the number one area of concern in the market at the moment. While office occupancy rates are down quite heavily in key markets like Austin and Dallas, that does not necessarily translate into a corresponding cash flow issue for owners as rents would have been set contractually. Furthermore, most of Frost’s investor office loan maturities appear to fall beyond 2026, limiting the risks from refinancing/selling in a tough market. An average loan-to-value ratio on the office portfolio of around 50% provides a further cushion. With the bank typically landing better than peers in terms of underwriting history, it’s not something I am especially worried about right now.

Source: Cullen/Frost Investor Presentation

Where the bank has been ‘struggling’ is on expenses. Operating expenses were up around 14% year-on-year in Q3, while for the nine-month period they were up around 16%. This is obviously constraining pre-provision income growth, especially in light of the aforementioned headwinds to NII. Struggling is not quite the right word hence the quote marks, as Frost is expanding into markets like Austin and Dallas which is partly why expense growth is high. This will serve the bank well in the long run but has perhaps taken on a little bit more salience this year due to the income headwinds the industry has faced.

Given that, I do think Frost has well above average growth prospects. It has the number one deposit share in its home market of San Antonio, but its position falls to the 4-6 range in big markets like Dallas/Fort Worth, Austin and Houston. Expansion efforts in these markets can support nice long-term growth well ahead of local GDP.

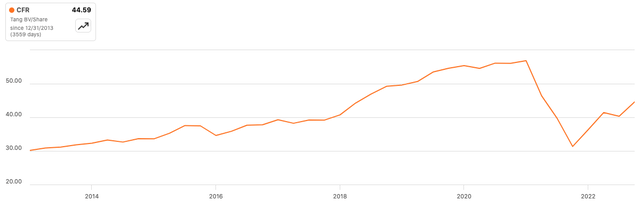

Source: Seeking Alpha

Cullen/Frost was previously growing tangible book value per share (“TBVPS”) at high single-digit annualized clip. It has taken a large dip due to the buildup of losses in its AOCI line, which is linked to unrealized losses in its portfolio of AFS investment securities. This has been a hot topic over the last few quarters but for various reasons (e.g. the nature of its deposit base, liquidity levels and so on) it isn’t a major concern here. Given the passage of time it would also correct itself all else equal. Alongside the bank’s expansion plans and underlying growth prospects, I see that driving solid double-digit annualized TBVPS growth in the coming years. I don’t think its took over the top to pay a premium 1.9x ex-AOCI TBVPS multiple for that given Cullen/Frost’s profitability. That would make the stock around 15-20% undervalued at the current $99 quote, and I’d be a buyer up to around the $110 per share mark.

Read the full article here