Digital Turbine’s (NASDAQ:APPS) Q2 FY2024 results were weak, with revenues and margins continuing to decline YoY. Most of this was expected but there appears to be issues within the AGP business that go beyond the company abandoning some activities. While this is obviously negative, I believe that Digital Turbine’s future will be largely dependent on the wider rollout and improved monetization of SingleTap and Hubs. In addition, Digital Turbine has a low valuation based on its ability to generate free cash flow, which should eventually support the stock, particularly if/when revenues and margins stabilize. Digital Turbine remains a speculative investment opportunity though. I previously pointed towards Digital Turbine’s low valuation and SingleTap’s potential and the stock is down over 40% since then.

Market

Macro conditions have reportedly stabilized and yet Digital Turbine has given conservative guidance based on macro and geopolitical uncertainty. Digital advertising companies generally reported accelerating growth in the third quarter of 2023 and Digital Turbine is lagging in this regard. This needs to be weighed against The Trade Desk’s (TTD) soft guidance and commentary around demand weakness in October.

Digital Turbine’s results also need to be viewed in light of its dependence on device sales, and the fact that it is moving away from some business activities. Soft device sales in the US continues to impact Digital Turbine and this weakness is expected to continue into 2024. Weak device sales are impacting the ODS business, although this is being somewhat offset by higher revenue per device. While device sales should eventually stabilize, allowing the ODS business to return to growth, the larger question for Digital Turbine is whether it can expand its OEM/carrier partnerships and maintain existing relationships. This appears to be a focus area for the company at the moment, particularly in international markets. For example, Digital Turbine has a partnership with Xiaomi that is focused on growth in Europe, the Middle East, Africa and Asia Pacific. The company is also adding new operators in Latin America and has a robust pipeline.

Competition is likely to increase in this area due in large part to AppLovin’s (APP) Array business. AppLovin is going from strength to strength at the moment which it is attributing to its AXON recommendation engine. The company’s traditional focus has been areas like in-app advertising, but it is now hoping to leverage AXON in areas like CTV and on-device marketing.

The ongoing inability of Digital Turbine to bring Chinese demand to its US supply is also a headwind. This is a potentially significant issue as US demand contributes less than 20% of revenues on Digital Turbine’s US supply. Digital Turbine has stated that it expects to see some progress on this front in the current quarter, but this is not baked into current guidance.

Digital Turbine

Digital Turbine plans on completing the consolidation of multiple exchanges in 2023, which is expected to improve efficiency and support new products, like SDK bidding. SDK bidding allows third-party buyers to purchase mobile app inventory and to render creatives using an SDK owned by the buyer. SDK bidding could help Digital Turbine capture more ad dollars from companies like The Trade Desk, Google (GOOG) and Amazon (AMZN). As part of the consolidation process, Digital Turbine has chosen not to migrate some smaller publishers to the DT exchange, which is creating a revenue headwind.

Digital Turbine has also beta launched its new DSP, DT Direct, which is expected to improve ROAS for customers and Digital Turbine’s margins. DT Direct will allow Digital Turbine to better leverage SingleTap, its first-party data, and machine learning at scale. Digital Turbine has suggested that this will be a growth driver in 2024, but this remains unclear at this stage.

Longer term, Digital Turbine’s app distribution products have significant potential, but this part of this business is still immature. Digital Turbine is progressing SingleTap with multiple social media companies. A number of publishers also supposedly want to use SingleTap to distribute alternative builds of their applications. Digital Turbine already has a SingleTap fixed fee licensing deal with Amazon to distribute alternative versions of Amazon apps. Digital Turbine has stated that this deal is worth low seven figures a year. The next step would be to expand the relationship to third-party applications which Digital Turbine has suggested would have different monetization.

Digital Turbine has also launched its first alternative app distribution products with five operators in the US and feedback has reportedly been positive. This is already generating revenue, which raises questions about the potential size of the business. Digital Turbine has stated that revenue is not yet material to overall results, but in-app purchase revenues and incremental cost per install revenues are higher. Digital Turbine expects to be across tens of millions of devices by the end of this calendar year, suggesting that it is still early days for this business.

The Digital Markets Act in the EU will become effective in March 2024 and should support the growth of Digital Turbine’s app distribution business. The Digital Markets Act will allow companies to distribute their own version of applications to users. Digital Turbine can support this with its Hub product or by white labelling.

Digital Turbine recently expanded its partnership with Flexion, the market leader in porting applications to an alternative version. Flexion works with a range of alternative app stores, like the Samsung Galaxy store, Amazon app store, Xiaomi Get Apps, Huawei’s app gallery and Aptoide.

Financial Analysis

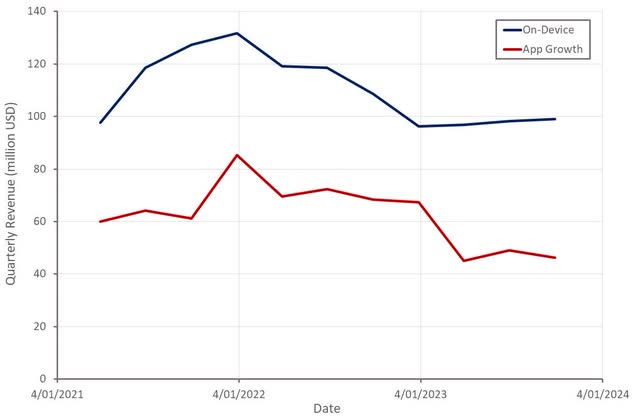

Digital Turbine’s revenue declined 18% YoY in Q2 FY2024 to 143.3 million USD. ODS revenue was down 9% YoY due to lower device volumes, which was somewhat offset by improved revenue per device in the US. Over the past five years, RPD has increased from slightly over 2 USD in 2020 to 6 USD now, with two of Digital Turbine’s postpaid carriers in the US at almost 10 USD per device.

Digital Turbine has seen a contraction in both content media and application media revenue, some of which was due to the end of a carrier partnership. The YoY impact of this change is expected to be finished within the December quarter. Digital Turbine believes that the content media business bottomed in the June quarter.

Application Media represents the portion of the ODS business platform that delivers apps to end users through partnerships with wireless carriers and OEMs. Content Media represents the portion of the ODS business platform that presents news, weather, sports, and other content directly within the native device experience.

AGP Revenue decreased 32% YoY in the second quarter, with this contraction driven by weaker digital advertising demand, consolidation and Digital Turbine exiting certain legacy business lines. Pricing is reportedly improving though, with Digital Turbine’s brand business growing nearly 10% sequentially on the back of a 25% increase in eCPMs.

Figure 1: Digital Turbine Revenue by Segment (source: Created by author using data from Digital Turbine)

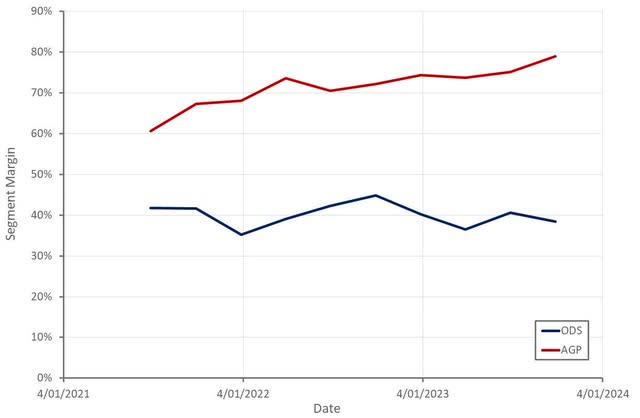

Fluctuations in Digital Turbine’s gross profit margins are primarily being driven by changes in revenue mix, as some revenue is reported on a net basis, and some reported on a gross basis. Digital Turbine expects gross profit margins to expand over the long-term though.

Figure 2: Digital Turbine Segment Margin (source: Created by author using data from Digital Turbine)

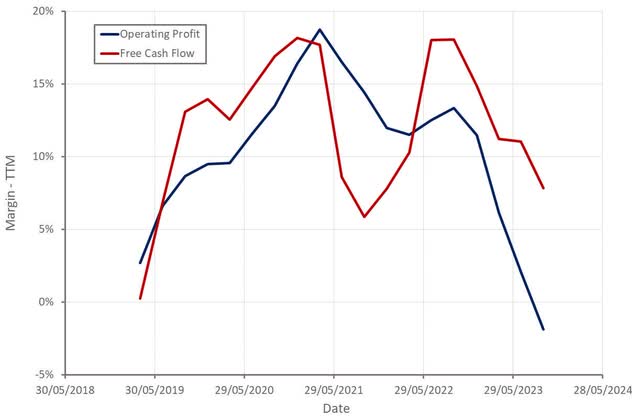

Operating profit margins have been under pressure due in large part to declining revenues. Digital Turbine is working to cut expenses but some of these efforts are currently contributing to costs. Digital Turbine began a digital transformation project in 2023 that is expected to drive cost efficiencies in the long run but is adding to expenses during the implementation phase. This project includes the adoption of a cloud-based ERP system and the consolidation of existing ancillary systems. The first deployment phase is expected to be completed in the third quarter of FY2024. Costs are expected to be incurred through early FY2026. This was roughly a 1.8% headwind to operating profit margins in the third quarter of 2023. Digital Turbine has also been incurring modest severance and acquisition-related costs. The second quarter included a 147 million USD non-cash goodwill impairment charge for the AGP business.

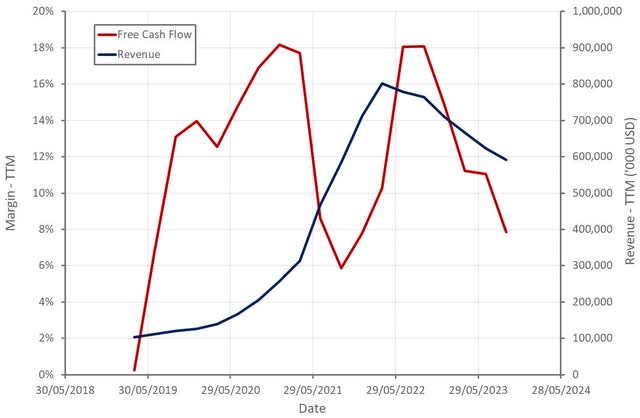

Figure 3: Digital Turbine Free Cash Flow (source: Created by author using data from Digital Turbine)

Much of the recent decline in profitability has been the result of non-cash expenses, with cash flows holding up much better than operating profits in recent quarters.

Figure 4: Digital Turbine Operating Profit Margin (source: Created by author using data from Digital Turbine)

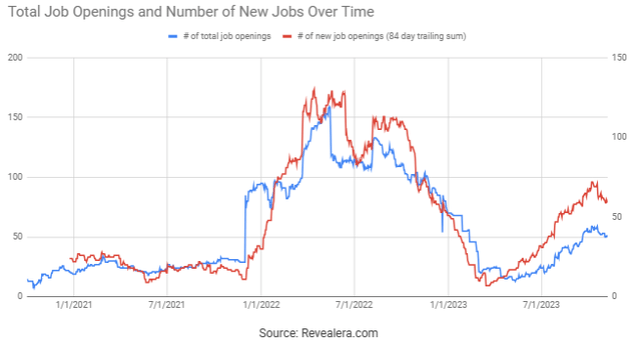

New growth initiatives are also adding to operating expenses at the moment, with job openings up significantly despite revenue weakness.

Figure 5: Digital Turbine Job Openings (source: Revealera.com)

Valuation

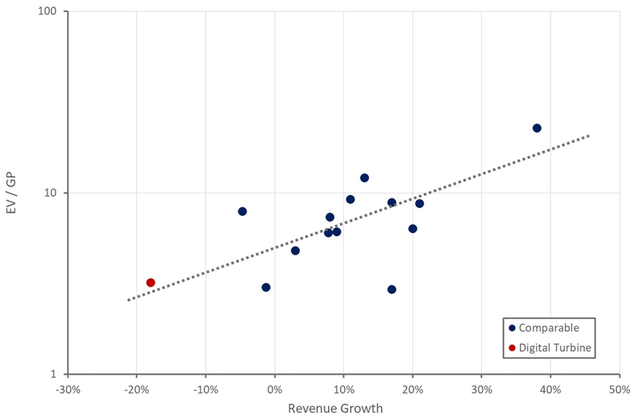

Digital Turbine’s valuation is currently depressed, which is largely a function of its declining revenues and deteriorating margins. The company is still working through issues related to its product portfolio, and this will take time to resolve. An improved balance sheet, along with a stabilization of revenue and margins over the next 12 months should provide support to the stock price. The alternative app distribution business could be a catalyst in 2024, although there is still significant uncertainty around this.

Figure 6: Digital Turbine Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here