We think the time to take advantage of high rates in the fixed income markets is running out

Brian Dress, CFA — Director of Research, Investment Advisor

Last month we (somewhat) gently made the case that opportunities in the bond market for high quality corporate securities is very attractive. This month, we are going to discuss the same subject. Why? Because the interest rate picture is finally beginning to change!

We saw a crucial data point this week suggesting that inflation is starting to look more benign. Inflation has been the main driver of weakness in both the stock and bond markets over the past two years, driving interest rates ever higher and causing both investor and consumer sentiment to remain quite negative. Rising interest rates have created an environment where income investors have been able to lock in generous rates of return in the bond market over the past 18 months, far in excess of the yields that were on offer in the two decades previous. We have written numerous pieces in this space over the last year suggesting that investors look to the corporate bond market for the rare opportunity to realize near-equity like returns, coupled with the relatively lower volatility of bonds.

Let me put that in the simplest language possible – with interest rates now showing signs of falling, the window of opportunity for locking in these generous rates of return is beginning to close. In today’s piece, we will look back to the two securities we mentioned in last month’s article to show you just how much things have changed in just the three weeks since we last shared our thoughts with you. We will also show you one more security that we think looks attractive, given current market conditions.

Though we won’t cover this phenomenon in depth here today, we note also the relative strength of the stock market, as well, in the face of falling interest rates. Since we wrote our last piece on October 27, the S&P 500 has gained nearly 10% in value. In our view, we may have seen peak pessimism in late October and sentiment clearly has changed, in anticipation of a potential “Santa Claus rally” moving toward the end of 2023.

Couple the move in interest rates with a relatively strong 3rd quarter earnings season, you can see that the ingredients for a potential rally, both in stocks and in bonds, are in place.

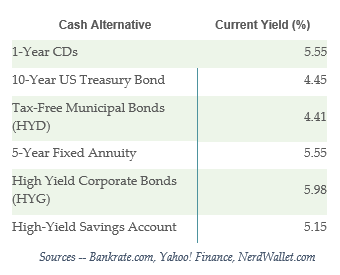

We know that investors have been seeking shelter in short-term cash alternatives which are paying much higher rates of return than at any time in the last 20 years. The question we have been asking these investors over the past year is “what is your plan for when rates begin to fall?” Granted, in the face of falling stock and bond markets, 5% in a 1-year CD seemed pretty enticing. However, an entire class of investors is getting ready to learn the definition of reinvestment risk – this is the risk that when an investment matures, there is not an equivalent investment to replace the return that the original investment, such as a CD, previously offered.

Bankrate.com, Yahoo! Finance, NerdWallet.com

The best way to avoid reinvestment risk is to find investments with maturity dates 5, 10, 15, 20 (or more) years in the future that offer high rates of return. In the context of interest rates that are beginning to fall, we are going to urge the investors out there to seek long-term securities with high rates of return before the window of opportunity closes. This week’s events suggest that we are close to that moment where the chance to lock in generous rates of return in high quality fixed income securities will be gone.

With that all being said, let’s get into it!

Rates Are Falling (and Fast)

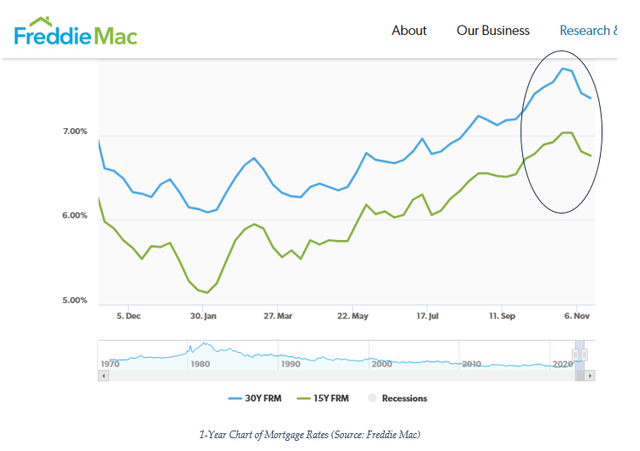

The first thing I noticed when I put together the infographic above is the significant change in the 10-year US Treasury interest rate. The 10-year Treasury is the interest rate upon which most other rates of interest are calculated, whether it be mortgage rates, bond rates, or savings account rates. In just 21 days, we have seen the 10-year Treasury rate fall from 4.85% to 4.45%. We have seen fixed annuity rates fall by 0.35% in just the past week! Mortgage rates have also fallen significantly in the last three weeks, as you can plainly see in the chart below:

Freddie Mac

As interest rates fall, the price of fixed instruments, like bonds, rise. That means that buyers of bonds are looking at higher prices than they were seeing just three weeks ago. I personally have experienced this phenomenon as I purchased bonds for clients over the last week. The opportunities we highlighted for you just three weeks ago are simply not as attractive as they were before. We think this is the beginning of a trend – with inflation now more in check, market participants seem to think the Federal Reserve is unlikely to continue raising interest rates. This means that the prices of bonds may increase, going forward, lowering the available annual yields associated with those securities.

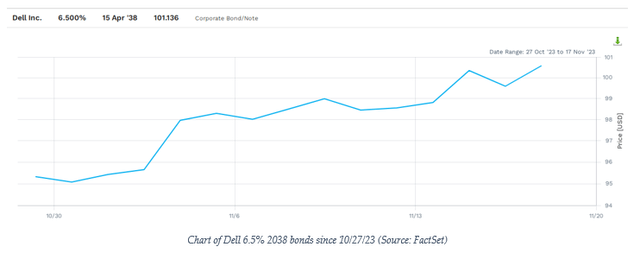

In order to illustrate the example for you, I wanted to take a quick look at the two bonds we covered for you in the October piece. In October, we highlighted two investment grade corporate bonds for you that were yielding in excess of 7% at that time – Dell 2038 bonds and Boeing 2042 bonds.

Spoiler alert, the rates available on these two bonds have fallen significantly and their prices have increased substantially since we last gave you our thoughts.

Take a look, first, at the Dell 6.5% 2038 bond we highlighted. In the three weeks since we showed you that bond, it has rallied in price from 95 to 101, nearly a 7% gain in price. Additionally, the implied yield of the bond for those purchasing it has fallen from 7.02% to 6.44% in just three weeks! This type of price behavior indicates to us that investors are sensing the window of opportunity closing in high-quality securities like this and are aggressively adding them to their portfolios.

FactSet

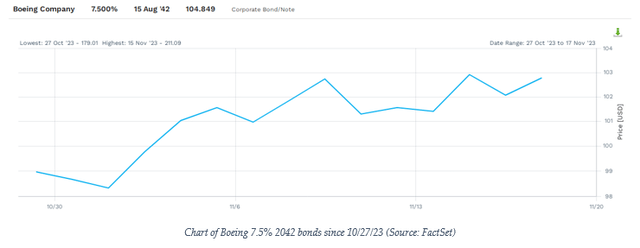

You can see a similar move in the other bond we highlighted last month, the Boeing 7.5% 2042 bond:

FactSet

We see another roughly 5% move higher in the Boeing 2042 bonds, from 99 to nearly 105 in the bond’s price, again in just three weeks. The implied yield here has fallen from 7.60% to just a shade over 7% at current prices.

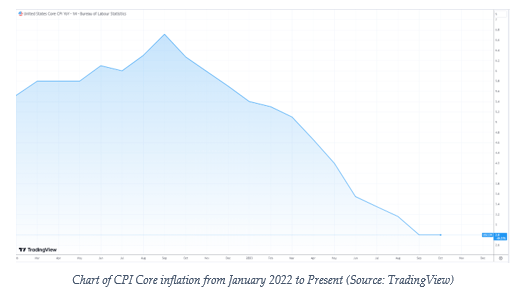

Again, as someone who buys bonds on a regular basis for clients, I have seen a marked shift in the prices and yields available in just a three-week period. Could inflation reaccelerate and change the picture for interest rates in the short term? Maybe, but the trajectory of inflation is clear and has been on the decline for some time now. We apologize if the chart is tough to read, but core CPI inflation peaked at 6.7% in September 2022 and has declined almost without exception since, with the most recent reading coming in at 2.8% Year-over-year inflation, just above the Federal Reserve’s stated target of 2%. We try not to forecast macroeconomic figures at Left Brain, but simply looking at the data gives us the impression that inflation is on the wane and, therefore, interest rates could continue to drop in the near to medium term.

All this is to suggest to you our view – the window of opportunity for locking in high-quality securities like the Dell and Boeing bonds is closing quickly. We think you have limited time to get these types of securities into your portfolio at attractive prices.

TradingView

One More Idea for Those Ready to Lock in High Rates

At Left Brain and in the Jarvis letter, we pride ourselves on giving readers actionable ideas that they can execute themselves. Whether you work with an advisor or manage your own account and whether you are aggressive, moderate, or conservative in your investments, we think you should consider whether there is a place in your portfolio for high quality bonds with high fixed rates of return. After all, we think this is the type of opportunity we may not see again for some time until the next interest rate hiking cycle comes around.

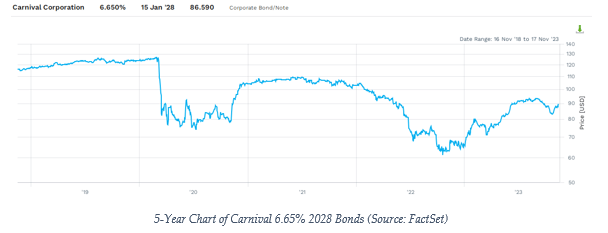

One company whose bonds we find attractive at this time is Carnival Corporation (CCL). Carnival is one of the world’s largest cruise operators, which fell on hard times during the pandemic and was forced to lean on debt financing to keep the business afloat (pun intended). Due to the company’s large indebtedness and reduced revenue between 2020 and 2022, the company’s bonds received downgrades and their prices fell substantially. This company had investment grade bonds pre-Covid.

The company is on the rise and sales have eclipsed pre-Covid levels each of the last two quarters. We feel confident in the company’s ability to service its debts. In fact, over the last two quarters, Carnival has reduced its debt by more than $3 billion to $30.7 billion.

We see an excellent opportunity in Carnival’s 6.65% 2028 bonds, which yield roughly 9.8% annually at current prices. As you can see below, there has already been a significant rally in this security:

FactSet

These bonds still carry a high-yield rating of ‘B-‘, despite the considerable improvement both in business results and in the company’s fiscal situation. We think there is a strong chance that Carnival bonds could receive upgrades from the ratings agencies in the near future, as business trajectories continue to improve.

Again, we are aggressively seeking opportunities for clients to lock in high fixed rates of return like that on offer from Carnival 2028 bonds. We like the chance to secure nearly 10% in annual yield for the next five years. For purposes of giving you a balanced presentation: your major risk in a security like Carnival bonds is that the company goes bankrupt, otherwise known as a default. So long as Carnival remains in business, they are contractually obligated to pay investors the agreed upon interest income, as well as the investment principal on the maturity date in January 2028.

Takeaways

We have spoken throughout 2023 about historically attractive opportunities in the corporate bond market. All the while, we have noted our belief that the window of opportunity to take advantage of high interest rates would be limited. Interest rates have remained persistently high over the past 18 months. However, since inflation seems to be on a downward trajectory, investors appear to be making the bet that the trend of high interest rates is likely to end soon.

In our view, we have finally reached that moment where interest rates could begin falling. Should that thesis play out, we think both bonds and stocks could be poised for strong performance in the coming 1-3 years. Especially as relates to opportunities in the bond market, we think the window of opportunity to lock in attractive rates of return for 5, 10, 15, 20 (or more) years could be closing.

We want to convey to our readers, clients, and friends, that we think there is an urgency to put cash and short-term fixed income money to work in long-dated fixed rate securities. Early in 2023, we communicated that we thought investors had a number of months to put a long-term fixed income strategy in place. Now, we think the window of opportunity is more a matter of weeks, rather than months.

DISCLAIMER: This report contains views and opinions which, by their very nature, are subject to uncertainty and involve inherent risks. Predictions or forecasts, described or implied, may prove to be wrong and are subject to change without notice. All expressions of opinion included herein are subject to change without notice. Predictions or forecasts described or implied are forward-looking statements based on certain assumptions which may prove to be wrong and/or other events which were not taken into account may occur. Any predictions, forecasts, outlooks, opinions, or assumptions should not be construed to be indicative of the actual events which will occur. Investing involves risk, including the possible loss of principal. The opinions and data in this report have been obtained from sources believed to be reliable; neither Left Brain nor its affiliates warrant the accuracy or completeness of such and accept no liability for any direct or consequential losses arising from its use. In addition, please note that Left Brain, including its principals, employees, agents, affiliates, and advisory clients, may have positions in one or more of the securities discussed in this communication. Please note that Left Brain, including its principals, employees, agents, affiliates, and advisory clients may take positions or effect transactions contrary to the views expressed in this communication based upon individual or firm circumstances. Any decision to effect transactions in the securities discussed within this communication should be balanced against the potential conflict of interest that Left Brain, its principals, employees, agents, affiliates, and advisory clients has by virtue of its investment in one or more of these securities.

Past performance is not indicative of future performance. The price of securities can and will fluctuate, and any individual security may become worthless. A high or favorable rating, rating outlook, gauge, or similar opinion is not indicative of future performance, and no user should rely on any such rating, rating outlook, gauge, or similar opinion to predict performance or potential for return. Future performance may not equal projected or forecasted performance or potential for return. All ratings and related analysis, as well as data, statistics, analysis, and opinions contained herein are solely statements of opinion and are not statements of fact or recommendations to purchase, hold, or sell any security or make any other investment decisions.

This report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will materialize. Reliance upon information herein is at the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left brain Wealth Management DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is current only as of the date set forth herein. Left Brain Wealth Management has no obligation to update the Report, or any material or content set forth herein.

Read the full article here