Investment thesis

In our first coverage of the “newbie” shipping company Himalaya Shipping Ltd. (NYSE:HSHP) of 29th June this year, we initiated our coverage with a Hold stance.

The main reason for this cautious stance was our desire to get a clearer picture on how HSHP would be performing financially before we potentially could take a bullish view. A view we hold on some of its peers.

Its share price has not done well for those that either got allocated shares at the IPO or bought it later on. The 7.72 million shares issued at the IPO were priced at $5.80 for each ordinary share.

HSHP’s share price development compared to SBLK and GOGL (SA)

The drop in price of the shares of HSHP is also seen amongst its peers.

We are the first to acknowledge that a one-year timeframe of investing is not a sufficient time to determine whether it was a good decision to get in at an early stage.

Let us first look at their latest set of financial results and also point out something about their future business prospects.

Q3 of 2023 Financial Results

It is a small fleet that HSHP owns, when we compare it to the likes of GOGL and SBLK.

As such, the numbers are also smaller. In the last quarter, HSHP had operating revenues of $10.2 million and a net loss of $2 million. Loss per share was $0.05.

Out of the 12 vessels in their fleet, 7 vessels are on the water generating money. The other 5 vessels will be delivered throughout 2024.

M/V “Mount Norefjell” (HSHP Q3 of 2023 Presentation)

All the seven vessels presently trading is fixed out for two to three years period charter. It is only one of the vessels, the “Mount Norefjell” that has a guaranteed rate, which is $30,000 per day. The other six are fixed on index-linked charters and we do assume that there is no floor limiting the downside. In other words, HSHP will get paid depending on what the spot market has to offer, plus a good premium for being the larger Newcastlemax vessels and for the scrubber-fittings.

We believe they decided to take as much coverage as they could do, bearing in mind that they are heavily geared.

The loan to purchase price is as high as 88%.

When we look at the cost of this high financial gearing, we can see that in the last quarter they had interest expense of $5 million. That is 50% of the revenue. The total debt as of the 30th of September 2023 was $421.9 million. This brings the average interest rate to 4.74% which in today’s environment is quite attractive.

Nevertheless, a company with high gearing is riskier than those with a lower gearing, such as SBLK, which has a much lower gearing ratio of just 40% and GOGL with 45%.

Business prospects

HSHP is a bet on what is going to happen with steel production and demand for coal from powerplants. Other commodities they ship is bauxite, the raw material used to make alumina.

Iron ore is still the largest commodity shipped.

According to Bimco, 65% of all seaborne iron ore trade goes to China. Of this, as much as 37% goes in to building residential properties and approximately 60% in total goes in to various construction industries. Overexuberant real estate developers started too many projects resulting in a market crash.

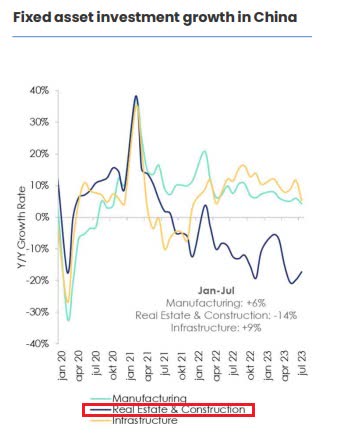

Management of HSHP, like all other managements, are obviously trying to spin a positive outlook on the market. They included a graph in their Q3 presentation which shows the negative development of fixed asset investment in real estate and construction in China. Since we know how important this is for the consumption of steel, we are not particularly bullish about next year.

Fixed investment growth in China (HSHP Q3 of 2023 Presentation)

Longer term, we should see higher rates for Capesize ships as the order book is favorable and demand should recover to earlier volumes.

According to the management SBLK’s presentation of Q3 2023, they had this information:

Iron ore trade is expected to expand by 4.7% during 2023 and to marginally contract by 0.2% in 2024. Coal trade is expected to expand by 6.9% during 2023 and to contract by 0.9% in 2024.One positive development has been the growing bauxite exports from West Africa which generates strong ton-miles for Capesize vessels with exports up by about 30% year-to-date. Apart from China, India has also been importing more coal as their electricity demand is currently outpacing domestic production. This is positive for drybulk, but for the most for smaller size vessels.

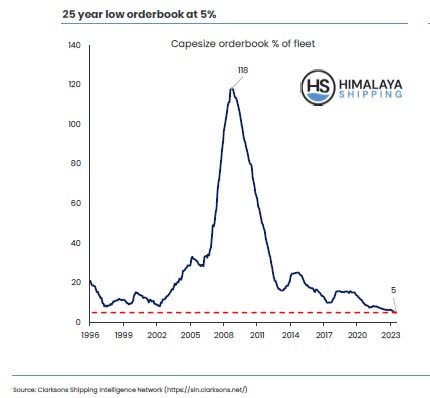

On the supply side, the order book for Capesize looks encouraging with only 5% of the present fleet.

Capesize order book is low (HSHP Q3 of 2023 Presentation)

Another positive element is that for those that want to order such vessel now, they will have to wait until 2026 before they can get delivery of their new vessels.

Risks to Thesis and a Conclusion

There is a risk, although we believe it is a low probability, that the market for Capesize vessels next year could be considerably lower than this year. There is no point in trying to guess how low it could be as nobody knows.

These markets are volatile and can change rapidly.

Bloomberg reported recently that the Chinese government plans to provide at least 1 trillion yuan ($137 billion) of low-cost financing for urban village renovation and affordable housing programs. That could push steel demand up.

HSHP is not profitable as they are in the stage where they have to build up more equity in their business, and they have to live with a much higher interest rate environment than what they experienced when they went out and ordered these vessels.

Herein lies the problem. Why would we want to invest in this company when we can choose other dry bulk owners that are well established and is making money?

It continues to be a Hold stance for us.

Read the full article here