Investment thesis

Our current investment thesis is:

- UNFI has achieved healthy growth in the last decade but this has seemingly come at the expense of margins, a poor trade-off in our view. This has made the business less attractive to investors but also contributed to the business being (partially) oversold.

- Investors understand that this is not an industry where outsized growth can be achieved, even by 1-2ppts, and so the protection of margins is absolutely critical to long-term success. With margins down and debt elevated, M&A will likely grind to a halt. All Management will have to show for it is scale, with ROE down 9ppts since FY13.

- With UNFI trading below its equity value and at a NTM FCF yield of ~8%, we do see a speculative investment proposition here. This does require a catalyst to drive positive price action, however, which we why we are suggesting investors remain patient.

Company description

United Natural Foods, Inc. (NYSE:UNFI) is a leading distributor of natural, organic, and specialty food products across North America. The company serves a wide range of customers, including grocery chains, independent retailers, e-commerce platforms, and foodservice operators.

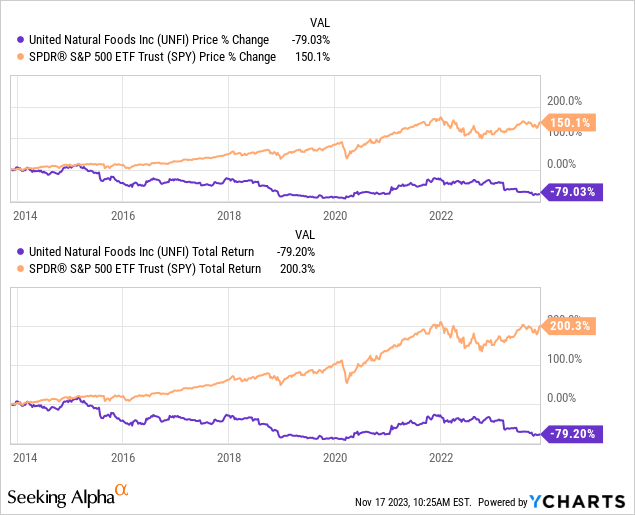

Share price

UNFI’s share price performance has been poor during the last decade, losing over 70% of its value while the S&P has generated impressive returns. This is a reflection of its underlying mediocre financial development despite a strong top-line performance.

Financial analysis

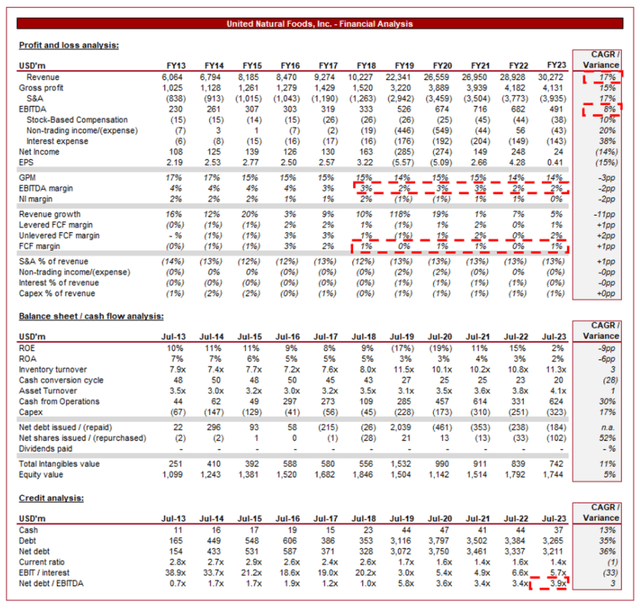

UNFI financials (Capital IQ)

Presented above are UNFI’s financial results.

Revenue & Commercial Factors

UNFI’s revenue growth has been extremely good, with a CAGR of 17%. This has been materially supported by acquisitions, particularly in FY19. During this period, organic growth has been broadly consistent.

Business Model

UNFI serves as a distribution partner for a wide range of natural, organic, and specialty food and product suppliers. The company sources products from manufacturers and delivers them to various retail channels, including grocery stores, supermarkets, natural food stores, and more.

UNFI offers an extensive product portfolio that includes natural and organic groceries, fresh produce, frozen foods, health and wellness products, beauty and personal care items, and more. This broad product offering allows the business to reach a significant scale while also deepening its relationship with customers. The company has positioned itself to be a supplier to a range of businesses, including traditional groceries and specialists. Its scale and extensive relationships with suppliers are likely its biggest competitive advantage.

UNFI’s private label products provide the company with opportunities to create value-added products and cater to retailers’ specific needs. This has seen strong growth in recent years, particularly due to price inflation from branded products.

The company operates a vast distribution network that includes warehouses strategically located across North America. This network enables efficient inventory management and timely delivery of products to retail partners. This is a critical success factor, as the industry operates with slim margins.

Further, strong relationships with suppliers allow UNFI to access a wide range of products and maintain a diverse product portfolio at a cost-effective level due to its scale, contributing to a strong competitive position.

UNFI has shown a willingness to supplement growth through M&A. Most recently, UNFI’s acquisition of SUPERVALU in 2018 expanded its market presence and customer base, contributing to an over +100% growth rate in that year. With margin dilution in the last decade, some of which coming from M&A, we are hesitant to encourage further in the coming years. The key is for acquisitions to be accretive on the bottom end, not just the top.

Food Distribution Industry

UNFI faces competition from other food distributors like Sysco (SYY), Performance Food Group (PFGC), US Foods Holding Corp (USFD), The Chefs’ Warehouse (CHEF), and KeHE Distributors. Competition is based on product range, distribution efficiency, and customer relationships.

The natural and organic products market has experienced consistent growth, primarily driven by the desire for a more healthy and sustainable lifestyle. This has contributed to healthy organic growth in the last decade, with further scope going forward.

Consumers are increasingly conscious of what they consume, leading to higher demand for products that align with their values and health preferences. This has generally contributed to a demand for higher-quality products, an area of strength for UNFI.

As e-commerce continues to grow in relevance, the demand for easily accessible products via an online channel is increasing. The Chefs’ Warehouse in particular has invested heavily in this and we consider it a key opportunity.

Finally, the factors above are contributing to changes in sustainability, ethical sourcing, and responsible (ESG) business practices, with increased pressure to modernize procurement to ensure more sustainable practice. This is threatening margins but also has the opportunity to improve the top line for those who can demonstrate an above-average track record.

Margins

UNFI’s margins have disappointed in the last decade, declining from an EBITDA-M of 4% in FY13 to 2% in FY23. This has contributed to an EBITDA growth rate of 8% while revenue has grown at 17%.

This is extremely disappointing given the company’s slim profitability, restricting its ability to generate FCF and thus distribute to shareholders. Management has seemingly traded investor capital and margins for greater scale, a poor trade off in our view.

The company ROE has declined from a reasonable 10% to 2%, suggesting investor capital has been completely misallocated. We consider this a major failure on Management’s part and is an issue that is unlikely to be rectified given the level of competition with the industry.

Quarterly results

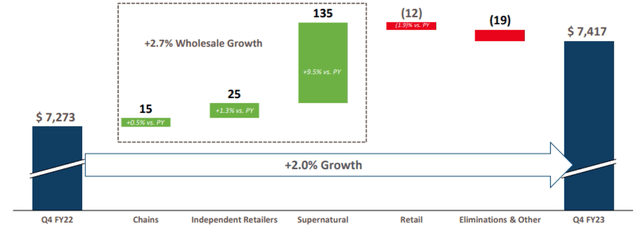

Growth bridge (UNFI) (UNFI)

Presented above is UNFI’s most recent quarterly result.

UNFI has experienced healthy growth in the most recent quarter (+2.0%. This suggests the company is navigating the current economic slowdown well, through a combination of robust demand and positive pricing where possible.

Despite this, UNFI’s share price continues to decline, with heavily negative sentiment around the company. The reason for this is its continued margin weakness, as well as the revision down of revenue expectations due to cycle headwinds.

Investors are losing all hope in the ability to recover its margins and revert to a well performing company. We feel the Management team likely needs clearing out (currently underway) and a wholesale restructuring exercise to fundamentally improve the cost base on this business.

Balance sheet & Cash Flows

UNFI’s balance sheet has been bloated by prior transactions but Management has rightly focused on deleveraging, contributing to its ND/EBITDA ratio declining to 3.9x. At this level, the business is far healthier, with not much further required.

This has the potential to allow for distributions to increase, although investment in operational improvements is likely a better near-term use of capital.

Outlook

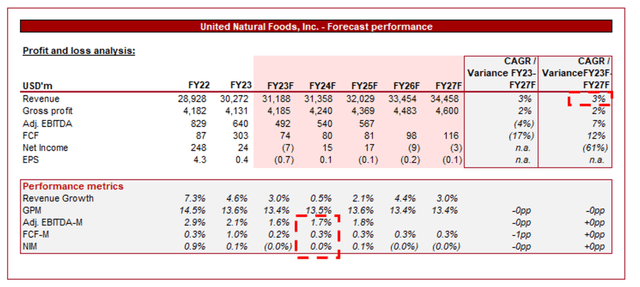

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of its modest revenue growth, with a CAGR of 3% into FY27F. This is in conjunction with little margin improvement, which based on the lack of historical improvement appears reasonable.

Industry analysis

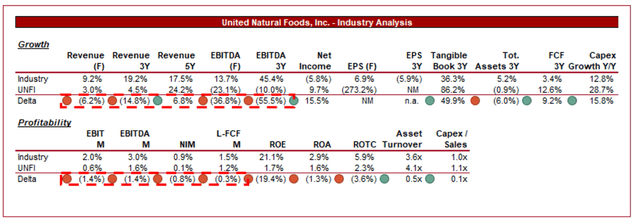

Food Distributors Stocks (Seeking Alpha)

Presented above is a comparison of UNFI’s growth and profitability to the average of its industry, as defined by Seeking Alpha (7 companies).

UNFI is a weak participant when compared to its peers. The company has underperformed in growth, implying market share loss and relative unattractiveness. Further, margin deterioration has contributed to a below-average level and we struggle to see how it will revert.

Despite its superior size and strong business model, the company is seemingly completely dominated by its peers. UNFI has been completely mismanaged.

Valuation

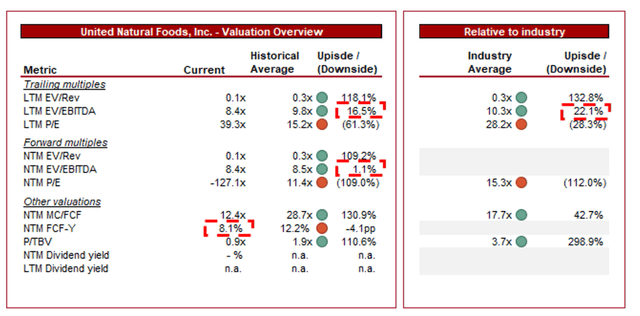

Valuation (Capital IQ)

UNFI is currently trading at 8x LTM EBITDA and 8x NTM EBITDA. This is a discount to its historical average.

UNFI’s discount to its historical average is undoubtedly warranted, owing to its margin deterioration and poor relative growth compared to peers. We do not consider the ~1%/~17% discount on a NTM/LTM EBITDA level to be sufficient to reflect this. We believe closer to 20-30% is appropriate.

Further, UNFI is trading at a discount to its peer group average, with a ~22% discount on an LTM EBITDA basis. This further increases on a FCF basis (~43%). This again is uncompelling in our view given the miss-allocation of FCF thus far and the uphill battle to revert to an attractive profitability level.

Aside from these two, UNFI currently has an equity value of ~$1.7bn (~$1bn when excl. intangibles) with positive FCF, compared to a market value of ~$0.9bn. Further, the company has a NTM FCF yield of ~8%. This represents a unique opportunity for speculative upside, implying a stabilization could immediately allow for it to exceed its liquidation value. This implies investors are expecting capital to continue to be inefficiently allocated and that pain ahead remains.

Key risks with our thesis

The risks to our current thesis are:

- Margin deterioration. There is a big risk that UNFI has yet to reach “the bottom”. Given how competitive the industry is, a decline in profitability will be significantly harder to win back.

- FCF decline. Inventory and the broader operational management are critical given the weakness in profitability. The business must maintain a c.1% FCF level to maintain a healthy return.

Final thoughts

UNFI has seemingly lost its way. The company has chased growth but lost margins, in an industry where profitability is critical to attracting investor interest. We suspect the business will face a difficult quarter or two before normalizing following this.

We generally suggest investors only invest in the highest quality businesses but occasionally there are opportunities that could be right for certain individuals who are willing to accept the risk. With a NTM FCF yield of ~8% and its equity value noticeably below its market cap, we do see upside.

Read the full article here