Investment action

I recommended a hold rating for Parsons Corp (NYSE:PSN) when I wrote about it the last time, as the valuation back then was too rich relative to history and peers. Based on my current outlook and analysis of PSN, I recommend a hold rating. I reiterate my view that PSN’s business performance in the near term is likely to be great given its visibility. However, the margin of safety is something that I am not comfortable with yet. Even at the current 15x forward EBITDA multiple (which I think PSN deserves given its performance), the upside is still not very attractive.

Review

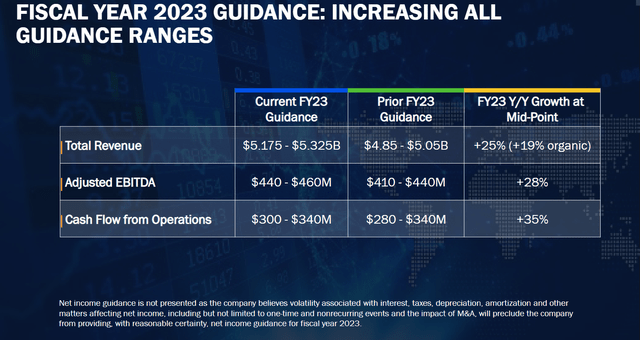

PSN posted a strong overall 3Q quarter, with revenue, EBITDA, and EPS all ahead of consensus. Revenue of $1.4 billion was up 23% organically and 12% above consensus, with Federal Solutions [FS] up 23% and Critical Infrastructure [CI] up 24%. Overall revenue growth was supported by higher volumes on new and existing contracts, as well as a $18 million contribution from SealingTech. Adjusted total EBITDA came in at $128 million (9% margin), 16% above consensus of $110 million.

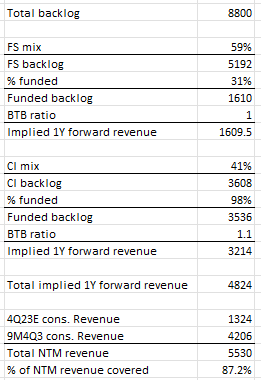

Forward looking indicator book-to-bill ratio [BTB] was at 1X, with the total backlog growing 7% to $8.8 billion. PSN’s BTB ratio deserves more attention as it gives an idea of the FY24 growth outlook. By segment, FS saw net bookings growth of 12%, ending the quarter with B2B of 1X, and CI saw 17% net bookings growth, ending the quarter with BTB of 1.1X. An important metric to track here is how much the backlogs are being funded. As of 3Q23, the backlog is split 59% between FS, with around 1/3 being funded, and 41% between CI, which is almost 100% funded. On an aggregate basis, 59% of the total backlog is being funded. This indicates that the majority of expected growth in the foreseeable future has already been secured through awarded and funded contracts. Based on these backlog data, I was able to do an analysis to sense-check whether PSN is able to achieve consensus expected NTM revenue. My analysis suggests that PSN has already locked in nearly 87% of the NTM revenue, which, in my opinion, is a very positive result as it reduces the risk of PSN missing consensus estimates.

Author’s work

Some might be concern about the competition risk when these contracts are up for renewal, but this is not much of a concern today. In 2023, re-competes account for only a small percentage of revenue, at 5%. The past few years have seen a 40-50% success rate for PSN, with re-compete win rates of over 90%. PSN’s year-to-date success rate is near 70%, and the company has recently won its four largest re-compete wins, including one from FAA. Therefore, recompete risk is not a concern in my opinion.

PSN

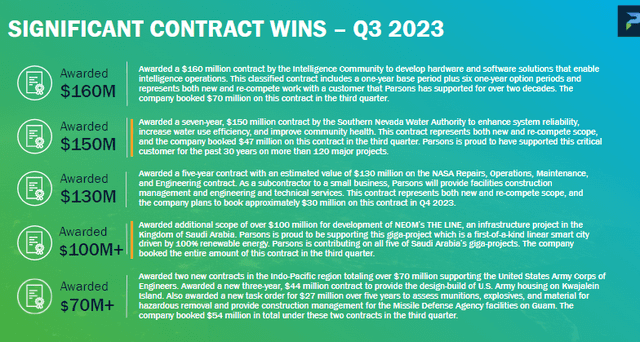

Looking ahead, multiple factors are driving the growth of PSN. Growth in CI is bolstered by recent contract wins in the Middle East, which I see as a result of the global infrastructure bill. Also, PSN should benefit from the US Infrastructure Investment and Jobs Act, which includes $550 billion in new federal investment in America’s roads and bridges, water infrastructure, resilience, internet, etc. In other aspects of the business, PSN’s cyber portfolio is broadly focused on electromagnetic spectrum work, physical security, surveillance, and chem-bio defense, making them well-positioned to aid countries in conflict (like Ukraine and Israel). Given the heightened need for defense, I believe the entire European continent will continue to increase its military defense budget.

Today, President Biden will announce that the U.S. aims to mobilize $200 billion for PGII over the next 5 years through grants, Federal financing, and leveraging private sector investments. Together with G7 partners, we aim to mobilize $600 billion by 2027 in global infrastructure investments. And this will only be the beginning. The United States and its G7 partners will seek to mobilize additional capital from other like-minded partners, multilateral development banks, development finance institutions, sovereign wealth funds, and more. White House

More importantly, there are $14 billion of contracts being awarded but not booked yet (so they are not reflected in the results) and another >$40 billion in the pipeline. These further support the growth outlook for PSN.

“And Sheila, one thing I would add is with all the success we’ve had, we have the $8.8 billion in backlog, plus we have $14 billion of awarded, not booked.” 3Q23 call

“And Andy, we are also having a $45 billion pipeline.” 2Q23 call

Valuation

Author’s work

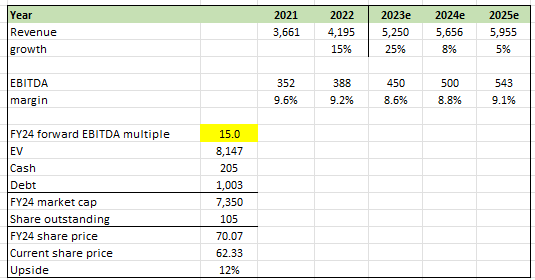

I believe PSN can grow as guided for FY23 and 8% in FY24, followed by 5% in FY25. FY23 revenue is pretty much locked in given the contractual nature of PSN’s revenue (supported by the backlog and funded data mentioned above). I raised my FY24 revenue growth estimates to 8% to reflect consensus numbers, as my analysis above suggests that PSN is already tracking near 87% of NTM consensus revenue. I assumed the same 5% growth for FY25. My assumption for EBITDA margins remains the same. In order to reflect the strong momentum and high visibility into FY24 revenue, I have increased the valuation assumption by 1x to reflect this. At 15x forward EBITDA, my target price is $70, or 12% upside. I would note, again, that PSN is still trading at a very high multiple when compared to its historical trading range. I am reiterating my hold rating as the margin of safety is not attractive.

PSN

Risk and final thoughts

Key risks include US government budget priorities, which could be changed and implementation delayed for reasons that are not publicly available, making it hard to model out-year growth rates. While PSN might benefit from the conflicts happening in the Europe/Middle East region, this also means they are exposed to heightened geopolitical risks. My recommendation for PSN remains a hold. While PSN exhibits great near-term performance prospects, the current 15x forward EBITDA multiple doesn’t offer an attractive upside.

Read the full article here