Investment Thesis

A10 Networks (NYSE:ATEN) recently reported Q3 earnings that showed a massive slowdown in sales driven by tough economic conditions. I wanted to take a look at the company’s financials to see if it would be a decent time to start a position. The management did a great job turning the company around and making it profitable, however, I have my concerns about the economic conditions that may still bring the share price of the company further down and will present a better entry point. Therefore, I initiate my coverage of the stock with a hold rating.

Comments on the Outlook

Recent Quarter Results

Revenue came in at $57.8m, which is around 20% lower y/y and 12% sequentially. The company has had a rough fiscal year and is looking to end the year with another disappointing sales quarter and will finish the year with around a 9% decrease in total sales y/y. The company is highly dependent on a broader economic situation, so it was no surprise that the company saw sales plummet. I believe that because we are in such a climate where high interest rates will remain high for longer, many projects and buying decisions will be pushed out in hopes easing of the rates sometime next year, which will hurt the company’s sales in the short term. Therefore, I believe that even after dropping around 30% YTD, the company will see further price pressures over the next half a year to a year as conditions may worsen in the short run and improve much later than anticipated.

The management did a commendable job of getting the company to be profitable on a GAAP basis in the last couple of years, so at least the company will be able to weather these downturns going forward, when the times turned bad, the company would have burned through cash and end up with significant losses. Even with inflation not going wild any longer, it is still very high compared to where the FED wants it to be, which means we either get further rate hikes, as the FED is still quite hawkish, or these interest rates stay higher for much longer. I also don’t think we are going to see interest rates coming down to pandemic lows, as historically interest rates hovered around 2%-3%.

Financials

As of Q3 ’23, the company had around $160m in cash and marketable securities against zero outstanding debt, which is a very good position to be in. This allows for flexibility in how the cash flow can be distributed, without having the burden of annual interest expenses on debt and paying down the debt itself. The company can use the cash flow to repurchase shares (if the stock is considered cheap), pay a dividend (not a fan), or further the growth of the company either organically or inorganically via acquisitions (big fan of this initiative). It is safe to say ATEN is at no risk of insolvency.

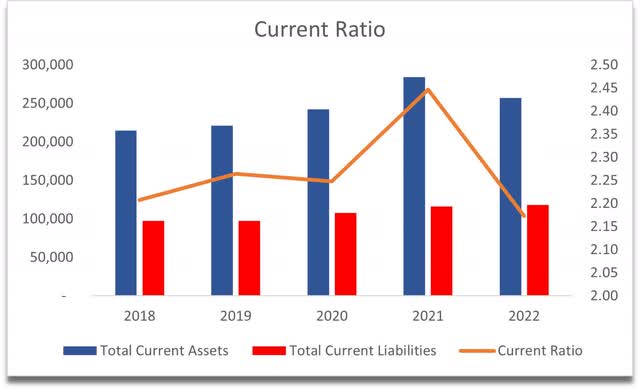

The company’s current ratio historically has been very strong, and it is no different in the latest quarter. It is just above what I consider to be an efficient current ratio, which is in the range of 1.5-2.0. I feel this is an efficient ratio range because it shows that the company has no liquidity issues as it can easily pay off its short-term obligations and also has plenty of capital for the future growth of the company. As of Q3 ’23, the company’s current ratio stood at around 2.4, which is just above that mentioned range, but it is better to be over than under the range.

Current Ratio (Author)

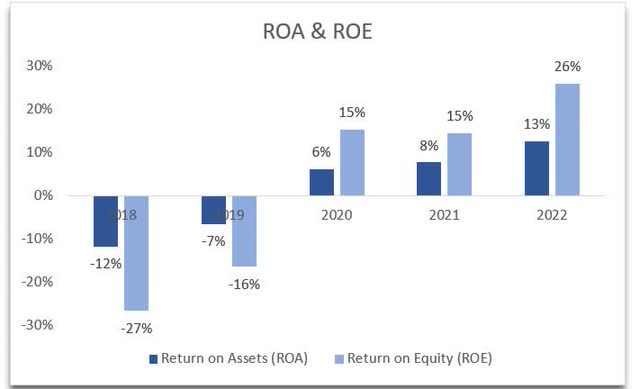

In terms of efficiency and profitability, the company’s ROA and ROE have improved massively since FY18, however, these have come down slightly in FY22, which can be attributed to a much lower bottom line compared to the prior year (~95m vs ~46m). The difference in Net income y/y is due to the company receiving a one-time benefit from income taxes due to “sustained profitability over the last four quarters.”

So, if we take out the one-time benefit, we can see that the company’s ROA and ROE have actually improved y/y, which is good to see. No complaints there.

ROA and ROE (Author)

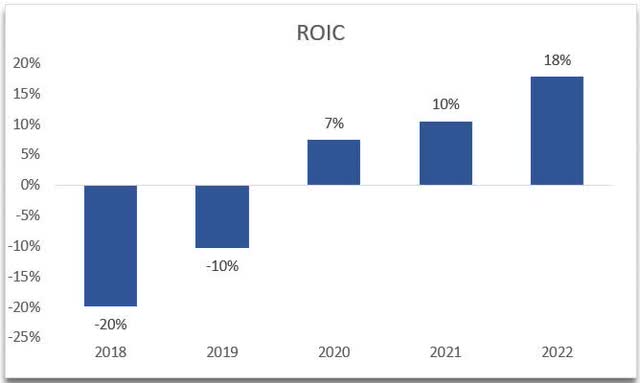

The same can be seen in the company’s return on invested capital, or ROIC. If we take out the one-time tax benefit, the company’s competitive edge and moat are on the rise and well above my minimum of 10%, which means the management is good at utilizing the company’s capital. It is good at deploying capital to profitable projects that have a high return.

ROIC (Author)

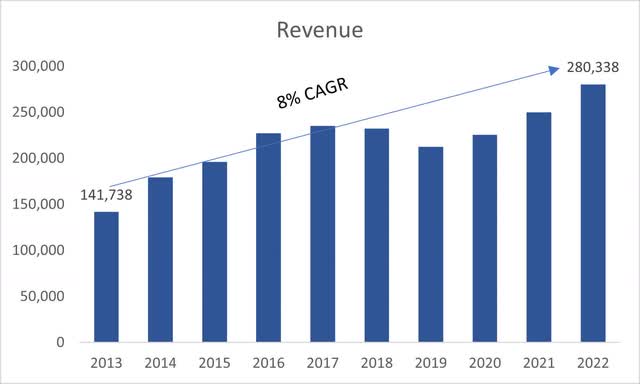

In terms of revenues, ATEN grew at around 8% CAGR over the last decade, which isn’t very impressive, however, it could have been worse. The management is guiding for around a 9% decline in sales for FY23, which is not unusual to see, given many companies are expecting some sort of a slowdown in sales for the rest of the year. The company is not immune to these broad downturns in the economy, so when this turns positive once again, the management expects the company to be more profitable and efficient too.

Revenue Growth (Author)

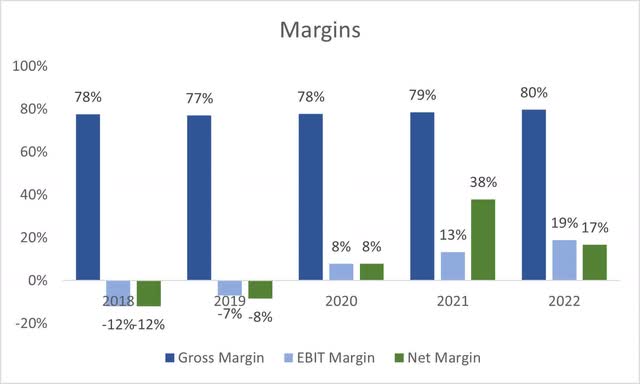

In terms of margins, we can see gross margins have been very consistent and high. We can see that operating and net margins have also vastly improved from the numbers seen in FY18. The company has climbed out of the hole and is a profitable business now. The big reason for this is the company’s ability to tame operating expenses considerably over the last 5 years (operating expenses were 91% of total revenue in FY18 vs 61% in FY22).

Margins (Author)

Overall, I can see a company that has turned itself around and is much more efficient and profitable as a result. The management did a commendable job of taming operating expenses and making the company profitable going forward.

Valuation

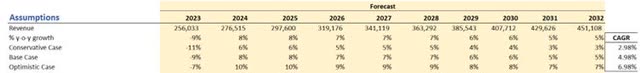

For Revenue assumptions, I went conservative as usual for that extra margin of safety, as it is better to be safe than sorry. I like to sleep well knowing I bought a company that is past my conservative estimates and is going to provide me with a better risk/reward outcome. Below are my revenue assumptions for the three cases, base, conservative, and optimistic, and their respective CAGRs.

Revenues Assumptions (Author)

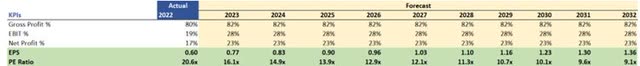

In terms of margins and EPS, I went with non-GAAP metrics that include share-based compensation. I decided to go with these measures because the management always mentions these metrics as their main determinants of the company’s true value, even though I may not agree with them. Below are assumptions for margins and EPS and how these compare to GAAP FY22 numbers.

Margins and EPS Assumptions (Author)

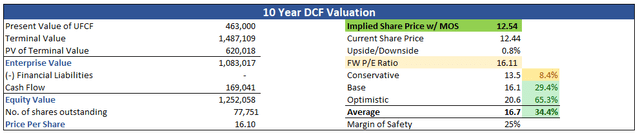

For my DCF analysis, I decided to use the company’s WACC as my discount rate, which is around 9.15%. I also used a 2.5% terminal growth rate as I would like the company to at least keep up with the long-term US inflation objective.

Since I used non-GAAP metrics for EPS and Margins, I will add a 25% margin of safety to the final calculation for that extra cushion. With that said, A10’s intrinsic value and what I would be willing to pay is $12.54 a share, which means the company is trading at its fair value.

Intrinsic Value (Author)

Closing Comments

So, it looks like the company is a good buy at these levels, however, I feel like this is just the beginning of the slowing down in sales, which will bring the company’s share price down further. It is already down over 30% over the last year, and I don’t think we have seen the end of it yet. Even if the management guided for a week performance for the year, which should be priced in by now, the market is very forgetful and when the company releases the expected bad numbers in three months, I wouldn’t be surprised if those bad numbers bring the share price further down.

In situations like this, I would go with a cash-secured put strategy at a lower strike price but unfortunately, the company doesn’t have a large volume of contracts trading, and strike prices are $2.5 apart so there isn’t a strike price at $11 a share, which is unfortunate. What I will do is set a price alert at around $11 a share and forget about it for the time being. I don’t expect the company to surprise on the upside for the next quarter, so I think I can get a better entry point in the next few months.

Read the full article here