Battalion Oil (NYSE:BATL) secured another $55 million in preferred equity commitments, allowing it to resume development activities. It has started drilling two Monument Draw wells, which are expected to come online in early 2024 and is also looking at additional locations.

The additional preferred equity funds should also allow it to keep up with its required term loan repayments, although it is uncertain whether Battalion will need to raise more money to complete the final $115 million term loan repayment due in November 2025.

Battalion continues to be hampered by its hedges and high gathering and treatment costs. The latter was expected to be improved by the acid gas injection facility joint venture, but that has run into delays and additional costs.

I currently expect Battalion to have around $166 million in preferred shares outstanding by its November 2025 term maturity, and this could increase to over $200 million if Battalion requires additional funding to pay out its remaining term loan debt at that time.

I am neutral on Battalion’s common shares at $6 per share since the preferred shares are likely to result in substantial future dilution. I estimate that the preferred shares could be converted into around 21 million common shares by November 2025, even if Battalion doesn’t seek to raise additional equity to pay off its term loan then.

Q3 2023 Results

Battalion’s production has declined significantly during 2023. It reported 16,200 BOEPD (50% oil) in Q1 2023 production, followed by 14,253 BOEPD (49% oil) in Q2 2023 production and 12,717 BOEPD (46% oil) in Q3 2023 production. Battalion’s total production has declined by around 22% from Q1 2023 to Q3 2023, while its average daily oil production has declined by around 28% over that period.

Some of that production decline is due to Battalion not putting any new wells online since Q1 2023. As well, Battalion indicated that downstream shut-ins are curtailing production by over 2,500 BOEPD. These shut-ins are expected to last into Q1 2024, and Battalion expects that production to be back online by the end of that quarter after third-party infrastructure improvements.

Battalion’s per unit operating costs remained relatively high in Q3 2023 at $10.13 per BOE for lease operating and workover expense and $13.26 per BOE for gathering and other expense. Battalion’s per unit operating costs were negatively affected by the reduced production caused by the downstream shut-ins, as well as an increased percentage of total production that required H2S treatment. The acid gas injection facility is still undergoing workover operations and should be fully online in Q1 2024. Thus Battalion’s operating costs per unit should be lower in 2024, but Q4 2023 operating costs per unit are likely to remain high.

Battalion reported $13.6 million in adjusted EBITDA in Q3 2023, hampered by reduced production and unfavorable hedges. Without realized hedging losses, Battalion’s adjusted EBITDA would have been $20.5 million during the quarter.

Term Loan Repayments

Battalion is required to make $10 million in term loan repayments in Q4 2023, followed by a total of $50 million in 2024 term loan repayments and $35 million in term loan repayments during the first three quarters of 2025.

After that, Battalion is also required to make a final payment of $115 million on the November 24, 2025 term loan maturity date.

More Preferred Stock

After issuing $38 million in Series A-1 Redeemable Convertible Preferred Stock in September, Battalion has now obtained commitments for another $55 million in preferred equity to fund incremental activity plans.

The details around the additional $55 million in preferred equity does not appear to be disclosed yet, but I’m assuming that the terms are similar to the Series A-1 Preferreds. Those have a 14.5% cash dividend rate, a 16.0% PIK dividend rate and an initial conversion price of $7.63.

If Battalion issues the incremental $55 million in preferred equity at the end of 2023, it would then have around $166 million (factoring in PIK dividends) in preferred equity outstanding when its term loan matures in November 2025. These would convert into approximately 21 million shares, resulting in a 125% increase in Battalion’s outstanding share count.

Future Outlook

Battalion has started drilling at Monument Draw again, with a two-well pad expected to be online in early 2024. It also mentioned that it is preparing additional locations across all three asset areas.

I am currently modeling Battalion’s 2024 oil production at 6,000 barrels per day, which assumes that its two-well pad goes online early in 2024 and that the downstream disruptions are resolved early in 2024 as well. I have not factored in other new wells beyond that two-well pad since there is too much uncertainty around Battalion’s other 2024 development plans.

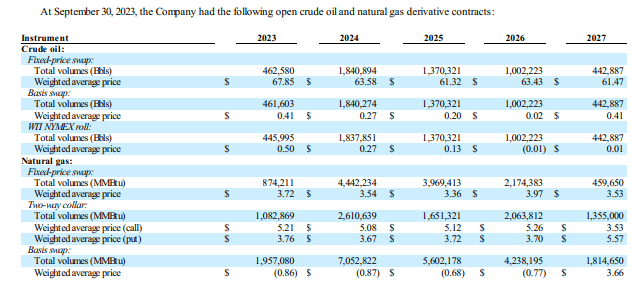

Battalion’s Hedges (battalionoil.com)

At $75 WTI oil in 2024, Battalion would then be projected to generate $90 million in unhedged EBITDA and approximately $70 million EBITDA after hedges. Battalion’s cash interest costs are projected at around $22 million in 2024, while I am assuming a $20 million capex budget, mostly to complete those two wells.

This results in a projection of $28 million in free cash flow for Battalion in 2024.

Battalion’s free cash flow in Q4 2023 may be around zero due to the initial spending on those two wells plus spending on its acid gas treatment joint venture. That joint venture has run into complications resulting in higher than expected costs. Battalion has advanced approximately $8 million to its joint venture partner to cover these costs and expects to advance another $5.5 million in Q4 2023. I’ve deducted these contributions from Battalion’s projected free cash flow, although it does have various potential ways to recover these contributions in the future.

With $28 million in projected free cash flow in the next five quarters and $43 million in cash on hand at the end of Q3 2023, Battalion can cover the $60 million in term loan repayments. That leaves limited funds for additional development without tapping its additional preferred equity commitment though.

The $55 million in preferred equity can help fund additional development in 2024 that should pay back by its term loan maturity if that development starts soon. However, it also seems likely that Battalion won’t be able to fully make its $115 million final term loan payment without at least some more funding.

Conclusion

Battalion Oil has secured an additional $55 million in preferred equity funding that should allow it to drill a handful of new wells in 2024 while making its scheduled term loan repayments. The total amount of preferred equity is adding up quickly though, and is projected at $166 million by November 2025. If Battalion needs to tap additional preferred equity funding to fully pay off its term loan, the preferred equity total could easily exceed $200 million.

With the average conversion price on the preferred equity likely to be under $8 per share, that significantly reduces Battalion’s upside beyond $8 per share. At $6 per share I am neutral on Battalion’s shares. A 20% compounded return per year (4% higher than its preferred share PIK interest) would require Battalion’s shares to reach $8.64 per share by November 2025.

Read the full article here