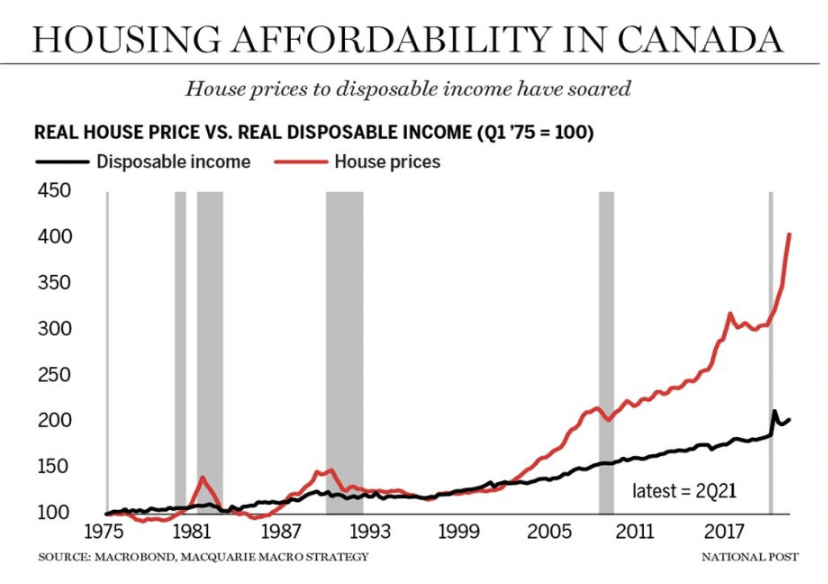

From 2000 to 2022, Canadian home prices increased 375% (an average of 17% annually, shown in red below), while the average Canadian wage (black line below) rose 3% per year.

In the Greater Toronto and Vancouver Areas, where most of the population lives, median home prices rose 450% and 490%, respectively.

The mania escalated during the pandemic, when prices in popular areas leapt 50% between the end of 2019 and February 2022, when the average sale price nationally reached $816k.

In October, the average sale price was $656k, down nearly 20% from the peak. Where I live, north of Toronto, “new price” discounts are evident, and properties are still sitting.

The trouble is that there is a huge supply of homes where owners and lenders are banking on market values over $1 million, more than 50% higher than October’s average sale price.

With buyers in hibernation, many owners/lenders are turning hopes to a stronger spring market (CREA). But with mortgage rates not likely to be significantly lower by then, prices will need to give.

Disclosure: No positions

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here