Shares of Macy’s, Inc. (NYSE:M) have been a poor performer over the past year, losing over 40% of their value. Investors did get some relief on Thursday as the company reported a solid set of Q3 earnings, sending shares up 7% immediately in response. The question for investors is whether this can be a sustained turnaround or just a dead-cat bounce. Given the fact we may be nearing a trough in consumer spending on apparel at department stores, M shares do now look interesting, assuming we do not have a recession.

Seeking Alpha

In the company’s third quarter, it earned $0.21 in adjusted EPS, blowing past consensus of $0.01, though revenue was still down 7% from last year at $4.9 billion. Alongside this, it raised the bottom end of its revenue guidance by $100 million to $22.9-23.2 million, meaning same-store sales will be down 6-7% from last year. It also tightened its full year earnings range to $2.88-$3.13 from $2.70-$3.20, leading to a ~$0.05 higher midpoint. This guidance implies Q4 sales of about $8.1 billion and $1.85-$2.1 in EPS

In the quarter, same store sales were down 6.3% from last year, and nearly 9% from two years ago. We are seeing some meaningful bifurcation across brands. Macy’s was down by 6.7%, while Bloomingdale’s was down by only 4.4%. Bloomingdale’s caters to a higher-end consumer, and those consumers are likely feeling less of a pinch from elevated inflation and are less likely to have exhausted all of their excess COVID savings. Bluemercury was up 2.5%, and it continues to be the bright spot for the company. Cosmetics saw less excess buying during the pandemic than clothing, meaning there is a less of a “hangover” now.

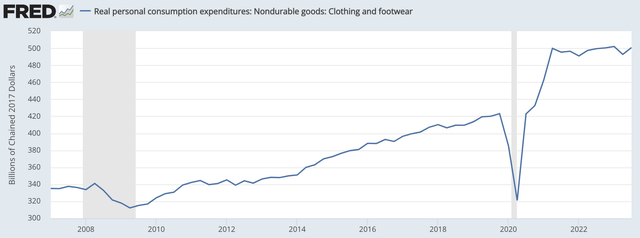

According to the census bureau, department store sales are down 4.1% from last year while overall retail sales are up 2.5%. The below chart speaks to the core of Macy’s challenges. There was a surge in apparel spending in 2021 when the world reopened and a last round of checks was sent to consumers. However, clothing spending has flatlined since 2021. This spending rose way above trend, and it could not sustainably grow from that elevated level. However, as it has flatlined for a longer and longer period, it is converging closer to its previous trend. Apparel spending is up over 4% annualized from pre-COVID levels. This is still a bit above the longer-term 3% trend, but we are approaching the end of this stagnation, in my view.

St. Louis Federal Reserve

Now, this is only true if we do not have a recession. In a recession, consumers pull back on discretionary spending, and we would likely see sales of clothing and home goods fall, not continue to stagnate. There is a lot of discussion of overstretched consumers, but unemployment does remain low. Retail earnings have recently been beating estimates, as seen by Macy’s, Walmart (WMT), and Target (TGT). Oil prices (CL1:COM) have also fallen over the past month, providing a bit of a boost to discretionary income.

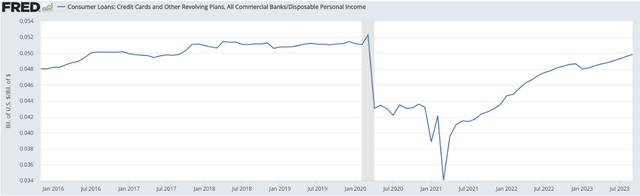

There has been much discussion of U.S. consumers having too much debt with credit card debt passing $1 trillion. This is true, but incomes have also risen. As a share of disposable income, credit card debt is actually a bit below pre-COVID levels, and the economy was healthy in 2019. We are primarily seeing a return to normal debt levels from abnormally low ones after government stimulus. This does not appear to me to be a consumer that cannot continue to spend. We may not see significant growth from here, but spending levels do appear to be sustainable.

St. Louis Federal Reserve

Turning back to Macy’s results, I was encouraged to see that gross margins rose 160bp to 40.3% Frankly, after seeing the surge in spending in 2021, retailers like Macy’s were overly optimistic that spending could continue to rise off this excess level. And so, they carried too much inventory as spending slowed, leaving them with excessive inventories. This forced them to be overly promotional, eating into their margins.

Over the past year, Macy’s has been working to right-size inventories, which has helped to normalize margins. Inventories are down 6% from last year and down 17% from 2019, and so this process looks largely complete. I would note that while SG&A spending fell by 2.3% to $2.04 billion, this was a slower decline than sales, leading its share of revenue to rise by 230bp to 40.5%. Given that loss in operating leverage, adjusted EBITDA declined 24% to $334 million as margins compressed by 140bp to 6.6%. Additionally, credit card net revenue of $142 million was down 31% as the company sets aside more for potential losses, though the pace of provisioning should moderate from here, absent a recession.

Now, it may be concerning to see that Macy’s had negative free cash flow of $555 million so far this year. However, its cash flow is very seasonal. While inventory is lower than a year ago, it rises intra-year into Q4 for the holiday season—after all, Q4 sales are expected to nearly double Q3 sales. Macy’s has built $1.76 billion of inventories year to date, down from $2.02 billion last year. This is a significant drain on cash flow.

Based on its guidance, Macy’s should do $800 million-$1.1 billion in free cash flow in Q4, as inventories and accounts payable normalize. That will lead to about $400 million of free cash flow for the calendar year. So far, Macy’s has spent $135 million on dividends and $25 million of buybacks, meaning the company will retain some cash on net over the year.

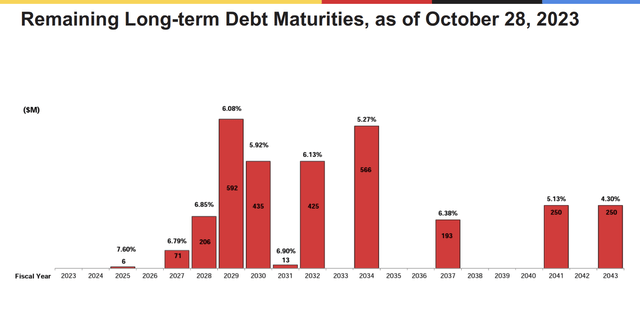

Macy’s has also done a good job of strengthening its balance sheet. It carries $3.2 billion of debt and $3 billion of leases. Macy’s has no material maturities until 2028; this provides it tremendous insulation from the current interest rate environment, as these bonds are fixed-rate, and the company does not need to rollover maturities at higher rates.

Macy’s

Macy’s also has a $3.5 billion market cap, which means it trades abouts $500 million below book value. This speaks to the fact the market has grown much less optimistic on the ability of it to generate from its real estate portfolio, by developing office space around its Herald Square location, just given the more negative outlook for commercial real estate.

I do not see Macy’s being a significant growth story, but with inventories better, we are seeing gross margins improvement, making each sale more valuable. There may also be some room to reduce SG&A expense, if this level of sales persist as Macy’s adjusts staffing levels. Importantly, Macy’s has been suffering a headwind from consumers spending outside of its core categories after ‘over-spending’ in these areas in 2021. We may be nearing the end of this cycle, which should help sales at least stabilize around this year’s levels. With $400 million in free cash flow, shares have an ~11% free cash flow yield, so lots of negativity is being discounted into the share price. Given its debt profile, I would be willing to give M an 11-12x free cash flow multiple, or $16-17, providing 20% upside from here as it uses that cash flow to pay it 5% dividend and also slowly reduce share count via opportunistic buybacks. After this quarter, I feel more confident saying Macy’s is bottoming and now has upside.

Read the full article here