Earlier this week I was at my local gym and I began thinking about the current commercial real estate investment landscape.

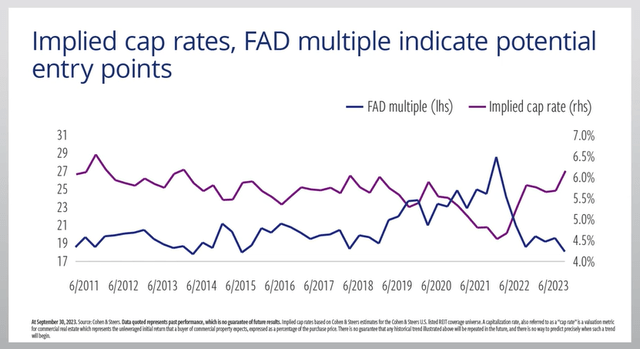

REITs are currently trading at an approximate 6.3% implied cap rate, vs. the historical average since 2010 of 5.7%, and around 17.5x, that’s the lowest level since the beginning of 2011.

Cohen & Steers

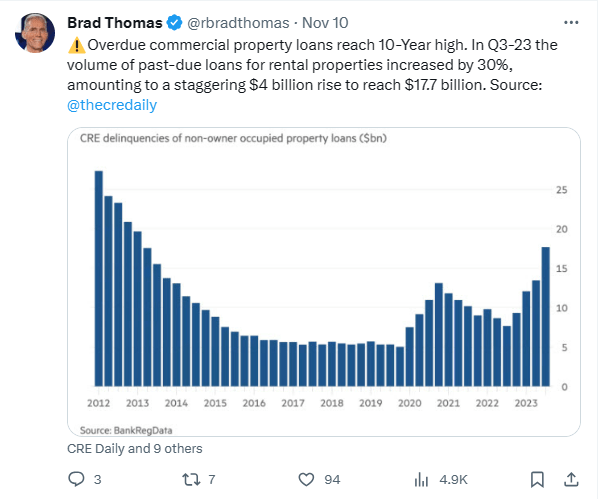

Driving the selloff are many forces, including higher interest rates (elevated cost of capital), bank tightening (lingering debt maturities) and increased loan defaults, to name just a few.

@rbradthomas

It’s obvious to see the fear associated with commercial real estate when you see how these combined forces (higher rates, debt maturities, and loan defaults) appear as daily headlines across most media channels.

It makes perfect sense for dividend investors to allocate capital to a money market fund or six-month Treasury that pays 5% or 6% vs. a REIT that yields the same.

In addition, REITs aren’t immune to dividend cuts, as see with the list of cutters below:

- W. P. Carey (WPC) – rated BBB

- Piedmont Office (PDM) – rated BBB

- Gladstone Commercial (GOOD) – not rated.

- Medical Properties (MPW) – rated BB

- Global Net Lease (GNL) – rated BB+

- SL Green (SLG) – rated BB+

We also have these eight REITs on our dividend watch list:

- Easterly Government (DEA): 108% payout ratio (based on AFFO)

- Global Net Lease (GNL): 101% payout ratio (based on AFFO)

- Granite Point Mortgage (GPMT): 200% payout ratio (based on EPS)

- AFC Gamma (AFCG): 97% payout ratio (based on AFFO)

- Healthcare Realty (HR): 106% payout ratio (based on AFFO)

- Crown Castle (CCI): 92% payout ratio (based on 2025 analyst estimates)

- Ready Capital (RC): 115% payout ratio (based on EPS)

- SL Green (SLG): 101% payout ratio (based on 2025 analyst estimates)

Guess what these eight REITs have in common:

- DEA: 9.7% dividend yield

- GNL: 17.5% dividend yield

- GPMT: 17.0% dividend yield

- AFCG: 19.1% dividend yield

- HR: 8.5% dividend yield

- CCI: 6.6% dividend yield

- RC: 14.8% dividend yield

Yes, they all have high dividend yields.

To be clear, I do own shares in HR and CCI, although I’m not increasing exposure to either of these REITs like now.

And I’m still an unlucky stakeholder in MPW!

Although there will be more pain ahead in commercial real estate, we have identified companies with sustainable and growing dividends, critical to our current investment objectives.

You may recall an article that I penned a few weeks ago titled, Earnings Determine Market Price In The Long Run, in which I explained,

“… at the heart of my thesis, is the real-world reality that the ‘stock market’ values a business by capitalizing the company’s earnings power in the long run.”

Legendary investor Warren Buffett has stated that “the value of the company is simply the total of the net owner earnings expected to occur over the life of the business.”

Although certain REITs (like those on our dividend watch list) are likely to see muted or negative earnings growth in the future, we have screened for three of the best companies that should continue to deliver growth over the next 12 months and beyond.

We believe these REITs will be the winners, which is why we’re continue to recommend them and I’m buying for my own account.

Alexandria Real Estate (ARE)

ARE is a life science REIT with a market cap of around $16.35 billion and a 75 million SF portfolio which consists of 41.5 million rentable square feet (“RSF”) of operating properties, 14.5 million RSF of projects in development or properties under construction, and 19.1 million SF allocated for future development.

Alexandria has been developing and leasing out Class A/A+ collaborative life science properties to leading medical, pharmaceutical, and biotechnology companies since they pioneered the life science real estate niche in 1994.

ARE looks to build and own properties in AAA innovation cluster locations which primarily include Boston, San Francisco, New York City, San Diego, Seattle, Maryland, and the Research Triangle.

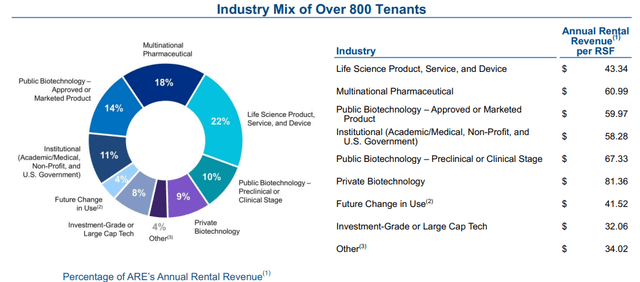

ARE leases its research and laboratory space out to more than 800 tenants which includes well established names such as Moderna, Pfizer, and Merck. The company is well diversified by tenant with its top 20 tenants only making up 32.4% of their annual rental revenue, and their top tenant, Bristol-Myers Squibb, only making up 3.3%.

Additionally, the top 20 tenants have a weighted average remaining lease term of 8.9 years and 16 out of their top 20 tenants are investment-grade credit rated by S&P Global.

ARE – IR

In October Alexandria released its third quarter operating results and reported total revenue during the quarter of $713.8 million, a year-over-year increase of 8.2% when compared to $659.9 million in total revenue they reported in the third quarter of 2022.

Funds from operations (“FFO”) came in at $386.4 million, or $2.26 per share during the third quarter, compared to FFO of $344.7 million, or $2.13 per share for the same period in 2022. On a per share basis, the year-over-year change in FFO represents a growth rate of roughly 6%.

ARE also ended the quarter with an operating property occupancy rate of 93.7% and a weighted average remaining lease term of roughly 7.0 years for its operating properties.

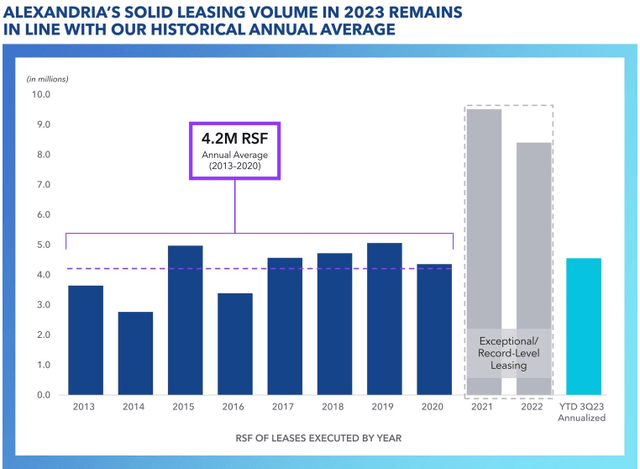

Alexandria reported solid leasing volume and rental rate increases during the quarter with 867,582 RSF of total leasing activity during the quarter with a weighted-average lease term of 13.0 years and an average rental rate increase of 28.8%, or 19.7% on a cash basis.

Additionally, the YTD third-quarter annualized leasing volume of 4.6 million RSF is in line with their average leasing results of 4.2 million RSF from 2013 to 2020.

ARE – IR

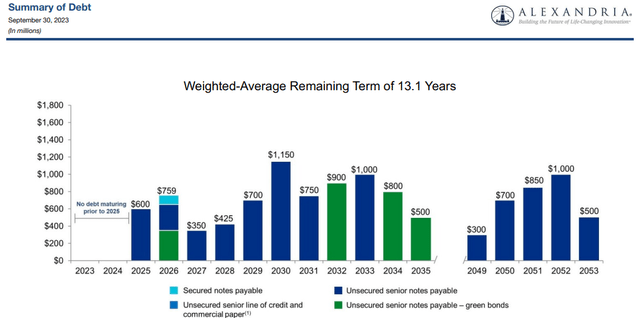

In today’s environment our team is closing watching the balance sheet health of the REITs we cover and Alexandria checks all the boxes with a fortress like balance sheet and significant liquidity at their disposal.

They have an investment-grade balance sheet with a BBB+ credit rating and excellent debt metrics including a total debt and preferred stock to gross assets of 27%, a net debt and preferred stock to adjusted EBITDA of 5.4x, and a fixed charge coverage ratio of 4.8x.

Almost all of the debt is fixed-rate (99%), with a weighted average interest rate of 3.70% and a weighted average term to maturity of 13.1 years. Additionally, they have no debt maturities before 2025 and significant liquidity of $5.9 billion as of their most recent update.

ARE – IR

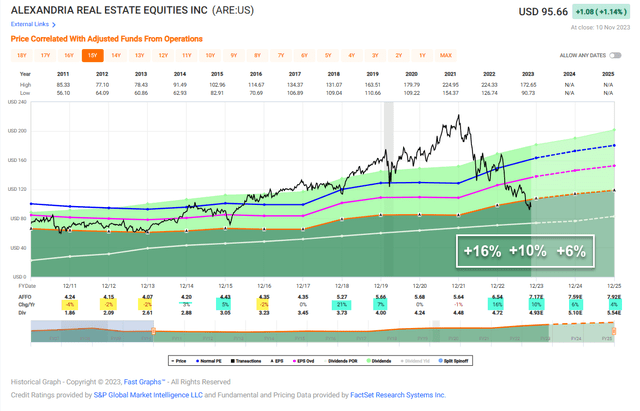

Over the last decade ARE has delivered a blended average adjusted funds from operations (“AFFO”) growth rate of 5.10% and an average dividend growth rate of 8.62%.

The life science REIT delivered a 16% AFFO growth rate in 2022 and analysts expect AFFO per share to increase by 10% and 6% in the years 2023 and 2024, respectively.

Alexandria pays a 5.19% dividend yield that’s well covered with a 2022 year-end AFFO payout ratio of 72.17% and an expected 2023 AFFO payout ratio of 68.75%.

Additionally, this blue-chip REIT is trading at a significant discount with a current P/AFFO ratio of 13.52x, compared to their 10-year average AFFO multiple of 24.18x.

We rate Alexandria Real Estate a Strong Buy.

FAST Graphs

Rexford Industrial (REXR)

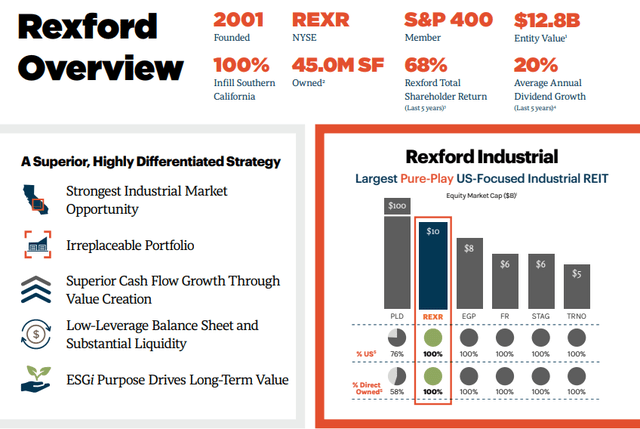

REXR is an industrial REIT that specializes in the acquisition, operation, and redevelopment of industrial properties located throughout infill Southern California (“SoCal”).

REXR is a very high-quality REIT in terms of its earnings growth and balance sheet safety. As a matter of fact, REXR and Prologis (PLD) are the only two industrial REITs that have a quality score of 99 on our ratings tracker, yet the two REITs investment strategy could not be more different.

While PLD has industrial properties in 19 countries across the globe, REXR is exclusively focused on investing in industrial properties throughout infill Southern California.

While normally I would be concerned with this level of geographical concentration, SoCal is the largest industrial market within the U.S. and the fourth largest industrial market in the world.

The SoCal region consistently has high demand for industrial properties with a vast economy made up of approximately 22 million residents and more than 600,000 businesses.

At the same time, industrial supply within the infill SoCal market is limited due to the scarcity of developable land given the natural barriers (mountains / ocean) and restrictive zoning regulations in the state.

REXR owns or has an ownership interest in 371 industrial properties covering 45.0 million RSF, which are occupied by a diverse base of approximately 1,600 tenants.

REXR – IR

Rexford released its third quarter operating results in October and reported total revenues of $205.4 million during 3Q-23, compared to $162.7 million of total revenue during 3Q-22.

Core FFO during the quarter was reported at $115.0 million, or $0.56 per share, compared to Core FFO of $86.1 million, or $0.50 per share during the third quarter of 2022.

Year-over-year Core FFO increased by approximately 33.5%, or 12.0% on a per share basis. Same Property Portfolio NOI increased by 8.9%, or 9.5% on a cash basis when compared to the same period in 2022 and REXR reported an Average Same Property Portfolio occupancy of 97.8%.

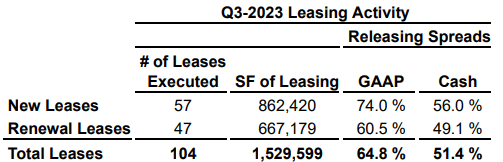

Additionally, during the third quarter REXR executed 104 leases totaling approximately 1.5 million SF with releasing spreads of 64.8% on a GAAP basis, or 51.4% on a cash basis.

REXR – IR

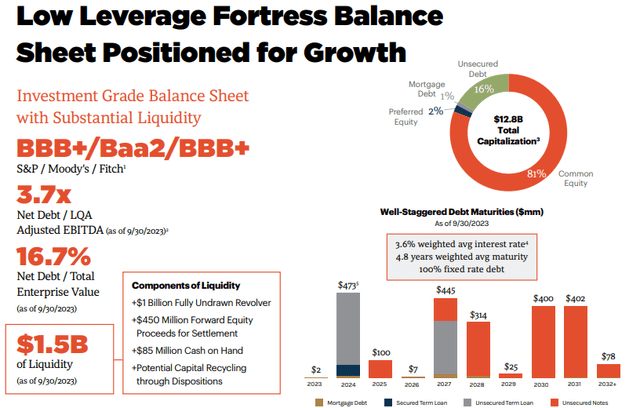

Rexford is investment-grade with a BBB+ credit rating and has excellent debt metrics including a net debt to adjusted EBITDA of 3.7x and a net debt to total enterprise value of 16.7%.

Their debt is 100% fixed rate with a weighted average interest rate of 3.6% and a weighted average term to maturity of 4.8 years. REXR ended the third quarter with approximately $1.5 billion of liquidity which consisted of $1.0 billion available to them under their fully undrawn revolving credit facility, $450 million of forward equity proceeds for settlement, and approximately $83.3 million in cash on hand.

Additionally, when including all available extension options, REXR has no significant debt maturities until 2026.

REXR – IR

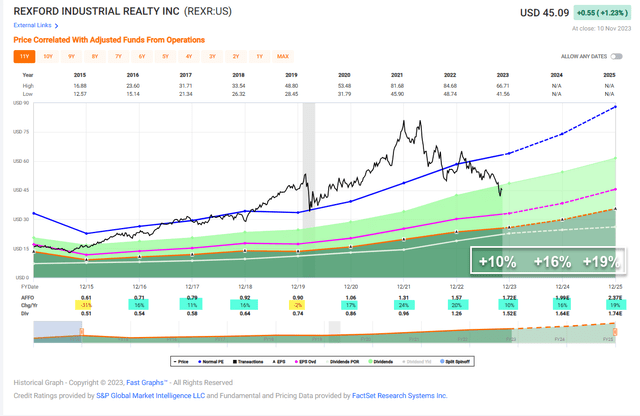

Rexford has achieved a blended average AFFO growth rate of 12.84% and a compound dividend growth rate of 22.03% over the last nine years.

Analysts expect the industrial REITs earnings to continue to grow at a rapid pace, with AFFO expected to increase by 10% in 2023, and then increase by 16% and 19% in the years 2024 and 2025.

REXR pays a 3.37% dividend yield that is well covered with a 2022 year-end AFFO payout ratio of 80.25% and currently trades at a P/AFFO of 26.54x, which is a sharp discount compared to their average AFFO multiple of 35.54x.

We rate Rexford Industrial Realty a Strong Buy.

FAST Graphs

Americold (COLD)

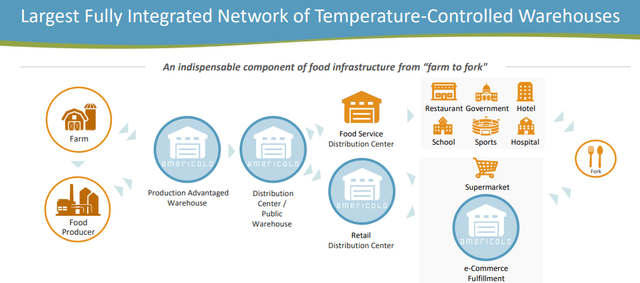

Americold is an industrial REIT that plays a critical role in the supply chain that connects food producers to distributors, retailers, and consumers with one of the most extensive temperature-controlled storage and distribution networks available.

COLD specializes in temperature-controlled logistics real estate and owns and / or operates 243 temperature-controlled warehouses covering approximately 1.5 billion refrigerated cubic feet (45.7 million SF) across North and South America, Europe, and Asia-Pacific.

At the end of the third quarter, COLD had 238 facilities in its Global Warehouse Portfolio and five facilities in its Third-Party Managed segment. By region, the vast majority of COLD’s investments are in North America that has 195 COLD facilities covering 1.3 billion cubic feet (39.5 million SF), followed by Europe that has 27 facilities covering 121 million cubic feet, Asia-Pacific with 19 facilities covering 80 million cubic feet, and South America with 2 facilities covering 10 million cubic feet.

COLD – IR

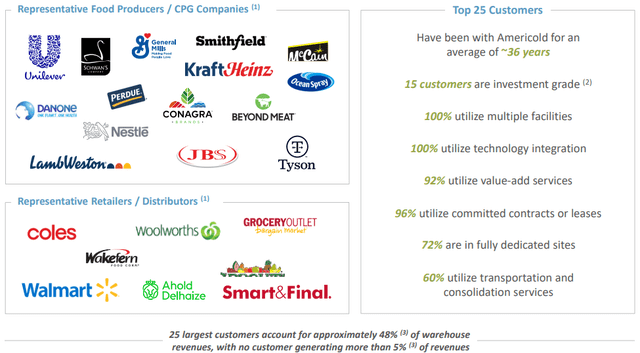

COLD’s industrial properties serve approximately 4,000 customers that include well-known names such as Conagra, General Mills, Ocean Spray, Kraft Heinz, and Krispy Kreme.

Approximately 79% of COLD’s revenue is derived from food manufactures and approximately 19% of their revenue is derived from retailers.

Americold’s top 25 customers have been with the industrial REIT for an average of approximately 36 years and 15 out of their top 25 customers have an investment grade credit rating.

COLD – IR

On Nov. 2 COLD released its operating results for the third quarter and reported total revenues during the quarter of $667.9 million, which is an 11.9% decrease from total revenues of $757.8 million reported during the third quarter of 2022. On the revenue decline, COLD’s management stated:

“Total revenue for the third quarter of 2023 was $667.9 million, a 11.9% decrease, which was driven by decreases in our Third-party managed and Transportation segments, largely offset by growth within our Global Warehouse segment.

The growth within our Global Warehouse segment was driven by our pricing initiatives, rate escalations, improvements in economic occupancy and incremental revenue from recently completed expansion and development projects, partially offset by a decline in throughput due to consumer buying habits, and the unfavorable impact of foreign currency translation.”

Core FFO in 3Q-23 was reported at $69.6 million, or $0.25 per share, compared to Core FFO during 3Q-22 of $67.1 million, or $0.25 per share, and AFFO was reported at $88.2 million, or $0.32 per share, compared to $79.3 million, or $0.29 per share in the third quarter of 2022.

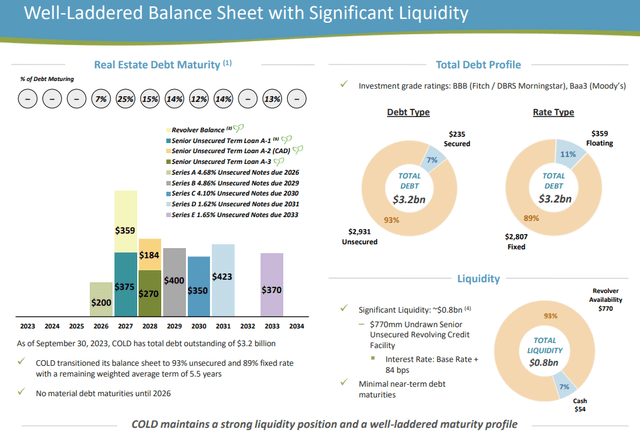

On a per share basis the growth in AFFO represents a year-over-year increase of approximately 10%. COLD, updating on its financial condition, reported a net debt to pro forma Core EBITDA of 5.7x and total liquidity of approximately $823.8 million consisting of cash and availability on its revolving credit facility.

COLD has an investment-grade balance sheet with a Baa3 credit rating from Moody’s and a conservative debt profile with unsecured and fixed rate debt making up 93% and 89% of their total debt, respectively.

Additionally, COLD’s real estate debt has a weighted average term to maturity of 5.5 years and weighted average contractual interest rate of 3.8% with no material debt maturities before 2026 when including the company’s extension options.

COLD – IR

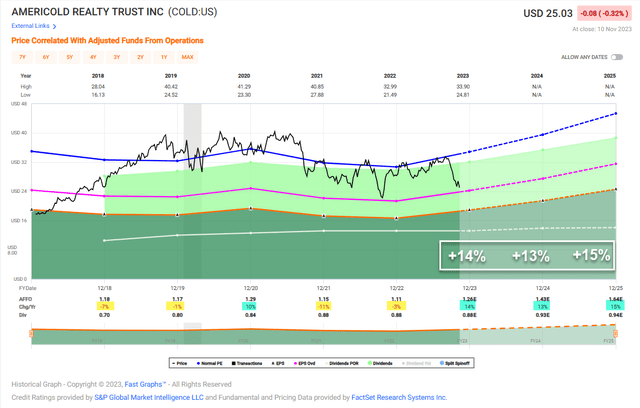

Since 2018 COLD has had a blended average AFFO growth rate of 3.30% and an average dividend growth rate of 5.93%.

COLD’s AFFO per share fell by -11% in 2021 and fell by -3% in 2022, but analysts are calling for AFFO per share to grow by 14% in 2023, and then grow by 13% and 15% in the years 2024 and 2025, respectively.

COLD pays a 3.52% dividend yield that’s well covered with a 2022 year-end AFFO payout ratio of 79.28% and a 2023 expected AFFO payout ratio of approximately 70%. The stock is trading at a P/AFFO of 20.20x, which is a significant discount when compared to their normal AFFO multiple of 27.65x.

We rate Americold Realty Trust a Buy.

FAST Graphs

In Closing

We recommend avoiding REITs with high leverage and elevated payout ratios, and instead focusing on REITs like the one’s discussed here.

As I mentioned above, I felt that it was important for readers to tune into my harbinger article after I began to ponder the current cycle. I even spotted these gloves that someone left at the gym, which was a signal that I should take my message to the masses.

Brad Thomas

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here