CrowdStrike Holdings, Inc. (NASDAQ:CRWD) has emerged as a formidable player in the cybersecurity domain, as evidenced by its impressive financial performance in past quarters. The company is set to unveil Q3 2024 earnings on November 28, 2023, with expected optimistic forecasts. This piece delves into CrowdStrike’s present financial condition and conducts a technical examination of its stock price to identify upcoming trends and investment possibilities. The analysis indicates that CrowdStrike’s positive earnings could significantly enhance the stock’s value.

Strong Revenue and Profit Growth

The company is expected to announce Q3 2024 earnings on November 28, 2023, and projects total revenue between $775.4 and $778.0 million. Non-GAAP income from operations is expected to range from $154.4 to $156.3 million, and non-GAAP net income attributable to CrowdStrike is forecasted to be between $179.8 and $181.8 million. Additionally, the diluted non-GAAP net income per share attributable to CrowdStrike common stockholders is estimated to be $0.74. The weighted average shares used in computing non-GAAP net income per share attributable to common stockholders are projected to be 244 million. Furthermore, the company projects its 2024 revenue to hit $3.04 billion, rising to $3.90 billion in 2025. These significant estimates point to a substantial increase in profitability.

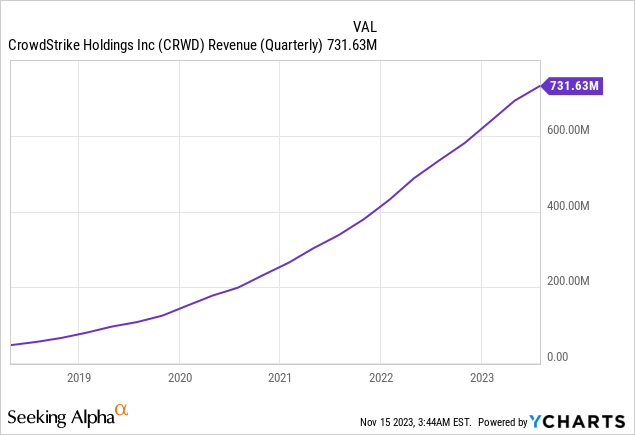

The robust forecasts are attributed to CrowdStrike’s impressive showing in Q2 2024. The company saw a solid revenue stream, with total earnings hitting $731.63 million. This represents a substantial 37% surge from the $535.2 million reported in Q2 2023. This growth was primarily driven by a notable rise in subscription revenue, which soared to $690.0 million, up 36% from $506.2 million in Q2 2023. The chart below illustrates CrowdStrike’s quarterly revenue, showcasing a linear upward trend in values, indicating the company’s profitability.

A key highlight of CrowdStrike’s financials in Q2 2024 was the substantial growth in Annual Recurring Revenue (ARR), which escalated by 37% year-over-year, reaching $2.93 billion. The addition of $196.2 million in net new ARR during the quarter underscores the company’s ability to attract and retain customers consistently. This growth in ARR is significant, as it indicates a stable and predictable revenue stream, which is crucial for long-term financial health.

Moreover, the improvement in gross margins, particularly in the subscription segment, was another positive aspect. The GAAP subscription gross margin increased to 78% from 76% in Q2 2023, while the non-GAAP subscription gross margin improved to 80% from 78%. These improvements reflect the company’s ability to scale its operations efficiently.

CrowdStrike’s move toward profitability was also evident. The company reported a GAAP loss from operations of $15.4 million, a substantial improvement from a $48.3 million loss in Q2 2023. More impressively, non-GAAP income from operations stood at $155.7 million, doubling from $87.3 million in Q2 2023. This transition towards profitability, particularly on a non-GAAP basis, signals robust operational control and effective cost management.

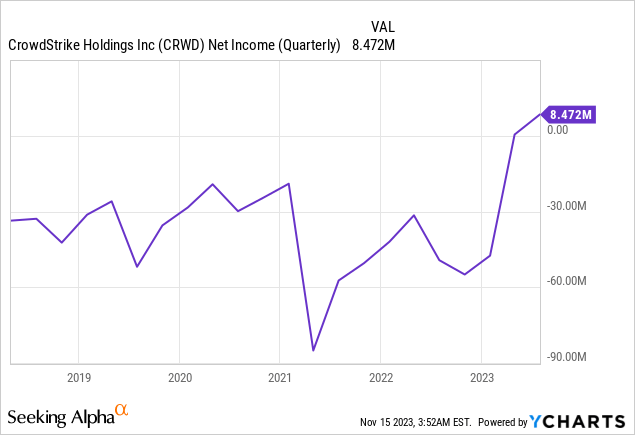

Net income figures further cemented this positive outlook. GAAP net income attributable to CrowdStrike was $8.472 million, a remarkable turnaround from a loss of $49.3 million in the previous year, as shown in the chart below. Non-GAAP net income was even more impressive at $180.0 million, up from $85.9 million in Q2 2023.

The company’s cash flow performance was also strong, with net cash generated from operations at $244.8 million and free cash flow at $188.7 million. These figures demonstrate robust cash generation capabilities and provide financial flexibility for future investments and growth initiatives.

Overall, CrowdStrike’s fiscal performance in Q2 2024 lays a solid foundation for its Q3 2024 projections, highlighting its consistent growth trajectory and operational efficiency. The financial results reflect a well-executed strategy for expanding its customer base and enhancing its product offerings, contributing to the significant rise in ARR and improved profit margins. Given these solid underlying trends, the anticipated Q3 2024 results will likely sustain this momentum, reinforcing CrowdStrike’s position as a leader in the cybersecurity industry.

Decoding the Dynamics of Bullish Market Prices

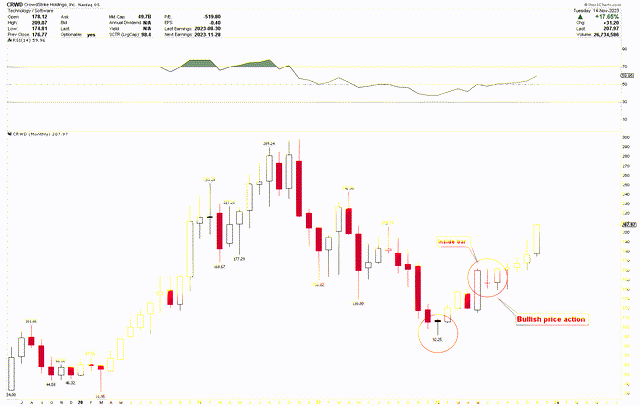

The long-term outlook for the CrowdStrike is strongly bullish, as seen by the monthly chart below. It is observed that the stock price has been rising from the 2020 bottom of $31.95 to an all-time high in 2021. This significant bottom in 2020 was marked due to initial market uncertainties caused by the COVID-19 pandemic. However, it rebounded and rose sharply later in 2020 and into early 2021. This surge was attributed to several key factors.

Firstly, the pandemic accelerated the shift towards remote work, dramatically increasing the demand for robust cybersecurity solutions to protect remote systems and data. CrowdStrike’s cloud-native Falcon platform, known for its effectiveness in endpoint security, became increasingly relevant in this new work environment. The company’s consistent revenue growth and expanding customer base, coupled with solid earnings reports, bolstered investor confidence. Furthermore, heightened cyber threats during this period underscored the importance of cybersecurity, making CrowdStrike’s services more vital than ever. These factors combined drove the rapid appreciation of CrowdStrike’s stock during this period.

CRWD Monthly Chart (stockcharts.com)

In 2022, the stock price of CrowdStrike was influenced by a confluence of broader market trends and specific company factors. The tech sector generally experienced a significant correction after the rapid growth seen during the pandemic, with investors reassessing valuations in the face of rising interest rates, inflation concerns, and economic uncertainty. For CrowdStrike specifically, although the company continued to demonstrate growth, there were concerns about slowing momentum in its earnings and customer acquisition rates as the urgency for remote work solutions stabilized post-pandemic.

Additionally, increased competition in the cybersecurity space added pressure. However, in 2023, CrowdStrike’s stock began to rebound, driven by its strong fundamentals, such as consistent revenue growth, a solid customer base, and a market environment more favorable to growth stocks. The company’s continued innovation in cybersecurity products and its strategic partnerships also played a crucial role in regaining investor confidence, leading to a recovery in its stock price.

The notable recovery seen in 2023 has been underscored by a robust bullish trend, as evidenced by the inside bar candlestick pattern in June 2023, signaling a period of price consolidation. This inside bar was subsequently breached on the upside, leading to a surge in prices to higher levels. The sustained elevation in prices post-June 2023 underscores the market’s bullish momentum.

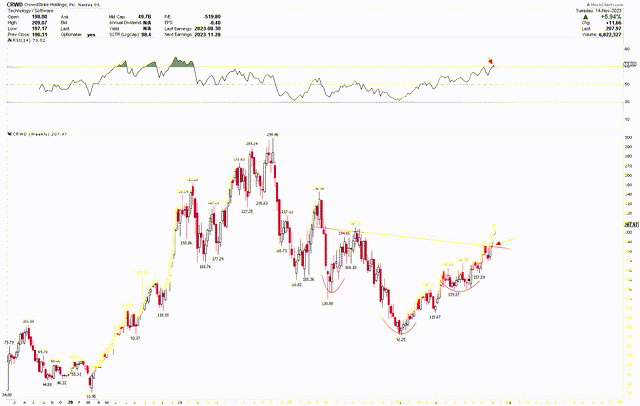

Furthermore, the weekly chart below showcases an inverted head and shoulders formation, with the head at $92.25 and the shoulders at $130 and $139.37. These formations underscore the bullish momentum in price movements and suggest an upward price trajectory. These patterns were surpassed two weeks ago, increasing prices rapidly. However, the current approach towards an overbought zone suggests the possibility of a market correction. Such a correction could offer attractive entry points for long-term investors.

CRWD Weekly Chart (stockcharts.com)

Given the above analysis and the optimistic price outlook, investors should consider buying CrowdStrike at its current value, with the potential for further gains. Investors may also consider increasing holdings should there be price dips around $180.

Market Risk

The cybersecurity market is highly competitive, with numerous established players and emerging startups. CrowdStrike faces the challenge of maintaining its market position and continuing to innovate in a rapidly evolving industry. As cybersecurity threats become more sophisticated, the company must continually invest in research and development to enhance its products and services. Failure to keep pace with technological advancements and evolving cyber threats could result in a loss of market share.

Another significant risk is the potential for economic downturns or shifts in IT spending. CrowdStrike’s growth trajectory could be impacted by broader economic factors such as recession, corporate IT spending changes, or regulatory environment shifts. For example, reducing IT budgets could decrease demand for cybersecurity solutions, impacting the company’s revenue and growth prospects. Furthermore, changes in data privacy and cybersecurity regulations across different regions could affect operational costs and require adjustments in business strategies, potentially impacting profitability.

Lastly, there’s a risk associated with the company’s valuation and stock performance. While CrowdStrike’s stock has recovered in 2023, the tech sector is known for its volatility. High-growth stocks like CrowdStrike often trade at premium valuations, making them susceptible to market sentiment and interest rate changes. The Federal Reserve’s monetary policy, particularly regarding interest rates, can significantly impact investor appetite for growth stocks. A rise in interest rates could lead to a revaluation of growth stock valuations, potentially resulting in stock price volatility.

Bottom Line

In conclusion, CrowdStrike is a beacon in the cybersecurity sector, demonstrating robust financial health and a promising growth trajectory. The company’s upcoming Q3 2024 earnings are anticipated with optimism, reflecting its strong financial performance in recent quarters. CrowdStrike’s impressive revenue growth, substantial increases in ARR, and a shift toward profitability underscore its operational prowess and strategic execution. These factors, coupled with an expanding customer base and enhanced product offerings, solidify its position as a leader in the industry.

The technical analysis of CrowdStrike’s stock price further accentuates its bullish market position. The recovery of its stock price in 2023, driven by solid fundamentals and market confidence, suggests a positive outlook for investors. The stock’s price patterns indicate a solid upward trajectory, although potential market corrections could provide advantageous entry points for long-term investment strategies. Investors have the opportunity to enter the market now, expecting the upward trend to persist. Nonetheless, if the price dips to around $180, it presents an additional chance to increase long positions.

Read the full article here