By James Smith, Developed Markets Economist

To no great surprise, UK inflation plunged in October as the impact of lower gas prices finally showed through in a meaningful way. Last year’s 25% increase in household energy bills has dropped out of the annual comparison, while electricity/gas prices fell by 7% in October this year. And though a much less important factor in this latest drop, food price inflation has slowed dramatically too. Producer prices suggest the level of consumer prices at the checkout could actually start falling over the next few months. The net result is that headline CPI now stands at 4.6%, down from 6.7% in September. It’s unlikely to change much again before year-end.

Inevitably, this will raise a few smiles in Downing Street, and much of the focus of Wednesday’s data will be on the fact that Prime Minister Rishi Sunak has met his goal of ‘halving inflation’. But the Bank of England has to be pretty pleased too.

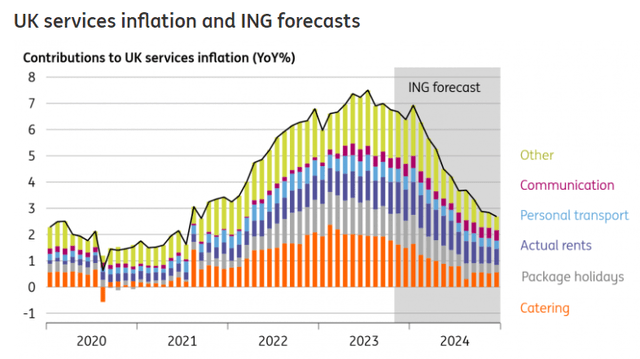

That’s because services inflation, the key metric for policymakers, came in much lower than the Bank had anticipated. Services CPI now stands at 6.6% on a year-on-year basis, below the BoE’s 6.9% forecast. That’s lower than we’d expected too, and this is partly because we’d been expecting another large increase in rents in October. The ONS reportedly updates social rents once per quarter and in April and July, we saw unprecedented increases in the overall rent category because of this, helping to push up services inflation. That ultimately didn’t happen last month, and while it’s a fairly niche quirk that would not likely have meant anything for monetary policy, it might help explain some of the difference with the BoE’s forecast.

Macrobond, ING calculations

Even so, we can be pretty confident now that services inflation has indeed peaked and is trending downwards. Surveys show that fewer firms are raising prices now, and for the service sector we think that can be partly explained by lower gas prices. Higher energy costs late last year were reported by firms to be a key driver of higher consumer prices, and we expect the same to be true in reverse now that gas prices are down. Further progress on services inflation may be limited in the short term – we expect it to end the year just above 6% – but we expect it to come down more readily from the spring and reach the 3.5-4% area next summer. Together with lower wage growth by that point, we think this will be a key catalyst for rate cuts to begin from August.

Wednesday’s figures also all but rule out a resumption of rate hikes in December, though the chances were already low. This was the only CPI release before the next meeting, and we’ll only get one more wage release before then. The next move in rates is therefore likely to be down.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here