Research Note Summary

Returning to a favorite sector of mine, financials, in today’s research note I’ll be doing my 3 month review of Capital One Financial (NYSE:COF), after its recent earnings release in late October.

My prior two notes on this stock appear to have been called correctly by me, as my hold rating in May was followed by a significant uptick in the share price while my sell rating in August was followed by a steep downward price dip.

COF – performance vs last ratings (Seeking Alpha)

After applying an updated methodology this time, I decided to upgrade this stock back to a hold rating again.

Some positives driving this rating are a nice 3 year dividend growth and 2.3% yield, YoY earnings growth, and undervaluation.

Some offsetting headwinds include underperformance vs the S&P500 index, YoY revenue declines and weak growth vs peers, and not a great dip-buying price opportunity right now as was earlier this year.

Key risks addressed in this note include exposure to office loans and rising net charge offs.

Methodology Used

My WholeScore Rating methodology looks at this stock holistically across multiple categories including key risks, and assigns a rating score. I exclusively cover stocks and foreign ADRs that are dividend-paying and trade on major US exchanges only (NYSE, Nasdaq), from all industry sectors.

Some of the data comes from the most recent FY23 Q3 results from October 26th, while the forward-looking sentiment relates to the upcoming FY23 Q4 earnings results expected in a few months on January 25th.

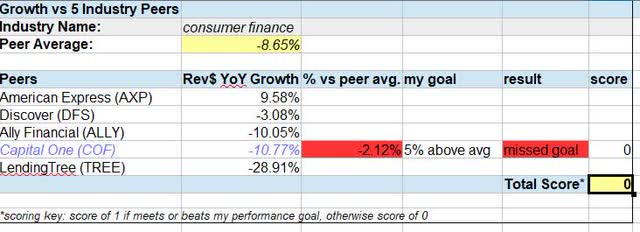

Growth vs Industry Peers

From the consumer finance sector, I selected a peer group of 5 stocks to compare each other’s YoY revenue growth. These were picked due to their strong brand names and market presence, and their extensive exposure to consumer cards and lending, rather than investment banking or custodian banking such as a Bank of New York Mellon (BK) or State Street (STT), for example.

Within this peer group I built, the YoY growth average was negative -8.6%, so definitely some headwinds to revenue in the last year. Capital One saw a nearly 11% drop in this period tracked, being worse than the peer average and missing my target, so losing a rating point from me.

COF – growth vs peers (author analysis)

The nature of this sector is that it took a hit last spring during the debacle over a few regional bank failures in the US, as fears of contagion were abundant. In fact, in my own portfolio of financial stocks, none of which are listed here, I also saw a significant unrealized loss in that period, but I also found a few opportunities to trade on short-term volatility that was happening.

This particular peer group is very exposed to the American consumer, and therefore the metrics that matter to me in this sector are items like net chargeoff trends, loan losses, net interest margin, and so on.

Financial Statements

Some of the key metrics that matter to me as a Seeking Alpha analyst come from the accounting statements themselves.

From the income statement, for instance, I care about the YoY growth in top-line revenue and bottom-line earnings. In the case of Capital One, they saw a slight 0.76% YoY decline in revenue, however also achieved a 5.6% YoY gain in net income, which I think is a plus, and beating my target.

COF – financial statements (author analysis)

In terms of cashflow, I saw a very impressive 173% YoY improvement in free cash flow per share, also beating my goal.

In addition, its $53.6B in positive equity was also a YoY improvement, earning another rating point from me.

As a consumer card – driven bank, among other things, I think it is important to mention the role of consumer spending with cards and how I think it will continue to benefit this bank going forward.

In its credit card segment, the bank’s Q3 comments mentioned “purchase volume up 6% year-over-year” and “revenue up $860 million, or 15%, year over-year.” Similar figures were seen in its domestic card business as well. Note that it was the consumer banking business that actually saw a drop in revenue, not the card business.

An article today in Fox Business highlighted the fact that US card spending remains strong, which I think will favor consumer-driven banks like Capital One in the near term at least:

Americans now owe $1.08 trillion on their credit cards after racking up a collective $48 billion in new spending during the third quarter of 2023, according to a recent report on household debt from the Federal Reserve Bank of New York.

Dividends

As a dividend-focused investor, I look for dividends that have an above average yield but also a nice 3 year positive growth of at least 5%.

In the case of this stock, when comparing the quarterly dividend of November 2023 with that of November 2020, it saw a 500% increase in that time period, beating my target by a lot.

COF – dividends (author analysis)

On the downside, though, its dividend yield (forward) was about 42% below the sector average that is close to 4% by now.

When comparing to its peer group, a much better dividend yield of 4.70% could be snagged from owning stock in Ally Financial (ALLY), for example, as well as from fellow consumer card-focused Discover Financial (DFS) with a yield of 3.3%.

Again, another reason I would wait on the next price dip to buy this stock and grab a much better dividend yield. Will that dip come? That remains to be seen. The market seems to be in a holding pattern waiting to see if the dreaded word “recession” ends up materializing or not, which of course can impact any consumer-driven stocks and bring out the bears.

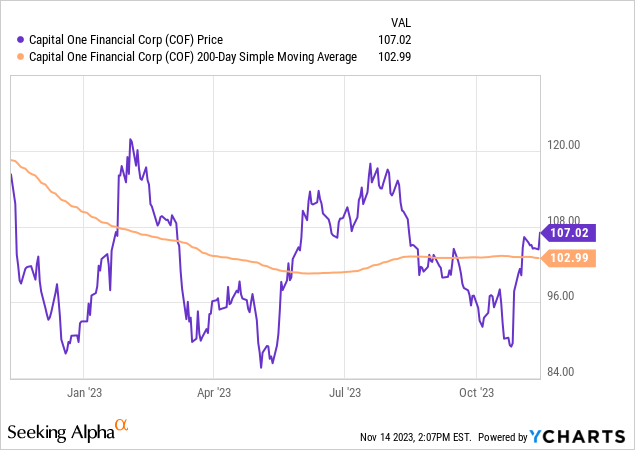

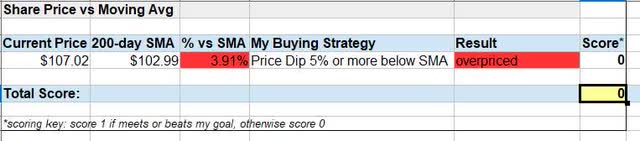

Share Price vs Moving Average

In the financials sector, particularly this year, I have been looking for decent price dip opportunities and crossovers below the 200 -day moving average.

With this stock, you see that the best dip opportunity to snatch would have been that spring dip during the regional banking meltdown, because soon after it led to a huge price rebound back above the moving average.

Another nice crossover below the average happened earlier this fall, possibly when several banks received rating agency downgrades. According to a CBS News article from August, Capital One was one of the banks whose outlook was shifted to negative from stable by agency Moody’s.

However, the market bulls saw the buy opportunity and drove the share price back up above the moving average, where it is now, hovering around $107.02 as of this article.

From my perspective, I think that its share price, nearly 4% above the moving average, is a bit higher than I would like to grab it at, particularly when its earnings results have not been great, so I am not calling it a buy at this price.

COF – share price vs moving avg (author analysis)

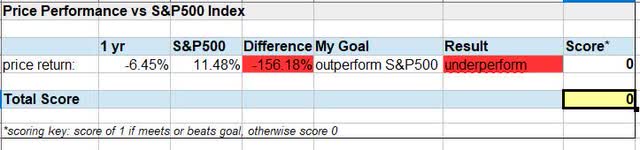

Performance vs S&P 500 Index

The market momentum of this stock has not been great this year, with a 1 year price return of -6.4%, underperforming the S&P500 index by more than 150%, and losing a point from me in this category.

COF – performance vs S&P500 (author analysis)

Its peer Discover Financial also did not fare well vs the tech-heavy S&P500 index, seeing a 1 year price return of negative -18.8%, while peer and a leading credit card issuer American Express (AXP) also underperformed the index.

Between the spring banking calamity, ratings downgrades from Moody’s, talk of recession, and concerns over deposits fleeing to higher-interest money market funds, this sector has taken a battering this year while at the same time the “AI” hype has helped steer bulls into big tech.

I think it may take a little while for banks to attract the market momentum again, but this situation could also present buy-and-hold opportunities since these banks have been paying steady dividends and that should be considered a cashflow opportunity particularly for long-term “holders” of these stocks.

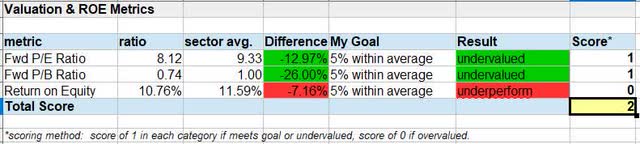

Valuation and ROE

There is clearly an undervaluation opportunity here with this stock, from looking into the valuation data such as forward P/E and P/B ratio.

We can see the P/E is nearly 13% below the sector average, while the P/B is 26% below the sector average and hovering under 1x book value.

COF – valuation and ROE (author analysis)

However, its return on equity (ROE TTM), which is another metric I look at in conjunction with valuation, is about 7% below the sector average, achieving nearly 11% return on equity.

The sluggish ROE could be due to poor earnings growth combined with positive equity growth. Both the price to earnings and price to book appear reasonably undervalued in my opinion.

Earnings have been sluggish and price has spiked but not all that much higher than the moving average, so it is keeping the price-to-earnings ratio at a reasonable 8x earnings. At the same time, with a nice improvement to equity (book value) lately it has driven the P/B ratio down to around 0.75x book value.

At these low valuations, I almost would love to give this stock a modest “buy” rating if only all the other metrics had lined up in its favor.

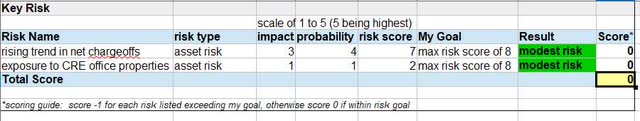

Key Risks

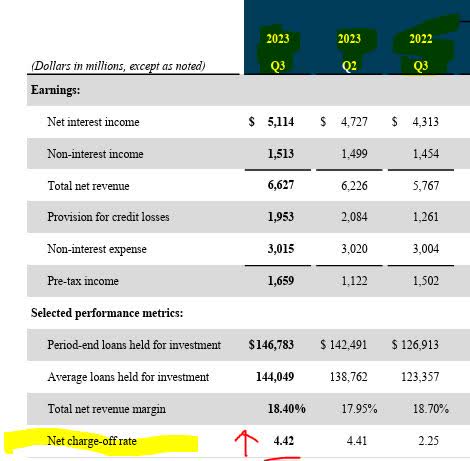

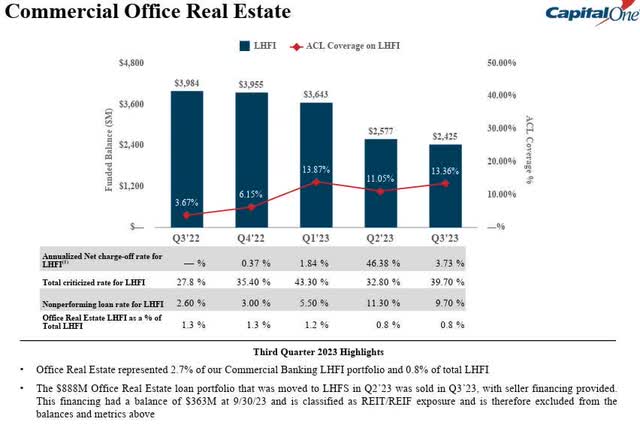

The two risks I want to highlight here for this company are exposure to commercial real estate loans, particularly office properties, as well as trends in net charge offs on loans and credit cards, a common metric tracked in banking.

From a risk view, these metrics also tell a risk story for this bank.

The below table from the company’s Q3 presentation shows the current net charge off rate on their credit card business has gone up to 4.42%, up from 2.25% in Q3 of the prior year. That is around a 96% increase in the ratio, so something to consider for sure.

COF – rise in net chargeoffs – credit cards (company Q3 earnings)

The net charge off rate also went up in the consumer banking business as well, now at 1.81%, up from 1.10% the same quarter a year ago.

COF – rise in net chargeoff rate – consumer banking (company earnings presentation)

The story this tells is of a rising trend in exposure to bad consumer debt, however it is not limited to this bank. For instance, a study by S&P Global in late September discovered that the net charge off rate has risen among six major US credit card issuers, but also rise in delinquency.

According to the article:

Across the six major US card issuers, the average 30-plus-day credit card delinquency rate increased 4 basis points sequentially to 1.21%, which was also 39 basis points higher on a yearly basis.

Capital One Financial continued to post the highest delinquency rate among the six issuers. The company’s 30-plus-days delinquency rate ticked up 8 basis points sequentially to 1.62% in August. The company’s yearly jump in delinquencies, 59 basis points, was the highest among the group in August.

In terms of commercial real estate exposure, the following graphic from the company’s own data shows the nonperforming loan rate at 9.7% in Q3, up quite a bit from 2.6% in the same quarter a year ago. However, the exposure to “office” appears to be less than 3% of the overall CRE portfolio, so not a huge number in my opinion.

COF – CRE exposure (company presentation)

Because these loans are an asset of the bank, I categorize it as an asset risk.

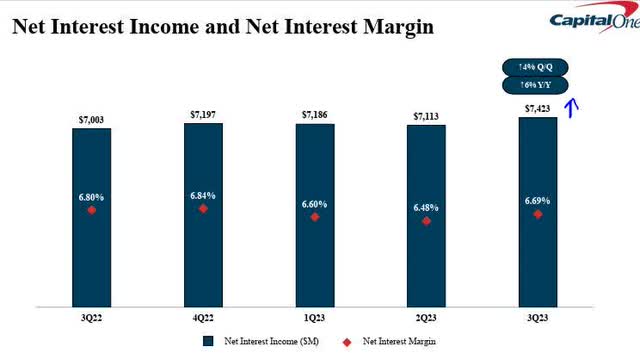

It should also be mentioned that there are offsetting factors to these risks, and that is the rising trend in net interest income (NII). as well as a strong net interest margin (NIM), which I would say are benefits of the high rate environment we are in.

COF – NII and NIM (company q3 presentation)

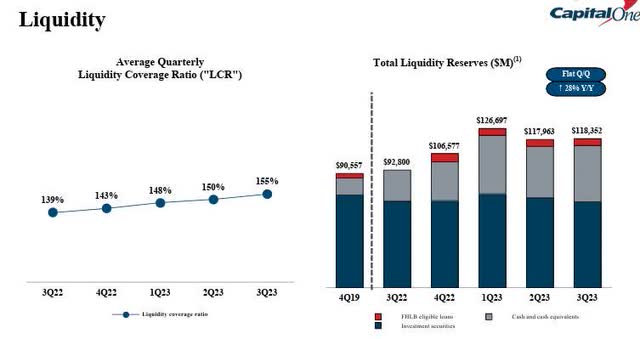

Another offsetting factor to the asset risk is that this bank has a strong liquidity position that continues to get even better each quarter. Consider that its liquidity coverage ratio and liquidity reserves have both seen improvements:

COF – liquidity (company q3 presentation)

So, in my risk scoring table below I determined that both risks are only modest ones, and I won’t be taking a point away from the total score because of them.

COF – key risks (author analysis)

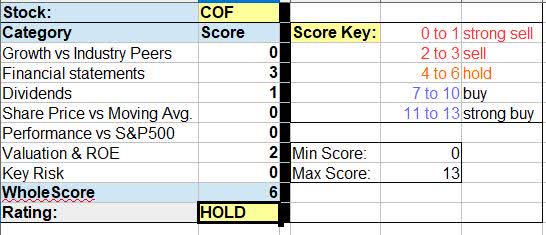

WholeScore Rating

In today’s WholeScore the stock scored a 6, earning a hold rating from me this time around.

COF – WholeScore (author analysis)

To compare my rating with that of the consensus, this time I am completely in agreement with the sentiment from Wall Street and SA analysts, but I think the SA quant system is being overly bullish yet this stock does not appear to be a bull case right now.

COF – rating consensus (Seeking Alpha)

My Forward-Looking Sentiment

As long as there is continued demand from the American consumer for buying things on debt, and enough confidence to keep spending, I think banks like Capital One will continue to have a robust card business that serves that purpose, despite competition from other card issuers targeting those same consumers.

At the same time, we cannot ignore the fact that the cost of credit also has risen a lot and sooner or later the chickens have to come home to roost, as the saying goes.

My forward sentiment therefore is positive but cautious, and although I don’t currently hold this stock in my financials portfolio if I did I would have added during the earlier price dip then held, using it for dividend income and selling covered call options to generate cashflow, but would have kept it in a diversified portfolio along with some bigger banks as well in order to spread the risk.

So, for this time around, upgrade from sell to hold and consider it a modest dividend income play.

Read the full article here