The BlackRock Taxable Municipal Bond Trust (NYSE:BBN) is one of the more interesting closed-end funds, or CEFs, that income-seeking investors can purchase in order to achieve their goals. This fund is a bit different than many of its peers though, because it invests in municipal debt. Ordinarily, investing in municipal debt would result in the fund having a lower-than-expected yield because municipal debt itself tends to have low yields relative to corporates or even to U.S. Treasuries. This is because these securities do not require their holders to pay federal income taxes on the interest payments, so the lower yields are acceptable.

This fund is a bit different though, because the municipal securities that it invests in are still subject to income taxes. Despite this though, the fund does have a pretty low yield in the current environment. As of the time of writing, the BlackRock Taxable Municipal Bond Trust only yields 7.18%. As we have seen in numerous previous articles, most fixed-income closed-end funds have yields in the double-digits right now, so this fund appears to have little to offer on the surface.

The only real advantage that this fund has over its higher-yielding peers is that municipalities are generally considered to be less likely to default than corporations or other private issuers. After all, these entities have the ability to raise taxes as necessary to come up with the money needed to pay their debts. As such, their debt will usually be higher rated than corporate debt and so have a bit lower interest rate to compensate for the lower default risk. However, municipalities are hardly free from default risk, and we have seen cities and towns go bankrupt on occasion. Thus, the securities in this fund are hardly “risk-free,” although the interest is subsidized by the Federal Government, so they are theoretically less risky than ordinary municipal bonds.

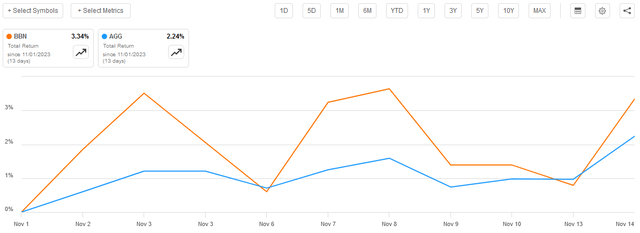

As regular readers may recall, we last discussed the BlackRock Taxable Municipal Bond Trust in early August. The fund’s performance since that time has been quite impressive, as it has managed to outperform the Bloomberg U.S. Aggregate Bond Index (AGG) on a total return basis:

Seeking Alpha

We can see though that the fund is far more volatile than the index, which is almost certainly due to its use of leverage. We will discuss that later in this article. Overall, though, the fund’s recent performance is probably good enough to keep most income-focused investors reasonably satisfied.

The big question at this point is, of course, where the fund goes from here. The market is clearly very optimistic as many market participants expect that the Federal Reserve will shortly cut rates and provide capital gains to the holders of fixed-income securities like the ones contained in this fund. That may not be as likely to occur as the market believes, however.

About The Fund

According to the fund’s webpage, the BlackRock Taxable Municipal Bond Trust has the primary objective of providing its investors with a high level of current income. This makes a lot of sense considering that this fund invests in fixed-income securities, which as we have discussed before deliver all of their net capital gains over their lifetimes to investors via direct payments. This fund uses a slightly different strategy than most other bond funds though, which is described in detail on the webpage:

BlackRock Taxable Municipal Bond Trust investment objective is to seek high current income, with a secondary objective of capital appreciation. Under normal market conditions, the Trust invests at least 80% of its managed assets in taxable municipal securities, which include Build America Bonds. The Trust also has the ability to invest up to 20% of its managed assets in securities other than taxable municipal securities. Such other securities include tax-exempt securities, U.S. Treasury securities, obligations of the U.S. Government, its agencies and instrumentalities and corporate bonds issued by issuers that have, in the investment adviser’s view, typically been associated with or sold in the municipal market, such as bonds issued by private universities and hospitals, or bonds sold to finance military housing developments.

Clearly, the fund wants to be viewed primarily as a municipal bond fund without veering into the tax-exempt realm occupied by most municipal bond funds. This removes a lot of the appeal that would normally come with purchasing municipal bonds. The fund’s yield is pretty low for a taxable bond fund, though. It is better than most tax-free municipal bond funds, though, as many of them have current yields under 6%. Thus, we are getting a yield that compensates for the fact that these are taxable securities, but a 7.18% yield is still very low compared to most fixed-income funds that are delivering double-digit payouts right now.

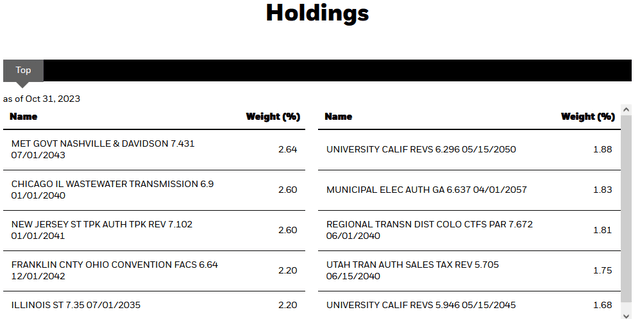

As the description of the fund’s strategy suggests, the BlackRock Taxable Municipal Bond Trust invests very heavily in Build America Bonds, which were created as part of the American Recovery and Reinvestment Act and were intended to finance infrastructure investment. As that law was passed in 2009, we might expect that many of the bonds held by this fund are many years old at this point. There is, unfortunately, no easy way to determine if this is the case as the fund’s literature and webpage only list maturity dates and not issuance dates. We can see that the bonds that constitute the fund’s top ten holdings all have maturity dates ranging from 2035 to 2057:

BlackRock

As such, these are very long-dated bonds. That is something that has been weighing on this fund for a while, due to the fact that bonds with maturity dates far into the future tend to be much more sensitive to interest rates. This is a concept called duration, and the BlackRock Taxable Municipal Bond Trust has an average duration of 10.90 years today. The effective duration of the iShares Core U.S. Aggregate Bond ETF, which tracks the Bloomberg U.S. Aggregate Bond Index, is 6.02 years as of the time of writing. As such, we can expect the bonds held by the BlackRock Taxable Municipal Bond Trust to be more interest-rate sensitive than the aggregate bond index.

We can in fact see that, this fund has underperformed the index by quite a lot over the past three years:

Seeking Alpha

As we can see, this fund both appreciated in 2021 and fell in 2022 a lot more than the Bloomberg U.S. Aggregate Bond Index. There may be some readers that highlight this fund’s leverage as a cause of that. It is certainly true that the fund’s leverage played a role in its underperformance too, but we still should not completely ignore the duration difference between the two assets. The BlackRock Taxable Municipal Bond Trust probably would have declined more than the aggregate bond index in 2022 even if it was not using leverage because of the duration difference.

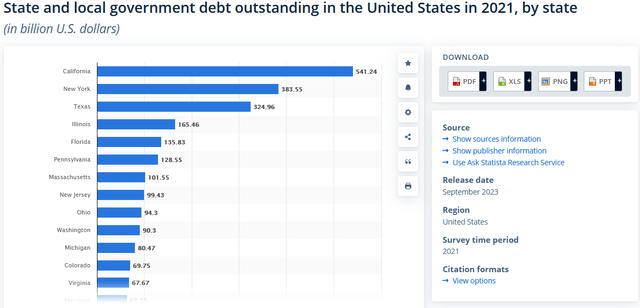

One thing that we have heard a lot about in the media is that some states are seeing their finances stressed. Exactly which states those are seems to depend on what source you consult. This article from MSN states that Texas, New Mexico, Alaska, and a few other states that have either manufacturing or the production of energy are on the brink of financial disaster. Other sources specifically mention California, Illinois, New York, and New Jersey. Sadly, it seems that right now even information about state and local government finances is being run through a partisan filter and affected by the opinion of the reporter.

Statista states that the following states are the most indebted:

Statista

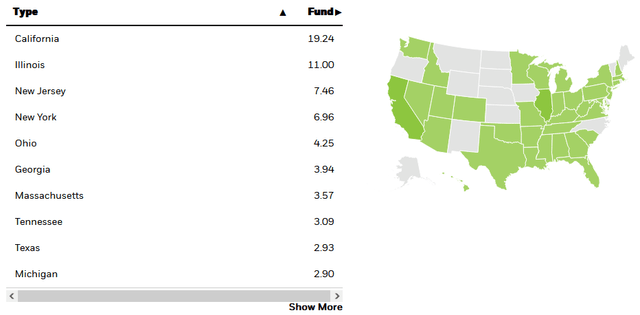

We specifically see California, New York, Illinois, and New Jersey on that list. This is important for our purposes today because these are also the states that have the largest representation in the BlackRock Taxable Municipal Bond Trust:

BlackRock

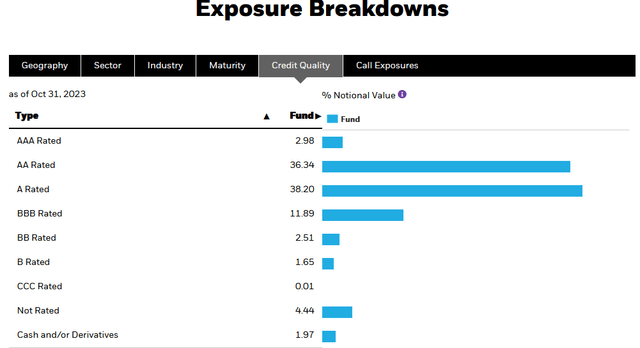

In particular, we can see that this fund has tremendously high exposure to both California and Illinois, which are both running fiscal deficits right now. For its part, California does tend to run a surplus when the stock market is booming, but the current financial struggles of these two states should be considered by investors before purchasing this fund. With that said though, the default risk of a state should be pretty low. Indeed, the major rating agencies do give most of the fund’s assets an investment-grade credit rating:

BlackRock

We can quickly see that 74.54% of the fund’s assets carry either an A or an AA rating and if we add in the AAA-rated debt above, we are well over three-fourths of the fund’s total assets. As such, investors can probably rest easy regarding the default risk of this fund, even though it does have substantial exposure to two of the most highly indebted states.

Interest Rate Risk

The biggest risk for investors in this fund is almost certainly going to be interest rates. As already mentioned, the bonds held by this fund have a higher duration than average, so they are more sensitive to changes in interest rates. That could, of course, be a problem if interest rates go up further from here.

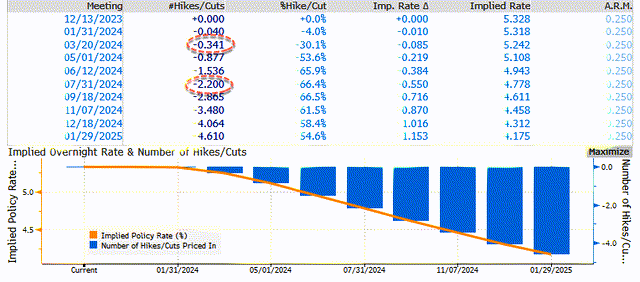

As I pointed out in a recent article, the market currently expects that interest rates will drop over the course of next year. In fact, fed funds futures are implying that the federal funds rate will be 4.312% in December of 2024:

Zero Hedge

That suggests that rates will be cut by 100 to 125 basis points by December 2024. The members of the Federal Open Market Committee certainly do not expect a cut to that degree. The median prediction of the committee members right now is a single 25-basis point cut sometime next year. Thus, the market may be predicting far lower rates than are actually likely to occur.

This could be problematic because the market has started to incorporate its prediction into asset prices. As we can see here, shares of the BlackRock Taxable Municipal Bond Trust have delivered a 3.34% total return since November 1, outperforming the Bloomberg U.S. Aggregate Bond Index:

Seeking Alpha

This strongly suggests that investors are bidding up shares of the fund in anticipation of a future series of rate cuts. If those rate cuts do not occur, it seems very likely that the fund’s shares will reverse course and decline.

In the article that I linked a few paragraphs ago, I made the case that lower rates may not happen even if the Federal Reserve does cut the federal funds rate. This is because of the apparent reluctance of investors around the world to lend money to the Federal Government at low-interest rates. We saw this with a few recent Treasury bond auctions that went far worse than expectations. If that proves to be the case, the Federal Reserve will have to choose between either buying the bonds itself and allowing inflation or acknowledging that interest rates are out of its control. The latter option would almost certainly play out poorly for this fund’s share price and net asset value.

Personally, I am rather reluctant to buy anything that is highly interest rate sensitive right now simply because of the very real possibility that the market is far too optimistic.

Leverage

As is the case with most closed-end funds, the BlackRock Taxable Municipal Bond Trust employs leverage as a method of boosting the effective yield of the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses this borrowed money to purchase Build America bonds and other taxable municipal bonds. As long as the yield of the purchased assets is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

With that said, this strategy is less effective today, with interest rates at 6% than it was at the start of last year, when rates were at 0%. This is because the difference between the borrowing rate and the yield of the bonds is much less than it once was.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This could be one reason why this fund was outperforming the comparable index back in the 2020 and 2021 bull market but underperformed since the start of 2022. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of assets for that reason.

As of the time of writing, the BlackRock Taxable Municipal Bond Trust has leveraged assets comprising 34.47% of its portfolio. That is above the one-third maximum level that I would like to see, but not by very much. As I have pointed out before, fixed-income funds can normally lever up a bit beyond that desired level without getting into too much trouble because the assets that they invest in are not nearly as volatile as common equities. This should be especially true with municipal bonds, as these are very highly rated securities. As such, the fund’s leverage should be acceptable right now and represents a reasonable balance between the risk and the reward.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Taxable Municipal Bond Trust is to provide its investors with a very high level of current income. In order to accomplish this objective, the fund invests primarily in taxable municipal bonds such as Build America bonds. These bonds deliver all of their net investment returns in the form of direct payments to their investors, which in this case is this fund. The fund collects all of the payments that it receives from the bonds that it has purchased, and then artificially boosts these payments by using leverage to control more bonds than it could with just its net assets. The fund then pays out all of the money that it receives from these bonds, net of its own expenses, to the investors. It could be expected that this would result in the fund having a very reasonable yield considering where interest rates currently are.

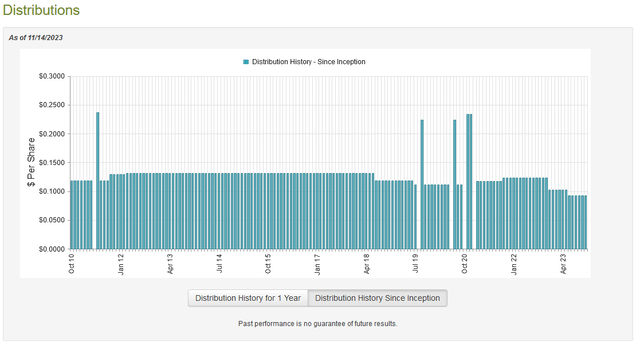

That is certainly the case, as the BlackRock Taxable Municipal Bond Trust currently pays a monthly distribution of $0.0929 per share ($1.1148 per share annually). This gives the fund a 7.18% yield at the current price, which is actually not that impressive for a closed-end bond fund, although it is still reasonable compared to the money market or Treasury securities. Unfortunately, this fund has not been especially consistent with its distribution over the years. As we can see here, its distribution has varied quite a lot over the past five years:

CEF Connect

The fact that the distribution has been changed numerous times over the past half-decade may prove to be something of a turn-off for any investor who is seeking to earn a secure and consistent income from the assets in their portfolios. The fact that this fund has cut its distribution twice in the past twelve months will only add to this general aversion. However, a lot of funds that invest in traditional fixed-income securities have been forced to reduce their distributions over the past two years. This is due to the fact that a lot of them took losses as bond prices started to fall in 2022 and they needed to ensure that their distributions were not destructive to the fund’s net asset value.

As is often the case though, brand-new investors do not need to worry about the actions that the fund has taken in the past with respect to its distribution. This is because anyone who purchases the fund today will receive the current distribution at the current yield and will be completely unaffected by any distribution cut that the fund made in the past. As such, the most important thing for our purposes today is the fund’s ability to sustain its distribution at the current level. Let us investigate this.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. This is a newer report than the one that we had available to us the last time that we discussed this fund, which is quite nice to see. This is because this report covers the first half of the year, which was generally a very optimistic period in the markets. Much like today, investors expected that the Federal Reserve would quickly reverse course on its monetary tightening path and begin to cut interest rates. They started bidding up the prices of numerous assets, including bonds, in anticipation of such an event. While the market ultimately turned out to be wrong, the euphoria may have still given this fund some potential to take advantage of rising bond prices and sell some assets in order to generate capital gains.

During the six-month period, the BlackRock Taxable Municipal Bond Trust received $432,608 in dividends along with $46,047,274 in interest from the assets in its portfolio. This gives the fund a total investment income of $46,479,882 over the period. The fund paid its expenses out of this amount, which left it with $27,500,274 available for the shareholders. That was, unfortunately, nowhere near enough to cover the $37,530,942 that the fund actually paid out in distributions during the period. This is concerning, as we typically like a bond fund to be able to cover its distributions entirely out of net asset value. This one has clearly failed to accomplish that task.

With that said, there are some other methods through which the fund can obtain the money that it needs to cover the distribution. For example, as already mentioned, the fund might have been able to sell appreciated assets into an optimistic market to generate some capital gains. Capital gains are not considered to be part of net investment income, but they clearly do represent money coming into the fund that could be paid out to the shareholders. This fund had mixed results in this task during the six-month period. The BlackRock Taxable Municipal Bond Trust reported net realized losses of $22,388,452 during the period, but these were more than offset by $71,689,950 net unrealized gains. Overall, the fund’s net asset value went up by $39,378,777 during the period. Thus, the fund did technically manage to cover its distributions.

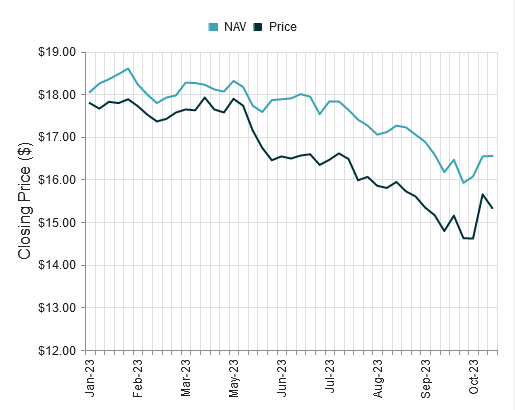

With that said, we can see that the fund only covered the distribution because it had a very substantial amount of net unrealized gains. As we have discussed in various previous articles, net unrealized gains can very quickly be erased by any market correction. As we can see here the fund’s net asset value has generally declined since July:

CEF Connect

As such, the fund’s finances could be weaker than we might think based solely on this earnings report. The declining net asset value in particular suggests that the fund has been overdistributing since the start of July and as such may not be able to sustain its current distribution unless the market corrects and hands it some more opportunities for capital gains.

Valuation

As of November 14, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Taxable Municipal Bond Trust has a net asset value of $16.75 per share but the shares only trade for $15.42 each. This gives the fund’s shares a 7.94% discount on net asset value at the current price. This is quite a bit better than the 6.56% discount that the shares have had on average over the past month, so the current price does look like a reasonable entry point if you want to add this fund to your portfolio today.

Conclusion

In conclusion, the BlackRock Taxable Municipal Bond Trust is an income-focused fund that may appeal to investors looking for a bit more safety than most fixed-income closed-end funds can provide. The fact that the bonds in this fund are backed by the taxing authority of government entities across the United States should render them safer from defaults than typical corporate bonds.

Unfortunately, that also results in BlackRock Taxable Municipal Bond Trust having a rather unimpressive yield compared to many other things that we can find in the fixed-income fund marketplace right now. This fund’s performance is relatively decent, as it did manage to cover its payout over the first half of the year, but it seems to be faltering recently. The biggest risk here is that the market is far too optimistic about interest rates right now and that the fund may decline once the market realizes that.

Read the full article here