It is always a good idea to buy an asset with a margin of safety. The biggest reason to do so is that it reduces your risk and often enhances your upside. We look at one such play today that could make sense for the speculative investor.

Star Holdings (NASDAQ:STHO)

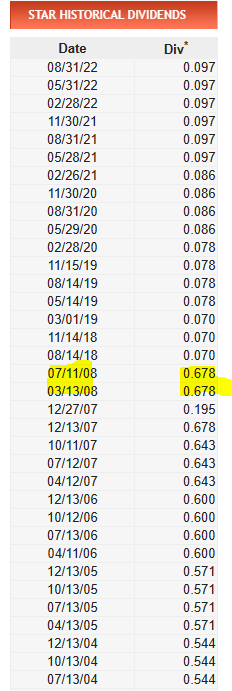

Investors might be familiar with the original parent company iStar Financial. iStar Financial was a large REIT that engaged in the financing, investing, and development of real estate and related projects. It started out in 1998 and paid steady dividends till, you guessed it, the global financial crisis.

Dividend Channel

It came back to the dividend stream business a decade later after it sorted through an avalanche of bad loans. iStar was also the founder and parent of the Land Lease REIT, Safehold Inc. (NYSE:SAFE). Star Holdings emerged as the company to profitably develop and dispose of the last remaining assets of the parent iStar. At the time iStar had accomplished the big task of creating SAFE and the ground lease business overwhelmed the remaining assets.

The Current Setup

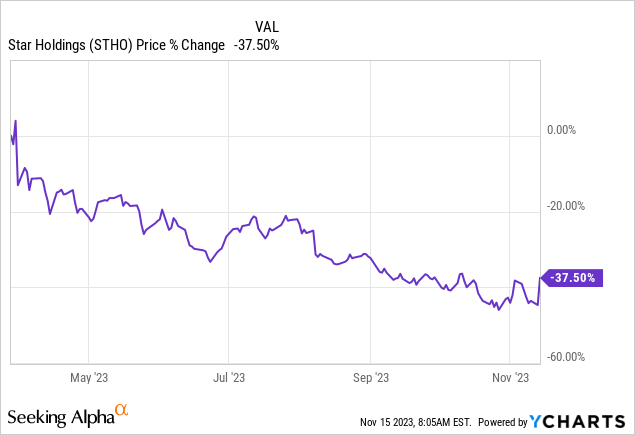

The spin-off was done with the right intentions but has worked out poorly so far.

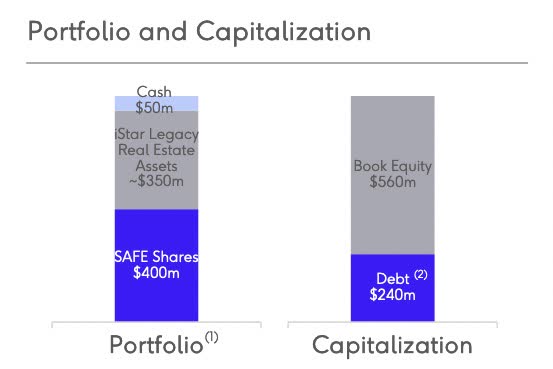

Let’s look at how it was setup and why that set up offers clues on the return profile so far. STHO was set up using $400 million of SAFE shares and legacy real estate assets.

iStar Presentation

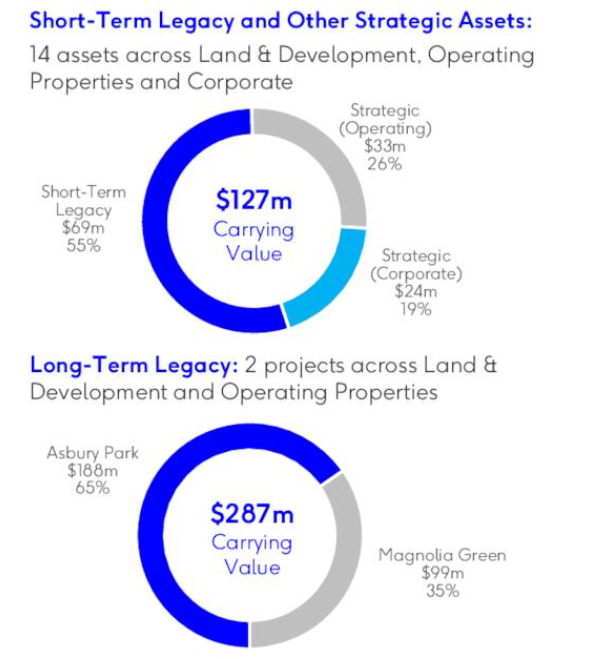

Those legacy assets consisted of primarily Asbury Park and Magnolia Green.

iStar Presentation

Asbury Park Waterfront is the big kahuna at the top and the aggregate carrying value of the Asbury Park Waterfront investment was approximately $157.1 million as of September 30, 2023. STHO plans to sell the remaining residential condominium units at Asbury Ocean Club and strategically monetize the remaining development sites through sales to third-party developers.

Magnolia Green is an approximately 1,900-acre master planned residential community near Richmond, Virginia, that is entitled to 3,550 single and multifamily dwelling units. As of September 30, 2023, 1,904 residential lots have been sold to homebuilders. There are an additional 193 acres marked for commercial development. The aggregate carrying value of Magnolia Green assets as of Q3-2023 was $78.4 million.

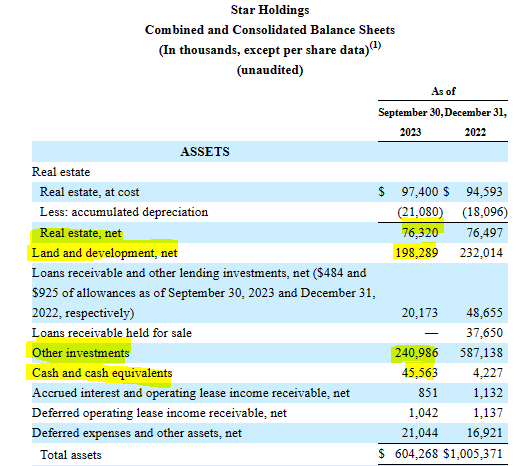

The current balance sheet helps us identify the key assets. Excluding accumulated depreciation, we have about $300 million of real estate assets in the top part of the asset ledger. That includes the Asbury Park and Magnolia Green numbers. The “other investments” category belongs to SAFE shares.

STHO 10-Q

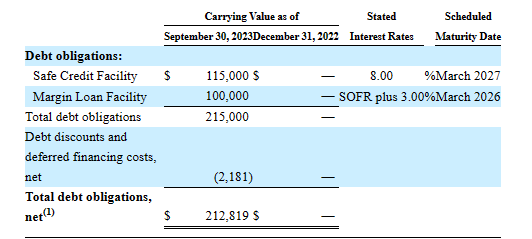

On the liability side of the balance sheet, we have the SAFE credit facility and margin loan facility. Both these carry interest rates of around 8% today.

STHO 10-Q

The margin loan facility is actually secured by SAFE shares. To prevent an unmitigated margin call risk, STHO paid down $40 million during the last few months to reduce the margin loan. It also amended the facility to prevent a forced sell-off.

On October 6, 2023, STAR SPV entered into an amendment to the Margin Loan Facility (refer to Note 9) with Morgan Stanley Bank, N.A., as initial lender. The Margin Loan Facility is secured by all of the SAFE Shares beneficially owned by the Company. The amendment: (i) reduces the floor price at which the market price of Safe common stock would trigger a mandatory prepayment of outstanding borrowings under the Margin Loan Facility from $14.00 to $10.00; and (ii) moderately lowers the loan-to-value ratios that would require STAR SPV to post additional collateral with the lender. Subsequent to September 30, 2023, the Company repaid $19.8 million principal amount of the Margin Loan Facility.

Source: STHO 10-Q

So today this stands near $80 million.

Outlook

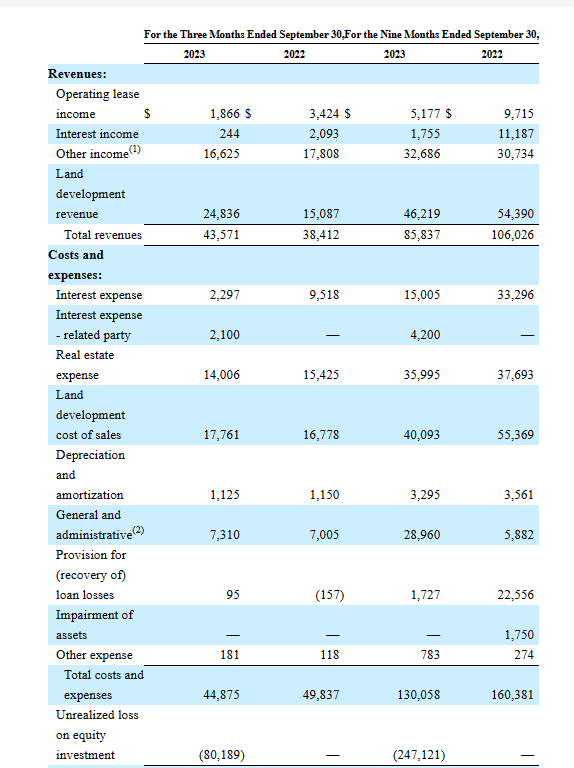

STHO has some brisk revenues from selling those land development lots, but so far the expense side has more than kept up with it.

STHO 10-Q

The other key number here is the $32.686 million in other income which relates to the dividends on SAFE shares. Investors might have noted that the 9-month figure is just about twice the quarterly run rate. The reason is that the spin-off was done just after the March 28 ex-dividend date and STHO only received two dividends so far.

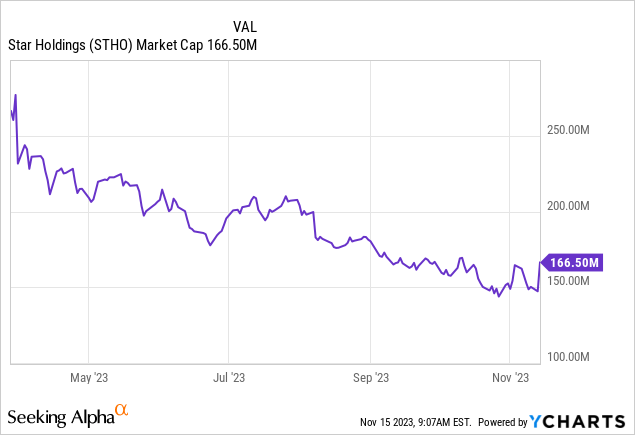

The key rationale for loving STHO comes if there are two conditions in place. The first is that you love SAFE stock. If you don’t then well there is really no reason to own STHO. If you do, then you need to believe that the $300 million in real estate at GAAP book values, can at least offset the expenses and eventually pay off the $212.8 million in debt obligations as of September 30, 2023. This sounds quite feasible on paper, based on what we have read about the quality of the two primary assets. But we have not yet seen it reflected in the income statement. If this does happen though, you have quite an investment setup. STHO will then be left with 13.5 million shares of SAFE and those would be worth about $260.00 million at the current price of $19.20. Compare that to the market cap of STHO.

So the potential is big. If you expect SAFE to double, STHO should more than a triple. The big risks come from the possibility that those development assets are not worth even the GAAP numbers. We think that is almost a zero risk but definitely possible. The second is of course a forced liquidation of SAFE shares in a market crash. This is a fairly low risk and STHO has reduced it further by getting that margin loan down. One way to potentially play this would be to,

1) Go Short SAFE 1X dollar value

2) Go Long STHO 2X dollar value.

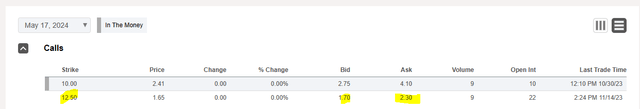

The carrying costs are high though as SAFE’s dividend plus borrow costs come into play and this likely takes three years to get to fruition. Still, it could produce great risk-adjusted returns for investors. Bullish investors on SAFE could also buy STHO and sell covered calls to generate income. We have shown the May 17, 2024 calls below.

Seeking Alpha

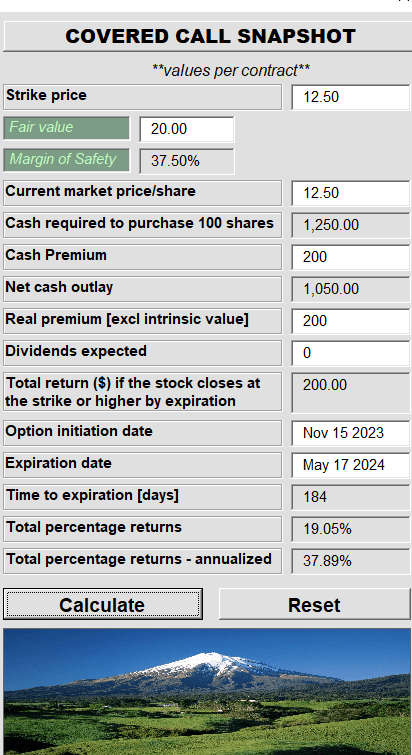

The high implied volatility gives you a solid return for a flat price. Note that our “fair value” below is built on the assumption that SAFE is fairly valued today for the purpose of estimating STHO value.

Author’s App

STHO is an interesting choice for SAFE bulls and we would not be surprised if we played it down the line.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here