There are few industries more cyclical than the North American Steel market. Steel prices in this business are volatile, and there frequently have been both big run-ups and significant selloffs in this sector. While North American steel prices were very high in early 2022, the market crashed in the back half of last year, and the recent price increases in this market in early of 2021 are also looking to be unsustainable as well. Today, the North American Steel market is seeing increasing signs of weakness.

Cleveland-Cliffs (NYSE:CLF) is the largest producer of flat-rolled and automotive grade steel in the United States. Hot rolled and coated steel account for just over 60% of what the company sells, with nearly 31% of their end steel products sold to automotive manufacturers. The company purchased the production assets from ArcelorMittal and also acquired AK Steel, financing both transactions through the debt markets. Cleveland-Cliffs is the largest provider of automotive grade steel in the United States. This company sells primarily in the North American Steel and Iron ore markets. Read my previous coverage on the company here.

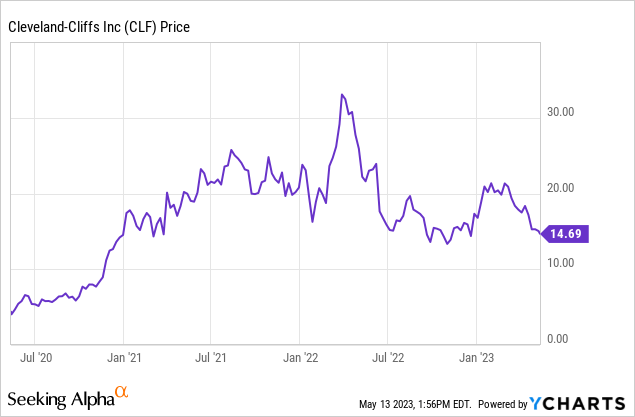

Cleveland-Cliffs’ stock has been predictably volatile, since North American Steel prices have fluctuated a lot in the last 2 years. The stock has sold-off by more than 50% since reaching a recent high of nearly $33 a share in 2022 when steel prices peaked in March of last year. The current share price is $14.69 a share

Not surprisingly, Cliffs’ stock has closely followed the price of hot-rolled steel in the United States.

A Chart of North American Hot Rolled Steel Prices (www.marketwatch.com/investing/future/hrn00)

In my last article I wrote on Cleveland-Cliffs in March of this year I talked about how the increase in Steel prices at the beginning of this year was not likely sustainable, and I was correct. Cliffs’ share price is down nearly 25% since I last covered this stock nearly three months ago. Today I am changing my coverage from sell to strong sell. The North American steel market remains oversupplied. Rising rates and continued supply chain issues are hurting the auto-industry Cliffs depends on heavily. There are also now increasing signs that the economy is likely to enter into a recession in the back half of this year.

The main problem for Steel producers in the North American market is that there are no significant supply constraints, and Steel production usually ramps up very quickly after prices increase. For the week ending in May 6th, Steel production was 1,712,000 net tons, and the capacity utilization rate in this industry was 76.1%. The capacity utilization rate in this industry prior to Steel prices crashing in the middle of last year was 80.2%. This is why the futures market is unsurprisingly already pricing in a significant drop in North American steel prices in the back half of this year. The August, September, and October future contracts for hot rolled steel all trade at between $785 and $797 a net ton.

The North American auto industry that Cliffs depends heavily on is also facing several challenges. The supply chain issues that have hurt this industry continue, with chip shortages are expected to continue to keep production levels down 2023. According to industry analysts, nearly 344,000 vehicles were removed from production this year, primarily because of the continued chip shortage. Industry experts also expect US auto sales to be lower than 2021 levels. Rising rates are also making the financing of new car purchases increasingly more difficult.

There are also increasing signs that the broader economy is likely to enter a prolonged and extended slowdown, and the auto industry has always been a more cyclical market. US GDP growth slowed to just 1% in the first quarter of this year, higher interest rates continue to hurt residential and non-residential investment, and spending on durable goods was notably weaker in February and March. Investment in intellectual property, which is associated with the tech industry, was the slowest this has been in nearly 3 years. The Fed also remains committed to the target of 2% for inflation, and April’s inflation data still came in high at 4.9%.

Cliffs also still looks overvalued, even after the recent sell-off. This company currently trades at 8.49x consensus estimates for 2023 earnings, but analysts are expecting Cliffs’ revenues to continue to fall over the next 2 years. The company is expected to modestly grow earnings per share at a high single-digit rate largely because of the significant share buyback program that was authorized in February of 2022. Still, the current valuation of 8.49x likely forward earnings is a high for a company expected to see lower revenues in both 2024 and 2025. Cliffs also faces a number of significant macro and industry specific headwinds. Analyst estimates are likely to drop in coming months from current levels.

Timing the market is also difficult, and while many traders and investors will be tempted to consider taking a position in Cliffs after the recent selloff, the company is still likely overvalued at the current share price. With the steel market still looking oversupplied, an even moderate recession could cause North American steel prices to plummet. With the Fed committed to raising rates, the auto industry still dealing with supply chain issues, and now growing signs of a slowdown in the broader economy, Cliffs share price also still looks overvalued.

Read the full article here