Elevator Pitch

I continue to assign a Buy rating to Pearson plc (NYSE:PSO) [PSON:LN] stock. My September 4, 2023 article for PSO touched on the company’s shareholder capital return plans and portfolio restructuring actions.

I highlight the growth potential of Pearson’s Assessment & Qualifications business and provide an update on PSO’s share repurchases in this latest update.

Pearson is in a good position to realize its 2025 top line growth and margin improvement goals, with expectations of a growing revenue contribution from the high-margin Assessment & Qualifications business. On the other hand, PSO’s planned conclusion of its current share buyback plan by end-2023 implies that the company’s shares are still cheap and there could be new investment opportunities emerging for Pearson next year. Therefore, I see no reason to change my existing Buy rating for PSO.

Assessment & Qualifications Business Is PSO’s Key Growth Driver

In my opinion, investors who are considering a potential investment in Pearson should pay more attention to PSO’s Assessment & Qualifications segment. The Assessment & Qualifications segment is the largest revenue contributor for the company, and this business has performed well on both an absolute and relative basis in recent times.

PSO derived 38% of its top line for the previous year from the Assessment & Qualifications business segment as indicated in the company’s FY 2022 20-F filing. In comparison, none of Pearson’s other business segments accounted for more than a quarter of the company’s revenue last year. Furthermore, PSO’s Assessment & Qualifications accounted for over half or 57% of its FY 2022 normalized operating income.

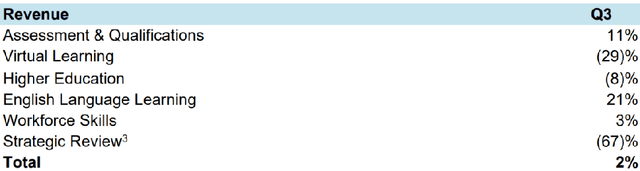

For the most recent quarter, Pearson’s Assessment & Qualifications business was the second best performing segment with respect to top line expansion for the most recent quarter as indicated in the chart below.

The Q3 2023 YoY Revenue Increase For Pearson’s Various Business Segments

Pearson’s Q3 2023 Financial Update Presentation

On November 6, 2023, PSO hosted an investor briefing on the company’s key Assessment & Qualifications business. Insights shared by Pearson regarding the Assessment & Qualifications segment gives me the confidence that Pearson can achieve its medium term financial targets.

Specifically, Pearson is targeting to deliver a mid single digit top line CAGR for the FY 2022-2025 time frame and improve its normalized operating profit margin from 12% in the prior year to 16%-17% for FY 2025. It is worth noting that PSO’s Assessment & Qualifications segment’s FY 2022 normalized operating margin of 18% was the highest among its businesses. As such, it is reasonable to assume that a rising revenue contribution from the high-margin Assessment & Qualifications business is one of the key factors that influences Pearson’s ability to meet its intermediate term financial goals.

The Assessment & Qualifications business’ individual divisions or units are leading players in their respective areas and benefit from secular growth trends.

One example of market leadership is that the company’s School Assessment and Qualification unit boasts a 25% share of the UK market as indicated in its investor presentation. As another example, Pearson revealed at the November 6 investor briefing that the “digital AI-scored four skills test of English” known as PTE offered by the Assessment & Qualifications segment “has a strong position as a top three player” with a market share of 14%.

The Three Major Secular Growth Trends For PSO’s Assessment & Qualifications Business

Pearson’s November 6, 2023 Investor Presentation

Also at the investor briefing, Pearson cited forecasts from education research firm HolonIQ indicating that the size of the worldwide learning industry could possibly grow from £6 trillion currently to £8 trillion by the end of the current decade.

Assessment & Qualifications forms a key part of the global learning market and benefits from multiple secular growth drivers as outlined in the chart presented above.

PSO stressed at its early-November investor event that “digitally-enabled products and solutions are driving nearly all of Assessment & Qualifications’ growth today.” This sends a clear and loud message that the trend involving the move from offline to online and increased digitalization in the learning space has a major positive impact on the Assessment & Qualifications segment’s future growth prospects.

Management Provides Positive Update On £300 Million Share Buyback Plan

In my September 4, 2023 write-up for Pearson, I mentioned that “Pearson plans to execute on its new (£300 million) share buyback program starting in Q3 2023.” I liked PSO’s efforts to increase the amount of capital distributed to its shareholders through buybacks.

At the end of last month, PSO indicated at its 9M 2023 business update call that “we might be completing (the £300 million share repurchase plan) by the end of the year” based on how “things are trending at the moment.” Pearson has already executed on more than a third (or £115 million to be exact) of its existing share buyback program as of late-October.

The positive update on the progress and the expected completion of Pearson’s current share repurchase program has two key favorable read-throughs for PSO.

Pearson’s shares rose by +16.4% (source: Seeking Alpha price data) in the past six months, and PSO’s consensus forward next twelve months’ EV/EBITDA re-rated from 8.2 times as of end-June 2023 to 9.4 times at the end of the November 13, 2023 trading day. But it is possible to infer from Pearson’s management commentary that the company thinks that PSO’s stock is still sufficiently undervalued to warrant share buybacks, notwithstanding its recent share price appreciation and valuation multiple expansion.

Separately, the expected conclusion of the current share buyback plan by end-2023 means that PSO has excess capital available for allocation to internal reinvestment and acquisitions in 2024, assuming the absence of new share repurchase programs. At its 9M 2023 business update presentation, Pearson highlighted “we’ll make a decision on any further (shareholder capital) returns in due course”, which seems to suggests that buyback activity could possibly slow next year.

Concluding Thoughts

I continue to rate Pearson as a Buy. My bullish view of PSO is reinforced by management’s recent disclosures relating to the Assessment & Qualifications business and its share buyback plan.

Read the full article here