The First of Long Island Corporation (NASDAQ:FLIC) operates as a holding company for The First National Bank of Long Island which provides financial services to small and medium-sized businesses, professionals, consumers, municipalities and other organizations.

Since the Fed began raising rates, this bank has lost about 50% of its value. However, if we considered the distance from the all-time high, the gap widens: about 65%. Yet, in recent months the price per share has rebounded by 30%.

In short, these are not easy years for FLIC, but as we shall see, the worst may be behind us.

How did we get to this point?

It had already been since late 2017 that this bank was not performing well; however, the final blow came with the failure of Silicon Valley Bank. After that episode, there was a rapid spread of distrust toward the entire banking industry, particularly the regional bank industry. FLIC, despite having a nearly 100-year history, capitalizes only $247 million and was unable to prevent a deterioration of its financial structure.

Over the next few weeks the bank faced an outflow of liquidity as deposits shifted to systematically important banks, and remedying this situation was a complex challenge. Replacing lost liquidity in an environment where the Fed Funds Rate is rising significantly means deteriorating margins.

The First of Long Island Corporation (FLIC) Q3 2023 Earnings Call

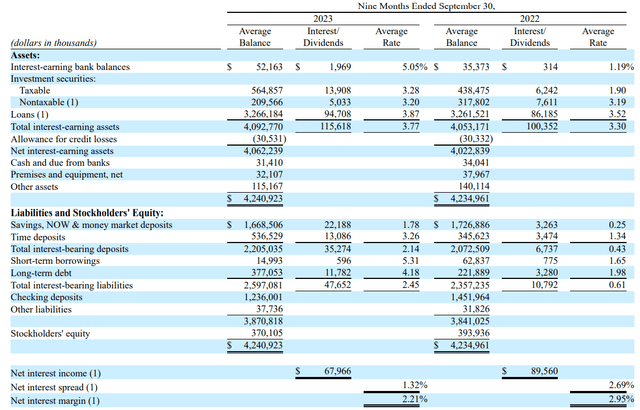

Comparing the 9 months ended September 2023 with those of 2022, a general decline is evident:

- Checking deposits decreased by $216 million, replaced by $190 million in expensive time deposits.

- Savings, NOW & money market deposits decreased by $58.38 million and their average cost increased by 153 basis points.

- Loans remained almost unchanged in amount and their average yield increased by 35 basis points. Certainly an improvement, but too modest compared to the increase in the cost of deposits.

All this has caused profitability to worsen, in fact the average net interest margin is only 2.21%, while in the same period in 2022 it was 2.95 %. Same trend for net interest income, declining by $21.60 million. But there is more.

Unrealized losses on fixed-rate securities also contributed to making the picture even worse. FLIC’s securities portfolio suffered a sharp deterioration that continues to this day. Regarding this aspect I will discuss in more detail in the next section.

What are the future prospects?

So, we have seen how FLIC’s situation is not the best, which is why the market has punished this bank so much. But what are the future prospects?

According to management’s words during the last conference call, growth prospects are more in the commercial rather than residential segment. To fill this gap, the bank has and will continue to buy residential mortgages; it is unlikely to originate them. The point is that while lending at 7% generates a good spread, demand is dropping a lot. On this aspect CFO Jay McConie has been quite clear: refinancing activity is at its lowest.

On the liability side, future prospects look better. In fact, according to CEO Chris Becker, the cost of funds will not deviate much from where it is now.

But what we’re seeing as we’re looking at our internal projections is that so much of our liability side has repriced, so even if there’s still some small repricing in things that have already repriced but maybe come up again over the next few quarters.

There’s obviously not as much upside from where they are now. So that’s being fully priced in, now we see the asset side, those $90 million in quarterly cash flows, that Jay talked about. We see those starting to be able to offset the liability pricing, and that’s why we kind of see the margin bottoming out over the next two quarters.

This is good news for the net interest margin, as we are beginning to see light at the end of the tunnel. It is likely that the bottom will be reached within the next two quarters and in my opinion the market had already discounted this scenario a few months ago in the price per share. Logically, if the Fed’s rate hike cycle is not yet over, all estimates have to be revised and profitability may continue to deteriorate for much longer.

In any case, my view is that the Fed has stopped its rate hike, so I expect FLIC to breathe again in the coming months. Today’s CPI figure was 3.20%, 10 basis points below expectations. If inflation continues to fall faster than expectations, then we can expect rate declines even in early 2024. At that point, FLIC’s recovery could be eased.

And then the liability side, assuming, again, the Fed stops with the rate increases, we see the liability side being done and the asset side little by little can start to tick up. And obviously, if the Fed makes some moves in the other direction and we get some steepness in the yield curve, that’s when you’ll see it turn around more rapidly.

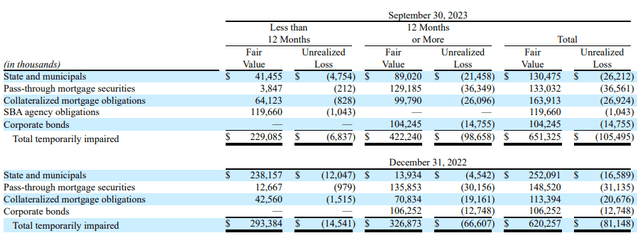

Finally, we now come to unrealized losses.

The First of Long Island Corporation (FLIC) Q3 2023 Earnings Call

At the beginning of the year, AOCI had improved slightly as T-bond yields fell, and the problem was thought to be receding. However, in the following quarters, government bond yields experienced a new upward trend and this resulted in further losses greater than the previous ones. To date, unrealized losses amount to $105 million and management has no plans to sell these securities. The strategy to be adopted will be to hold them until maturity, in this way the problem will fall completely.

The First of Long Island Corporation (FLIC) Q3 2023 Earnings Call

Since slightly more than half of them have a maturity of more than 12 months, it will take time for the problem to fully recede. If the Fed were to reduce rates, then it would accelerate this process.

Conclusion

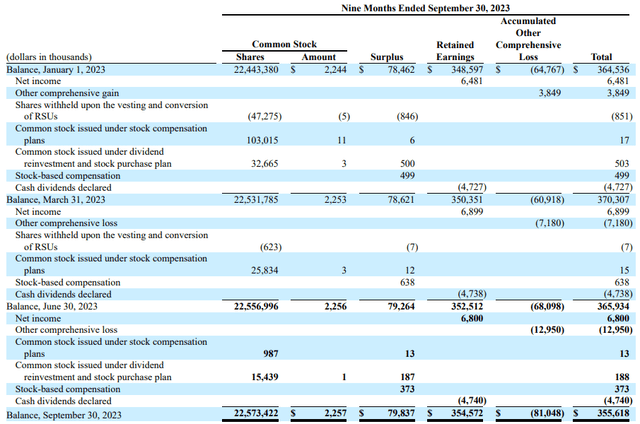

FLIC is a bank that has suffered a lot in recent years: first with the pandemic, then with the banking crisis, and now with rates at 20-year highs. In any case, since the last quarterly report it seems that a light has come on at the end of the tunnel, in fact the net interest margin at the beginning of 2024 may return to growth.

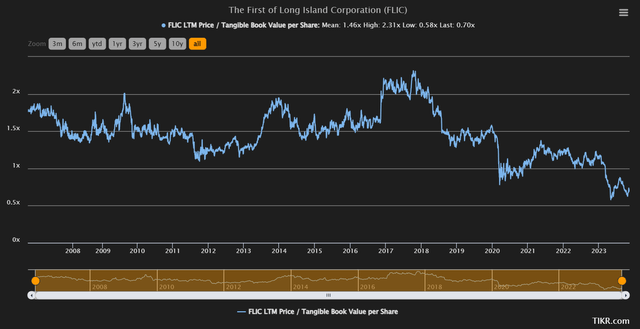

TIKR

To date, the bank is undervalued on paper: the current price/TBV per share is only 0.70x, less than half the historical average. By the way, not even during the great financial crisis was such a low level reached.

Finally, even looking at the dividend we can see a marked undervaluation.

Seeking Alpha

The dividend yield is 7.67%, an outlier compared to the past. So, this makes FLIC quite interesting stock to be on the watchlist especially for dividend investors.

Read the full article here