I recently wrote about ON Semiconductor (NASDAQ:ON) in my note ON Semiconductor: Successful Transformation And SiC Rollout Make It A Buy, where I talked about the strong competitive positioning of the company in key semiconductor growth markets such as automotive and Silicium Carbide (“SiC”) and issued a Buy rating despite what was a highly elevated valuation with a strong premium to peers. Since then the company has issued its Q3 earnings release which, despite a nominal beat on top- and bottom-line, hinted at several underlying weaknesses in both end-markets and the company’s long-term sales agreements (“LTSAs”) with indications that automotive and industrial, which have been resilient for the majority of 2023, are now entering demand correction. This was further reinforced by a significant order pushback from a major customer in SiC which led the company to cut its FY23 guidance for SiC revenues from $1 billion to $800 million.

With these headwinds in mind and further elevation of inventory levels, I reconsidered my investment thesis and, despite remaining highly constructive on the company’s long-term value proposition, cut my price target by 26% to $87. I do not believe that long-term investors (including myself) should become spooked out of the stock; however, I do believe that especially given the emerging doubt about the true visibility of the LTSAs and lack of indication for a peak in inventories, a more cautious outlook in the near- and mid-term with further downside potential is appropriate and thus cut the stock to a Hold rating.

Performance Highlights

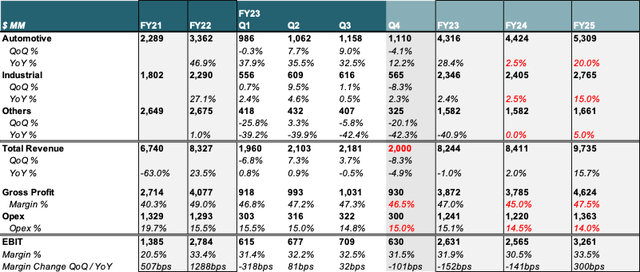

Looking solely at financials, ON’s Q3 performance has been relatively solid with headline revenues of c.$2.2 billion, up 3.7% vs Q2 but down 0.5% YoY, following the trend of flattish YoY growth since Q1 2023. Gross margins have expanded marginally vs Q2 to 47.3% vs 47.2% and Opex as % of sales decreased by 20bps to 14.8% for a 30bps higher EBIT margin at 32.5% (down c.200bps YoY). Key benefactors to margins which helped to offset softer volumes have been stable pricing power and subsiding headwinds from the East Fishkill fab as well as a faster-than-expected insourcing for SiC wafers.

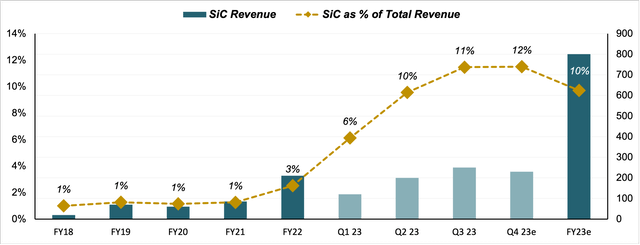

On a disaggregated basis, strong YoY growth in Automotive (+32.5%) has been largely offset by continued divestments in Others (-42.4%) and flat revenues in Industrial (+0.5%). While those figures are, as mentioned, relatively solid and definitely do not warrant a selloff and multiple rerating as we have seen, most of problems become only apparent in the company’s guidance and analyst call following the release. SiC revenues, which are a key part of management’s long-term strategy, have grown far less than projected to about $250MM vs $200MM in Q2. This was largely due to a single order pushout from a major customer experiencing softer end demand. The company has not further specified the identity of this customer but has hinted towards demand weakness across European tier ones such as Volkswagen (OTCPK:VWAGY), Stellantis (STLA) or Mercedes (OTCPK:MBGAF). This has caused ON to cut its previously issued FY23 guidance of $1 billion sales from SiC chips by roughly 20% to “more than” $800 million.

Key Takeaways

Gross margins to remain under pressure but management is confident in holding mid-40s

Despite a slight QoQ uptick in gross margins which benefitted from subsiding previous headwinds at the East Fishkill fab, margins have come under increasing pressure during FY23 in light of lower volumes which management anticipates to further continue in the near term. However, management is actively working towards managing down utilization and structural changes due to the previously discussed fab lite model and the faster than expected insourcing for SiC wafers (50% target achieved early) should provide a floor for margins in the mid-40s even as volumes remain soft. SiC headwinds to margins should also alleviate with the segment expected to reach parity during Q4. One important thing to note however is that the margin pressure is exclusively related to volume and the company does not see any deterioration in pricing as it cites the security that LTSAs provide even as customers struggle with end demand. For Q4 management is guiding to a gross margin range of 45.5%-47.5%, representing a c.0-200bps QoQ decrease for a FY23 gross margin between 46.7% and 47.2%, down from 49% in FY22. With no clear guidance for FY24 yet, I deem this as a highly critical point for ON and management which really puts the impact of the various structural changes implemented over the past years to test and thus advise investors to critically monitor upcoming prints.

Inventory buildup and customer order pushout expected to continue in the near term

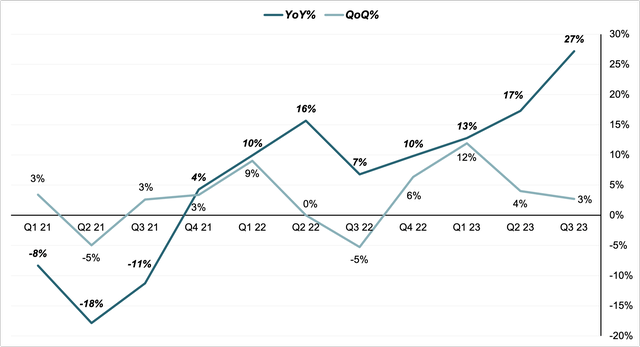

While QoQ growth in DIO (days inventory outstanding) further slowed to 3% with Q3 DIO up to 160 from 156, YoY growth accelerated and now stands at its highest for the period since Q1 2021 at 27%.

DIO Development (Company Filings)

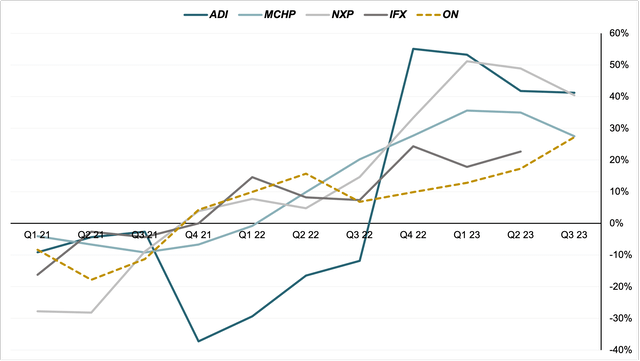

An important thing to note here is that ON has not reached its DIO rollover point yet while competitors’ metrics start or continue to tick down. This is largely related to the strong focus the company has on automotive and industrial end markets. After having remained resilient through the majority of 2023, demand normalization has started to accelerate with management citing a feed-through of higher rates as well as uncertainty weighing on customer decisions. A key area of weakness as stated during Q3 earnings has emerged in European tier ones. Management has stated their proactiveness in actively reducing utilization to enable customers to burn through their inventories. However, I do become more cautious and think a key metric going forward will be the rollover in YoY growth in DIO which management has not yet been able to accurately guide towards.

DIO YoY% Change vs Peers (Note: No Q3 print available for Infineon yet) (Company Filings)

Miss on SiC mainly due to order pushout from a single customer, long-term strategic focus remains unchanged

Due to an order pushout from a large customer Q3 SiC sales came in lower than expected at a $1bn annual run-rate or c.$250MM (11% of total) for YTD revenues of c.$570MM (9% of total). The company also cut its $1bn target for full-year 2023 sales down to “more than” $800MM. Using the lower end of this, this leaves c.$230MM for the Q4 period at c.12% of management-guided group revenue and puts SiC share of revenues for FY23 at 10%, up from 3% in FY22. Despite the near-term headwinds, management continues to remain highly confident in the segment, citing their target to reach 2x SiC market growth in FY24 (which could be around 40% as per Yole research). Given the significant order pushout we saw this Q as well as general automotive and industrial end markets softness I deem this as optimistic and will closely monitor SiC trajectory in upcoming Qs. Management also highlighted that the current weakness in SiC is not specific to EVs but rather more general across automotive applications and continues to view EV adoption as a key trend to achieve ON’s long-term targets.

SiC Revenues Development (Company Filings )

LTSAs are not as set in stone as previously thought

Along with most analysts, I previously regarded the various LTSAs the company was signing with customers as providing highly visible and to an extent safe revenues which was a key part of the investment thesis as laid out in my prior note. The order pushback we saw from major customers in Q3 somewhat moves this thesis and makes me more cautious going forward, especially if end-market demand continues to become softer in light of higher prices and elevated rates. During the analyst call management cited their commitment to negotiating “win-win” deals with customers that see lower demand to not force push their inventory onto them and emphasized that pushed-back orders are not lost but will still be fulfilled at a later point. Despite management confirming that this was a singular event and they do not expect any further pushouts in the near term from their communication with customers, I do remain a bit more wary of the visibility of those revenues going forward and I think investors should apply some margin of safety to those contracts if market conditions further deteriorate.

Valuation Update

Similarly to the note I wrote on ON earlier, I want to employ a DCF method as I think the underlying long-term fundamentals with multiple key growth levers do not warrant a multiple-based valuation. However, I will use this opportunity to update my DCF to account for a longer time frame as well as use more detailed forecasting in the near term rather than simply relying on the mid-term growth assumptions laid out in ON’s investor day.

For Q4 I expect total revenues of $2bn at the midpoint of management guidance to bring total FY23 revenues to c.$8.2bn, down slightly YoY. Gross margin should come under further pressure in Q4 due to lower volumes at 46.5% (midpoint of management guidance for 45.5-47.5%) with estimated Opex at lower end of guidance at $300MM for a full year EBIT margin of 31.9%, down c.150bps vs FY22. Going forward, I expect current headwinds in topline and margins to continue in FY24 with strong catchup and reacceleration from FY25 on. For FY24, I model a marginal 2.5% growth for both automotive and industrial following management’s comments that they expect at least Q1 and Q2 to have negative sequential growth. The Others segment should stabilize at 0% YoY given the announced end of further divestments there. Despite the company actively adjusting utilization lower, margins should remain highly pressured in FY24 where I expect a trough of c.45% as management stated their confidence in being able to hold mid-40s. Partially offset by lower Opex, EBIT margins should further contract to about 30.5% before re-expanding in FY25. FY25 should also see the topline expand again with strong catch-up growth in both automotive and industrial.

Q3 Updated Financial Model (Company Filings and Author’s Projections)

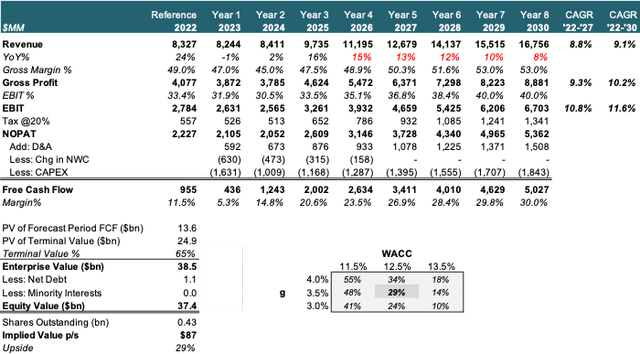

Flowing these forecasts into an 8-Year DCF model and revising FY27 gross and EBIT margin targets back to FY30 to reflect near-term headwinds, I estimate a total FY22-FY27 top-line CAGR of c.8.8% vs. previously guided 10-12%, which I think is reasonable given the recent downward revisions in outlook across the majority of ON’s end-markets. Still, margin re-expansion from FY25 onwards should drive EBIT growth in the LDD over the period. Using a CAPM ß derived WACC of 12.5% and a 3.5% terminal growth rate as well as assuming a reversion of NWC down to 0 by FY27 and following management’s guidance for Capex (low teens in FY24 and on path to 11% FY27 target), I obtain a total Enterprise Value of $38.5 billion. Adjusting for net debt and minorities this yields an updated fair price per share of $87 or around 29% upside to November 10 trading.

Q3 Updated DCF Model (Company Filings and Author’s Projections)

Wrap-Up and Outlook

As mentioned above, I do not believe that these results and management comments materially change ON’s long-term investment thesis. EVs will continue to grow in market share despite some headwinds in the near term and the company’s offering in SiC and the market position it has will remain a strong growth driver once demand picks up again. However, the quarter has pointed to some key headwinds that I did not appropriately account for in my prior note. Management has been upfront about their projections that demand in both automotive and industrial end markets has started to roll over and will normalize further in the coming Qs. Even though the company does not currently anticipate further order pushbacks in their LTSAs, this cannot be ruled out, especially if economic uncertainty remains or accelerates. The second crucial point to look for in the near term will be inventory management. While ON is actively trying to adjust utilization to burn through excess inventories, it is the only player in the peer group which has not seen a peak in YoY DIO growth yet, largely due to its automotive and industrial weighted sales mix.

With those headwinds in place, I do believe it is warranted to apply a higher degree of caution over the coming Qs until clear signs of demand uptick and/or inventory rollover become apparent. Therefore, I urge investors to closely monitor upcoming Q4 earnings for such signs and management’s guidance for FY24 which is to be specified as part of the call.

Read the full article here