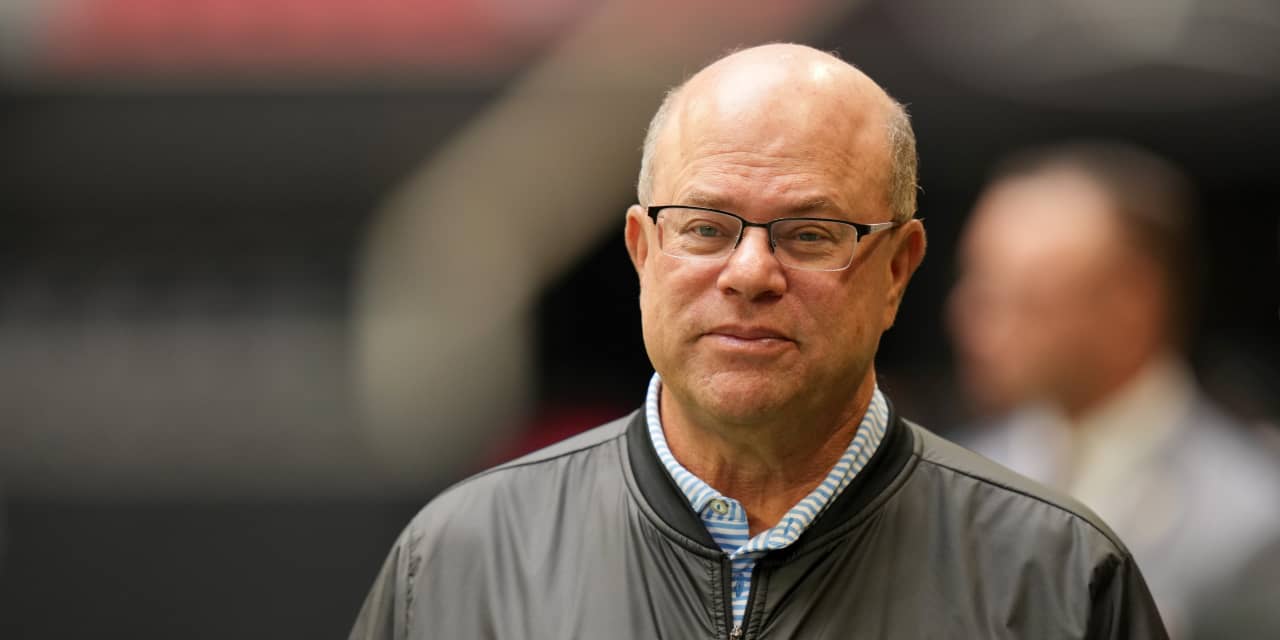

David Tepper’s Appaloosa Management hedge fund raised its stake in Amazon.com Inc. and dropped its stake in Apple Inc., according to a filing with the Securities and Exchange Commission late Tuesday.

In the quarterly filing, Appaloosa increased its Amazon

AMZN,

stake to 3.75 million shares from 3.16 million shares in August. Tepper raised his stake in Google parent Alphabet Inc.

GOOGL,

to 2.75 million shares from 2.31 million and raised his stake in Facebook parent Meta Platforms Inc.

META,

to 1.95 million shares from 1.5 million previously.

The fund raised its stake in Microsoft Corp.

MSFT,

to 1.65 million shares from 1.24 million and increased its stake in Caesars Entertainment Inc.

CZR,

to 1.53 million shares from 1.24 million.

The fund dumped its 480,000-share stake in Apple

AAPL,

as well as a 120,000-share stake in Broadcom Inc.

AVGO,

It trimmed its Advanced Micro Devices Inc.

AMD,

stake to 2.28 million shares from 2.31 million in August, while reducing its stake in Alibaba Group Holding Ltd.

BABA,

to 3.6 million shares from $4.48 million.

The fund lowered its stake in Qualcomm Inc.

QCOM,

to 1.3 million shares from 1.85 million previously. It lowered its stake in Taiwan Semiconductor Manufacturing Co.

TSM,

to 1 million shares from 1.78 million and cut its stake in Intel Corp.

INTC,

to 6.25 million shares from 6.78 million previously.

Appaloosa maintained stakes in Uber Technologies Inc.

UBER,

at 7.25 million shares and held onto about 1.4 million Micron Technology shares

MU,

about 1.03 million Nvidia Corp. shares

NVDA,

about 650,000 FedEx Corp. shares

FDX,

and about 200,000 UnitedHealth Group Inc.

UNH,

shares.

Read the full article here