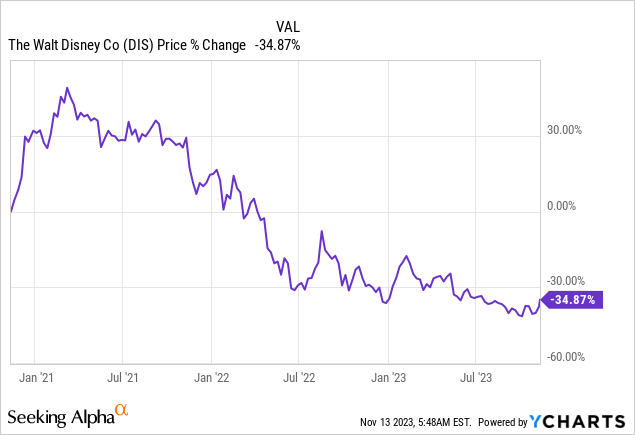

Shares of The Walt Disney Company (NYSE:DIS) soared after the streaming company reported better than expected earnings for FQ4’23 and the company issued an optimistic forecast for FY 2024 free cash flow. The streaming company also announced that it will focus on more aggressive cost-savings, raising its cost-cutting target from $5.5B to $7.5B and Disney reported a surge in Disney+ subscribers in Q3’23 as well. While I believe that the increase in subscribers and the free cash flow guidance were especially noteworthy, narrowing losses in the streaming segment suggest that Disney is nearing operating income profitability in the near term. If Disney can continue on this trajectory, I believe investors could participate in an epic valuation recovery!

Previous rating

I rated (and upgraded) shares of Disney from hold to buy in August: Nearing An Inflection Point (Rating Upgrade). As reasons for the upgrade, I cited subscription plan price increases which were set to boost the company’s direct-to-consumer business. Disney’s surge in subscribers in FQ4’23, strong free cash outlook and much more aggressive cost guidance for FY 2024 are reasons why I am upgrading shares of Disney to strong buy.

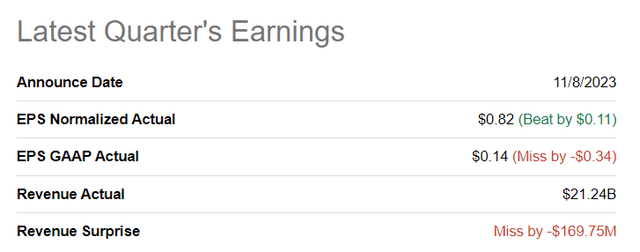

Disney crushed earnings estimates

Disney reported adjusted earnings of $0.82 per share, beating the $0.71 per-share average earnings prediction for FQ4’23 by $0.11 per share. Disney missed slightly on the top line with actual revenues coming in at $21.24B, but it was an overall very impressive earnings release.

Source: Seeking Alpha

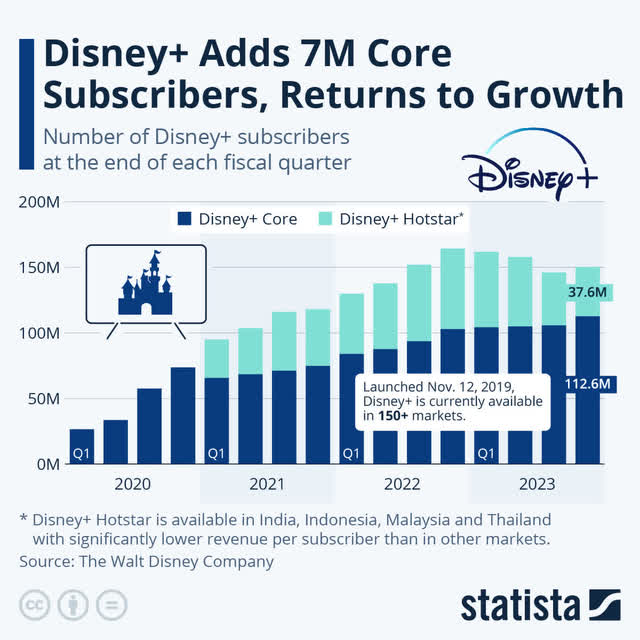

Disney experiences a surge in subscribers

Streaming companies did well in the last quarter and moderating inflation as well as confidence in the economic outlook have likely been positive tailwinds as well. Netflix added 8.8M subscribers to its streaming platform in the third quarter, a great result which was driven in large part by the company’s efforts to crack down on the password-sharing tactic that many of Netflix’s subscribers used to avoid paying.

Disney also had a great quarter as the streaming firm added nearly 7M Disney+ subscribers in FQ4’23, the majority of which, 6.4M, came from its international business. The surge in subscribers brought the total count of Disney+ subscribers to 150.2M in the last quarter. Subscribers to Disney+ in the previous quarter, FQ3’23, increased only 0.8M, so the rebound has been quite significant and it has been responsible, together with price increases, for a bounce in DTC revenues and narrowing streaming losses.

Source: Statista

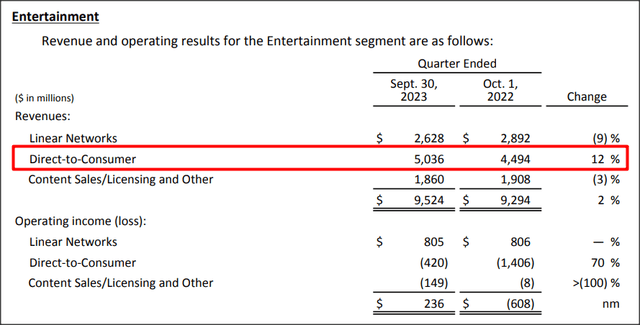

The surge in subscribers was an important catalyst for Disney’s revenues which soared 12% in the streaming segment to $5.0B in FQ4’23. Disney’s total revenues increased 5% year over year to $21.2B.

Source: Disney

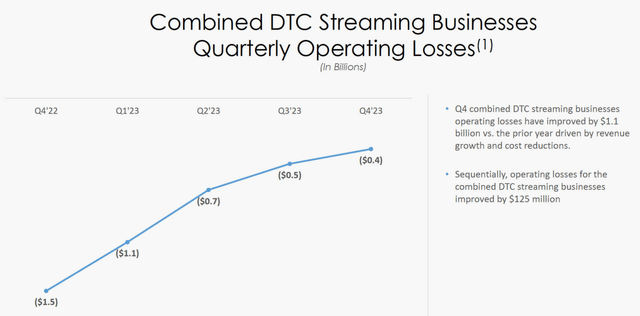

Because of subscriber growth as well as price increases (the price for a Disney+ premium subscription increased 27% in the third quarter), Disney has been able to narrow its losses in the streaming segment quite significantly. Disney’s direct-to-consumer segment reported a loss of $0.4B in FQ4’23, showing a material decline of $1.1B compared to the year-earlier period.

Source: Disney

Disney massively ramps up its cost-savings target, free cash flow guidance is impressive

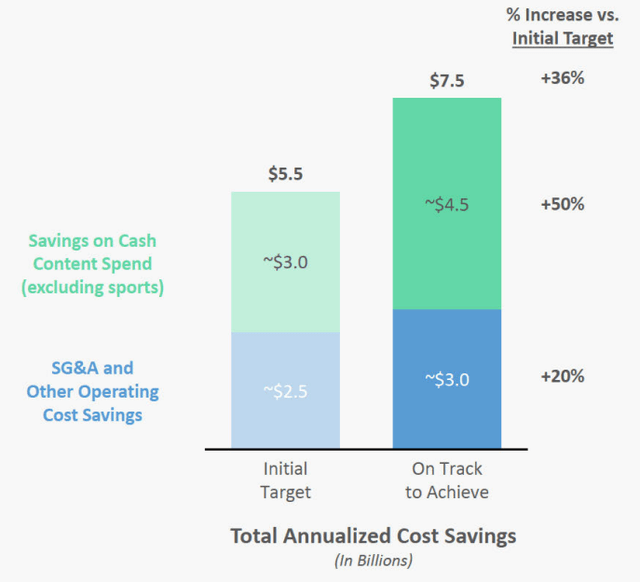

Disney’s earnings release for the fourth fiscal quarter contained a number of surprises and the more focused approach to dealing with inflated costs was one of them. Disney has previously guided for $5.5B in cost savings as the company seeks to improve its profitability profile, especially in the loss-making direct-to-consumer business. This cost target has now been raised by $2.0B to $7.5B. The new cost target implies a 36% increase compared to the previous target and is driven chiefly by a reduction in spending on new content.

Source: Disney

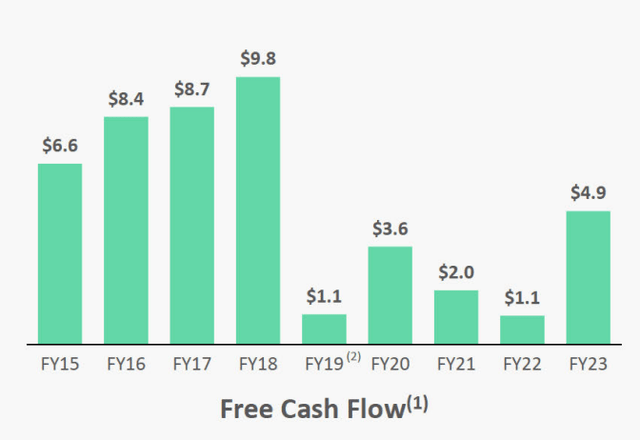

In FY 2023, Disney generated $4.9B in free cash flow, showing 345% year-over-year growth, but the real takeaway from the earnings release was management’s commentary about its free cash flow expectations.

Together with a much more favorable cost outlook, Disney has said that it projects “significant” free cash flow growth in FY 2024 and that it expects to see an FCF level approaching pre-pandemic levels.

Disney generated $6.9B in free cash flow, on average, between FY 2015 and FY 2019, the years before the pandemic. A return to this level in FY 2024 implies a ~41% jump in free cash flow in the new fiscal year.

Source: Disney

Disney’s valuation

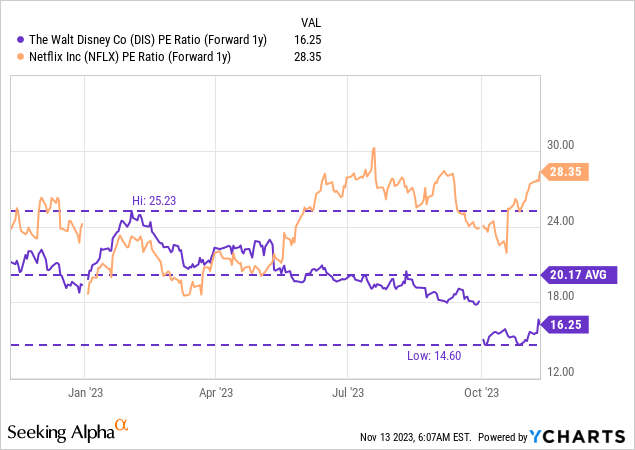

Shares of Disney are attractively valued considering the momentum the streaming firms generates on all levels of the business. Disney is currently expected by analysts to achieve EPS of $4.49 per share in FY 2024 and $5.43 per share next year, implying a year-over-year EPS growth rate of 21%. Netflix is projected to grow its earnings per share 30% next year.

While Netflix is expected to grow its EPS faster, Disney’s shares are a real bargain, in my opinion, considering how drastically the business is growing and improving. Disney is currently valued at a forward P/E ratio of 16.3X compared to Netflix’s 28.4X forward P/E. For Netflix, the fiscal year ends in December while the financial year for Disney ends in September. Netflix is expected to grow its EPS 9 PP faster than Disney, but I don’t believe the difference justifies a 75% higher valuation factor.

Shares of Disney also trade ~20% below the 1-year average P/E ratio so I believe DIS is an extremely compelling bet in the streaming market right now. If Disney were to trade at the same earnings multiplier as Netflix, which it did in the past, then Disney would be valued at ~$154.

I believe that given Disney’s double-digit EPS growth potential, DIS could easily be valued at 25X forward earnings, in my opinion, which implies a fair value of around $136 (54% revaluation potential).

Both companies have seen strong subscriber growth in the last quarter, but my choice in the streaming market would be Disney. The streaming company has a number of catalysts beyond just growing its subscriber base as it is guiding for massive growth in free cash flow for FY 2024 and is set to achieve operating income profitability in DTC streaming.

Risks with Disney

The biggest risk with Disney is that the company fails to achieve operating income profitability in the streaming business. Considering that management just announced a major increase in its cost-savings target, the achievement of DTC profitability is a very real possibility in FY 2024. What would change my mind about Disney is if the streaming company saw negative subscriber growth in its core Disney+ segment.

Final thoughts

Shares of Disney soared 6% after the presentation of third-quarter results and I believe the streaming company is on a good trajectory given its surge in subscribers in the last quarter. In my opinion, achieving operating income in the important direct-to-consumer business will remain the most important inflection point, not just for Disney, but also for the streaming firm’s shares. The optimistic cost and free cash flow guidance strongly improve the risk profile for Disney, in my opinion. Considering that Disney faces the catalyst of positive operating income in DTC, is expecting massive growth in FCF in FY 2024 and the business is cheap based off of P/E, I believe Disney’s shares are ripe for an epic recovery!

Read the full article here