EMX Royalty Update

EMX Royalty Corporation (NYSE:EMX) just had one of its best quarterly earnings in recent memory. Revenue, cash flow, and earnings all exceeded my expectations, and, as a result, EMX’s balance sheet looks improved here with more cash on hand than in prior quarters.

The strong quarter was largely driven by the company-changing news of its updated Timok Royalty agreement. EMX received a cool $6.6 million in royalty proceeds in Q3 from its Timok royalty property with Zijin, which included back-dated payments for the prior 3 years, followed by a prolonged royalty dispute. That provided a big cushion to its quarterly results.

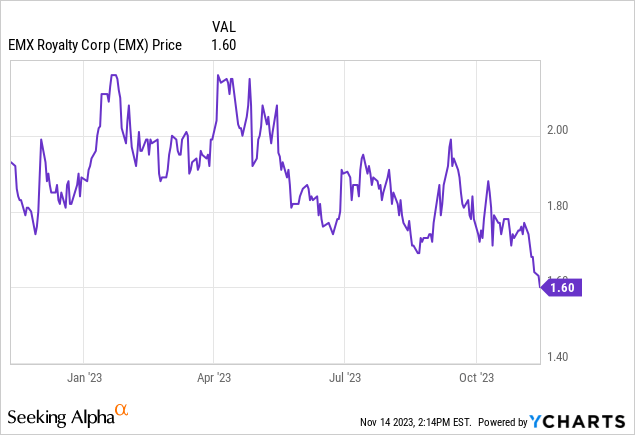

Yet, the stock has not reacted positively to the news. Shares are down 7.56% in the past week, and 10.17% over the past month. What’s going on?

Below I break down EMX’s recent quarterly earnings and give potential reasons why its shares are underperforming. I also provide an updated recommendation on its stock.

EMX’s Q3 Earnings Snapshot

As mentioned in the intro, EMX’s Q3 earnings were primarily bolstered by the significant update to the Timok Royalty agreement, which led to a substantial inflow of $6.67 million.

But other royalty revenue sources for EMX this quarter included:

-

Approximately $1.95 million from the Gediktepe Mine’s oxide gold deposit.

-

About $1.74 million from the Caserones royalty.

-

Revenue of roughly $773,000 from Leeville.

-

EMX also recognized $568,000 from the Balya property.

-

Gold Bar South contributed $134,000.

- This led to revenue of nearly $13 million, operating cash flow of $7.5 million, and positive net income of $2.44 million.

Updated Balance Sheet

|

Financial Metrics |

As of Sep 30, 2023 |

As of Dec 31, 2022 |

% Change |

|

Cash |

$21,587,000 |

$15,508,000 |

+39.21% |

|

Investments and Receivables |

$12,739,000 |

$14,561,000 |

-12.52% |

|

Loans Payable |

$41,927,000 |

$40,489,000 |

+3.55% |

|

Net Debt |

-$7,601,000 |

-$10,420,000 |

+27.06% |

Despite holding over $40 million in debt, EMX’s net cash position has improved this quarter, a trend that is expected to continue with the Timok dispute resolved and other assets producing strong cash flow.

Its cash has grown 39.21% compared to Dec. 31, 2022. Overall, EMX’s net debt has improved by 27% since then, and I’ve estimated it is currently -$7.6 million.

EMX: Other Big Developments in Q3

First, the Franco-Nevada Corporation (FNV) partnership has been fortified with a new royalty partnership announced in early Q3.

This joint venture involves Franco-Nevada contributing 55% (up to US$5.5 million) and EMX 45% (up to US$4.5 million) towards new royalty acquisitions. Franco-Nevada also maintains a 6% stake in EMX, so it’s a strategic investor and partner with EMX.

Next, AbraSilver Resource reported encouraging results from the Phase III drill program at the Diablillos silver-gold royalty property, indicating strong long-term growth prospects for EMX. Results included 1,042 g/t silver over 12 meters and 148 g/t silver over 64 meters.

These drill holes and more will be incorporated into an updated mineral resource estimate, and a preliminary feasibility study (“PFS”) is also scheduled to be completed before year’s end. The report should provide updated production estimates and could shed some light on how much royalty revenue EMX stands to earn once the mine is in production. This is an excellent long-term growth project for EMX.

Finally, Arizona Sonoran reported updated mineral resource estimates for the Parks-Sayler porphyry copper property, showing a significant copper resource upside. The deposit, containing various types of copper ore, is estimated to hold about 143.6 million tonnes with a 1.015% copper grade, equaling 2.92 billion pounds of copper. EMX’s 1.5% NSR royalty on this asset is looking more and more valuable each quarter.

EMX: Why Did the Stock Price fall?

YCharts

I don’t see any specific news or developments that would be viewed as negative by the market.

If I had to guess, one thing that may be upsetting some investors here is the company’s continued high spending rate to acquire and generate royalties.

For example, EMX said that it spent $4.76 million for this purpose in Q3, while only recovering $1.14 million from its partners.

While spending was down $500k from $5.269 million last year, EMX also recovered $2 million less from partners this year.

So it’s essentially costing the company more money to generate and acquire royalties, and since there are no immediate or medium-term returns from these activities, investors may think this is no longer a prudent use of the company’s capital.

I also think the looming threat of a “hard landing” recession in early 2024 could lead to lower copper prices, potentially impacting EMX’s revenues, given its significant exposure to copper royalties.

U.S. recession probability is currently 56%, according to YCharts, compared to 23.07% last year. A recession would likely result in lower copper prices, which would hurt EMX’s business since so many of its royalties are on copper mines (or mines with copper produced as a byproduct of another metal).

EMX Royalty: The Final Verdict

Despite the perceived negatives by the market, I think EMX shares are starting to look really cheap. This is a company that is now producing upwards of $8-$10 million of royalty revenue per quarter going forward following the Timok royalty agreement. With a market cap of US$176 million, you can make the case that its shares are very discounted.

The market seems to be pessimistic about EMX’s royalty generation/prospecting business because of its high costs and low near-term return potential. EMX stock, however, looks like a pretty good buy here regardless following the Timok settlement.

In addition, I remain bullish on EMX’s long-term growth potential, mainly, its royalty assets on the Diablillos property, Parks-Sayler, and Hermosa properties look very promising. Further strong exploration results should provide more positive catalysts headed into 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here