Pfizer certainly looks like a victim of its own success.

Is Pfizer less attractive than a Treasury note?

Pfizer Inc. (NYSE:PFE) has long been considered as a Treasury substitute, since it paid a slightly but reliably growing dividend, with a stock that went nowhere over the long term. Today, it yields about 100 basis points more than the 10-year Treasury, which means investors are probably factoring in further stock declines.

Reasons for this pessimism discussed among investors include:

- Pfizer so far seems to be a loser in the race to bring to market a new category of weight loss drugs, which means that investors seeking exposure to the healthcare sector avoid the stock.

- Capital allocation: Pfizer likely overpaid for Seagen Inc. (SGEN).

- The Seagen acquisition might be blocked by an over-zealous administration that hates M&A of all sorts.

- Pfizer is unloved simply because it is so closely associated with the pandemic that nobody wants to be reminded of.

- Upcoming lawsuits related to vaccine side effects might result in billions of dollars of damage payouts.

- The political administration might change in 2024 and interfere with vaccinations, thus reducing demand.

- Vaccine and Paxlovid demand is cratering anyway.

- Window dressing results in this year’s winners moving even higher and the losers going lower.

In this article we will examine all these aspects and try to come to a conclusion.

Sweet memories

Long past are those days – just three years ago – when waving people with tears of joy in their eyes lined the streets to salute the first Pfizer trucks bringing Comirnaty to a world trembling with fear. The mission was nothing less than to save the world – and in the eyes of Pfizer it has certainly been accomplished, as within the subsequent years billions of people got the jabs invented by BioNTech SE (BNTX) and smartly distributed by the U.S. pharma giant, enabling all of us to return to normal lives.

That said, even when the vaccination campaign had already started, just a few months after the emotional moment I have just described, the stock market still hated Pfizer. And I, for the first time in my life, bought the stock.

In February 2021 Pfizer traded for $34 or 11x the expected earnings for 2021, which included ~$0.60 from the COVID vaccine. Excluding those earnings – which at the time were still rather unpredictable – the multiple was 13.6.

Before COVID, the company had given a promising 5-year guidance during its 2020 investor day which implied at the very least ~$56B of revenues (6% CAGR) in 2025/26 and $3.60 of EPS in the same period (10% CAGR).

For the later years of the decade, Pfizer guided to very little growth due to patent expirations and I expected the average EPS growth rate for the entire decade to come down to a pretty standard 7%.

And this is why I bought the stock: The company, despite being a pretty reliable, anti-cyclical, recession-resistant high dividend payer, was trading for just 13x earnings – despite having, for the first time in many years, pretty good (and certain) growth prospects. In fact, all COVID earnings would come on top of that pre-COVID guidance and would add to my margin of safety.

We all know how it played out: Carried by COVID-euphoria, the stock market suddenly priced in multi-year, gigantic vaccine and Paxlovid revenues, and the stock doubled (including dividends). On the way up I sold out, as the company’s market cap seemed to price in just too many good things in my view.

Today, we are back to Pfizer being hated and the stock is even lower than in February 2021. Ironically, its steep fall itself makes it already look like a loser.

Ironically, Pfizer is widely expected to deliver on its original 2020 guidance, with consensus EPS estimates for 2025 and 2026 of $3.52 and $3.67, respectively. These estimates, however, include at least some COVID earnings (of uncertain durability).

Hence, we might argue that Pfizer’s fundamental valuation is roughly unchanged compared to February 2021: It trades about 15% lower, since its ex-COVID earnings are expected to come in a bit below its original guidance, while the market remains reluctant to pay up for such a volatile thing as the company’s COVID portfolio.

What is the market missing?

First of all, Seagen. Back in 2020, Pfizer guided to revenues helped by M&A for the later part of the decade, but that M&A had still to be identified and had not been paid for. Any acquisition had to be funded with dollars coming out of the ordinary pharma business.

Today, Pfizer investors get a fully filled pipeline for the later part of the decade which has been largely funded by COVID earnings.

And if the Seagen acquisition doesn’t get all necessary approvals, the cash will stay there for other acquisitions. It seems illogical to complain both about the unlikelihood of approval and about the high price of the Seagen acquisition. Either it is too expensive – and we should be happy if it won’t go through – or the price is ok and we should trust management to acquire some other good business if the cash becomes available again.

And if it gets approved while being deemed too expensive – sure that would be not so good, but the cash used for the acquisition is still mostly “free” from the 2021 perspective.

This means Pfizer is quite a bit cheaper now than it was in 2021. In 2021 we got the COVID portfolio for free on top, today it’s the (potential) Seagen acquisition – or the cash earmarked for it.

In addition, the sole fact that the company has so far delivered on its 2020 long-term guidance is an undisputable positive.

Moreover, Pfizer still has a horse in the race when it comes to the new weight loss drugs. If the danuglipron trial data (expected before year-end) is good, the stock will zoom higher, although a lot in the new field remains to be sorted out: How will payers cover the costs, who will be eligible, which drugs will be favored and why, potential combination therapies in this space, etc. At this price point, danuglipron likely represents a free option.

COVID side effects affecting Pfizer

Now that it’s over, being so closely intertwined with the pandemic and all the controversies associated with it, further fanned by political divisions, certainly doesn’t help. But this aspect relates more to a “beauty contest” than to business fundamentals and could effectively create a nice opportunity.

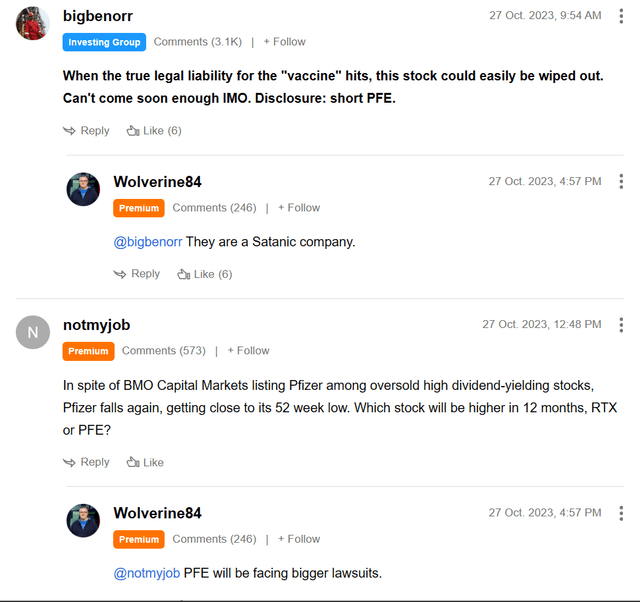

Screenshot of discussion under a recent Seeking Alpha article. (Seeking Alpha)

The fact that allegations about upcoming multi-billion lawsuits related to vaccine side-effects by this “satanic company” are circulating on message boards is a positive for value investors, since, if anything, it makes the company less popular, but not worth less.

– Right, because these allegations are totally made up.

Already in 2020 CNBC explained how tough it would be to win any sort of vaccine-related lawsuit. And this year BioSpace reiterated that it might already be a challenge for a plaintiff to file a lawsuit in the first place.

If you read the Financial Times’ report on BioNTech’s German lawsuits and the firms involved, you will see that there is no chance the plaintiffs can hurt the inventor of the vaccine in court. In addition, you can’t avoid the feeling that there is something else behind all these maneuvers – presumably an attempt to discredit the entire political spectrum and the media, except for the one and only party in Germany that has always opposed any sort of COVID-related restriction or obligation, i.e., the far-right AFD.

The most prominent of the firms, the Düsseldorf-based Rogert & Ulbrich, is headed by Tobias Ulbrich, a specialist in transport and freight law who has railed against the vaccine makers on social media. … Ulbrich is a controversial figure, who has claimed that the American billionaire Bill Gates wanted to use vaccination to reduce the population of Germany to 27mn people – a claim that a spokesman for his foundation said was “false”. Ulbrich also claimed that blood tests on some of his clients have shown them to be suffering from a “vaccine-acquired immunodeficiency syndrome” or “V-AIDS” – a syndrome that respected scientists say is not real.

Effectively, the German newspaper Berliner Morgenpost found the lawyer to be very close to the “Querdenker” movement, which is closely related to the far-right AFD party.

That said, as the FT states, even “a verdict against BioNTech would likely have limited direct financial damage on the company because of an EU legal shield that largely protected vaccine makers from legal liability.”

In fact, BioNTech doesn’t even mention these lawsuits in its latest quarterly report. Nor does Pfizer.

The only fundamental impact of all these meritless allegations and the hate spread by ‑ presumably at least partly political actors ‑ might be a slight reduction in vaccine demand. Certainly a different administration unsupportive of vaccines (think Robert F. Kennedy Jr.) would not help either, but the fact that RFK already had to backpedal probably shows that his radical conspiracy theories don’t find a majority.

I fully expect the political exploitation of the COVID turmoil to become less important over time, as the fears and memories related to the pandemic fade and medical issues return to what they have rightfully been in all times: personal matters discussed in private with trusted medical advisors.

This means that, over time, vaccine demand will probably simply follow the (unpredictable) evolution of the virus and the (predictable) usage patterns we know from the flu vaccine. The good thing for us as investors is that in Pfizer’s stock price there is no premium whatsoever for the COVID portfolio. The stock trades for an extremely modest 8x multiple of its expected 2026 earnings.

Is Pfizer a bad capital allocator?

After 2026 until the end of the decade, consensus earnings estimates are roughly flat – an unexciting perspective for most investors. According to consensus, revenue losses because of patent expiries will simply be made up by acquired growth and R&D, but there won’t be any growth.

If consensus expectations are right, in 2030 Pfizer will earn $3.63 per share. If it trades for an average market multiple of 16x, its stock will be worth $58. Hence, today’s buyers will double their money and get a 5.5% dividend yield on top.

I think that’s pretty attractive and therefore unlikely to represent the current market view. This begs the question why the company should trade for a lower multiple in 2030? To provide not much more than the Treasury yield, it would need to trade for just 8x earnings – basically keep a constant multiple. Which means the market is considering Pfizer as a perpetual no-growth stock, even after 2030.

But what does the market or anybody know about that period? Nothing. It simply projects into the future what it sees in its rear-view mirror.

At the same time, however, huge FCF will flow into Pfizer’s coffers. Apparently, the market believes that this FCF won’t make any difference, as it is likely to be spent badly.

While I agree that the Seagen acquisition looks a bit overpriced, I also believe that delivering over several years on its 2020 guidance remains an important positive, as it lends credibility to management. Therefore, I tend to be less bearish on capital allocation than the market, although I still remain skeptical as well.

How to trade Pfizer

I would not buy Pfizer as a permanent holding. This is mainly because, over long periods of time, it is simply likely to return as much as a broadly diversified healthcare index fund. But the index fund has less volatility and is overall the safer holding.

That said, there is likely a short-term trading opportunity in Pfizer, as the market has simply become too bearish and year-end window dressing is certainly worsening the situation.

Big pharma stocks tend to fluctuate far more than their rather stable business fundamentals. If you buy when sentiment is very sour, you pay less for all the upside potential that might materialize thanks to trial successes, return to the mean multiple, unexpectedly high COVID revenues, short-term effects of capital allocation decisions like buybacks or dividend hikes.

Pfizer stock is currently priced with a very bearish view on the next decade and even on the one after that. The market is treating the business as if its earnings would never grow.

While the market might even be ultimately right, in the meantime there will be more bullish phases. Positive danuglipron results, a new flu-COVID vaccine combo, decent COVID sales in 2024, continued good execution on the ex-COVID business, buybacks – all these could provide a short-term boost for the stock. And even if that doesn’t happen, there is not much to lose at these levels as it is hard to find anything positive priced into the stock. I also expect the stock to hold up better than average in a general bear market, which means additional optionality, as you could sell it than to buy things that have fallen deeper.

So, overall, I consider it as a good portfolio addition and will hold it until it has outperformed the general market – for whatever reason that might happen.

Read the full article here