Introduction

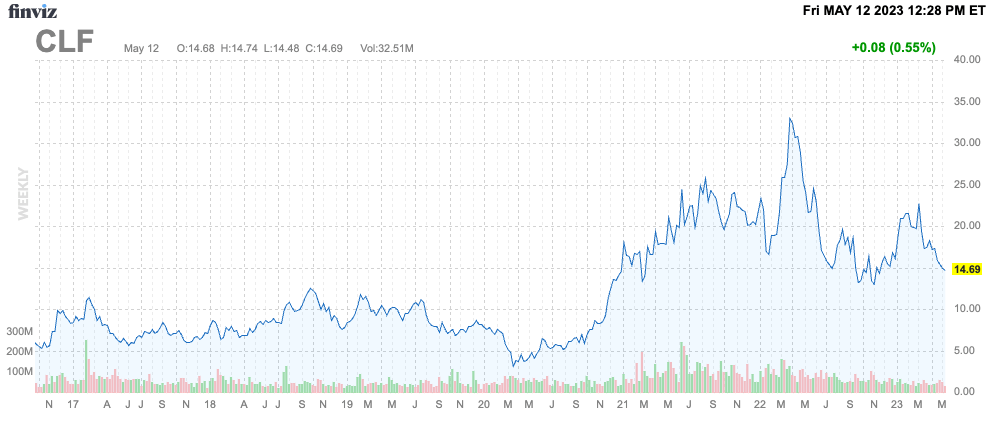

Ohio-based steel giant Cleveland-Cliffs (NYSE:CLF) is selling off. The stock is down 40% from its 52-week high and down almost 10% on a year-to-date basis. Shares have lost nearly 60% from the 2022 peak, close to $35 per share.

FINVIZ

However, buyers aren’t giving up. On the contrary, insiders are buying. On May 1, Celso Goncalves, CFO of CLF (and son of CEO Lourenco Goncalves), bought $100,000 worth of stock at $15.18. On April 27, his father bought $1.5 million worth of stock at $14.96. He now owns close to 2.5 million shares. On May 2, Director Michael Ralph bought shares worth $150,000.

With that said, my plan isn’t to write an article every time an insider buys stock. It’s just that this is an interesting situation. We’re dealing with a deterioration in economic growth expectations while CLF continues to benefit from secular tailwinds.

Hence, this is what I wrote in my prior article (emphasis added):

However, I do not expect the stock price to get to $33 without some drama and steep drawdowns. I still believe that the stock market will make another attempt to fall to the lower 3,000 points range (S&P 500). While CLF will likely keep outperforming the market, investors need to be aware that more weakness is highly likely.

This leads me to another question? When can we expect CLF to rebound? Or is it poised to become a pet rock again with high volatility and no meaningful long-term capital gains?

The Secular Boom & Cyclical Decline

One of the biggest reasons to buy CLF was (and still is) the return of manufacturing activity in the United States. Economic re-shoring and the need to improve existing infrastructure are both reasons to expect that long-term steel demand is about to improve.

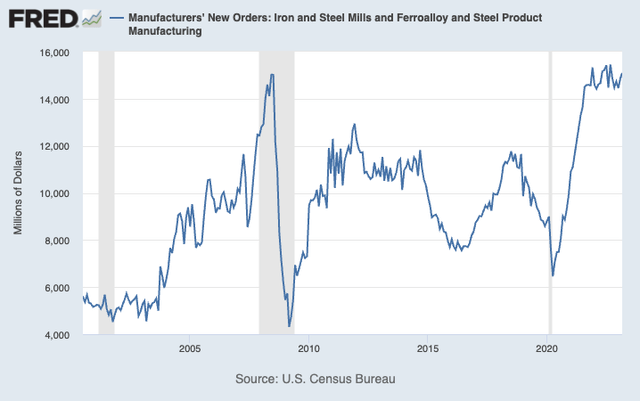

Since the pandemic, there has been an unprecedented surge in the new order value of iron and steel mills in the United States. According to the latest data, which has been updated through March 2023, there has been no indication of weakness after plateauing at levels not seen since the Great Financial Crisis. During that time, orders peaked at around $15 billion.

Federal Reserve Bank of St. Louis

According to a recent Wall Street Journal article, the US steel industry is benefiting from several non-cyclical factors.

Wall Street Journal

The paper reports that despite a slowdown in other sectors of the US economy, manufacturers of construction equipment, trucks, building supplies, and industrial software are still thriving. Manufacturing companies are benefiting from a backlog of orders due to supply-chain bottlenecks caused by the pandemic and higher demand from new factories under construction.

New factories are driving demand for construction materials, including steel, as well as the systems and equipment needed to operate the plants once completed. The strength of such construction projects has helped companies like Caterpillar (CAT) exceed the expectations of investors and industry analysts.

As a result, the sector is offsetting the effects of rising interest rates and weakening US economic growth.

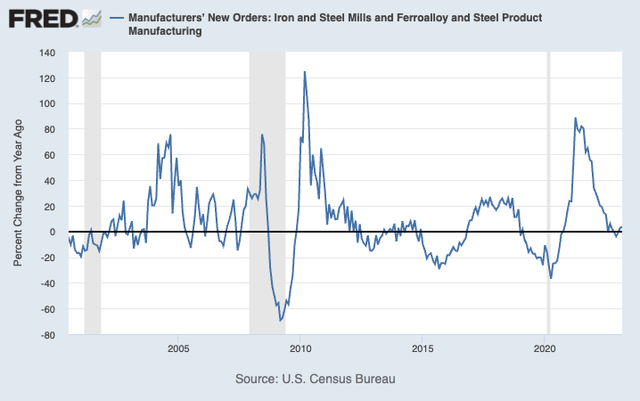

Nonetheless, the rate of change has come down quite significantly. In March, the new order value of iron and steel was flat after growing by more than 80% last year.

Federal Reserve Bank of St. Louis

This decline makes sense as growth expectations have gone down the drain – despite the aforementioned secular tailwinds.

The ISM Manufacturing Index rose to 47.1 in April. However, it remained below the neutral level at 50, indicating further contraction in manufacturing industries.

As reported by Bloomberg earlier this month:

“New order rates remain sluggish as panelists remain concerned about when manufacturing growth will resume,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Panelists’ comments registered a 1-to-1 ratio regarding optimism for future growth and continuing near-term demand declines.”

After everything that has been said so far, we’re in a very tricky situation. It’s why I mentioned in my last article that CLF was likely to encounter more weakness, despite my long-term bullish outlook.

Now, let’s see how CLF is doing.

Cleveland-Cliffs Is Doing Fine – And Perfectly Positioned For Long-Term Success

1Q23 was a stellar quarter for the company. The company generated revenue of $5.3 billion, which is $90 million higher than expected but 11.7% below the prior-year quarter result.

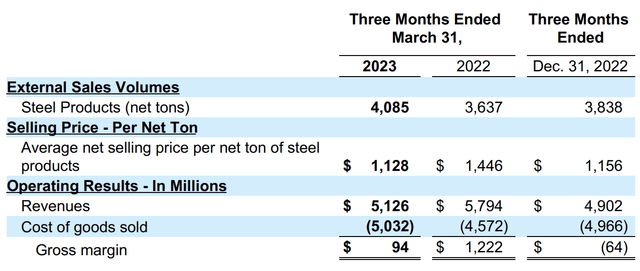

Looking at the numbers below, we see that this sales decline is the result of lower prices. The company reported a significant increase in external steel sales. However, the average selling price fell from $1,446 to $1,128 per ton. As prices/margins are usually bigger drivers of revenues than volumes, the company was unable to grow its revenue.

Cleveland-Cliffs

With that said, CLF was quite happy with the result, especially when it came to pricing. 1Q23 selling prices exceeded expectations due to higher tonnage and higher value-added mix in the automotive industry.

More than half of CLF’s sales are index-linked with lags, generally varying from one to three months. Due to these lags, the recent rise in flat-rolled index pricing was barely reflected in its Q1 results.

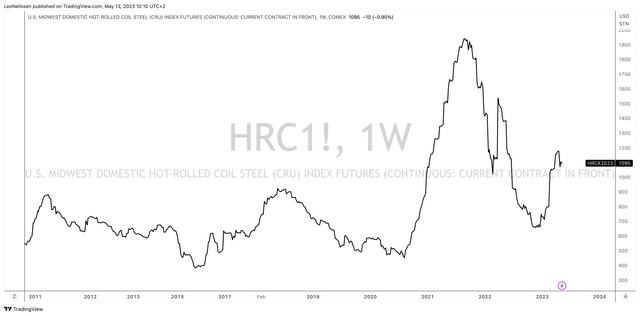

The chart below displays the renewed surge in COMEX hot-rolled coil futures.

TradingView

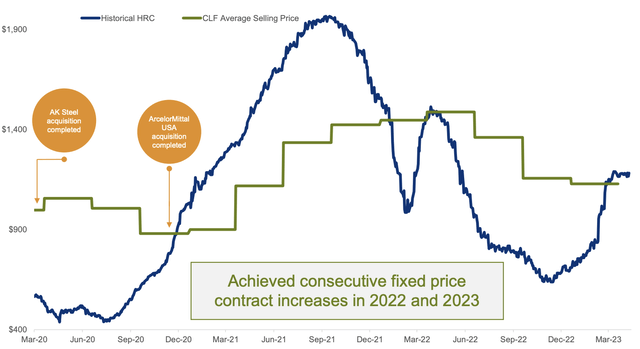

The next chart compares HRC prices to the company’s average selling prices, which shows the lag between price hikes and cuts.

Cleveland-Cliffs

According to the company, these pricing improvements are now in full force, which will benefit CLF’s results meaningfully in Q2 and beyond.

Furthermore, CLF has successfully implemented several spot price increases over the past few months and achieved continued increases in their fixed price contracts for the April 1 renewal cycle. Due to the same factors that drove Q1 costs lower, CLF’s unit costs should continue to decrease going forward.

With that said, there are other secular benefits besides supply chain re-shoring and easing bottlenecks.

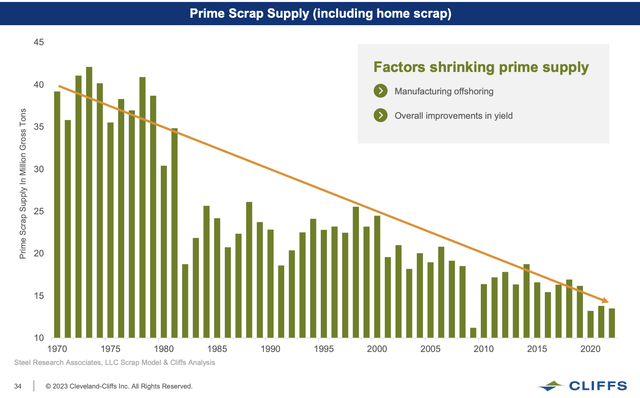

The company believes that United States prime scrap and metallic shortages will continue to tighten over the coming years and that last year’s unusual scrap movement in the second half of the year has been proven to be an outlier.

The prime scrap market is back in a shortage position, with less than 20 million tons of annual prime scrap and metallic supply in North America currently. Scrap availability has been in a downtrend since the 1970s. Now, supply is getting tight.

Cleveland-Cliffs

The company anticipates that with the new electric arc furnace coming online, demand for prime scrap and metallics will be at 30 million tons by 2026, requiring significant levels of imported metallics.

The alternative to address the scrap shortage would be additional metallics production, which requires iron ore. As the largest producer of iron ore pellets in North America, this plays into CLF’s favor.

Cleveland-Cliffs

Not only is CLF benefiting from a well-integrated internal supply chain, but it also mines high-quality HBI used in electronic arc furnaces. It also holds between 15% and 20% of the prime scrap market.

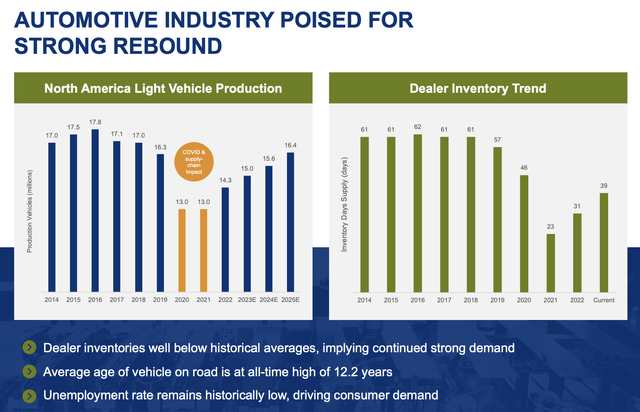

Adding to that, CLF also benefits from secular automotive demand. Since 2022, automotive producers have boosted production after supply chain constraints prevented them from dealing with the rapid increase in post-pandemic orders.

Cleveland-Cliffs noted that seasonally adjusted annual sales in the United States averaged about 15.2 million units during 1Q23, a significant increase after averaging 13.7 million units in 2022.

The company’s forecast for North American automotive units in 2023 of 15.5 million light vehicles is the best in four years.

Cleveland-Cliffs

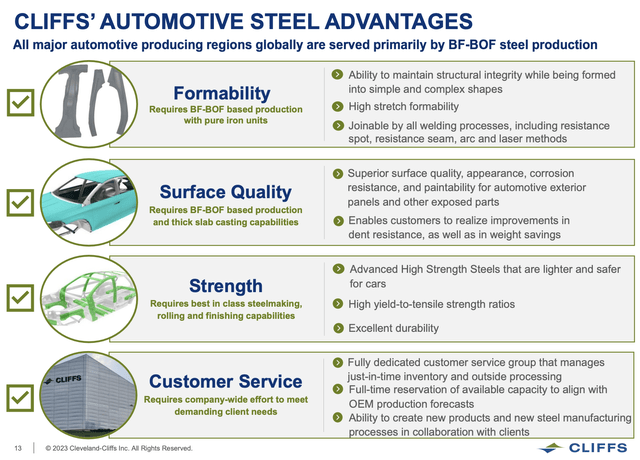

Related to this, one car equals roughly 1 ton of steel. With Cleveland-Cliffs representing nearly half of the flat-rolled market for automotive steel, this will bring significant additional volume.

With regard to its position in the automotive market, the company noted that the metallurgical challenge in automotive is too big for some EAF start-ups, which is why CLF remains the supplier of choice to the automotive industry in the United States. This is also due to its customer service and R&D capabilities translating to annual price increases from all of its major automotive clients.

Cleveland-Cliffs

So, what about shareholders?

Balance Sheet, Distributions & Valuation

After two major acquisitions in the past few years (AK Steel & ArcelorMittal US), the company continues to pay back debt.

In 1Q23, CLF completed a 7Y unsecured notes offering for $750 million, priced at only 325 basis points above the comparable treasury, which is the tightest spread in the company’s history. This underlines new trust in the company’s abilities.

CLF used the proceeds to pay down its ABL (asset-based loan), which is priced off of currently much higher short-term rates. In other words, despite the surge in rates, CLF is able to improve its financial position.

Although the swap of shorter-term debt with longer-term notes does not change CLF’s capital allocation priorities, the additional liquidity provides the company with more flexibility for whatever market conditions or opportunities may come up.

The main priority for debt reduction will be to continue using the robust free cash flow CLF expects to generate this year toward continued debt repayment and opportunistic share buybacks. CLF still has over $1 billion in prepayable debt on the ABL and another $1.5 billion in callable bonds.

The company is expected to end this year with a net debt ratio of 1.3x EBITDA, which is very low.

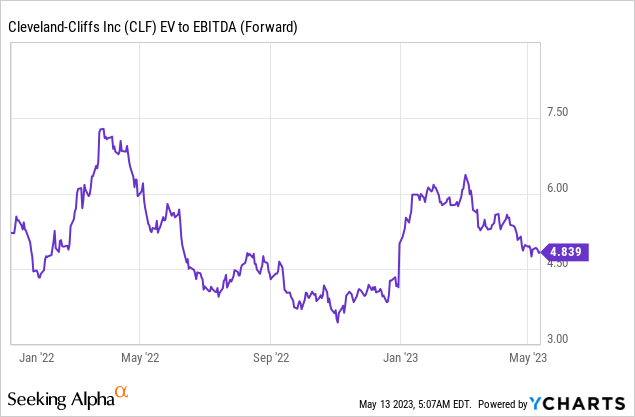

With all of this in mind, the company is trading at 4.8x NTM EBITDA, which is far from overvalued.

It gets better when going further into the future. Using a 6.3x EBITDA multiple, just $1.4 billion in 2024E net debt (implying further debt reduction), and $2.7 billion in potential 2024E EBITDA, we’re dealing with a market cap target of $15.3 billion, which implies roughly 100% from today’s $7.7 billion market cap.

This would put my fair price target at $30, which is still below its 2022 peak.

However, please note a few things:

- The company is unlikely to start an uptrend without getting support from rising economic expectations (like the ISM index).

- Expectations for 2024 will likely improve once economic demand bottoms, which could in a higher longer-term price target.

- Short-term expectations will have to be revised if economic weakness persists.

In other words, as much as I like the long-term bull case, more short-term pain cannot be ruled out.

Takeaway

Cleveland-Cliffs is experiencing a significant decline in its stock price, which has dropped 40% from its 52-week high and almost 10% year-to-date. Despite this, insiders are still buying, with the CFO, CEO, and directors all purchasing large amounts of stock in the past few days.

Although the US manufacturing industry is expected to benefit from lasting secular benefits to supply chain re-shoring, cyclical demand weakness is keeping pressure on steel producers and CLF.

On a long-term basis, Cleveland-Cliffs is well-positioned for long-term success, with terrific capabilities in scrap, and automotive steel, a healthier balance sheet, and its well-integrated supply chain of high-quality steel production.

The company also remains attractively valued, leading me to believe that the company could double as soon as economic demand bottoms.

In other words, my bullish rating is a long-term rating.

Read the full article here